|

市場調查報告書

商品編碼

1699264

雙能量 X光吸收法市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Dual-energy X-ray Absorptiometry Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

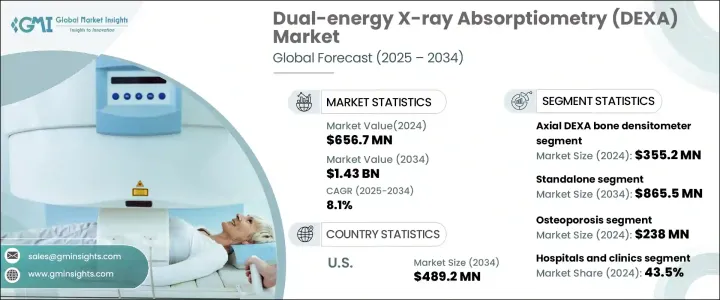

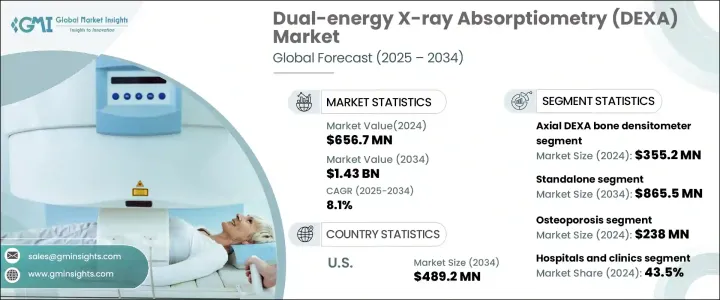

2024 年全球雙能量 X光吸收儀市值為 6.567 億美元,預計 2025 年至 2034 年期間的複合年成長率為 8.1%。 DEXA 是一種廣泛使用的醫學影像技術,旨在評估骨礦物質密度 (BMD) 和身體組成。其主要應用是診斷骨質疏鬆症和長期追蹤骨骼健康狀況。骨質疏鬆症盛行率的上升和全球人口老化是這些系統需求不斷增加的關鍵促進因素。由於老年人骨折風險較高且骨密度降低,早期發現和持續監測的需求日益成長。 DEXA 系統因其在評估骨折風險和測量骨骼健康方面的精確度而在醫院、診斷中心和專科診所中變得越來越普遍。對預防性醫療保健的重視和醫學影像技術的進步進一步加速了市場的成長。

市場分為全軸和周邊 DEXA 骨密度儀。 2024 年,軸向 DEXA 領域引領市場,創造 3.552 億美元的收入。該領域因其在診斷骨質疏鬆症和評估臀部和脊柱等關鍵骨骼區域的 BMD 方面的高準確性而受到青睞。與周邊系統相比,軸向 DEXA 在檢測骨質疏鬆症的早期跡象和監測治療進展方面具有更高的精度。它在運動醫學和肥胖管理領域的廣泛應用也有助於其佔據市場主導地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.567億美元 |

| 預測值 | 14.3億美元 |

| 複合年成長率 | 8.1% |

市場的另一個細分是基於產品類型,包括獨立和攜帶式 DEXA 系統。獨立部分在 2024 年佔了 59.4% 的市場佔有率,預計到 2034 年價值將達到 8.655 億美元。這些系統主要安裝在醫院、診斷中心和研究機構,在那裡它們提供高成像強度和骨密度評估的準確性。它們能夠提供精確的診斷並支持代謝健康評估,這使它們成為醫療機構的首選。領先的產業參與者正在整合低劑量輻射功能,以提高病患安全性,同時不影響診斷效率。

在應用方面,DEXA 市場涵蓋骨質疏鬆症診斷、身體組成分析、骨折管理、骨密度測量和其他醫療用途。 2024 年,骨質疏鬆症領域創造了 2.38 億美元的收入,由於疾病的盛行率不斷上升,該領域保持領先地位。隨著骨骼健康意識的增強,越來越多的患者和醫療保健提供者開始重視早期發現和常規評估。

醫院和診所成為最大的終端使用領域,到 2024 年就佔了 43.5% 的市場。這些機構作為主要醫療保健提供者,進行 DEXA 掃描以準確診斷骨質疏鬆症並監測患者。這些設施中先進的醫療設備和熟練的專業人員的結合促進了這些系統的廣泛應用。

美國市場收入大幅成長,2023 年達到 2.126 億美元,預計到 2034 年將達到 4.892 億美元。骨質疏鬆症盛行率高和骨密度測試的保險覆蓋率是推動市場擴張的關鍵因素。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 骨質疏鬆症和維生素D缺乏症發生率激增

