|

市場調查報告書

商品編碼

1698583

C 臂市場機會、成長動力、產業趨勢分析及 2025-2034 年預測C-arm Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

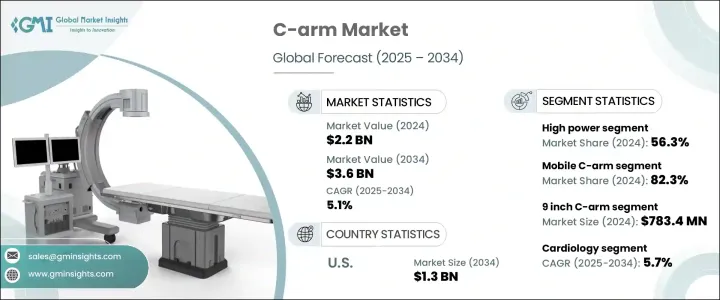

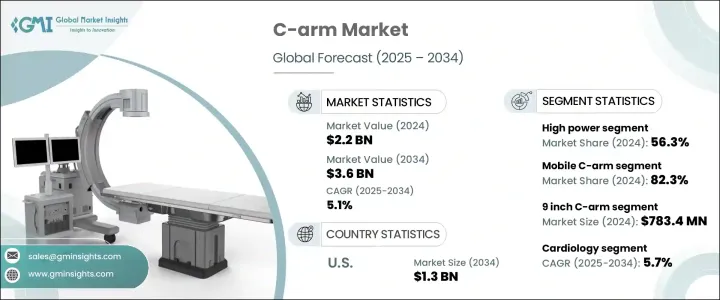

全球 C 臂市場價值 2024 年為 22 億美元,預計 2025 年至 2034 年的複合年成長率為 5.1%。 C 臂是一種先進的成像設備,有移動和固定兩種配置,旨在為醫療程序提供即時 X 光成像。這些設備在骨科、心臟病學和腫瘤學等各個專業的手術、診斷和介入放射學中發揮關鍵作用。由於人口老化、久坐不動的生活方式和不良的飲食習慣,慢性病發病率不斷上升,推動了對先進影像解決方案的需求。

隨著慢性病變得越來越普遍,診斷、治療和外科手術對高解析度影像的需求不斷增加。 C 臂系統透過提供清晰的即時視覺效果來提高手術精確度和患者治療效果,從而促進血管成形術、整形外科手術和腫瘤切除等複雜手術的進行。成像品質、易用性和便攜性的進步進一步促進了市場擴張。醫院和外科中心擴大整合這些設備,以提高診斷準確性和治療效率,從而加強市場穩定的成長軌跡。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 36億美元 |

| 複合年成長率 | 5.1% |

就產品類型而言,移動式 C 臂在 2024 年佔據全球市場主導地位,佔有 82.3% 的佔有率。其便攜性使其能夠在醫院各部門之間無縫運輸,使其成為空間受限且在不同地點進行多項手術的設施的理想選擇。增強的成像品質、改進的可操作性和方便用戶使用的設計促進了它們的廣泛應用。這些系統還為各種應用提供即時成像,例如創傷病例、骨科手術和透視手術,從而刺激需求並鞏固其市場主導地位。

根據發電機功率,市場分為高功率和低功率部分。高功率 C 臂在 2024 年佔據了 56.3% 的佔有率,因其能夠提供對準確診斷和治療至關重要的高解析度影像而成為外科、骨科和創傷應用的首選。這些系統在對緻密組織和複雜解剖結構進行成像時特別有價值,可確保複雜醫療程序的精確度。慢性病病例的增加、全球人口老化以及微創手術的進步繼續推動對高功率 C 臂設備的需求。它們能夠提供即時成像,同時最大限度地減少輻射暴露,使其成為現代醫療保健環境中的首選。

市場也按影像增強器類型進行細分,其中 9 吋 C 臂類別領先,2024 年市場規模達 7.834 億美元。這些系統在便攜性和成像解析度之間實現了最佳平衡,非常適合手術室和門診中心的手術。它們在支持骨科手術、血管介入和疼痛管理應用方面的多功能性進一步促進了它們的廣泛應用。

在各種醫療應用中,心臟病學預計到 2034 年將以 5.7% 的複合年成長率成長最快。心血管疾病的盛行率不斷上升,推動了對先進影像系統的需求,以促進複雜的干涉。即時成像對於血管造影和支架置入等手術至關重要,推動了該領域對 C 臂的需求不斷成長。全球向微創心臟病治療的轉變正在進一步加速市場擴張。

按最終用途分類,醫院佔據市場主導地位,2024 年的收入為 12 億美元。作為各種診斷和外科手術的主要醫療保健提供者,醫院是 C 臂系統的主要消費者。他們擁有更高的預算和先進的醫療技術,因此能夠更快地採用和整合這些成像設備。患者數量的增加,尤其是急診和重症監護室的患者數量,繼續推動需求,使醫院成為市場領先地位。

受骨科、心臟病學和神經病學領域對微創手術的需求不斷成長的推動,美國 C 臂市場規模預計將在 2034 年達到 13 億美元。即時影像技術的廣泛應用在提高手術精度和改善醫療機構患者預後方面發揮著至關重要的作用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 外科手術數量不斷增加

