|

市場調查報告書

商品編碼

1699319

直接晶片液冷市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Direct-to-chip Liquid Cooling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

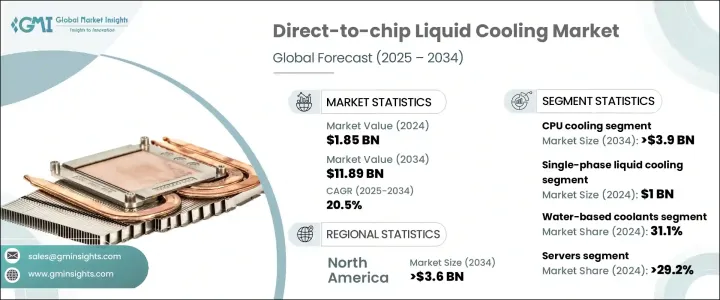

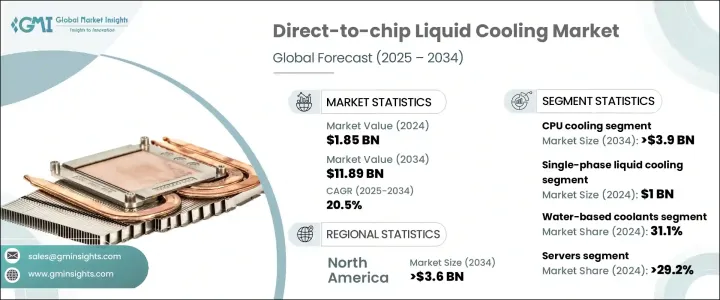

全球直接晶片液體冷卻市場預計在 2024 年達到 18.5 億美元,隨著企業越來越重視高效能運算、能源效率和永續資料中心解決方案,該市場預計將在 2025 年至 2034 年間以 20.5% 的複合年成長率擴張。人工智慧 (AI)、機器學習 (ML) 和雲端運算的快速普及正在推動資料處理需求的空前激增,使得傳統的冷卻方法在管理先進處理器不斷上升的熱負荷方面變得不那麼有效。世界各地的組織正在轉向直接晶片液體冷卻解決方案,以提高系統可靠性、防止熱節流並最佳化功耗。人們對綠色資料中心和減少碳足跡的日益重視進一步加速了液體冷卻的採用,使其成為下一代運算基礎設施的重要創新。

隨著高效能運算 (HPC) 環境不斷突破處理能力的界限,傳統的空氣冷卻難以滿足 CPU、GPU 和記憶體模組的散熱需求。直接晶片液體冷卻透過將熱量直接從晶片轉移到液體冷卻劑來實現精確的熱管理,正在成為資料中心最佳化領域的變革者。雲端服務供應商、超大規模資料中心和部署人工智慧驅動工作負載的企業正在整合液體冷卻技術,以最大限度地提高效率並最大限度地降低營運成本。對即時資料分析、高密度運算集群和5G基礎設施部署的需求進一步加強了市場的擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18.5億美元 |

| 預測值 | 118.9億美元 |

| 複合年成長率 | 20.5% |

按組件冷卻細分,市場涵蓋 GPU 冷卻、CPU 冷卻、記憶體冷卻、ASIC 冷卻和其他特定於組件的解決方案。預計到 2034 年,CPU 冷卻領域的規模將達到 39 億美元,這得益於人工智慧和基於雲端的應用程式的廣泛採用,這些應用程式將顯著增加處理器的功耗。先進的 CPU 會產生大量的熱負荷,需要先進的熱管理解決方案來維持系統穩定性並防止效能下降。直接晶片液體冷卻可提供卓越的散熱效果,即使在極端運算工作負載下也能確保持續的效能。

市場還根據液體冷卻劑類型進行分類,包括水性冷卻劑、介電流體、礦物油和工程流體。水性冷卻劑在 2024 年佔據了 31.1% 的市場佔有率,因其出色的導熱性和成本效益而越來越受歡迎。隨著企業注重永續性,這些冷卻劑正在成為降低能源消耗同時保持高性能標準的首選。其卓越的傳熱性能使其成為致力於平衡效率和環境責任的現代資料中心的理想解決方案。

