|

市場調查報告書

商品編碼

1698562

衛星雷射通訊市場機會、成長動力、產業趨勢分析及2025-2034年預測Satellite Laser Communication Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

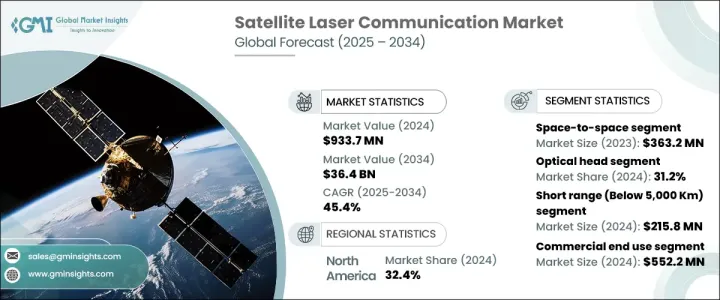

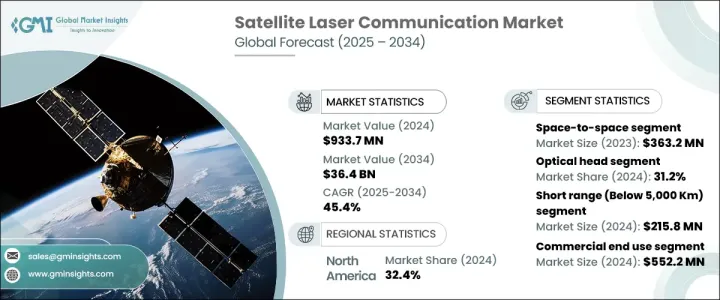

2024 年全球衛星雷射通訊市場價值為 9.337 億美元,預計 2025 年至 2034 年期間的複合年成長率將達到 45.4%。這一成長是由對高速資料傳輸、增強頻寬和複雜光纖系統廣泛部署的需求不斷成長所推動的。隨著載波頻率的發展,調變技術不斷改進,提高了資料承載能力,實現了高效率的點對點傳輸。全球各地的企業都優先考慮快速可靠的連接,以提高生產力和增強客戶服務,從而推動對高速資料傳輸的需求。衛星雷射通訊可實現卓越的資料速率,最大限度地減少訊號損失並確保無縫傳輸。該技術比射頻系統提供更高的頻寬,並且需要更低的重量、體積和功率,使其成為衛星星座和太空探索的理想選擇。隨著低地球軌道(LEO)衛星數量的增加,衛星雷射通訊的應用範圍不斷擴大。公司正在投資先進的調製技術來最佳化資料可靠性和傳輸效率。

根據解決方案,市場可細分為空間對空間、空間對地面站和空間對其他應用。太空對太空通訊,2023 年價值 3.632 億美元,支援高速衛星間資料傳輸,增強即時連接。太空對地面站部分預計到 2022 年價值 1.96 億美元,可為科學研究、全球寬頻和天氣預報服務提供高效的資料傳輸。太空對其他應用在 2021 年創造了 4,650 萬美元的收入,其中包括深空探索和行星任務,需要延遲最小的長距離光通訊。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.337億美元 |

| 預測值 | 364億美元 |

| 複合年成長率 | 45.4% |

市場還按組件進行分類,包括光學頭、數據機、雷射接收器和發射器以及調製器。到 2024 年,光學頭部分將佔據 31.2% 的市場佔有率,這對於使用先進光學元件實現精確的雷射光束傳輸至關重要。雷射接收器和發射器預計將佔據 24.8% 的市場佔有率,可確保安全、高速的資料交換。調變解調器佔 20.4% 的市場佔有率,可將數資料轉換為光訊號,實現無縫傳輸;而調變器佔據 17.2% 的市場佔有率,可提高頻譜效率和資料吞吐量。

按範圍細分包括短距離、中距離和長距離通訊。短距離部分價值 2024 年為 2.158 億美元,涵蓋用於地球觀測和即時寬頻網路的低地球軌道衛星鏈路。中程通訊連接不同軌道的衛星,2023 年價值 1.233 億美元。遠程部分的價值在 2022 年達到 3.259 億美元,用於支援深空任務和行星際探測。

最終用途類別包括商業、政府和軍事應用。商業領域規模最大,預計到 2024 年將達到 5.522 億美元,由於全球寬頻和資料中繼服務需求的增加,該領域正在擴大。政府部門利用雷射通訊進行氣候監測、災害管理和安全資料交換,2024 年價值 2.008 億美元。軍事領域預計將在 2025 年至 2034 年期間以 46.7% 的複合年成長率成長,該領域將投資於國防和監視行動的安全高速通訊。

受電信基礎設施大量投資的推動,北美將在 2024 年佔據市場主導地位,佔有 32.4% 的佔有率。美國市場價值 2024 年將達到 2.558 億美元,由於政府和私營部門對衛星通訊系統的大力投資,該市場正在快速發展。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 高速資料傳輸的需求不斷增加

- 太空探索與衛星星座

- 擴大採用基於空間的服務

- 雷射通訊技術的進步

- 政府措施和投資

- 產業陷阱與挑戰

- 開發和部署成本高

- 航太級組件供應有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依解,2021-2034 年

- 主要趨勢

- 空對空

- 空對地站

- 空間對其他應用

第6章:市場估計與預測:依組件,2021-2034

- 主要趨勢

- 光學頭

- 雷射接收器和發射器

- 數據機

- 調節劑

- 其他

第7章:市場估計與預測:依範圍,2021-2034

- 主要趨勢

- 短距離(5,000 公里以下)

- 中距離(5,000-35,000 公里)

- 長距離(35,000 公里以上)

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 商業的

- 政府

- 軍隊

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Airbus SE

- Axelspace Corporation

- Ball Aerospace & Technologies Corp.

