|

市場調查報告書

商品編碼

1699381

高頻高速覆銅板(CCL)市場機會、成長動力、產業趨勢分析及2025-2034年預測High Frequency High Speed Copper Clad Laminate (CCL) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

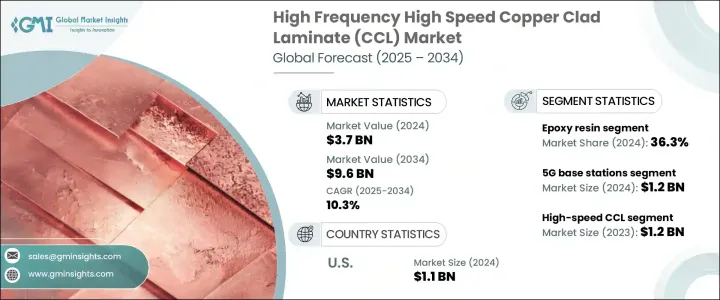

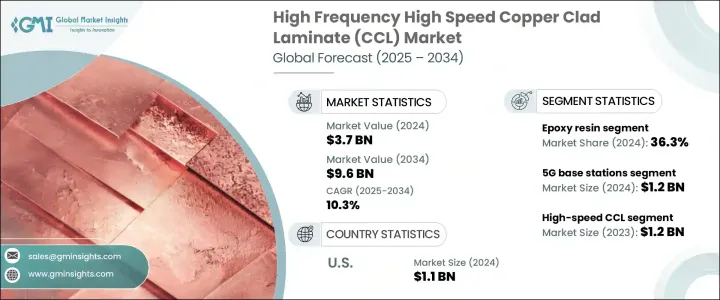

2024 年全球高頻高速覆銅板市場規模達 37 億美元,預估 2025 年至 2034 年期間複合年成長率將達到 10.3%。這一成長主要得益於 5G 技術的快速普及以及各行各業對先進電子設備的需求激增。隨著對高速資料傳輸和增強連接性的需求不斷增加,製造商越來越依賴高頻和高速 CCL 等高性能材料。這些層壓板在印刷電路板的生產中起著至關重要的作用,印刷電路板為現代電子設備、電信基礎設施和高速計算系統提供動力。

人工智慧、物聯網 (IoT) 和自動駕駛汽車的日益整合進一步擴大了對高效高速電子元件的需求。隨著資料處理需求的不斷發展,各行各業都開始關注需要堅固可靠的電路材料的下一代技術。此外,向緊湊、輕巧和節能設備的轉變為製造商在材料成分方面進行創新創造了機會,提高了覆銅板的熱阻、訊號完整性和整體性能。隨著對半導體進步和無線通訊網路的大量投資,高頻和高速 CCL 市場將在未來幾年大幅擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 37億美元 |

| 預測值 | 96億美元 |

| 複合年成長率 | 10.3% |

市場主要分為高頻 CCL 和高速 CCL,其中高頻部分預計將佔據主導地位,到 2024 年將達到 25 億美元。對先進電信基礎設施的日益依賴以及對不間斷高速資料流日益成長的需求正在推動對高頻 CCL 的需求。電信和消費性電子等產業正在經歷前所未有的向更快、更可靠的電子元件的轉變,這進一步加速了這些層壓板的採用。

就樹脂類型而言,高頻高速覆銅板(CCL)市場分為酚醛樹脂、環氧樹脂、聚醯亞胺樹脂和雙馬來醯亞胺-三嗪(BT)樹脂。環氧樹脂領域在 2024 年佔據了 36.3% 的市場佔有率,這得益於其卓越的性能特點和增強 PCB 結構完整性的能力。環氧樹脂配方的不斷進步正在提高覆銅板的耐久性、熱穩定性和電氣性能,使其成為 PCB 製造商的首選。

預計到 2024 年,美國高頻高速覆銅板 (CCL) 市場規模將達到 11 億美元,這得益於 5G 基礎設施的快速部署、電子產品的普及以及汽車行業的擴張。隨著對更智慧、更有效率電子設備的需求不斷成長,對高頻和高速覆銅板等高性能材料的需求將在多個領域成長,從而加強其在未來數位轉型中的關鍵作用。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 5G技術擴展需求

- 電子設備需求不斷成長

- 消費性電子產品需求激增

- 航太和國防技術的進步

- 產業陷阱與挑戰

- 生產過程成本高

- 嚴格遵守環境法規

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 高頻覆銅板

- 高速覆銅板

第6章:市場估計與預測:依樹脂類型,2021-2034

- 主要趨勢

- 環氧樹脂

- 酚醛樹脂

- 聚醯亞胺樹脂

- 雙馬來醯亞胺-三嗪(BT)樹脂

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 5G基地台

- 汽車電子

- 消費性電子產品

- 智慧型手機

- 平板電腦

- 筆記型電腦

- 電信

- 路由器

- 開關

- 天線

- 航太和國防

- 雷達系統

- 通訊系統

- 其他

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AGC Inc. (Asahi Glass Co., Ltd.)

