|

市場調查報告書

商品編碼

1699259

機器人泳池清潔器市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Robotic Pool Cleaner Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

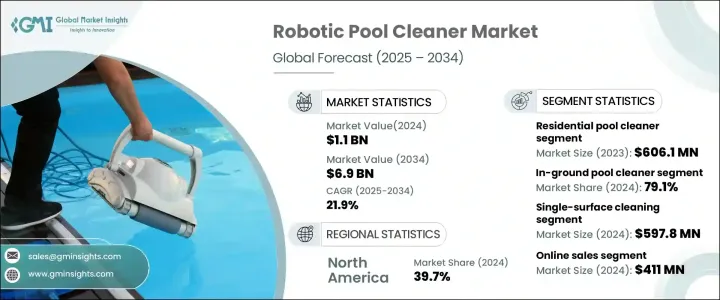

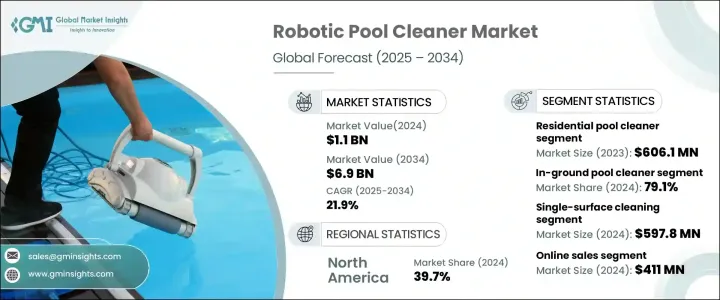

2024 年全球機器人泳池清潔器市場規模達到 11 億美元,預計 2025 年至 2034 年的複合年成長率將達到 21.9%。市場成長的動力來自北美和歐洲游泳池安裝量的增加以及機器人技術的快速進步。人工智慧和自動化領域的創新使得泳池清潔更加高效,降低了能源消耗,並最大限度地減少了化學品的使用。

人工智慧驅動的機器人泳池清潔器旨在繪製最佳清潔路線、繞過障礙物並適應泳池佈局以實現全面覆蓋。這些智慧功能提高了清潔效率並延長了設備的使用壽命。人們對永續解決方案的日益青睞也加速了需求,因為機器人泳池清潔器比傳統清潔方法消耗更少的電力,從而節省了成本並減少了對環境的影響。隨著消費者尋求無憂的泳池維護,該行業正在經歷顯著成長,特別是在住宅和商業應用方面。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 11億美元 |

| 預測值 | 69億美元 |

| 複合年成長率 | 21.9% |

市場根據產品類型進行細分,其中住宅機器人泳池清潔器領先,2023 年市場規模達 6.061 億美元。這些自動化設備利用基於人工智慧的導航、吸力和壓力驅動機制來有效清潔泳池地板、牆壁和水線。它們能夠減少人工和能源消耗,因此成為屋主的首選。另一方面,2022 年商用泳池清潔器市場價值為 2.324 億美元。商用級機器人泳池清潔器具有更高的耐用性和效率,可降低營運成本,同時為大型泳池提供徹底的清潔。

就泳池類型而言,市場分為地下和地上的機器人泳池清潔器。到 2024 年,地下太陽能將佔全球市場的 79.1%,反映出其被廣泛採用。這些清潔器易於安裝和維護,使其成為需要深度和持續清潔的泳池的首選解決方案。地上泳池清潔器也越來越受歡迎,為安裝在地面以上的泳池提供有效的解決方案。

機器人泳池清潔器根據清潔類型進一步分類,包括單表面清潔和多表面清潔兩種。單表面清潔劑在 2024 年創造了 5.978 億美元的最高收入,適用於玻璃纖維或混凝土等均勻表面的泳池。然而,市場正在轉向多表面清潔劑,這種清潔劑更能適應各種泳池紋理,從而增加了其需求。

配銷通路分析凸顯了線上銷售的主導地位,2024 年線上銷售規模達到 4.11 億美元。電子商務平台在市場擴張中發揮關鍵作用,提供無縫的購買體驗、有競爭力的價格和送貨上門服務。其他管道,包括家居裝飾店和泳池用品店,也促進了整體銷售的成長。

就連接性而言,市場分為有線和無線機器人泳池清潔器。有線部分在 2024 年以 3.472 億美元的市場規模領先。這些型號可提供持續電力,但由於電纜限制,移動性有限。無線變體正在成為一種便利的替代品,提供更大的靈活性。

從地理位置來看,受高可支配收入和強勁的游泳池所有權趨勢的推動,北美在 2024 年佔據了 39.7% 的最大市場佔有率。美國貢獻了 3.653 億美元,反映出消費者對配備智慧型手機整合和智慧導航等先進功能的高階機器人泳池清潔器有著強勁的需求。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 先進技術、人工智慧和感測器的整合度不斷提高

- 節能環保的泳池清潔解決方案

- 消費者對智慧家庭解決方案的需求不斷增加

- 提高能源效率和環境永續性

- 產業陷阱與挑戰

- 先進的機器人泳池清潔器初始成本高

- 對不規則泳池形狀和表面的適應性有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 住宅泳池清潔器

- 商業泳池清潔劑

- 其他

第6章:市場估計與預測:按池類型,2021-2034

- 主要趨勢

- 地下泳池清潔器

- 地上泳池清潔器

第7章:市場估計與預測:依清潔類型,2021-2034

- 主要趨勢

- 單表面清潔

- 多表面清潔

第8章:市場估計與預測:依連結性,2021-2034

- 主要趨勢

- 有線

- 無線

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 網上銷售

- 家居裝飾店

- 泳池用品商店

- 直銷

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Aiper

- AQUATRON ROBOTIC TECHNOLOGY LTD.

