|

市場調查報告書

商品編碼

1699285

行動寵物護理市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Mobile Pet Care Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

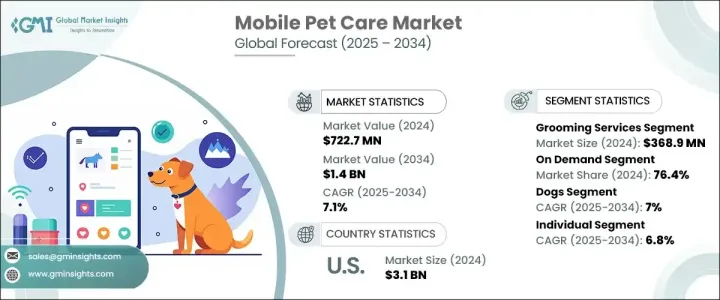

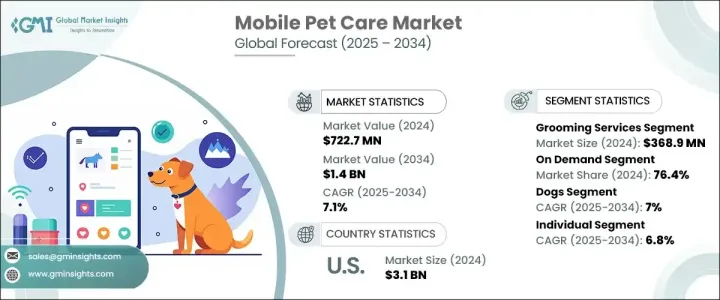

2024 年全球行動寵物護理市場規模達到 7.227 億美元,預計 2025 年至 2034 年的複合年成長率為 7.1%。寵物主人數量的增加、寵物保健支出的增加以及對客製化醫療服務的需求不斷成長是推動行業成長的關鍵因素。隨著消費者尋求更方便、更靈活的解決方案,行動寵物護理服務正成為首選,無需出行,並可在家中提供客製化服務。此外,寵物主人越來越傾向於環保和永續的產品,以確保寵物的安全和福祉,從而促進市場擴張。

市場按服務類型細分,包括美容、獸醫和其他寵物護理解決方案。美容部分包括洗澡、刷毛、修指甲和其他衛生服務,2024 年的收入為 3.689 億美元。這些服務可滿足各種寵物需求,包括除毛、除毛和客製化護理。在家美容的便利性,加上人們對寵物健康和衛生意識的不斷提高,正在推動服務採用率的提高。數位化的進步簡化了時間安排,讓主人可以輕鬆預約行動美容服務。隨著寵物衛生變得越來越重要,對專業美容解決方案的需求仍然強勁。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.227億美元 |

| 預測值 | 14億美元 |

| 複合年成長率 | 7.1% |

根據服務交付模式,該行業分為按需服務和訂閱服務。按需細分市場在 2024 年佔據 76.4% 的佔有率,預計在整個預測期內將以 7% 的複合年成長率成長。寵物主人越來越青睞靈活的服務,因為可以省去交通的麻煩,這使得移動寵物護理成為一種有吸引力的選擇。這些服務不僅限於美容,還延伸到獸醫諮詢和專門治療,提供全面的健康解決方案。在熟悉的環境中評估、診斷和治療寵物的能力極大地促進了行動獸醫服務的普及。

預計到 2034 年,美國行動寵物護理市場規模將達到 5.764 億美元,引領北美產業。主要參與者對行動美容的日益偏好以及技術先進的獸醫服務的引入正在推動成長。預計寵物護理支出的增加、人們對寵物健康的認知的提高以及支持性監管舉措將進一步推動擴張,並在未來幾年加強該行業的影響力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物擁有量增加

