|

市場調查報告書

商品編碼

1699335

癲癇治療藥物市場機會、成長動力、產業趨勢分析及預測(2025-2034)Epilepsy Treatment Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

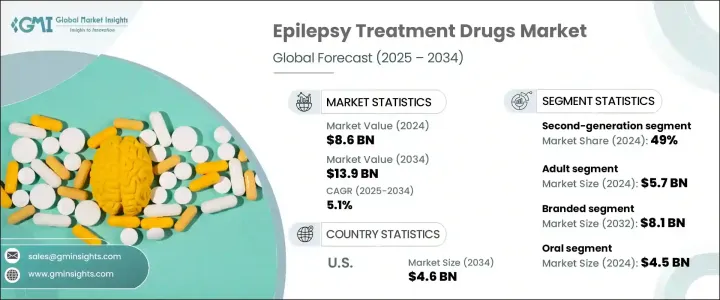

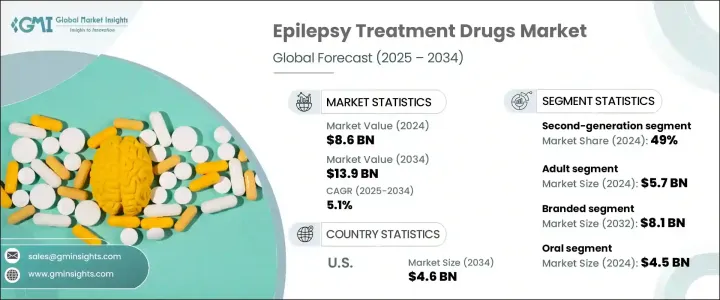

2024 年全球癲癇治療藥物市場規模達到 86 億美元,預計 2025 年至 2034 年的複合年成長率為 5.1%。推動這一成長的因素包括癲癇盛行率的上升、藥物研究的進步以及政府和私人組織投資的增加。全球範圍內癲癇病例數量的不斷增加推動了對有效藥物的需求,而藥物研發的突破則帶來了療效更強、副作用更少的創新治療方案的推出。正在進行的研究和開發計劃正在為下一代癲癇藥物鋪平道路,這些藥物可以改善患者的治療效果並提供更大的治療益處。

製藥公司正在大力投資臨床試驗和監管快速通道,以便更快地將先進的抗癲癇藥物推向市場。老年人口的不斷成長更容易患神經系統疾病,這進一步增加了對癲癇藥物的需求。此外,加強宣傳活動、改善醫療保健基礎設施以及更便捷的藥物取得方式正在加強市場擴張。精準醫療和個人化治療方法的引入也在重塑癲癇治療格局中發揮關鍵作用。隨著藥品製造商繼續優先考慮安全性和有效性,市場正在見證大量具有最佳化劑量和最小副作用的新配方的湧入。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 86億美元 |

| 預測值 | 139億美元 |

| 複合年成長率 | 5.1% |

市場根據藥物類別細分為第一代、第二代和第三代藥物。第二代藥物在 2024 年佔據主導地位,佔據總市場佔有率的 49%,預計到 2034 年將以 5.2% 的複合年成長率成長。與第一代藥物相比,第二代藥物的廣泛採用主要歸因於患者依從性較好、藥物交互作用風險較低、副作用較少。由於這些藥物在治療癲癇以外的多種神經系統疾病方面有效,監管機構正在加速批准這些藥物。隨著製藥公司不斷增強其產品組合,對第二代癲癇藥物的需求預計將大幅上升。

根據藥物類型,市場也分為品牌癲癇治療藥物和仿製癲癇治療藥物。 2024 年,品牌藥物領域佔據市場主導地位,佔總收入的 59.1%,預計到 2034 年將達到 81 億美元。製藥公司正專注於開發安全性更高、治療效果更好的品牌癲癇藥物,從而推動對優質治療解決方案的需求。由於品牌藥物可靠、有效且副作用風險較低,患者和醫療保健提供者越來越青睞品牌藥物。隨著向下一代品牌療法的不斷轉變,市場有望實現持續成長。

美國仍然是癲癇治療藥物銷售的主要貢獻者,預計到 2034 年市場規模將達到 46 億美元。癲癇病例數量的增加推動了對抗癲癇藥物的強勁需求,而政府措施和研究資金正在加速藥物開發。旨在提高治療可及性和治療策略進步的聯邦計劃正在進一步加強市場擴張。隨著製藥公司不斷創新並獲得監管部門的批准,美國市場預計將在全球癲癇治療藥物產業中保持主導地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 癲癇盛行率上升

