|

市場調查報告書

商品編碼

1699281

黏液補充劑市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Viscosupplementation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

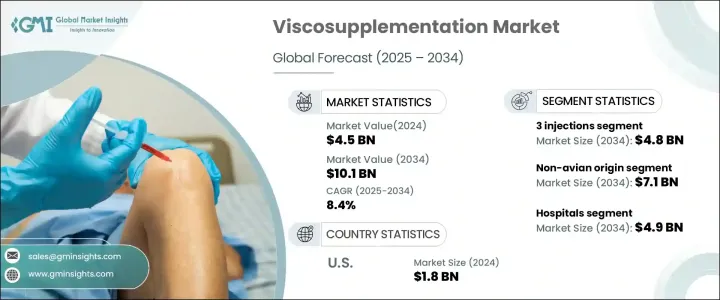

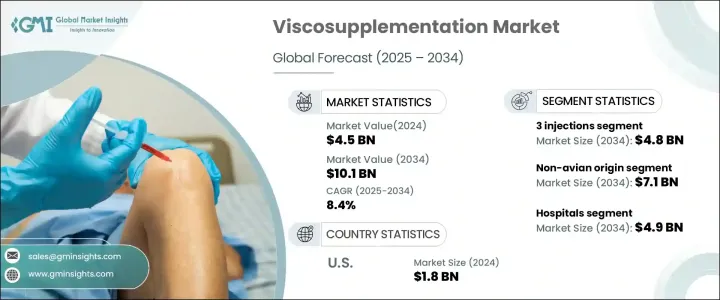

2024 年全球黏液補充劑市場規模達到 45 億美元,預計 2025 年至 2034 年的複合年成長率為 8.4%。骨關節炎(尤其是膝關節骨性關節炎)盛行率的上升繼續推動對先進治療方案的需求。作為一種非手術干預措施,黏彈性補充療法因其改善關節活動性、緩解疼痛和延緩侵入性手術需求的能力而獲得廣泛認可。由於人口老化,市場正在快速擴張,因為老年人更容易受到關節退化和骨關節炎相關併發症的影響。

隨著全球骨關節炎病例激增,醫療保健提供者和患者擴大轉向黏液補充劑進行長期症狀管理。該手術包括將透明質酸注射到受影響的關節中,以恢復潤滑、減少僵硬並增強活動性。患者更喜歡這種治療方法,因為它的恢復時間最短,並且減少了對止痛藥的依賴。同時,配方技術和產品純度的不斷進步正在擴大不同患者群體的採用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 45億美元 |

| 預測值 | 101億美元 |

| 複合年成長率 | 8.4% |

具有更強功效和更好生物相容性的下一代黏液補充劑的推出進一步推動了市場的成長。製造商不斷創新以提高產品性能,確保黏液補充劑仍然是骨關節炎管理的首選。此外,政府的支持措施、不斷增加的醫療支出以及對非手術治療替代方案的認知不斷提高,正在加速市場的發展軌跡。

黏液補充劑市場根據產品類型分為單次注射、三次注射和五次注射。其中,三聯注射劑市場佔據主導地位,2024 年收入達 21 億美元,預計到 2034 年將達到 48 億美元,複合年成長率為 8.5%。它在控制骨關節炎症狀和恢復關節功能方面的有效性使其成為標準治療方法。醫生之所以青睞這種療法,是因為其結構化的給藥方案,可以持續緩解症狀,同時最大限度地減少頻繁就醫的需要。由於其易於管理、治療時間均衡、臨床結果一致,該領域的受歡迎程度持續上升。

根據來源,市場分為禽源性和非禽源性黏液補充劑,其中非禽源性產品在 2024 年佔據 71.6% 的市場佔有率。由於人們對過敏反應、道德考量和產品一致性提高的擔憂日益增加,預計到 2034 年,這一細分市場的規模將達到 71 億美元。非禽源性黏液補充劑具有更高的純度和更低的免疫反應風險,因此越來越受到患者和醫療保健提供者的青睞。隨著製造商專注於開發無過敏原、高純度配方,向合成和生物工程替代品的轉變正在進一步塑造市場。

隨著北美骨關節炎病例持續增加,北美黏液補充劑市場規模將於 2024 年達到 18 億美元。研究表明,關節炎仍然是最常見的關節疾病,影響數百萬人,而骨關節炎是老年人殘疾的主要原因。研究表明,65歲及以上的人中有43%患有骨關節炎,主要由於軟骨退化、關節惡化和彈性降低。隨著對有效、微創解決方案的需求不斷成長,黏彈性補充療法繼續鞏固其作為骨關節炎護理關鍵治療選擇的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 老年人口日益成長,易患骨關節炎

