|

市場調查報告書

商品編碼

1699309

人工器官市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Artificial Organs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

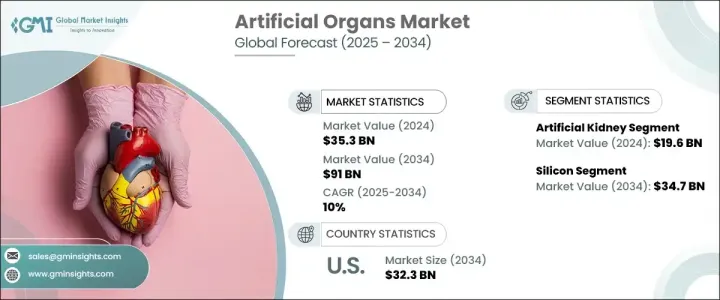

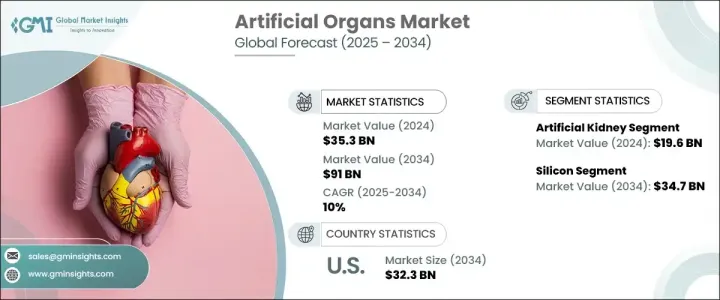

2024 年全球人工器官市場價值為 353 億美元,預計 2025 年至 2034 年期間的複合年成長率為 10%。隨著醫療技術的進步,人工器官擴大取代、支持和增強生物功能,幫助患者恢復正常。隨著慢性病和器官衰竭病例的增加,對這些救生設備的需求也在激增,這加劇了對傳統移植以外的替代解決方案的需求。由於捐贈器官嚴重短缺,人工替代品提供了一個可行的長期解決方案,大大減少了對器官捐贈的依賴。生物工程材料和尖端技術的整合正在提高設備的壽命、相容性和效率,促進醫療機構的更廣泛應用。

持續的研究和開發努力正在推動人工器官設計的創新,從而改善其功能並改善患者的治療效果。結合先進生物材料和再生醫學的下一代生物人工器官正在重塑市場格局。隨著 3D 生物列印技術的發展,生產客製化、針對特定患者的人工器官變得越來越可行,加速了醫學的進步。隨著醫療保健公司和政府機構的投資不斷增加,人工器官產業將在未來十年實現大幅擴張。慢性腎臟病、肝衰竭和心血管疾病的盛行率不斷上升,進一步加劇了對技術先進的器官解決方案的需求,確保了市場的持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 353億美元 |

| 預測值 | 910億美元 |

| 複合年成長率 | 10% |

市場按器官類型細分,包括人工腎臟、肝臟、肺臟、胰臟、心臟和其他器官。人工腎臟佔最大的市場佔有率,2024 年市場規模達 196 億美元。腎臟相關疾病發生率的上升推動了需求,從而推動腎臟護理技術不斷進步。隨著需要治療慢性病的患者數量不斷增加,創新的人工腎臟解決方案正在成為不可或缺的醫療干預措施。治療選擇的擴大和醫療能力的增強確保了市場穩步擴張。

材料細分包括矽、塑膠、鋼和其他生物材料。矽在 2024 年佔 36.2% 的佔有率,預計到 2034 年將達到 347 億美元。其卓越的靈活性、耐用性和相容性使其成為製造先進義肢和醫療植入物的理想選擇。對高性能生物材料的需求不斷增加,促進了其在人造器官中的廣泛應用。患者治療效果的改善和拒絕率的降低正在加強市場定位,從而鼓勵對下一代材料的進一步研究。隨著技術創新不斷完善人工器官設計,矽等生物相容性材料繼續主導該產業。

2023 年,美國人工器官市場規模達 117 億美元,預計到 2034 年將達到 323 億美元。慢性病病例的增加推動了人工器官的採用,從而增加了對先進醫療解決方案的需求。器官衰竭率的上升促使醫療機構投資尖端技術。隨著業界專注於開發更有效的解決方案,人造器官正在成為現代醫療保健不可或缺的一部分。製造業研究的不斷擴大和改進正在加速產業成長,推動主要參與者提高生產能力。隨著技術的不斷進步,人工器官的採用將會增加,從而塑造醫學科學和病患照護的未來。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球器官捐贈者短缺

