|

市場調查報告書

商品編碼

1699313

冷鏈監控市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Cold Chain Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

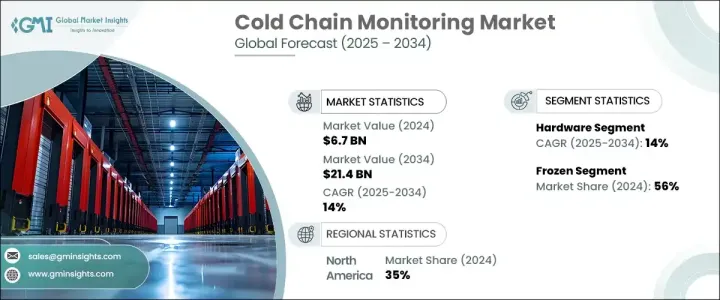

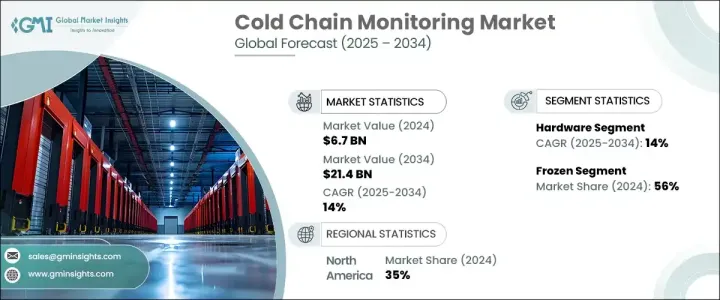

2024 年全球冷鏈監控市場規模達 67 億美元,預計 2025 年至 2034 年的複合年成長率為 14%。這一成長是由各行各業對溫度敏感商品的需求不斷成長所推動的。由於製藥、食品和飲料行業嚴重依賴冷藏和運輸,企業擴大採用先進的監控解決方案來確保產品完整性和法規遵循。隨著公司不斷擴大其全球供應鏈,對即時追蹤技術的需求變得比以往任何時候都更加重要。

物聯網感測器、RFID 設備和遠端資訊處理解決方案的整合正在改變整個行業,為企業提供無與倫比的物流網路可視性和控制力。世界各地的監管機構正在實施嚴格的指導方針,以維持最佳的儲存和運輸條件,進一步推動對尖端監控系統的投資。隨著公司專注於降低風險、防止損壞和提高營運效率,市場可望繼續擴張。人工智慧分析和基於雲端的監控平台的採用正在重塑產業,實現即時決策和預測性維護,以防止與溫度相關的中斷。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 67億美元 |

| 預測值 | 214億美元 |

| 複合年成長率 | 14% |

對溫控物流的日益依賴正在推動市場擴張,企業認知到保持產品安全和遵守不斷發展的監管標準的重要性。公司優先實施強大的監控解決方案,以即時追蹤環境條件,確保易腐貨物保持在規定的溫度閾值內。採用智慧監控系統不僅提高了供應鏈透明度,而且還減少了與產品損壞和召回相關的財務損失。

按組件細分,市場由硬體和軟體解決方案組成。硬體部門在 2024 年創造了 45 億美元的收入,並預計在整個預測期內以 14% 的複合年成長率成長。對溫度敏感物流的需求不斷成長,推動了先進硬體解決方案的採用,包括感測器、RFID 追蹤器和遠端資訊處理設備。這些技術提供即時環境資料,使企業能夠主動應對潛在風險並維持遵守品質和安全標準。隨著冷鏈產業的發展,公司正在利用創新的硬體組件來最佳化效率和可靠性,確保整個儲存和運輸網路的無縫運作。

根據溫度範圍,市場分為冷凍和冷藏部分。 2024 年,冷凍食品佔了 56% 的市場佔有率,預計到 2034 年複合年成長率將達到 14%。對超低溫儲存解決方案日益成長的需求正在加速製藥和生物技術等需要嚴格熱調節的行業的採用。先進的監測技術在維持溫度敏感產品的功效和穩定性方面發揮著至關重要的作用。企業為了努力遵守嚴格的儲存要求,正在投資智慧解決方案,以增強可追溯性並最大限度地減少因溫度偏差造成的損失。

2024 年,北美將以 35% 的佔有率引領全球冷鏈監控市場,其中美國的收入為 21 億美元。該地區強大的市場影響力歸功於製藥業越來越依賴冷藏解決方案來確保運輸過程中的產品安全。美國嚴格的監管準則強調了維持溫度控制的重要性,促使公司投資先進的監控技術。此外,透過電子商務平台運送新鮮和冷凍食品的需求不斷成長,也加速了對強大的冷鏈基礎設施的需求。隨著企業尋求滿足不斷變化的消費者期望和監管要求,對創新監控解決方案的投資預計將激增,從而增強溫度敏感供應鏈的可靠性和安全性。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 硬體提供者