- 微創治療需求不斷成長

- 技術進步

- 運動相關傷害增加

- 產業陷阱與挑戰

- 治療費用高

- 替代療法的可用性

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 單次注射

- 3次注射

- 5次注射

第6章:市場估計與預測:依原產地,2021 年至 2034 年

- 主要趨勢

- 禽類起源

- 非禽類來源

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 骨科診所

- 門診手術中心(ASC)

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Anika Therapeutics

- APTISSEN

- Avanos

- Biotech Healthcare

- Bioventus

- Ferring Pharmaceuticals

- Fidia Pharma

- Premier Surgical

- Sanofi

- Seikagaku Corporation

- Stellar Pharmaceuticals

- TRB Pharma

- Zimmer Biomet

The Global Viscosupplementation Market reached USD 4.5 billion in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2034. The rising prevalence of osteoarthritis, particularly knee osteoarthritis, continues to drive the demand for advanced treatment solutions. As a non-surgical intervention, viscosupplementation is gaining widespread recognition for its ability to improve joint mobility, alleviate pain, and delay the need for invasive procedures. The market is witnessing rapid expansion due to the aging population, as older individuals are more susceptible to joint degeneration and osteoarthritis-related complications.

With osteoarthritis cases surging globally, healthcare providers and patients alike are increasingly turning to viscosupplementation for long-term symptom management. The procedure involves injecting hyaluronic acid into the affected joints to restore lubrication, reduce stiffness, and enhance mobility. Patients prefer this treatment for its minimal recovery time and reduced dependence on pain medication. Meanwhile, ongoing advancements in formulation technologies and product purity are expanding adoption across diverse patient groups.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 8.4% |

The introduction of next-generation viscosupplements with extended efficacy and improved biocompatibility is further fueling market growth. Manufacturers are continuously innovating to enhance product performance, ensuring that viscosupplementation remains a preferred choice for osteoarthritis management. Additionally, supportive government initiatives, rising healthcare expenditure, and increasing awareness about non-surgical treatment alternatives are accelerating the market's trajectory.

The viscosupplementation market is segmented by product type into single injection, three injections, and five injections. Among these, the three-injection segment dominated the market with USD 2.1 billion in revenue in 2024 and is expected to reach USD 4.8 billion by 2034, registering a CAGR of 8.5%. Its effectiveness in managing osteoarthritis symptoms and restoring joint function has made it the standard treatment approach. Physicians favor this regimen due to its structured dosing schedule, which provides sustained symptom relief while minimizing the need for frequent medical visits. The segment's popularity continues to rise due to its ease of administration, balanced treatment duration, and consistent clinical outcomes.

By source, the market is categorized into avian-origin and non-avian-origin viscosupplements, with non-avian-origin products accounting for 71.6% of the market share in 2024. This segment is projected to reach USD 7.1 billion by 2034, driven by growing concerns over allergic reactions, ethical considerations, and improved product consistency. Non-avian-origin viscosupplements offer enhanced purity and a lower risk of immune response, making them increasingly preferred by both patients and healthcare providers. The transition toward synthetic and bioengineered alternatives is further shaping the market as manufacturers focus on developing allergen-free, high-purity formulations.

North America viscosupplementation market reached USD 1.8 billion in 2024, as osteoarthritis cases continue to rise across the region. Studies indicate that arthritis remains the most common joint disorder, affecting millions of individuals, with osteoarthritis being the leading cause of disability among aging populations. Research shows that 43% of individuals aged 65 and above suffer from osteoarthritis, primarily due to cartilage degeneration, joint deterioration, and reduced resilience. As demand for effective, minimally invasive solutions grows, viscosupplementation continues to cement its position as a key treatment option in osteoarthritis care.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing geriatric population prone to osteoarthritis

- 3.2.1.2 Rising demand for minimally invasive treatments

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increasing sport-related injuries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment cost

- 3.2.2.2 Availability of alternative treatments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Single injection

- 5.3 3 injections

- 5.4 5 injections

Chapter 6 Market Estimates and Forecast, By Source of Origin, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Avian origin

- 6.3 Non-avian origin

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Orthopedic clinics

- 7.4 Ambulatory surgical centers (ASCs)

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anika Therapeutics

- 9.2 APTISSEN

- 9.3 Avanos

- 9.4 Biotech Healthcare

- 9.5 Bioventus

- 9.6 Ferring Pharmaceuticals

- 9.7 Fidia Pharma

- 9.8 Premier Surgical

- 9.9 Sanofi

- 9.10 Seikagaku Corporation

- 9.11 Stellar Pharmaceuticals

- 9.12 TRB Pharma

- 9.13 Zimmer Biomet