|

市場調查報告書

商品編碼

1699353

軟膠囊市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Softgel Capsules Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

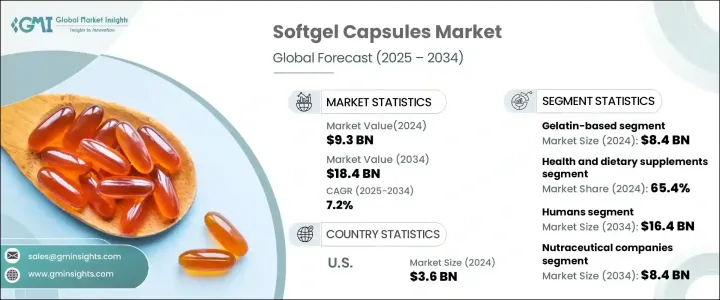

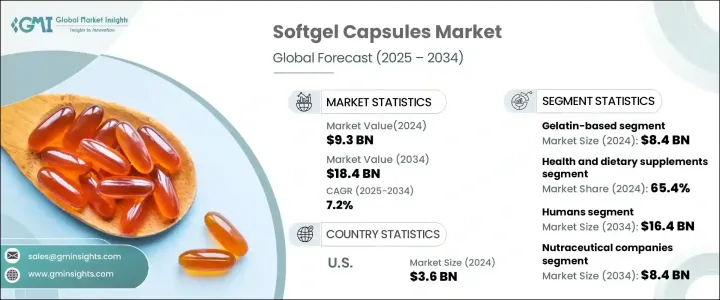

2024 年全球軟膠囊市場規模達 93 億美元,預估 2025 年至 2034 年複合年成長率為 7.2%。維生素、ω-3 脂肪酸補充劑和草藥等營養保健品的消耗量增加是推動市場成長的主要因素。與傳統藥物相比,這些產品更容易服用、吸收更快,因此成為消費者的首選。此外,軟膠囊製造技術的進步,例如引入馬鈴薯澱粉、羥丙基甲基纖維素 (HPMC) 和普魯蘭多醣等植物替代品,進一步推動了產業成長。隨著人們對免疫系統增強劑和膳食補充劑的關注度不斷提高,尤其是在疫情之後,對軟膠囊的需求激增。人們對預防性醫療保健的認知不斷提高以及向更健康生活方式的轉變促進了膳食補充劑的採用,從而增加了市場的成長勢頭。

軟膠囊,也稱為軟明膠膠囊,由單片外殼組成,其中填充有液體、半固體、凝膠或糊狀形式的各種化合物。它們的優點包括易於吞嚥、提高生物利用度、掩蓋味道和防篡改特性,使其成為溶解度和滲透性差的藥物的理想選擇。根據類型,市場分為素食膠囊和明膠膠囊,其中明膠膠囊佔據市場主導地位,2024 年價值為 84 億美元。這些膠囊具有更好的生物利用度、更快的起效速度,並能防止光、空氣和濕氣等環境因素的影響,因此比傳統的藥片和膠囊更受歡迎。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 93億美元 |

| 預測值 | 184億美元 |

| 複合年成長率 | 7.2% |

2024 年,健康和膳食補充劑領域佔據了 65.4% 的市場佔有率,預計在預測期內的複合年成長率為 7.5%。人們對維生素、礦物質和 Omega-3 補充劑的需求不斷增加,以增強免疫力並改善整體健康,推動了這一領域的發展。預防性醫療保健的趨勢促使消費者在日常生活中加入補充劑,以預防心血管疾病和骨質疏鬆症等慢性疾病。不斷上漲的醫療成本也促使人們採用補充劑作為管理長期健康的一種經濟有效的措施,從而進一步刺激了對軟膠囊的需求。技術進步簡化了製造流程,使得軟膠囊配方中可以包含更廣泛的成分,從而促進了市場成長。

人類領域引領了市場,2024 年市場規模達 84 億美元,預計到 2034 年將達到 164 億美元。人口老化,尤其是在已開發國家,推動了對軟膠囊等易於吞嚥和方便的藥物形式的需求。注重健康的消費者對維生素、礦物質和草藥補充劑的日益熱愛進一步推動了市場的成長。製藥公司繼續採用軟膠囊製劑,因為它們美觀且符合消費者的喜好,從而加強了該行業的成長軌跡。

2024 年,營養保健品公司佔據了相當大的市場佔有率,預計到 2034 年將達到 84 億美元。消費者對健康和保健的意識不斷提高,再加上直接面對消費者 (DTC) 模式和電子商務平台的激增,擴大了營養補充劑的覆蓋範圍,增加了對軟膠囊的需求。不同地區的監管機構透過批准各種健康聲明來支持營養保健品的使用,為創新軟膠囊配方的開發鋪平了道路。

在北美,美國佔有突出的市場地位,2024 年市場價值為 36 億美元。消費者對自我藥療和非處方 (OTC) 補充劑的趨勢增加,加上有利的監管框架和不斷成長的研發資金,推動了市場的擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 對營養保健品的需求不斷增加

