|

市場調查報告書

商品編碼

1699357

大腸直腸癌診斷市場機會、成長動力、產業趨勢分析及預測(2025-2034)Colorectal Cancer Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

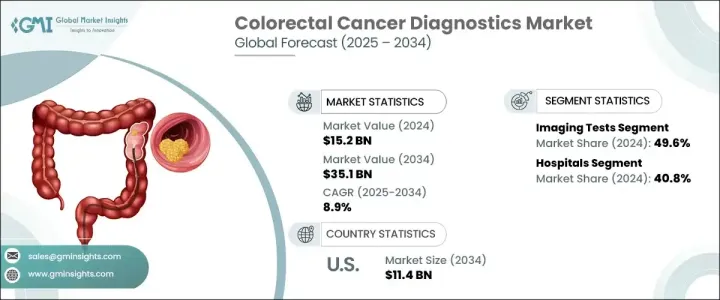

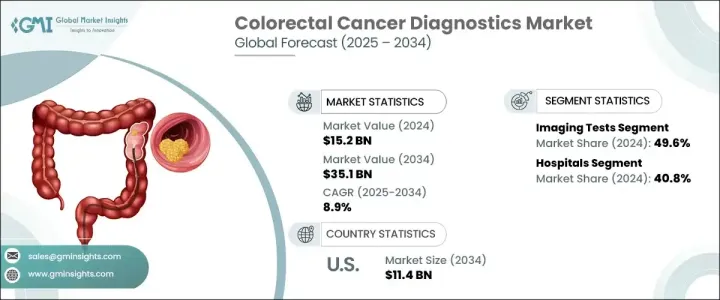

2024 年全球大腸直腸癌診斷市場價值為 152 億美元,預計 2025 年至 2034 年的複合年成長率為 8.9%。大腸直腸癌 (CRC) 是全球最常見的癌症之一,每年影響數百萬人。隨著 CRC 發病率的上升,尤其是在年輕人中,對準確、高效和早期診斷解決方案的需求從未如此迫切。早期發現可顯著提高存活率,因此先進的診斷技術對於及時介入至關重要。

由於影像技術、液體活體組織切片和人工智慧診斷工具的不斷進步,大腸直腸癌診斷市場正在迅速擴大。重點地區不斷加強的宣傳活動和政府支持的 CRC 篩檢計劃進一步推動了對可靠且易於獲取的診斷方法的需求。領先的市場參與者正在積極投資開發適合臨床環境和家庭篩檢的高精度、非侵入性檢測解決方案。糞便 DNA 檢測、血液生物標記篩檢和人工智慧影像解決方案的日益普及正在徹底改變 CRC 診斷,確保患者能夠得到早期和準確的評估。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 152億美元 |

| 預測值 | 351億美元 |

| 複合年成長率 | 8.9% |

大腸直腸癌診斷市場按測試類型細分,包括血液檢查、糞便測試、影像學檢查、活體組織切片和其他診斷方法。由於對早期癌症檢測和準確疾病評估的需求不斷成長,影像學檢查在 2024 年佔據了 49.6% 的市場佔有率,佔據主導地位。先進的影像技術,尤其是 PET-CT 掃描和 AI 輔助放射學,在早期發現大腸直腸惡性腫瘤方面發揮著至關重要的作用。這些高精度工具提高了診斷的準確性,促進了個人化的治療方法。糞便隱血檢測和 CRC DNA 篩檢等糞便檢測也因其非侵入性而越來越受到關注,使其成為大規模篩檢計畫的首選。

市場根據最終用途進一步分類,其中醫院、診斷影像中心和癌症研究機構成為關鍵部分。 2024 年,醫院佔據了 40.8% 的市場佔有率,這主要歸功於其先進的腫瘤科和胃腸科。完善的診斷設施、熟練的醫療專業人員以及綜合的 CRC 篩檢計畫使醫院成為領先的診斷機構。世界各國政府繼續實施全國性的大腸癌篩檢計劃,進一步推動醫院的診斷測試。

2024 年,美國大腸直腸癌診斷市場產值達到 50 億美元,反映出對早期檢測解決方案的強勁需求。年輕族群中 CRC 發生率的上升,加上人們對早期篩檢重要性的認知不斷提高,正在推動市場擴張。隨著血液生物標記和糞便檢測等家庭診斷解決方案的普及,CRC 篩檢變得更加容易,人們可以採取主動措施進行早期發現。隨著技術進步繼續影響診斷領域,對高度準確、非侵入性和人工智慧驅動的結直腸癌篩檢解決方案的需求預計將激增,鞏固美國作為全球市場關鍵成長中心的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 大腸直腸癌發生率和盛行率不斷上升

- 與癌症篩檢測試相關的政府措施和政策

- 癌症診斷領域的技術進步

- 早期診斷意識不斷增強

- 產業陷阱與挑戰

- 診斷測試和程序成本高昂

- 缺乏診斷測試的報銷政策

- 成長動力

- 成長潛力分析

- 技術格局

- 監管格局

- 差距分析

- 專利分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按測試類型,2021 年至 2034 年

- 主要趨勢

- 血液檢查

- 糞便檢查

- 糞便潛血試驗(FOBT)

