|

市場調查報告書

商品編碼

1699246

觸覺感測器市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Tactile Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

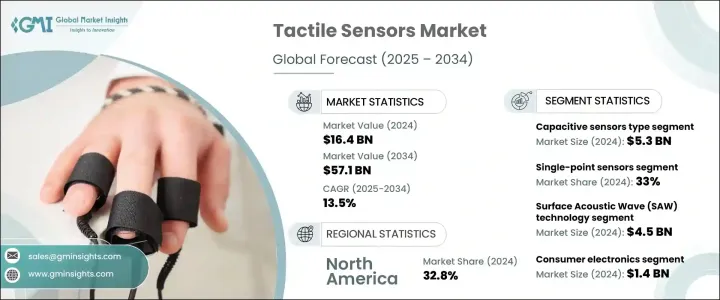

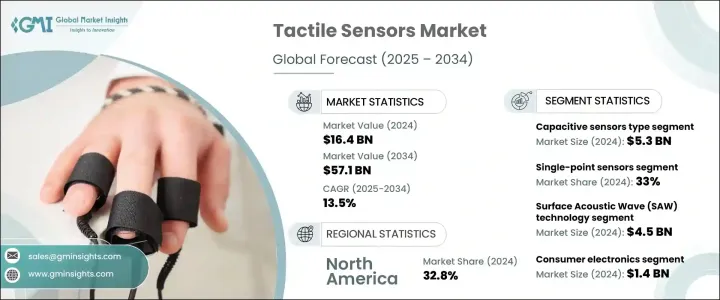

2024 年全球觸覺感測器市場價值為 164 億美元,預計 2025 年至 2034 年期間的複合年成長率為 13.5%。這一成長是由消費電子設備的日益普及、汽車領域觸覺感測器的使用日益增多以及對自動化和機器人技術的日益成長的傾向所推動的。這些旨在複製人類觸覺的感測器正在多個行業中廣泛應用,增強了其功能性和效率。它們在改善使用者介面和實現更智慧、更具互動性的系統方面發揮作用,從而推動了需求。人工智慧、機器學習和物聯網技術的不斷擴大正在進一步加速其應用,尤其是在高科技產業。此外,感測器精度、靈敏度和耐用性的不斷進步使其在醫療設備、工業自動化和國防領域中得到更廣泛的應用。將人工智慧觸覺感測器整合到智慧型設備和自主系統中正在成為一種主要趨勢,促使公司投資先進的感測器技術以提高性能和效率。

根據類型,電容式感測器在 2024 年的市場規模為 53 億美元。與電阻式和電感式感測器相比,電容式感測器具有更高的精度、更長的使用壽命和更高的靈敏度,因此得到了廣泛的應用。對於具有捏合縮放等功能的多點觸控介面的需求不斷成長,也支援了細分市場的擴展。隨著消費性電子產品不斷發展,觸控感應功能也越來越複雜,電容式感測器仍然是製造商的首選。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 164億美元 |

| 預測值 | 571億美元 |

| 複合年成長率 | 13.5% |

產品部分包括整合感測器、陣列感測器、單點感測器和混合感測器。 2024 年,單點感測器領域佔據全球市場的 33%。它們能夠提供精確的力和壓力檢測,這使得它們在工業自動化、機器人和穿戴式技術中不可或缺。隨著各行各業在從輔助技術到智慧型穿戴裝置等應用中尋求更先進的觸敏解決方案,對這些感測器的需求正在上升。

市場依技術細分為表面聲波 (SAW)、電活性聚合物 (EAP)、微機電系統 (MEMS) 等。到 2024 年,SAW 技術將以 45 億美元的市場規模佔據主導地位。對經濟高效、緊湊且高效的感測器組件的需求日益成長,推動了其應用,尤其是隨著 5G 和物聯網技術的興起。微型電子產品和行動裝置擴大採用基於 SAW 的感測器,進一步推動成長。

從應用角度來看,市場涵蓋消費性電子、汽車、醫療保健、工業自動化、航太等。受智慧型手機、平板電腦和先進觸覺回饋技術的廣泛應用推動,消費性電子產品市場規模到 2024 年將達到 14 億美元,佔據主導地位。觸覺感測器透過模擬觸摸來增強使用者體驗,使其成為現代電子設備不可或缺的一部分。

從地區來看,北美在 2024 年佔據了市場 32.8% 的收入佔有率,這得益於大量研發投資和嚴格的工業自動化安全法規。光是美國市場的價值就達到 35 億美元,機器人、醫療穿戴式裝置和義肢技術的進步帶來了強勁的需求。領先感測器製造商的存在進一步促進了創新和產品開發。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 消費性電子設備的普及率不斷提高

- 觸覺感測器在汽車工業的新興應用

- 對自動化和機器人技術的興趣日益濃厚

- 日益發展的技術

- 產業陷阱與挑戰

- 與設計和測試相關的複雜性

- 對電力消耗的擔憂日益加劇

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 電容式感測器

- 電阻式感測器

- 壓電感測器

- 光學感測器

- 其他

第6章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 單點感應器

- 陣列感測器

- 整合感測器

- 混合感測器

第7章:市場估計與預測:依技術,2021-2034 年

- 主要趨勢

- 表面聲波(SAW)

- 電活性聚合物(EAP)

- 微機電系統(MEMS)

- 其他

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 消費性電子產品

- 汽車

- 醫療保健和醫療器械

- 機器人技術

- 工業自動化

- 航太與國防

- 其他

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Airmar Technology Corporation

- Analog Devices, Inc.