北美將主導直接晶片液體冷卻市場,預計到 2034 年估值將達到 36 億美元。該地區資料中心的快速擴張、不斷成長的雲端運算生態系統以及對 HPC 解決方案不斷成長的需求正在推動其廣泛採用。美國在 2024 年佔據了 78.4% 的市場佔有率,其資料基礎設施投資正在飆升,這推動了對先進冷卻系統的需求。隨著人工智慧驅動的應用程式和超大規模雲端服務突破運算能力的極限,對高效熱管理解決方案的需求持續激增,鞏固了美國市場在不斷發展的資料中心領域的領導地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 對高效能運算(HPC)的需求不斷成長

- 提高資料中心密度

- 更加重視永續性

- 高效能運算的需求不斷成長

- 越來越關注資料中心的能源效率和永續性

- 產業陷阱與挑戰

- 初期投資成本高

- 維護和操作的複雜性

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按冷卻解決方案類型,2021 年至 2034 年

- 主要趨勢

- 單相液體冷卻

- 雙相液體冷卻

第6章:市場估計與預測:依冷卻組件分類,2021 年至 2034 年

- 主要趨勢

- CPU涼

- GPU冷卻

- ASIC冷卻

- 記憶體冷卻

- 其他部件冷卻

第7章:市場估計與預測:依液體冷卻劑類型,2021 年至 2034 年

- 主要趨勢

- 水性冷卻液

- 介電流體

- 礦物油

- 工程流體

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 伺服器

- 工作站

- 邊緣運算設備

- 超電腦

- 遊戲電腦

- 其他

第9章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 資料中心

- 高效能運算 (HPC)

- 人工智慧/機器學習系統

- 遊戲和電子競技

- 電信

- 金融服務

- 醫療保健和生命科學

- 石油和天然氣

- 汽車(用於電動車電池)

- 航太和國防

- 其他

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳新銀行

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Asetek

- Alfa Laval

- Castrol

- Cisco Systems, Inc.

- CoolIT Systems

- DCX The Liquid Cooling Company

- Danfoss A/S

- DUG Technology

- Equinix, Inc.

- Fujitsu Limited

- Green Revolution Cooling (GRC)

- Huawei Technologies Co., Ltd.

- Iceotope Technologies Ltd.

- Inspur Systems

- LiquidCool Solutions

- LiquidStack

- Rittal GmbH & Co. KG

- Schneider Electric

- STULZ GmbH

- Submer Technologies

- Super Micro Computer, Inc.

- Vertiv Group Corp.

- ZutaCore

The Global Direct-To-Chip Liquid Cooling Market, valued at USD 1.85 billion in 2024, is on track to expand at a CAGR of 20.5% from 2025 to 2034 as enterprises increasingly prioritize high-performance computing, energy efficiency, and sustainable data center solutions. The rapid proliferation of artificial intelligence (AI), machine learning (ML), and cloud computing is driving an unprecedented surge in data processing demands, making conventional cooling methods less effective in managing the rising thermal loads of advanced processors. Organizations worldwide are shifting toward direct-to-chip liquid cooling solutions to enhance system reliability, prevent thermal throttling, and optimize power consumption. The growing emphasis on green data centers and carbon footprint reduction further accelerates adoption, positioning liquid cooling as an essential innovation in next-generation computing infrastructure.

As high-performance computing (HPC) environments push the boundaries of processing power, traditional air-based cooling struggles to keep pace with the heat dissipation needs of CPUs, GPUs, and memory modules. Direct-to-chip liquid cooling, which enables precise thermal management by transferring heat directly from the chip to a liquid coolant, is emerging as a game-changer in data center optimization. Cloud service providers, hyperscale data centers, and enterprises deploying AI-driven workloads are integrating liquid cooling technologies to maximize efficiency and minimize operational costs. The demand for real-time data analytics, high-density computing clusters, and 5G infrastructure deployment is further reinforcing the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.85 Billion |

| Forecast Value | $11.89 Billion |

| CAGR | 20.5% |

Segmented by component cooling, the market encompasses GPU cooling, CPU cooling, memory cooling, ASIC cooling, and other component-specific solutions. The CPU cooling segment is projected to reach USD 3.9 billion by 2034, driven by the widespread adoption of AI and cloud-based applications that significantly increase processor power consumption. Advanced CPUs generate substantial heat loads, requiring cutting-edge thermal management solutions to maintain system stability and prevent performance degradation. Direct-to-chip liquid cooling delivers superior heat dissipation, ensuring sustained performance even under extreme computational workloads.

