|

市場調查報告書

商品編碼

1699360

醫療數據貨幣化解決方案市場機會、成長動力、產業趨勢分析及預測 2025-2034Healthcare Data Monetization Solutions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

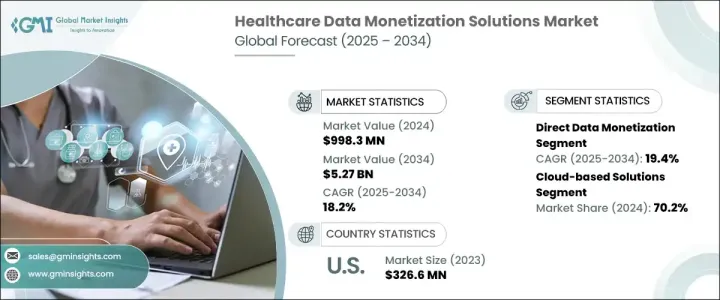

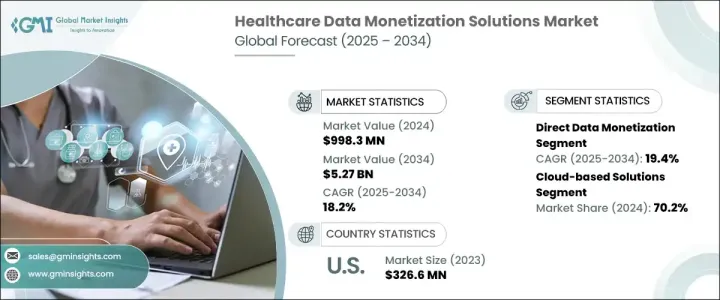

2024 年全球醫療保健數據貨幣化解決方案市值為 9.983 億美元,預計 2025 年至 2034 年期間的複合年成長率為 18.2%。醫療保健產業正在經歷數位革命,資料貨幣化正在成為關鍵的成長動力。隨著電子健康記錄 (EHR)、人工智慧診斷和連網醫療設備的日益普及,醫療機構正在產生大量資料。公司正在認知到這些資料的價值,並利用這些數據來開發新的收入來源、最佳化患者護理並提高營運效率。

數位平台的進步、雲端服務的普及以及技術提供者和醫療保健組織之間的策略合作推動了對醫療保健資料貨幣化解決方案的需求。隨著醫療保健系統產生和儲存前所未有的大量患者資料,企業正在利用分析、人工智慧和機器學習來提取可操作的見解。這些見解使製藥公司、保險公司和醫療保健提供者能夠做出數據驅動的決策、簡化營運並改善患者的治療效果。隨著監管機構執行嚴格的合規措施,各組織正在投資安全、可擴展且合規的資料貨幣化解決方案,以在不斷變化的市場環境中保持競爭力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.983億美元 |

| 預測值 | 52.7億美元 |

| 複合年成長率 | 18.2% |

直接資料貨幣化部分預計將大幅成長,預測期內複合年成長率預計為 19.4%。企業擴大利用其專有資料來開發新服務、最佳化產品供應和提高營運效率。直接貨幣化允許醫療保健組織透過出售去識別的患者資料、提供分析即服務以及許可資料集用於研究目的來創造收入。同時,間接資料貨幣化仍然是一項關鍵策略,因為公司利用資料洞察來加強行銷力度、推動客戶參與並改善業務決策流程。

基於雲端的解決方案繼續主導醫療資料貨幣化市場,到 2024 年將佔據 70% 的市場佔有率。對雲端技術的日益依賴源於其能夠提供經濟高效、可擴展且易於存取的解決方案。基於雲端的平台使醫療保健提供者能夠遠端管理和分析資料,從而無需昂貴的內部基礎設施。透過自動更新、增強的安全功能以及與人工智慧分析工具的無縫整合,基於雲端的資料貨幣化解決方案正在徹底改變醫療保健行業管理和利用資料資產的方式。

2022 年美國醫療保健數據貨幣化解決方案市值為 2.802 億美元,持續引領北美。該國完善的醫療保健基礎設施,加上其早期採用的數位轉型舉措,加速了對數據驅動解決方案的需求。美國各地的醫療機構正在利用人工智慧分析、預測模型和區塊鏈技術安全合規地將患者資料貨幣化。隨著醫療保健產業的發展,資料貨幣化正在成為創收策略不可或缺的組成部分,使美國成為這個快速擴張的市場的領導者。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 電子健康記錄(EHR)的採用率不斷提高

- 數位健康解決方案的採用率不斷提高

- 資料分析技術進步

- 動態採用人工智慧驅動的解決方案,簡化數位健康貨幣化項目

- 產業陷阱與挑戰

- 監管限制

- 資料隱私和安全問題

- 成長動力

- 成長潛力分析

- 技術格局

- 監管格局

- 波特的分析

- PESTEL分析

- 差距分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 直接資料貨幣化

- 間接資料貨幣化

第6章:市場估計與預測:依部署類型,2021 年至 2034 年

- 主要趨勢

- 本地部署

- 雲

第7章:市場估計與預測:按應用,2021 年至 2032 年

- 主要趨勢

- 預測分析與疾病管理

- 人口健康管理

- 收入周期管理

- 精準醫療

- 其他應用

第8章:市場估計與預測:按資料類型,2021 年至 2034 年

- 主要趨勢

- 臨床資料

- 索賠資料

- EHR資料

- 基因組資料

- 其他資料類型

第9章:市場估計與預測:依最終用途,2021 年至 2032 年

- 製藥和生物技術公司

- 醫療保健付款人

- 醫療保健提供者

- 醫療科技公司

- 其他最終用途

第 10 章:市場估計與預測:按地區,2021 年至 2032 年(百萬美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Accenture