- 全球慢性病盛行率不斷上升

- 軟膠囊製造技術創新

- 越來越多轉向無明膠膠囊

- 產業陷阱與挑戰

- 來自替代劑型的競爭

- 嚴格的監管要求

- 成長動力

- 成長潛力分析

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 明膠基

- 素食膠囊

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 健康和膳食補充劑

- 維生素

- 酵素

- 歐米茄

- 礦物質

- 其他健康和膳食補充劑

- 處方藥

- 抗生素和抗病毒藥物

- 抗發炎藥物

- 咳嗽和感冒藥

- 其他處方藥

- 其他應用

第7章:市場估計與預測:按適應症,2021 年至 2034 年

- 主要趨勢

- 人類

- 動物

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 製藥公司

- 營養保健品公司

- 獸醫業

- 其他最終用途

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Aenova Group

- Capsugel (Lonza)

- Captek Softgel International

- Catalent

- Curtis Health Caps

- Delpharm Evreux

- Estrellas

- Eurocaps

- Fuji Capsules

- Guangdong Yichao Biological

- Nutramax Laboratories

- Patheon

- Procaps Group

- Sirio Pharma

The Global Softgel Capsules Market reached USD 9.3 billion in 2024 and is expected to exhibit a CAGR of 7.2% from 2025 to 2034. Increasing consumption of nutraceuticals such as vitamins, omega-3 fatty acid supplements, and herbal medicines is a primary factor driving market growth. These products offer easier consumption and faster absorption compared to traditional medicines, making them a preferred choice among consumers. Additionally, advancements in softgel capsule manufacturing, such as the introduction of plant-based alternatives like potato starch, hydroxypropyl methylcellulose (HPMC), and pullulan, are further boosting industry growth. With a heightened focus on immune system boosters and dietary supplements, particularly after the pandemic, there has been a surge in demand for softgel capsules. Growing awareness about preventive healthcare and a shift toward healthier lifestyles have contributed to the increased adoption of dietary supplements, adding to the market's growth momentum.

Softgel capsules, also known as soft gelatin capsules, consist of a single-piece shell filled with various compounds in liquid, semi-solid, gel, or paste form. Their advantages include ease of swallowing, improved bioavailability, taste masking, and tamper-proof features, making them ideal for drugs with poor solubility and permeability. Based on type, the market is segmented into vegetarian and gelatin-based capsules, with the gelatin-based segment dominating the market, valued at USD 8.4 billion in 2024. These capsules provide better bioavailability, faster onset of action, and protection against environmental factors like light, air, and moisture, making them preferable over traditional tablets and capsules.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.3 Billion |

| Forecast Value | $18.4 Billion |

| CAGR | 7.2% |

The health and dietary supplements segment accounted for 65.4% of the market in 2024 and is projected to grow at a CAGR of 7.5% during the forecast period. Increasing demand for vitamins, minerals, and omega-3 supplements to boost immunity and improve overall health is driving this segment. The trend toward preventive healthcare has led consumers to include supplements in their daily routines to prevent chronic conditions such as cardiovascular diseases and osteoporosis. Rising healthcare costs have also encouraged the adoption of supplements as a cost-effective measure to manage long-term health, further fueling the demand for softgel capsules. Technological advancements have streamlined the manufacturing process, enabling the inclusion of a wider range of ingredients in softgel formulations, contributing to market growth.

The human segment led the market, generating USD 8.4 billion in 2024, and is projected to reach USD 16.4 billion by 2034. An aging population, particularly in developed nations, has fueled demand for easy-to-swallow and convenient medication forms like softgel capsules. The growing popularity of vitamins, minerals, and herbal supplements among health-conscious consumers has further boosted market growth. Pharmaceutical companies continue to embrace softgel formulations for their aesthetic appeal and consumer preference, strengthening the industry's growth trajectory.

Nutraceutical companies held a significant share of the market in 2024 and are expected to reach USD 8.4 billion by 2034. Rising consumer awareness about health and wellness, coupled with the proliferation of direct-to-consumer (DTC) models and e-commerce platforms, has expanded the reach of nutritional supplements, increasing demand for softgel capsules. Regulatory agencies in different regions have supported the use of nutraceuticals by approving various health claims, paving the way for the development of innovative softgel formulations.

In North America, the U.S. held a prominent position in the market, valued at USD 3.6 billion in 2024. Increased consumer inclination toward self-medication and over-the-counter (OTC) supplements, combined with favorable regulatory frameworks and growing research and development funding, has fueled the market's expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for nutraceuticals

- 3.2.1.2 Growing prevalence of chronic ailments globally

- 3.2.1.3 Technological innovation in softgel manufacturing

- 3.2.1.4 Increasing shift towards gelatin free capsules

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from alternative dosage forms

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Gelatin based

- 5.3 Vegetarian capsules

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Health and dietary supplements

- 6.2.1 Vitamins

- 6.2.2 Enzymes

- 6.2.3 Omega

- 6.2.4 Minerals

- 6.2.5 Other health and dietary supplements

- 6.3 Prescription medicine

- 6.3.1 Antibiotics and antivirals

- 6.3.2 Anti-inflammatory drugs

- 6.3.3 Cough and cold drugs

- 6.3.4 Other prescription medicines

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Humans

- 7.3 Animals

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical companies

- 8.3 Nutraceutical companies

- 8.4 Veterinary industry

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aenova Group

- 10.2 Capsugel (Lonza)

- 10.3 Captek Softgel International

- 10.4 Catalent

- 10.5 Curtis Health Caps

- 10.6 Delpharm Evreux

- 10.7 Estrellas

- 10.8 Eurocaps

- 10.9 Fuji Capsules

- 10.10 Guangdong Yichao Biological

- 10.11 Nutramax Laboratories

- 10.12 Patheon

- 10.13 Procaps Group

- 10.14 Sirio Pharma