|

市場調查報告書

商品編碼

1699364

商用柴油發電機組市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Commercial Diesel Gensets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

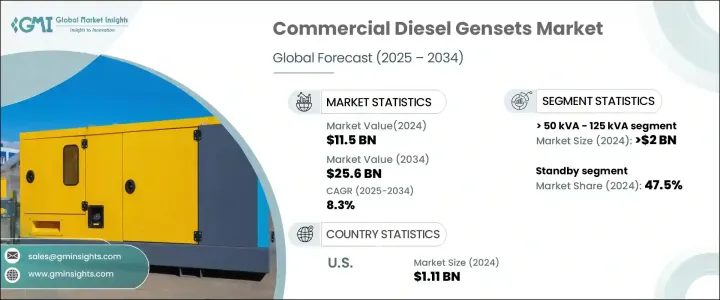

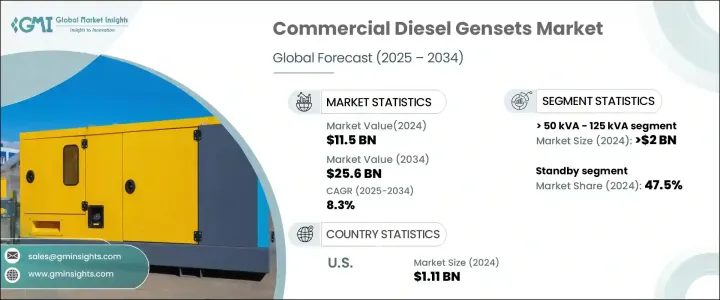

2024 年全球商用柴油發電機組市場規模達 115 億美元,預計 2025 年至 2034 年的複合年成長率為 8.3%。建築、醫療保健、製造和電信等行業對可靠和不間斷電力供應的需求不斷成長,是市場成長的主要驅動力。隨著企業努力保持營運連續性,對備用電源解決方案的需求持續激增。尤其是新興經濟體,正在經歷快速的基礎設施發展,推動了柴油發電機組的採用。市場對分散式發電的依賴也越來越大,進一步促進了其擴張。

電網老化、極端天氣事件和電力需求激增導致停電頻率不斷增加,迫使各行各業尋求替代電力解決方案。在電網基礎設施不可靠的地區,柴油發電機組在確保業務連續性方面發揮著至關重要的作用。此外,資料中心、飯店和醫院等商業機構正在投資高性能發電機組,以降低與電源故障相關的風險。這些發電機組提供緊急電源和支援關鍵應用的能力大大促進了它們的採用。隨著企業和機構認知到柴油發電機組的長期成本效益和營運效率,商業部門預計將保持穩定的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 115億美元 |

| 預測值 | 256億美元 |

| 複合年成長率 | 8.3% |

環境法規正在塑造市場動態,推動製造商創新和開發更清潔、更省油的發電機組。更嚴格的排放標準,包括多個地區實施的 Tier 4 法規,導致了排放量減少的先進柴油發電機組的生產。這些創新正在幫助企業實現永續發展目標,同時確保可靠的發電。智慧監控系統和自動化功能的整合進一步增強了現代柴油發電機組的吸引力,使用戶能夠最佳化燃料消耗並降低營運成本。

預計到 2034 年,額定功率 <= 50 kVA 的商用柴油發電機組市場將以 8% 的複合年成長率成長。這一成長主要受到對經濟高效且可靠的備用電源解決方案不斷成長的需求的推動。隨著工業和小型企業越來越意識到不間斷電源的重要性,這些發電機組在不同應用中的部署正在增加。它們價格實惠、效率高,是小型商業設施和建築工地臨時電力需求的首選。

受電力消費高峰需求管理挑戰的推動,到 2034 年,調峰領域預計也將以 8% 的複合年成長率擴張。由於工業和商業設施面臨巨大的尖峰需求費用和電網壓力,柴油發電機組被證明是降低電力成本的有效解決方案。這些發電機組可協助企業最佳化能源消耗、降低公用事業費用並提高整體電網可靠性。

2024 年,美國商用柴油發電機組市場產值將達到 11.1 億美元,這得益於電網在處理更高需求負載方面所面臨的日益嚴峻的挑戰。颶風伊爾瑪和颶風哈維等嚴重颶風的後果進一步凸顯了彈性備用電源解決方案的重要性。此外,資料中心的擴張和全國教育機構的不斷發展也推動了對商用柴油發電機組的需求。企業和公共設施優先考慮可靠的能源解決方案以防止中斷,從而進一步鞏固市場的上升軌跡。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依功率等級,2021 年至 2034 年

- 主要趨勢

- ≤50千伏安

- > 50千伏安 - 125千伏安

- > 125 千伏安 - 200 千伏安

- > 200 千伏安 - 330 千伏安

- > 330 千伏安 - 750 千伏安

- > 750千伏安

第6章:市場規模及預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 電信

- 衛生保健

- 資料中心

- 教育機構

- 政府中心

- 飯店業

- 零售額

- 房地產

- 商業綜合體

- 基礎設施

- 其他

第7章:市場規模及預測:依應用,2021 年至 2034 年

- 主要趨勢

- 支援

- 削峰

- 主/連續

第8章:市場規模及預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 俄羅斯

- 英國

- 德國

- 法國

- 西班牙

- 奧地利

- 義大利

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 印尼

- 馬來西亞

- 泰國

- 越南

- 菲律賓

- 緬甸

- 孟加拉

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亞

- 阿爾及利亞

- 南非

- 安哥拉

- 肯亞

- 莫三比克

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第9章:公司簡介

- Aggreko

- Ashok Leyland

- Atlas Copco

- Caterpillar

- Cummins

- Deere & Company

- FG Wilson

- Generac Power Systems, Inc.