- 糞便生物標記檢測

- CRC DNA篩檢測試

- 影像學檢查

- CT

- 超音波

- 磁振造影

- 寵物

- 大腸鏡檢查

- 其他影像學檢查

- 活體組織切片

- 其他測試類型

第6章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 診斷影像中心

- 癌症研究中心

- 其他最終用途

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Abbott Laboratories

- Becton, Dickinson and Company

- Danaher Corporation

- Exact Sciences Corporation

- F-Hoffmann-La Roche

- Fujirebio

- GE Healthcare

- Geneoscopy

- Guardant Health

- Hologic

- NeoGenomics Laboratories

- Qiagen

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fischer Scientific

The Global Colorectal Cancer Diagnostics Market was valued at USD 15.2 billion in 2024 and is projected to grow at a CAGR of 8.9% from 2025 to 2034. Colorectal cancer (CRC) is one of the most commonly diagnosed cancers worldwide, affecting millions of individuals each year. With CRC incidence rates rising, particularly among younger adults, the need for accurate, efficient, and early diagnostic solutions has never been more critical. Early detection significantly improves survival rates, making advanced diagnostic technologies essential for timely intervention.

The market for colorectal cancer diagnostics is expanding rapidly due to continuous advancements in imaging technologies, liquid biopsy, and AI-powered diagnostic tools. Increasing awareness campaigns and government-backed CRC screening programs across key regions are further driving demand for reliable and accessible diagnostic methods. Leading market players are actively investing in the development of high-precision, non-invasive testing solutions that cater to both clinical settings and at-home screening. The growing adoption of stool-based DNA tests, blood biomarker screenings, and AI-driven imaging solutions is revolutionizing CRC diagnostics, ensuring patients receive early and accurate assessments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.2 Billion |

| Forecast Value | $35.1 Billion |

| CAGR | 8.9% |

The colorectal cancer diagnostics market is segmented by test type, including blood tests, stool tests, imaging tests, biopsies, and other diagnostic methods. Imaging tests dominated the market with a 49.6% share in 2024, driven by the rising demand for early cancer detection and accurate disease assessment. Advanced imaging technologies, particularly PET-CT scans and AI-assisted radiology, play a crucial role in detecting colorectal malignancies at an early stage. These high-precision tools enhance diagnostic accuracy, facilitating personalized treatment approaches. Stool-based tests, including fecal occult blood tests and CRC DNA screenings, are also gaining traction due to their non-invasive nature, making them a preferred choice for large-scale screening programs.

The market is further categorized based on end use, with hospitals, diagnostic imaging centers, and cancer research institutions emerging as key segments. Hospitals accounted for 40.8% of the market share in 2024, primarily due to their advanced oncology and gastroenterology departments. The availability of comprehensive diagnostic facilities, skilled healthcare professionals, and integrated CRC screening programs has positioned hospitals as the leading diagnostic setting. Governments worldwide continue to implement nationwide colorectal cancer screening initiatives, further fueling hospital-based diagnostic testing.

The U.S. colorectal cancer diagnostics market generated USD 5 billion in 2024, reflecting a strong demand for early detection solutions. The rising incidence of CRC among younger populations, combined with growing awareness of the importance of early screening, is driving market expansion. The increased availability of at-home diagnostic solutions, such as blood biomarkers and stool-based tests, has made CRC screening more accessible, allowing individuals to take proactive steps toward early detection. As technological advancements continue to shape the diagnostic landscape, demand for highly accurate, non-invasive, and AI-powered colorectal cancer screening solutions is expected to surge, solidifying the U.S. as a key growth hub for the global market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence and prevalence of colorectal cancer

- 3.2.1.2 Government initiatives and policies associated with cancer screening tests

- 3.2.1.3 Technological advancements in field of cancer diagnostics

- 3.2.1.4 Growing awareness regarding early diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of diagnostic tests and procedures

- 3.2.2.2 Lack of reimbursement policies for diagnostic tests

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Regulatory landscape

- 3.6 Gap analysis

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Blood tests

- 5.3 Stool tests

- 5.3.1 Fecal occult blood test (FOBT)

- 5.3.2 Fecal biomarker test

- 5.3.3 CRC DNA screening test

- 5.4 Imaging tests

- 5.4.1 CT

- 5.4.2 Ultrasound

- 5.4.3 MRI

- 5.4.4 PET

- 5.4.5 Colonoscopy

- 5.4.6 Other imaging tests

- 5.5 Biopsy

- 5.6 Other test types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Diagnostic imaging centers

- 6.4 Cancer research centers

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 Becton, Dickinson and Company

- 8.3 Danaher Corporation

- 8.4 Exact Sciences Corporation

- 8.5 F-Hoffmann-La Roche

- 8.6 Fujirebio

- 8.7 GE Healthcare

- 8.8 Geneoscopy

- 8.9 Guardant Health

- 8.10 Hologic

- 8.11 NeoGenomics Laboratories

- 8.12 Qiagen

- 8.13 Siemens Healthineers

- 8.14 Sysmex Corporation

- 8.15 Thermo Fischer Scientific