- 寵物健康和衛生意識不斷提高

- 行動服務的技術進步

- 產業陷阱與挑戰

- 營運成本高

- 農村市場滲透率有限

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按服務,2021 年至 2034 年

- 主要趨勢

- 美容

- 沐浴

- 刷牙

- 剪指甲

- 其他美容服務

- 獸醫

- 疫苗接種

- 診斷測試和成像

- 身體健康監測

- 其他獸醫服務

- 其他服務

第6章:市場估計與預測:依服務交付,2021 年至 2034 年

- 主要趨勢

- 一經請求

- 訂閱

第7章:市場估計與預測:按動物,2021 年至 2034 年

- 主要趨勢

- 狗

- 貓

- 其他動物

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 個人

- 商業的

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 4 Paws Mobile Spa

- Aussie Mobile Vet

- Blue Wheelers

- Dapper Dog Mobile Pet Grooming

- Dial a Dog Wash

- Good Dog Mobile Grooming

- Home Veterinary Services

- HousePaws Mobile Veterinary Service

- La Boit Specialty Vehicles

- Mobi Dog Grooma

- Mobile Veterinary Services

- My Pet Mobile Vet

- Woofie's Pet Ventures

The Global Mobile Pet Care Market reached USD 722.7 million in 2024 and is projected to register a CAGR of 7.1% from 2025 to 2034. The rising number of pet owners, increasing expenditure on pet wellness, and growing demand for customized healthcare services are key factors fueling industry growth. As consumers seek more convenient and flexible solutions, mobile pet care services are becoming a preferred choice, eliminating the need for travel and offering tailored services at home. Additionally, pet owners are showing a greater preference for eco-friendly and sustainable products to ensure the safety and well-being of their animals, contributing to market expansion.

The market is segmented by service type, including grooming, veterinary, and other pet care solutions. The grooming segment, which encompasses bathing, brushing, nail trimming, and additional hygiene services, recorded USD 368.9 million in 2024. These services cater to various pet needs, including de-matting, de-shedding, and customized treatments. The convenience of at-home grooming, combined with rising awareness of pet health and hygiene, is boosting service adoption. Digital advancements have simplified scheduling, allowing owners to book mobile grooming appointments with ease. As pet hygiene continues to gain importance, the demand for specialized grooming solutions remains strong.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $722.7 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 7.1% |

Based on service delivery models, the industry is divided into on-demand and subscription-based services. The on-demand segment accounted for 76.4% share in 2024 and is expected to grow at a CAGR of 7% throughout the forecast period. Pet owners increasingly favor flexible services that eliminate the hassle of transportation, making mobile pet care an attractive alternative. These services go beyond grooming, extending to veterinary consultations and specialized therapies, offering comprehensive health solutions. The ability to evaluate, diagnose, and treat pets in a familiar environment has significantly contributed to the rising adoption of mobile veterinary services.

US mobile pet care market is projected to reach USD 576.4 million by 2034, leading the North American industry. The increasing preference for mobile grooming and the introduction of technologically advanced veterinary services by key players are fueling growth. Rising pet care expenditures, greater awareness of pet well-being, and supportive regulatory initiatives are expected to drive further expansion, strengthening the industry's footprint in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing pet ownership

- 3.2.1.2 Rising awareness about pet health and hygiene

- 3.2.1.3 Technological advancements in mobile services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High operational costs

- 3.2.2.2 Limited market penetration in rural areas

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Services, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Grooming

- 5.2.1 Bathing

- 5.2.2 Brushing

- 5.2.3 Nail clipping

- 5.2.4 Other grooming services

- 5.3 Veterinary

- 5.3.1 Vaccination

- 5.3.2 Diagnostic tests and imaging

- 5.3.3 Physical health monitoring

- 5.3.4 Other veterinary services

- 5.4 Other services

Chapter 6 Market Estimates and Forecast, By Service Delivery, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 On demand

- 6.3 Subscription

Chapter 7 Market Estimates and Forecast, By Animal, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dogs

- 7.3 Cats

- 7.4 Other animals

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Individual

- 8.3 Commercial

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 4 Paws Mobile Spa

- 10.2 Aussie Mobile Vet

- 10.3 Blue Wheelers

- 10.4 Dapper Dog Mobile Pet Grooming

- 10.5 Dial a Dog Wash

- 10.6 Good Dog Mobile Grooming

- 10.7 Home Veterinary Services

- 10.8 HousePaws Mobile Veterinary Service

- 10.9 La Boit Specialty Vehicles

- 10.10 Mobi Dog Grooma

- 10.11 Mobile Veterinary Services

- 10.12 My Pet Mobile Vet

- 10.13 Woofie's Pet Ventures