- Hayward Industries, Inc

- iRobot Corporation

- Kreepy Krauly

- Mariner 3S AG

- Maytronics

- Ofuzzi

- Pentair

- Polaris

- Pool Corporation

- Smorobot

- ZODIAC

The Global Robotic Pool Cleaner Market reached USD 1.1 billion in 2024 and is projected to expand at a CAGR of 21.9% from 2025 to 2034. The market growth is fueled by increasing swimming pool installations across North America and Europe and rapid advancements in robotics technology. Innovations in artificial intelligence and automation are making pool cleaning more efficient, reducing energy consumption, and minimizing chemical usage.

AI-driven robotic pool cleaners are designed to map optimal cleaning routes, navigate obstacles, and adjust to the pool's layout for comprehensive coverage. These smart features enhance cleaning efficiency and extend equipment longevity. The growing preference for sustainable solutions is also accelerating demand, as robotic pool cleaners consume less electricity than traditional cleaning methods, resulting in cost savings and a smaller environmental footprint. As consumers seek hassle-free pool maintenance, the industry is witnessing significant growth, particularly in residential and commercial applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 21.9% |

The market is segmented based on product type, with residential robotic pool cleaners leading at USD 606.1 million in 2023. These automated devices utilize AI-based navigation, suction, and pressure-driven mechanisms to clean pool floors, walls, and waterlines efficiently. Their ability to reduce manual effort and energy usage has made them a preferred choice for homeowners. On the other hand, the commercial pool cleaner segment was valued at USD 232.4 million in 2022. Commercial-grade robotic pool cleaners offer enhanced durability and efficiency, reducing operational costs while delivering thorough cleaning for large swimming pools.

In terms of pool type, the market is categorized into in-ground and above-ground robotic pool cleaners. The in-ground segment accounted for 79.1% of the global market in 2024, reflecting its widespread adoption. These cleaners are easy to install and maintain, making them the go-to solution for pools that require deep and consistent cleaning. Above-ground pool cleaners are also gaining traction, providing effective solutions for pools that are installed above ground level.

Robotic pool cleaners are further classified based on cleaning type, with single-surface and multi-surface cleaning variants. Single-surface cleaners generated the highest revenue of USD 597.8 million in 2024, catering to pools with uniform surfaces such as fiberglass or concrete. However, the market is shifting toward multi-surface cleaners, which are more adaptable to various pool textures, thereby increasing their demand.

The distribution channel analysis highlights the dominance of online sales, which accounted for USD 411 million in 2024. E-commerce platforms are playing a key role in market expansion, offering seamless purchasing experiences, competitive pricing, and doorstep delivery. Other channels, including home improvement stores and pool supply outlets, also contribute to overall sales growth.

In terms of connectivity, the market is divided into corded and cordless robotic pool cleaners. The corded segment led with USD 347.2 million in 2024. These models provide continuous power but have limited mobility due to cable constraints. Cordless variants are emerging as a convenient alternative, offering greater flexibility.

Geographically, North America held the largest market share of 39.7% in 2024, driven by high disposable incomes and strong pool ownership trends. The United States contributed USD 365.3 million, reflecting strong consumer demand for premium robotic pool cleaners equipped with advanced features such as smartphone integration and intelligent navigation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing integration in advanced technology, AI and sensors

- 3.6.1.2 Energy-efficient and eco-friendly pool cleaning solutions

- 3.6.1.3 Increasing consumer demand for smart home solutions

- 3.6.1.4 Enhanced energy efficiency and environmental sustainability

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial cost of advanced robotic pool cleaners

- 3.6.2.2 Limited adaptability to irregular pool shapes and surfaces

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & Thousand Unit)

- 5.1 Key trends

- 5.2 Residential pool cleaner

- 5.3 Commercial pool cleaner

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Pool Type, 2021-2034 (USD Million & Thousand Unit)

- 6.1 Key trends

- 6.2 In-ground pool cleaners

- 6.3 Above-ground pool cleaners

Chapter 7 Market Estimates & Forecast, By Cleaning Type, 2021-2034 (USD Million & Thousand Unit)

- 7.1 Key trends

- 7.2 Single-surface cleaning

- 7.3 Multi-surface cleaning

Chapter 8 Market Estimates & Forecast, By Connectivity, 2021-2034 (USD Million & Thousand Unit)

- 8.1 Key trends

- 8.2 Corded

- 8.3 Cordless

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million & Thousand Unit)

- 9.1 Key trends

- 9.2 Online sales

- 9.3 Home improvement stores

- 9.4 Pool supply stores

- 9.5 Direct sales

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Thousand Unit)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aiper

- 11.2 AQUATRON ROBOTIC TECHNOLOGY LTD.

- 11.3 Hayward Industries, Inc

- 11.4 iRobot Corporation

- 11.5 Kreepy Krauly

- 11.6 Mariner 3S AG

- 11.7 Maytronics

- 11.8 Ofuzzi

- 11.9 Pentair

- 11.10 Polaris

- 11.11 Pool Corporation

- 11.12 Smorobot

- 11.13 ZODIAC