- 增加對研發活動的投資

- 對新型癲癇治療方法的需求日益成長

- 提高認知和早期診斷

- 產業陷阱與挑戰

- 與抗癲癇藥物相關的不良反應

- 專利到期

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類別,2021 年至 2034 年

- 主要趨勢

- 第一代

- 第二代

- 第三代

第6章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 品牌

- 泛型

第7章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 鼻腔

- 注射劑

- 直腸

第8章:市場估計與預測:按年齡層,2021 年至 2034 年

- 主要趨勢

- 兒科

- 成人

第9章:市場估計與預測:按扣押類型,2021 年至 2034 年

- 主要趨勢

- 局部性癲癇

- 全身性癲癇

- 合併發作

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Bausch Health Companies

- Dr. Reddy's Laboratories

- Eisai

- GlaxoSmithKline

- Jazz Pharmaceuticals

- Neurelis

- Novartis

- Novel Laboratories

- Pfizer

- Sanofi

- SK Biopharmaceuticals

- SUMITOMO PHARMA

- Sun Pharmaceutical Industries

- UCB Pharma

The Global Epilepsy Treatment Drugs Market reached USD 8.6 billion in 2024 and is projected to expand at a CAGR of 5.1% from 2025 to 2034. The growth is driven by an increasing prevalence of epilepsy, advancements in pharmaceutical research, and rising investments from government and private organizations. The rising number of epilepsy cases worldwide is fueling demand for effective medications, while breakthroughs in drug development are leading to the introduction of innovative treatment options with enhanced efficacy and fewer side effects. Ongoing research and development initiatives are paving the way for next-generation epilepsy medications that offer improved patient outcomes and greater therapeutic benefits.

Pharmaceutical companies are investing heavily in clinical trials and regulatory fast-tracking to bring advanced anti-epileptic drugs to market faster. The growing elderly population, which is more susceptible to neurological disorders, is further contributing to the demand for epilepsy medications. Additionally, increased awareness campaigns, improved healthcare infrastructure, and better access to medications are strengthening market expansion. The introduction of precision medicine and personalized treatment approaches is also playing a pivotal role in reshaping the epilepsy treatment landscape. As drug manufacturers continue prioritizing safety and efficacy, the market is witnessing an influx of new formulations with optimized dosing and minimal adverse effects.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.6 Billion |

| Forecast Value | $13.9 Billion |

| CAGR | 5.1% |

The market is segmented based on drug class into first-generation, second-generation, and third-generation drugs. Second-generation drugs dominated in 2024, accounting for 49% of the total market share, and are anticipated to grow at a CAGR of 5.2% through 2034. Their widespread adoption is primarily attributed to better patient compliance, lower risk of drug interactions, and fewer side effects compared to first-generation alternatives. Regulatory bodies are increasingly expediting approvals for these medications due to their effectiveness in treating multiple neurological disorders beyond epilepsy. As pharmaceutical companies continue to enhance their portfolios, the demand for second-generation epilepsy drugs is expected to rise significantly.

The market is also categorized by drug type into branded and generic epilepsy treatment medications. In 2024, the branded segment led the market, capturing 59.1% of total revenue, and is projected to reach USD 8.1 billion by 2034. Pharmaceutical firms are focusing on the development of branded epilepsy drugs with enhanced safety profiles and improved therapeutic performance, fueling demand for premium treatment solutions. Patients and healthcare providers increasingly prefer branded medications due to their reliability, effectiveness, and reduced risk of side effects. With the ongoing shift toward next-generation branded therapies, the market is poised for sustained growth.

The United States remains a key contributor to epilepsy treatment drug sales, with the market projected to generate USD 4.6 billion by 2034. The rising number of epilepsy cases is driving strong demand for anti-epileptic medications, while government initiatives and research funding are accelerating drug development. Federal programs aimed at improving treatment accessibility and advancements in therapeutic strategies are further strengthening market expansion. As pharmaceutical companies continue innovating and securing regulatory approvals, the U.S. market is expected to maintain its dominant position in the global epilepsy treatment drugs industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of epilepsy

- 3.2.1.2 Increasing investments in research and development activities

- 3.2.1.3 Increasing demand for novel treatment for epilepsy

- 3.2.1.4 Growing awareness and early diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects associated with the antiepileptic drugs

- 3.2.2.2 Patent expiration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 First-generation

- 5.3 Second-generation

- 5.4 Third-generation

Chapter 6 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Branded

- 6.3 Generics

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Nasal

- 7.4 Injectable

- 7.5 Rectal

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pediatric

- 8.3 Adult

Chapter 9 Market Estimates and Forecast, By Seizure Type, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Focal seizure

- 9.3 Generalized seizure

- 9.4 Combined seizure

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Bausch Health Companies

- 12.2 Dr. Reddy's Laboratories

- 12.3 Eisai

- 12.4 GlaxoSmithKline

- 12.5 Jazz Pharmaceuticals

- 12.6 Neurelis

- 12.7 Novartis

- 12.8 Novel Laboratories

- 12.9 Pfizer

- 12.10 Sanofi

- 12.11 SK Biopharmaceuticals

- 12.12 SUMITOMO PHARMA

- 12.13 Sun Pharmaceutical Industries

- 12.14 UCB Pharma