- Bosch Sensortec GmbH

- Cypress Semiconductor Corporation

- Honeywell International Inc.

- Infineon Technologies AG

- Melexis NV

- Microchip Technology Inc.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors

- Omron Corporation

- Panasonic Corporation

- Pepperl+Fuchs SE

- Renesas Electronics Corporation

- STMicroelectronics

- TE Connectivity Ltd.

- Texas Instruments Incorporated

The Global Tactile Sensors Market was valued at USD 16.4 billion in 2024 and is projected to expand at a CAGR of 13.5% from 2025 to 2034. This growth is driven by the increasing adoption of consumer electronic devices, the rising use of tactile sensors in the automotive sector, and the growing inclination toward automation and robotics. These sensors, designed to replicate the human sense of touch, are gaining traction across multiple industries, enhancing functionality and efficiency. Their role in improving user interfaces and enabling smarter, more interactive systems is fueling demand. The expanding footprint of artificial intelligence, machine learning, and IoT technologies is further accelerating adoption, particularly in high-tech industries. Additionally, ongoing advancements in sensor accuracy, sensitivity, and durability are enabling broader applications in medical devices, industrial automation, and defense sectors. The integration of AI-powered tactile sensors into smart devices and autonomous systems is becoming a key trend, prompting companies to invest in advanced sensor technologies to enhance performance and efficiency.

Based on type, capacitive sensors accounted for USD 5.3 billion in 2024. Their superior accuracy, longer lifespan, and higher sensitivity compared to resistive and inductive sensors have contributed to their widespread use. The increasing demand for multi-touch interfaces with functions such as pinch-to-zoom is also supporting segment expansion. As consumer electronics continue to evolve with sophisticated touch-sensitive features, capacitive sensors remain a preferred choice for manufacturers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.4 billion |

| Forecast Value | $57.1 billion |

| CAGR | 13.5% |

The product segment includes integrated sensors, array sensors, single-point sensors, and hybrid sensors. In 2024, the single-point sensors segment held a 33% share of the global market. Their ability to provide precise force and pressure detection has made them essential in industrial automation, robotics, and wearable technologies. Demand for these sensors is rising as industries seek more advanced touch-sensitive solutions in applications ranging from assistive technologies to smart wearables.

The market is segmented by technology into Surface Acoustic Wave (SAW), Electroactive Polymers (EAP), Micro-electromechanical Systems (MEMS), and others. SAW technology led the market with USD 4.5 billion in 2024. The growing need for cost-effective, compact, and highly efficient sensor components has driven its adoption, particularly with the rise of 5G and IoT technologies. Miniaturized electronics and mobile devices are increasingly incorporating SAW-based sensors, further propelling growth.

Application-wise, the market spans consumer electronics, automotive, healthcare, industrial automation, aerospace, and others. Consumer electronics dominated with USD 1.4 billion in 2024, driven by the widespread adoption of smartphones, tablets, and advanced haptic feedback technologies. Tactile sensors enhance user experience by simulating touch, making them integral to modern electronic devices.

Regionally, North America accounted for 32.8% of the market's revenue share in 2024, supported by substantial investments in R&D and stringent industrial automation safety regulations. The U.S. market alone was valued at USD 3.5 billion, with strong demand stemming from advancements in robotics, medical wearables, and prosthetic technologies. The presence of leading sensor manufacturers is further fostering innovation and product development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing adoption of consumer electronic devices

- 3.6.1.2 Emerging use of tactile sensors in automotive industry

- 3.6.1.3 Rising inclination towards automation and robotics

- 3.6.1.4 Increasing technological developments

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Complexities associated with designing and testing

- 3.6.2.2 Growing concerns regarding power consumption

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Capacitive sensors

- 5.3 Resistive sensors

- 5.4 Piezoelectric sensors

- 5.5 Optical sensors

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Single-point sensors

- 6.3 Array sensors

- 6.4 Integrated sensors

- 6.5 Hybrid sensors

Chapter 7 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Surface Acoustic Wave (SAW)

- 7.3 Electroactive Polymers (EAP)

- 7.4 Micro-electromechanical Systems (MEMS)

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Healthcare & medical devices

- 8.5 Robotics

- 8.6 Industrial automation

- 8.7 Aerospace & defense

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airmar Technology Corporation

- 10.2 Analog Devices, Inc.

- 10.3 Bosch Sensortec GmbH

- 10.4 Cypress Semiconductor Corporation

- 10.5 Honeywell International Inc.

- 10.6 Infineon Technologies AG

- 10.7 Melexis NV

- 10.8 Microchip Technology Inc.

- 10.9 Murata Manufacturing Co., Ltd.

- 10.10 NXP Semiconductors

- 10.11 Omron Corporation

- 10.12 Panasonic Corporation

- 10.13 Pepperl+Fuchs SE

- 10.14 Renesas Electronics Corporation

- 10.15 STMicroelectronics

- 10.16 TE Connectivity Ltd.

- 10.17 Texas Instruments Incorporated