- 器官衰竭發生率上升

- 不斷進步的技術

- 老年人口不斷增加

- 產業陷阱與挑戰

- 人造器官和手術成本高昂

- 設備故障和併發症的風險

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按器官類型,2021 年至 2034 年

- 主要趨勢

- 人工腎

- 人工肝

- 人工肺

- 人工胰臟

- 人工心臟

- 其他器官類型

第6章:市場估計與預測:依材料類型,2021 年至 2034 年

- 主要趨勢

- 矽

- 塑膠

- 鋼

- 其他材料類型

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- ABIOMED

- Berlin Heart

- Boston Scientific

- Cochlear

- Edwards Lifesciences

- Ekso Bionics

- Jarvik Heart

- Medtronic

- SynCardia Systems

- Zimmer Biomet

The Global Artificial Organs Market was valued at USD 35.3 billion in 2024 and is projected to register a 10% CAGR between 2025 and 2034. As medical technology advances, artificial organs are increasingly replacing, supporting, and enhancing biological functions, helping patients regain normalcy. The demand for these life-saving devices is surging as chronic illnesses and organ failure cases rise, intensifying the need for alternative solutions beyond traditional transplants. With a severe shortage of donor organs, artificial replacements offer a viable, long-term solution, significantly reducing dependency on organ donations. The integration of bioengineered materials and cutting-edge technologies is improving device longevity, compatibility, and efficiency, fostering wider adoption across healthcare facilities.

Continuous research and development efforts are propelling innovations in artificial organ design, allowing for improved functionality and better patient outcomes. Next-generation bioartificial organs, incorporating advanced biomaterials and regenerative medicine, are reshaping the market landscape. As 3D bioprinting technology gains momentum, the production of customized, patient-specific artificial organs is becoming more feasible, accelerating medical advancements. With increasing investments from healthcare companies and government bodies, the artificial organs industry is poised for substantial expansion over the next decade. The rising prevalence of chronic kidney disease, liver failure, and cardiovascular disorders is further intensifying the need for technologically advanced organ solutions, ensuring sustained market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.3 Billion |

| Forecast Value | $91 Billion |

| CAGR | 10% |

The market is segmented by organ type, including artificial kidneys, livers, lungs, pancreas, hearts, and other organs. Artificial kidneys held the largest market share, generating USD 19.6 billion in 2024. The rising incidence of kidney-related diseases is driving demand, leading to continuous advancements in renal care technologies. With a growing number of patients requiring treatment for chronic conditions, innovative artificial kidney solutions are emerging as essential medical interventions. Expanding treatment options and enhanced medical capabilities are ensuring steady market expansion.

Material segmentation includes silicon, plastic, steel, and other biomaterials. Silicon accounted for a 36.2% share in 2024 and is projected to reach USD 34.7 billion by 2034. Its superior flexibility, durability, and compatibility make it an ideal choice for manufacturing advanced prosthetics and medical implants. Increasing demand for high-performance biomaterials is contributing to its widespread usage in artificial organs. Improved patient outcomes and reduced rejection rates are strengthening market positioning, thus encouraging further research into next-generation materials. As technological innovations refine artificial organ designs, biocompatible materials like silicon continue to dominate the industry.

U.S. artificial organs market generated USD 11.7 billion in 2023 and is expected to reach USD 32.3 billion by 2034. Growing cases of chronic diseases are driving adoption, increasing the demand for advanced medical solutions. Rising organ failure rates are prompting medical institutions to invest in cutting-edge technologies. As the industry focuses on developing more efficient solutions, artificial organs are becoming an integral part of modern healthcare. Expanding research and improvements in manufacturing are accelerating industry growth, pushing key players to enhance production capabilities. With ongoing advancements, artificial organ adoption is set to increase, shaping the future of medical science and patient care.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Scarcity of organ donors globally

- 3.2.1.2 Increasing incidence of organ failures

- 3.2.1.3 Growing technological advancements

- 3.2.1.4 Rising geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of artificial organs and procedures

- 3.2.2.2 Risk of device failure and complications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Organ Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Artificial kidney

- 5.3 Artificial liver

- 5.4 Artificial lungs

- 5.5 Artificial pancreas

- 5.6 Artificial heart

- 5.7 Other organ types

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Silicon

- 6.3 Plastic

- 6.4 Steel

- 6.5 Other material types

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 ABIOMED

- 8.2 Berlin Heart

- 8.3 Boston Scientific

- 8.4 Cochlear

- 8.5 Edwards Lifesciences

- 8.6 Ekso Bionics

- 8.7 Jarvik Heart

- 8.8 Medtronic

- 8.9 SynCardia Systems

- 8.10 Zimmer Biomet