- HIMOINSA

- Huu Toan

- JC Bamford Excavators Ltd.

- Kirloskar Oil Engines Limited

- Kohler Co.

- Mahindra Powerol

- Mitsubishi Heavy Industries, Ltd.

- Powerica Limited

- Rolls-Royce plc

- SUDHIR POWER LTD.

- SUPERNOVA GENSET

- Wartsila

The Global Commercial Diesel Gensets Market reached USD 11.5 billion in 2024 and is projected to expand at a CAGR of 8.3% from 2025 to 2034. The rising need for reliable and uninterrupted power supply across industries such as construction, healthcare, manufacturing, and telecommunications is a major driver of market growth. As businesses strive to maintain operational continuity, the demand for backup power solutions continues to surge. Emerging economies, in particular, are witnessing rapid infrastructure development, fueling the adoption of diesel gensets. The market is also experiencing a growing reliance on decentralized power generation, further contributing to its expansion.

The increasing frequency of power outages caused by aging electrical grids, extreme weather events, and surging electricity demand is pushing industries to seek alternative power solutions. In regions with unreliable grid infrastructure, diesel gensets play a crucial role in ensuring business continuity. Additionally, commercial establishments such as data centers, hotels, and hospitals are investing in high-performance gensets to mitigate risks associated with power failures. The ability of these gensets to provide emergency power and support critical applications is significantly boosting their adoption. The commercial sector is expected to maintain steady demand as businesses and institutions recognize the long-term cost benefits and operational efficiency of diesel gensets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.5 Billion |

| Forecast Value | $25.6 Billion |

| CAGR | 8.3% |

Environmental regulations are shaping market dynamics, driving manufacturers to innovate and develop cleaner, more fuel-efficient gensets. Stricter emission norms, including the Tier 4 regulations enforced in several regions, have led to the production of advanced diesel gensets with reduced emissions. These innovations are helping businesses comply with sustainability goals while ensuring reliable power generation. The integration of smart monitoring systems and automation features is further enhancing the appeal of modern diesel gensets, allowing users to optimize fuel consumption and reduce operational costs.

The market for commercial diesel gensets with a power rating of <= 50 kVA is forecasted to grow at a CAGR of 8% through 2034. This growth is largely driven by the rising demand for cost-effective and dependable backup power solutions. As industries and small businesses become more aware of the importance of an uninterrupted power supply, the deployment of these gensets across diverse applications is increasing. Their affordability and efficiency make them a preferred choice for small commercial setups and temporary power needs at construction sites.

The peak shaving segment is also expected to expand at a CAGR of 8% through 2034, driven by the challenge of managing peak demand in electricity consumption. With industries and commercial facilities facing significant peak demand charges and strains on the power grid, diesel gensets are proving to be an effective solution for reducing electricity costs. These gensets help businesses optimize energy consumption, lower utility expenses, and improve overall grid reliability.

The US commercial diesel genset market generated USD 1.11 billion in 2024, driven by the increasing challenges faced by electrical grids in handling higher demand loads. The aftermath of severe hurricanes, including Hurricane Irma and Hurricane Harvey, has further underscored the importance of resilient backup power solutions. Additionally, the expansion of data centers and the continuous development of educational institutions across the country are fueling demand for commercial diesel gensets. Businesses and public facilities are prioritizing reliable energy solutions to prevent disruptions, further solidifying the market's upward trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 – 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 330 kVA

- 5.6 > 330 kVA - 750 kVA

- 5.7 > 750 kVA

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Telecom

- 6.3 Healthcare

- 6.4 Data centers

- 6.5 Educational institutions

- 6.6 Government centers

- 6.7 Hospitality

- 6.8 Retail sales

- 6.9 Real estate

- 6.10 Commercial complex

- 6.11 Infrastructure

- 6.12 Others

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Standby

- 7.3 Peak shaving

- 7.4 Prime/continuous

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Russia

- 8.3.2 UK

- 8.3.3 Germany

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.4.8 Thailand

- 8.4.9 Vietnam

- 8.4.10 Philippines

- 8.4.11 Myanmar

- 8.4.12 Bangladesh

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Turkey

- 8.5.5 Iran

- 8.5.6 Oman

- 8.6 Africa

- 8.6.1 Egypt

- 8.6.2 Nigeria

- 8.6.3 Algeria

- 8.6.4 South Africa

- 8.6.5 Angola

- 8.6.6 Kenya

- 8.6.7 Mozambique

- 8.7 Latin America

- 8.7.1 Brazil

- 8.7.2 Mexico

- 8.7.3 Argentina

- 8.7.4 Chile

Chapter 9 Company Profiles

- 9.1 Aggreko

- 9.2 Ashok Leyland

- 9.3 Atlas Copco

- 9.4 Caterpillar

- 9.5 Cummins

- 9.6 Deere & Company

- 9.7 FG Wilson

- 9.8 Generac Power Systems, Inc.

- 9.9 HIMOINSA

- 9.10 Huu Toan

- 9.11 J C Bamford Excavators Ltd.

- 9.12 Kirloskar Oil Engines Limited

- 9.13 Kohler Co.

- 9.14 Mahindra Powerol

- 9.15 Mitsubishi Heavy Industries, Ltd.

- 9.16 Powerica Limited

- 9.17 Rolls-Royce plc

- 9.18 SUDHIR POWER LTD.

- 9.19 SUPERNOVA GENSET

- 9.20 Wartsila