- H1

- IBM

- Infor

- Innovaccer

- LexisNexis Risk Solutions

- Microsoft

- Oracle

- Salesforce

- SAS Institute

- Siemens Healthineers

- Snowflake

- Thoughtspot

- Verato

The Global Healthcare Data Monetization Solutions Market was valued at USD 998.3 million in 2024 and is projected to grow at a CAGR of 18.2% between 2025 and 2034. The healthcare industry is undergoing a digital revolution, and data monetization is emerging as a crucial growth driver. With the increasing adoption of electronic health records (EHRs), AI-powered diagnostics, and connected medical devices, healthcare institutions are generating vast amounts of data. Companies are recognizing the value of this data, using it to develop new revenue streams, optimize patient care, and enhance operational efficiency.

The demand for healthcare data monetization solutions is being fueled by advancements in digital platforms, the proliferation of cloud-based services, and strategic collaborations between technology providers and healthcare organizations. As healthcare systems generate and store an unprecedented amount of patient data, businesses are leveraging analytics, AI, and machine learning to extract actionable insights. These insights are enabling pharmaceutical companies, insurers, and healthcare providers to make data-driven decisions, streamline operations, and improve patient outcomes. With regulatory bodies enforcing stringent compliance measures, organizations are investing in secure, scalable, and compliant data monetization solutions to remain competitive in the evolving market landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $998.3 Million |

| Forecast Value | $5.27 Billion |

| CAGR | 18.2% |

The direct data monetization segment is expected to witness substantial growth, with a projected CAGR of 19.4% during the forecast period. Businesses are increasingly capitalizing on their proprietary data by developing new services, optimizing product offerings, and improving operational efficiencies. Direct monetization allows healthcare organizations to generate revenue by selling de-identified patient data, offering analytics-as-a-service, and licensing datasets for research purposes. Meanwhile, indirect data monetization remains a critical strategy, as companies utilize data insights to enhance marketing efforts, drive customer engagement, and improve business decision-making processes.

Cloud-based solutions continue to dominate the healthcare data monetization market, holding a 70% market share in 2024. The growing reliance on cloud technology stems from its ability to offer cost-effective, scalable, and easily accessible solutions. Cloud-based platforms empower healthcare providers to manage and analyze data remotely, eliminating the need for expensive on-premises infrastructure. With automatic updates, enhanced security features, and seamless integration with AI-driven analytics tools, cloud-based data monetization solutions are revolutionizing how the healthcare sector manages and leverages data assets.

The U.S. Healthcare Data Monetization Solutions Market was valued at USD 280.2 million in 2022 and continues to lead North America. The country's well-established healthcare infrastructure, coupled with its early adoption of digital transformation initiatives, has accelerated the demand for data-driven solutions. Healthcare institutions across the U.S. are leveraging AI-powered analytics, predictive modeling, and blockchain technology to monetize patient data securely and compliantly. As the healthcare sector evolves, data monetization is becoming an integral component of revenue generation strategies, positioning the U.S. as a frontrunner in this rapidly expanding market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of electronic health records (EHRs)

- 3.2.1.2 Growing adoptability of digital health solutions

- 3.2.1.3 Technological advancement in data analysis

- 3.2.1.4 Dynamic adoption of AI-driven solutions streamlining digital health monetization projects

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory constraints

- 3.2.2.2 Data privacy and security concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technological landscape

- 3.5 Regulatory landscape

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Direct data monetization

- 5.3 Indirect data monetization

Chapter 6 Market Estimates and Forecast, By Deployment Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 On-premise

- 6.3 Cloud

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2032 ($ Mn)

- 7.1 Key trends

- 7.2 Predictive analytics and disease management

- 7.3 Population health management

- 7.4 Revenue cycle management

- 7.5 Precision medicine

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By Data Type, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Clinical data

- 8.3 Claims data

- 8.4 EHR data

- 8.5 Genomic data

- 8.6 Other data types

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2032 ($ Mn)

- 9.1 Pharmaceutical and biotechnology companies

- 9.2 Healthcare payers

- 9.3 Healthcare providers

- 9.4 Medical technology companies

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2032 ($ Mn

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Accenture

- 11.2 Google

- 11.3 H1

- 11.4 IBM

- 11.5 Infor

- 11.6 Innovaccer

- 11.7 LexisNexis Risk Solutions

- 11.8 Microsoft

- 11.9 Oracle

- 11.10 Salesforce

- 11.11 SAS Institute

- 11.12 Siemens Healthineers

- 11.13 Snowflake

- 11.14 Thoughtspot

- 11.15 Verato