- 軟體和平台開發人員

- 系統整合商

- 連接提供者

- 服務提供者

- 利潤率分析

- 技術與創新格局

- 專利分析

- 用例

- 冷鏈物流統計

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 易腐商品需求不斷增加

- 對溫度敏感產品的運輸和儲存施加嚴格的監管要求

- 技術、物聯網和資料分析的進步

- 更加重視食品安全與品質

- 產業陷阱與挑戰

- 發展中地區的基礎建設挑戰

- 實施成本高且複雜

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 感應器

- RFID設備

- 遠端資訊處理

- 網路裝置

- 其他

- 軟體

- 即時監控

- 分析和報告

第6章:市場估計與預測:按溫度,2021 - 2034 年

- 主要趨勢

- 《冰雪奇緣》

- 冷藏

第7章:市場估計與預測:按物流,2021 - 2034 年

- 主要趨勢

- 貯存

- 運輸

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 製藥和醫療保健

- 食品和飲料

- 物流與配送

- 化學

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Berlinger & Co

- CargoSense

- Cold Chain Technologies

- Controlant

- Descartes Systems Group

- Digi International

- ELPRO-BUCHS

- Emerson Electric

- Honeywell International

- Infratab

- Intelleflex

- Monnit

- ORBCOMM

- Roambee

- Sensaphone

- Sensitech

- Swisslog Holding

- Testo SE & Co

- Tive

- Zebra Technologies

The Global Cold Chain Monitoring Market reached USD 6.7 billion in 2024 and is anticipated to grow at a CAGR of 14% from 2025 to 2034. The growth is driven by the rising demand for temperature-sensitive goods across various industries. With pharmaceuticals, food, and beverage sectors relying heavily on cold storage and transportation, businesses are increasingly adopting advanced monitoring solutions to ensure product integrity and regulatory compliance. As companies continue to expand their global supply chains, the need for real-time tracking technologies is becoming more critical than ever.

The integration of IoT-enabled sensors, RFID devices, and telematics solutions is transforming the industry, offering businesses unparalleled visibility and control over their logistics networks. Regulatory authorities worldwide are imposing stringent guidelines to maintain optimal storage and transportation conditions, further propelling investments in cutting-edge monitoring systems. The market is poised for continued expansion as companies focus on mitigating risks, preventing spoilage, and enhancing operational efficiency. The adoption of AI-powered analytics and cloud-based monitoring platforms is reshaping the industry, enabling real-time decision-making and predictive maintenance to prevent temperature-related disruptions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.7 Billion |

| Forecast Value | $21.4 Billion |

| CAGR | 14% |

The increasing reliance on temperature-controlled logistics is fueling market expansion, with businesses recognizing the importance of maintaining product safety and compliance with evolving regulatory standards. Companies are prioritizing the implementation of robust monitoring solutions to track environmental conditions in real time, ensuring that perishable goods remain within prescribed temperature thresholds. The adoption of smart monitoring systems is not only enhancing supply chain transparency but also reducing financial losses associated with product spoilage and recalls.

Segmented by components, the market consists of hardware and software solutions. The hardware segment generated USD 4.5 billion in 2024 and is set to grow at a CAGR of 14% throughout the forecast period. The increasing demand for temperature-sensitive logistics is driving the adoption of advanced hardware solutions, including sensors, RFID trackers, and telematics devices. These technologies provide real-time environmental data, enabling businesses to proactively address potential risks and maintain adherence to quality and safety standards. As the cold chain industry advances, companies are leveraging innovative hardware components to optimize efficiency and reliability, ensuring seamless operations across storage and transportation networks.

By temperature range, the market is categorized into frozen and chilled segments. The frozen segment accounted for 56% of the market share in 2024 and is expected to register a CAGR of 14% through 2034. The growing demand for ultra-low temperature storage solutions is accelerating adoption across industries that require strict thermal regulation, such as pharmaceuticals and biotechnology. Advanced monitoring technologies are playing a crucial role in preserving the efficacy and stability of temperature-sensitive products. As businesses strive to comply with rigorous storage requirements, they are investing in smart solutions that enhance traceability and minimize losses caused by temperature deviations.

North America led the global cold chain monitoring market with a 35% share in 2024, with the U.S. accounting for USD 2.1 billion in revenue. The region's strong market presence is attributed to the pharmaceutical sector's growing reliance on cold storage solutions to ensure product safety during transit. Strict regulatory guidelines in the U.S. emphasize the importance of maintaining temperature control, prompting companies to invest in advanced monitoring technologies. Additionally, the rising demand for fresh and frozen food deliveries through e-commerce platforms is accelerating the need for robust cold chain infrastructure. As businesses seek to meet evolving consumer expectations and regulatory mandates, investments in innovative monitoring solutions are expected to surge, reinforcing the reliability and security of temperature-sensitive supply chains.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Hardware providers

- 3.2.2 Software & platform developers

- 3.2.3 System integrators

- 3.2.4 Connectivity providers

- 3.2.5 Service providers

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Use cases

- 3.7 Cold chain logistics statistics

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing demand for perishable goods

- 3.10.1.2 Stringent regulatory requirements imposed on the transportation and storage of temperature-sensitive products

- 3.10.1.3 Advancements in technology, IoT, and data analytics

- 3.10.1.4 Increasing focus on food safety and quality

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Infrastructure challenges in developing regions

- 3.10.2.2 High implementation costs and complexity

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 RFID devices

- 5.2.3 Telematics

- 5.2.4 Networking devices

- 5.2.5 Others

- 5.3 Software

- 5.3.1 Real-time monitoring

- 5.3.2 Analytics and reporting

Chapter 6 Market Estimates & Forecast, By Temperature, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Frozen

- 6.3 Chilled

Chapter 7 Market Estimates & Forecast, By Logistics, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Storage

- 7.3 Transportation

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Pharmaceutical & healthcare

- 8.3 Food & beverage

- 8.4 Logistics & distribution

- 8.5 Chemical

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Berlinger & Co

- 10.2 CargoSense

- 10.3 Cold Chain Technologies

- 10.4 Controlant

- 10.5 Descartes Systems Group

- 10.6 Digi International

- 10.7 ELPRO-BUCHS

- 10.8 Emerson Electric

- 10.9 Honeywell International

- 10.10 Infratab

- 10.11 Intelleflex

- 10.12 Monnit

- 10.13 ORBCOMM

- 10.14 Roambee

- 10.15 Sensaphone

- 10.16 Sensitech

- 10.17 Swisslog Holding

- 10.18 Testo SE & Co

- 10.19 Tive

- 10.20 Zebra Technologies