- 慢性病盛行率上升

- C臂機器的技術進步

- 微創手術的需求不斷成長

- 產業陷阱與挑戰

- C 臂機器成本高昂

- 缺乏熟練的醫療保健專業人員

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 固定C臂

- 移動式C臂

第6章:市場估計與預測:按發電機功率,2021 年至 2034 年

- 主要趨勢

- 高功率

- 低功耗

第7章:市場估計與預測:按影像增強器類型,2021 年至 2034 年

- 主要趨勢

- 9吋C臂

- 12吋C臂

- 4/6吋C型臂

- 其他類型的影像增強器

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 骨科和創傷

- 心臟病學

- 神經病學

- 胃腸病學

- 腫瘤學

- 牙科

- 其他應用

第9章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 診斷中心

- 其他最終用途

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Canon

- Fujifilm

- GE Healthcare

- Genoray

- Hologic

- Philips

- Perlove Medical

- Shimadzu Corporation

- Siemens Healthineers

- StrenMed

- Trivitron Healthcare

- Turner Imaging Systems

- UMG/DEL Medical

- Villa Sistemi Medicali

- Ziehm Imaging

The Global C-Arm Market, valued at USD 2.2 billion in 2024, is set to grow at a CAGR of 5.1% from 2025 to 2034. A C-arm is an advanced imaging device, available in both mobile and fixed configurations, designed to deliver real-time X-ray imaging for medical procedures. These devices play a critical role in surgeries, diagnostics, and interventional radiology across various specialties, including orthopedics, cardiology, and oncology. The rising incidence of chronic diseases, fueled by aging populations, sedentary lifestyles, and poor dietary habits, is driving demand for advanced imaging solutions.

As chronic conditions become more prevalent, the need for high-resolution imaging in diagnosis, treatment, and surgical interventions continues to expand. C-arm systems facilitate complex procedures such as angioplasty, orthopedic surgeries, and tumor removals by providing clear, real-time visuals that enhance surgical precision and patient outcomes. Advances in imaging quality, ease of use, and portability further contribute to market expansion. Hospitals and surgical centers are increasingly integrating these devices to enhance diagnostic accuracy and treatment efficiency, reinforcing the market's steady growth trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 5.1% |

In terms of product type, mobile C-arms dominated the global market with an 82.3% share in 2024. Their portability enables seamless transport across various hospital departments, making them ideal for facilities where space is constrained and multiple procedures occur in different locations. Enhanced imaging quality, improved maneuverability, and user-friendly designs have contributed to their widespread adoption. These systems also provide real-time imaging for a variety of applications, such as trauma cases, orthopedic surgeries, and fluoroscopic procedures, boosting demand and solidifying their market dominance.

Based on generator power, the market is categorized into high-power and low-power segments. High-power C-arms, which captured a 56.3% share in 2024, are preferred in surgical, orthopedic, and trauma applications due to their ability to deliver high-resolution images critical for accurate diagnoses and treatments. These systems are particularly valuable in imaging dense tissues and complex anatomical structures, ensuring precision during intricate medical procedures. Growing cases of chronic diseases, an aging global population, and advancements in minimally invasive surgeries continue to propel demand for high-power C-arm devices. Their ability to deliver real-time imaging while minimizing radiation exposure makes them a preferred choice in modern healthcare settings.

The market is also segmented by image intensifier type, with the 9-inch C-arm category leading at USD 783.4 million in 2024. These systems offer an optimal balance between portability and imaging resolution, making them highly suitable for procedures in operating rooms and outpatient centers. Their versatility in supporting orthopedic surgeries, vascular interventions, and pain management applications further contributes to their widespread adoption.

Among various medical applications, cardiology is projected to grow at the fastest CAGR of 5.7% through 2034. The increasing prevalence of cardiovascular conditions is fueling the need for advanced imaging systems to facilitate complex interventions. Real-time imaging is essential in procedures like angiography and stent placement, driving the growing demand for C-arms in this segment. The global shift toward minimally invasive cardiology treatments is further accelerating market expansion.

By end use, hospitals dominated the market with USD 1.2 billion in revenue in 2024. As the primary healthcare providers for a vast range of diagnostic and surgical procedures, hospitals are major consumers of C-arm systems. Their higher budgets and access to advanced medical technologies enable faster adoption and integration of these imaging devices. Increasing patient volumes, particularly in emergency departments and critical care units, continue to drive demand, positioning hospitals as the leading segment in the market.

The U.S. C-arm market is on track to reach USD 1.3 billion by 2034, driven by the rising demand for minimally invasive procedures across orthopedic, cardiology, and neurology fields. The widespread adoption of real-time imaging technology is playing a crucial role in enhancing surgical precision and improving patient outcomes across healthcare facilities.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing number of surgical procedures

- 3.2.1.2 Rising prevalence of chronic diseases

- 3.2.1.3 Technological advancements of C-arm machines

- 3.2.1.4 Growing demand for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with C-arm machines

- 3.2.2.2 Dearth of skilled healthcare professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Fixed C-arm

- 5.3 Mobile C-arm

Chapter 6 Market Estimates and Forecast, By Generator Power, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 High power

- 6.3 Low power

Chapter 7 Market Estimates and Forecast, By Image Intensifier Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 9 inch C-arm

- 7.3 12 inch C-arm

- 7.4 4/6 inch C-arm

- 7.5 Other image intensifier types

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Orthopedics and trauma

- 8.3 Cardiology

- 8.4 Neurology

- 8.5 Gastroenterology

- 8.6 Oncology

- 8.7 Dental

- 8.8 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Canon

- 11.2 Fujifilm

- 11.3 GE Healthcare

- 11.4 Genoray

- 11.5 Hologic

- 11.6 Philips

- 11.7 Perlove Medical

- 11.8 Shimadzu Corporation

- 11.9 Siemens Healthineers

- 11.10 StrenMed

- 11.11 Trivitron Healthcare

- 11.12 Turner Imaging Systems

- 11.13 UMG/DEL Medical

- 11.14 Villa Sistemi Medicali

- 11.15 Ziehm Imaging