- Blue Canyon Technologies LLC

- BridgeComm, Inc.

- EnduroSat AD

- General Atomics Electromagnetic Systems Inc.

- Infostellar Inc.

- Kongsberg Satellite Services AS

- L3 Harris Technologies, Inc.

- Laser Light Communications, LLC

- Lockheed Martin Corporation

- Mynaric AG

- NEC Corporation

- Thales Group

The Global Satellite Laser Communication Market, valued at USD 933.7 million in 2024, is projected to surge at a CAGR of 45.4% from 2025 to 2034. This growth is driven by escalating demand for high-speed data transmission, enhanced bandwidth, and widespread deployment in complex fiber systems. As carrier frequencies evolve, modulation techniques improve, increasing data-carrying capacity for efficient point-to-point transmission. Businesses worldwide are prioritizing fast and reliable connectivity to boost productivity and enhance customer service, driving demand for high-speed data transmission. Satellite laser communication enables superior data rates, minimizing signal loss and ensuring seamless transmission. The technology offers higher bandwidth than radio frequency systems and requires lower weight, volume, and power, making it ideal for satellite constellations and space exploration. With the rising number of low Earth orbit (LEO) satellites, the adoption of satellite laser communication continues to expand. Companies are investing in advanced modulation techniques to optimize data reliability and transmission efficiency.

The market is segmented based on solutions into space-to-space, space-to-ground station, and space-to-other applications. Space-to-space communication, valued at USD 363.2 million in 2023, supports high-speed inter-satellite data transfer, enhancing real-time connectivity. The space-to-ground station segment, worth USD 196 million in 2022, enables efficient data transmission for scientific research, global broadband, and weather forecasting services. Space-to-other applications, which generated USD 46.5 million in 2021, include deep-space exploration and planetary missions, necessitating long-range optical communication with minimal latency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $933.7 Million |

| Forecast Value | $36.4 Billion |

| CAGR | 45.4% |

The market is also classified by components, including optical heads, modems, laser receivers and transmitters, and modulators. The optical head segment is set to account for 31.2% of the market in 2024, crucial for precise laser beam transmission using advanced optics. Laser receivers and transmitters, projected to hold 24.8% of the market, ensure secure, high-speed data exchange. Modems, with a 20.4% share, convert digital data into optical signals for seamless transmission, while modulators, representing 17.2% of the market, enhance spectral efficiency and data throughput.

Segmentation by range includes short, medium, and long-range communication. The short-range segment, valued at USD 215.8 million in 2024, covers LEO satellite links for Earth observation and real-time broadband networks. Medium-range communication, worth USD 123.3 million in 2023, connects satellites in different orbits. The long-range segment, valued at USD 325.9 million in 2022, supports deep-space missions and interplanetary probes.

End-use categories include commercial, government, and military applications. The commercial segment, the largest at USD 552.2 million in 2024, is expanding due to increased demand for global broadband and data relay services. The government sector, valued at USD 200.8 million in 2024, leverages laser communication for climate monitoring, disaster management, and secure data exchange. The military sector, expected to grow at a 46.7% CAGR from 2025 to 2034, invests in secure, high-speed communication for defense and surveillance operations.

North America dominates the market with a 32.4% share in 2024, driven by significant investments in telecommunication infrastructure. The US market, valued at USD 255.8 million in 2024, is advancing rapidly due to strong government and private sector investments in satellite-based communication systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for high-speed data transmission

- 3.6.1.2 Space exploration and satellite constellations

- 3.6.1.3 Increasing adoption of space-based services

- 3.6.1.4 Advancements in laser communication technology

- 3.6.1.5 Government initiatives and investments

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High development and deployment costs

- 3.6.2.2 Limited availability of space-qualified components

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Solution, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Space-to-Space

- 5.3 Space-to-Ground station

- 5.4 Space-to-Other applications

Chapter 6 Market Estimates & Forecast, By Component, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Optical head

- 6.3 Laser receivers and transmitters

- 6.4 Modems

- 6.5 Modulators

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Range, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Short range (Below 5,000 Km)

- 7.3 Medium range (5,000-35,000 Km)

- 7.4 Long range (Above 35,000 Km)

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Government

- 8.4 Military

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airbus SE

- 10.2 Axelspace Corporation

- 10.3 Ball Aerospace & Technologies Corp.

- 10.4 Blue Canyon Technologies LLC

- 10.5 BridgeComm, Inc.

- 10.6 EnduroSat AD

- 10.7 General Atomics Electromagnetic Systems Inc.

- 10.8 Infostellar Inc.

- 10.9 Kongsberg Satellite Services AS

- 10.10. L3 Harris Technologies, Inc.

- 10.11 Laser Light Communications, LLC

- 10.12 Lockheed Martin Corporation

- 10.13 Mynaric AG

- 10.14 NEC Corporation

- 10.15 Thales Group