- 骨密度測量技術進步

- 全球老齡人口不斷增加

- 人們對骨質疏鬆症及其對骨骼健康影響的認知不斷提高

- 產業陷阱與挑戰

- 骨密度儀成本高

- 與骨密度儀相關的風險

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 軸向DEXA骨密度儀

- 周邊DEXA骨密度儀

第6章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 獨立

- 便攜的

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 骨質疏鬆症

- 身體組成分析

- 骨折管理

- 骨密度測定

- 其他應用

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院和診所

- 診斷中心

- 專業中心

- 其他最終用途

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Aurora Spine

- BeamMed

- DMS

- Fonar

- Fujifilm

- Furuno Electric

- GE Healthcare

- Hologic

- Medilink International

- Medonica

- Osteometer Meditech

- OSTEOSYS

- Scanflex Healthcare

- Shenzhen XRAY Electric

- Swissray Medical

- Xingaoyi

The Global Dual-Energy X-Ray Absorptiometry Market was valued at USD 656.7 million in 2024 and is projected to expand at a CAGR of 8.1% from 2025 to 2034. DEXA is a widely used medical imaging technology designed to assess bone mineral density (BMD) and body composition. Its primary application is in diagnosing osteoporosis and tracking bone health over time. The rising prevalence of osteoporosis and an aging global population are key drivers behind the increasing demand for these systems. With a higher risk of fractures and reduced BMD among older adults, the need for early detection and continuous monitoring is growing. DEXA systems are becoming more prevalent in hospitals, diagnostic centers, and specialty clinics due to their precision in evaluating fracture risks and measuring bone health. The emphasis on preventive healthcare and advancements in medical imaging technologies are further accelerating market growth.

The market is divided into total axial and peripheral DEXA bone densitometers. In 2024, the axial DEXA segment led the market, generating USD 355.2 million in revenue. This segment is favored for its high accuracy in diagnosing osteoporosis and assessing BMD in crucial skeletal regions like the hip and spine. Compared to peripheral systems, axial DEXA provides superior precision in detecting early signs of osteoporosis and monitoring treatment progress. Its extensive use in sports medicine and obesity management also contributes to its market dominance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $656.7 Million |

| Forecast Value | $1.43 Billion |

| CAGR | 8.1% |

Another segmentation of the market is based on product type, which includes standalone and portable DEXA systems. The standalone segment accounted for 59.4% of the market share in 2024, with a projected value of USD 865.5 million by 2034. These systems are primarily installed in hospitals, diagnostic centers, and research institutions, where they offer high imaging strength and accuracy in bone density assessment. Their ability to provide precise diagnostics and support metabolic health evaluations makes them a preferred choice in medical facilities. Leading industry players are integrating low-dose radiation features to enhance patient safety without compromising diagnostic efficiency.

Regarding applications, the DEXA market encompasses osteoporosis diagnosis, body composition analysis, fracture management, bone densitometry, and other medical uses. The osteoporosis segment generated USD 238 million in 2024, maintaining a leading position due to the increasing prevalence of the disease. As bone health awareness grows, more patients and healthcare providers are prioritizing early detection and routine assessments.

Hospitals and clinics emerged as the top end-use segment, capturing 43.5% of the market share in 2024. These institutions serve as primary healthcare providers, conducting DEXA scans for accurate osteoporosis diagnosis and patient monitoring. The combination of advanced medical equipment and skilled professionals in these facilities contributes to the widespread adoption of these systems.

The U.S. market has seen substantial revenue growth, reaching USD 212.6 million in 2023, and is projected to hit USD 489.2 million by 2034. High osteoporosis prevalence and insurance coverage for bone density tests are key factors fueling market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in incidence of osteoporosis and vitamin D deficiency

- 3.2.1.2 Technological advancements in the bone densitometry

- 3.2.1.3 Increasing elderly population worldwide

- 3.2.1.4 Growing awareness of osteoporosis and its impact on bone health

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of bone densitometers

- 3.2.2.2 Risk associated with bone densitometers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Axial DEXA bone densitometer

- 5.3 Peripheral DEXA bone densitometer

Chapter 6 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Standalone

- 6.3 Portable

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Osteoporosis

- 7.3 Body composition analysis

- 7.4 Fracture management

- 7.5 Bone densitometry

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Diagnostic centers

- 8.4 Specialty centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aurora Spine

- 10.2 BeamMed

- 10.3 DMS

- 10.4 Fonar

- 10.5 Fujifilm

- 10.6 Furuno Electric

- 10.7 GE Healthcare

- 10.8 Hologic

- 10.9 Medilink International

- 10.10 Medonica

- 10.11 Osteometer Meditech

- 10.12 OSTEOSYS

- 10.13 Scanflex Healthcare

- 10.14 Shenzhen XRAY Electric

- 10.15 Swissray Medical

- 10.16 Xingaoyi