The market is also categorized by liquid coolant type, including water-based coolants, dielectric fluids, mineral oils, and engineered fluids. Water-based coolants, which held a 31.1% market share in 2024, are gaining traction due to their exceptional thermal conductivity and cost-effectiveness. As enterprises focus on sustainability, these coolants are becoming a preferred choice for reducing energy consumption while maintaining high-performance standards. Their superior heat transfer properties make them an ideal solution for modern data centers striving to balance efficiency and environmental responsibility.

North America is set to dominate the direct-to-chip liquid cooling market, with projections indicating a valuation of USD 3.6 billion by 2034. The region's rapid data center expansion, growing cloud computing ecosystem, and escalating demand for HPC solutions are driving widespread adoption. The United States, which held a commanding 78.4% market share in 2024, is witnessing soaring investments in data infrastructure, fueling the need for advanced cooling systems. With AI-driven applications and hyperscale cloud services pushing the limits of computing power, the demand for high-efficiency thermal management solutions continues to surge, reinforcing the U.S. market's leadership in the evolving data center landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for high-performance computing (HPC)

- 3.2.1.2 Increasing data center density

- 3.2.1.3 Increased focus on sustainability

- 3.2.1.4 Rising demand for high-performance computing

- 3.2.1.5 Growing focus on energy efficiency and sustainability in data centers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Complexity of maintenance and operations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Cooling Solution Type, 2021 – 2034 (USD Mn)

- 5.1 Key trends

- 5.2 Single-phase liquid cooling

- 5.3 Two-phase liquid cooling

Chapter 6 Market Estimates and Forecast, By Component Cooling, 2021 – 2034 (USD Mn)

- 6.1 Key trends

- 6.2 CPU cooling

- 6.3 GPU cooling

- 6.4 ASIC cooling

- 6.5 Memory cooling

- 6.6 Other component cooling

Chapter 7 Market Estimates and Forecast, By Liquid Coolant Type, 2021 – 2034 (USD Bn)

- 7.1 Key trends

- 7.2 Water-based coolants

- 7.3 Dielectric fluids

- 7.4 Mineral oils

- 7.5 Engineered fluids

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn)

- 8.1 Key trends

- 8.2 Servers

- 8.3 Workstations

- 8.4 Edge computing devices

- 8.5 Supercomputers

- 8.6 Gaming PCs

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Bn)

- 9.1 Key trends

- 9.2 Data centers

- 9.3 High-performance computing (HPC)

- 9.4 Artificial intelligence/machine learning systems

- 9.5 Gaming and eSports

- 9.6 Telecommunications

- 9.7 Financial services

- 9.8 Healthcare and life sciences

- 9.9 Oil and gas

- 9.10 Automotive (for electric vehicle batteries)

- 9.11 Aerospace and defense

- 9.12 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 ANZ

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Asetek

- 11.2 Alfa Laval

- 11.3 Castrol

- 11.4 Cisco Systems, Inc.

- 11.5 CoolIT Systems

- 11.6 DCX The Liquid Cooling Company

- 11.7 Danfoss A/S

- 11.8 DUG Technology

- 11.9 Equinix, Inc.

- 11.10 Fujitsu Limited

- 11.11 Green Revolution Cooling (GRC)

- 11.12 Huawei Technologies Co., Ltd.

- 11.13 Iceotope Technologies Ltd.

- 11.14 Inspur Systems

- 11.15 LiquidCool Solutions

- 11.16 LiquidStack

- 11.17 Rittal GmbH & Co. KG

- 11.18 Schneider Electric

- 11.19 STULZ GmbH

- 11.20 Submer Technologies

- 11.21 Super Micro Computer, Inc.

- 11.22 Vertiv Group Corp.

- 11.23 ZutaCore