- Arlon Electronic Materials

- Doosan Corporation Electro-Materials

- Elite Material Co., Ltd. (EMC)

- Grace Electron

- Hanwha Advanced Materials

- Hitachi Chemical Co., Ltd.

- Isola Group

- ITEQ Corporation

- Kingboard Laminates Holdings Ltd.

- Mitsubishi Gas Chemical Company, Inc.

- Nan Ya Plastics Corporation

- Nelco Products (Park Electrochemical Corp.)

- Nippon Mektron, Ltd.

- Panasonic Corporation

- Rogers Corporation

- Shengyi Technology Co., Ltd.

- Shinko Electric Industries Co., Ltd.

- Sumitomo Bakelite Co., Ltd.

- SYTECH

- Taiwan Union Technology Corporation (TUC)

- TUC (Taiwan Union Technology Corporation)

- Ventec International Group

- Wazam New Materials

- Zhongying Science & Technology

The Global High Frequency High Speed Copper Clad Laminate Market reached USD 3.7 billion in 2024 and is expected to grow at a robust CAGR of 10.3% from 2025 to 2034. This growth is largely fueled by the rapid adoption of 5G technology and the surging demand for advanced electronic devices across various industries. With the increasing need for high-speed data transmission and enhanced connectivity, manufacturers are relying more on high-performance materials such as high-frequency and high-speed CCLs. These laminates play a crucial role in the production of printed circuit boards, which power modern electronic equipment, telecommunications infrastructure, and high-speed computing systems.

The growing integration of artificial intelligence, the Internet of Things (IoT), and autonomous vehicles is further amplifying the demand for efficient and high-speed electronic components. As data processing needs evolve, industries are focusing on next-generation technologies that require robust and reliable circuit materials. Additionally, the shift toward compact, lightweight, and energy-efficient devices is creating opportunities for manufacturers to innovate in material composition, improving the thermal resistance, signal integrity, and overall performance of copper clad laminates. With significant investments in semiconductor advancements and wireless communication networks, the market for high-frequency and high-speed CCLs is poised for substantial expansion in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $9.6 billion |

| CAGR | 10.3% |

The market is primarily categorized into high-frequency CCL and high-speed CCL, with the high-frequency segment projected to dominate, reaching USD 2.5 billion in 2024. The increasing reliance on advanced telecommunications infrastructure and the growing need for uninterrupted, high-speed data flow are driving the demand for high-frequency CCLs. Industries such as telecommunications and consumer electronics are witnessing an unprecedented shift toward faster, more reliable electronic components, further accelerating the adoption of these laminates.

In terms of resin types, the high frequency high-speed copper clad laminate (CCL) market is segmented into phenolic resin, epoxy resin, polyimide resin, and Bismaleimide-Triazine (BT) resin. The epoxy resin segment held a 36.3% market share in 2024, driven by its superior performance characteristics and ability to enhance the structural integrity of PCBs. Ongoing advancements in epoxy resin formulations are improving the durability, thermal stability, and electrical performance of copper clad laminates, making them a preferred choice among PCB manufacturers.

The U.S. high frequency high-speed copper clad laminate (CCL) market is forecasted to reach USD 1.1 billion in 2024, propelled by the rapid deployment of 5G infrastructure, increased electronics adoption, and the expansion of the automotive industry. As the demand for smarter, more efficient electronic devices continues to rise, the need for high-performance materials like high-frequency and high-speed CCLs is set to grow across multiple sectors, reinforcing their critical role in the future of digital transformation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Demand for 5G technology expansion

- 3.6.1.2 Increasing demand for electronic devices

- 3.6.1.3 Surge in consumer electronics demand

- 3.6.1.4 Advancements in aerospace and defense technologies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs of production processes

- 3.6.2.2 Stringent environmental regulations compliance

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 High frequency CCL

- 5.3 High speed CCL

Chapter 6 Market Estimates & Forecast, By Resin Type, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Epoxy resin

- 6.3 Phenolic resin

- 6.4 Polyimide resin

- 6.5 Bismaleimide-Triazine (BT) resin

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 5G Base stations

- 7.3 Automotive electronics

- 7.4 Consumer electronics

- 7.4.1 Smartphones

- 7.4.2 Tablets

- 7.4.3 Laptops

- 7.5 Telecommunications

- 7.5.1 Routers

- 7.5.2 Switches

- 7.5.3 Antennas

- 7.6 Aerospace and defense

- 7.6.1 Radar systems

- 7.6.2 Communication systems

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AGC Inc. (Asahi Glass Co., Ltd.)

- 9.2 Arlon Electronic Materials

- 9.3 Doosan Corporation Electro-Materials

- 9.4 Elite Material Co., Ltd. (EMC)

- 9.5 Grace Electron

- 9.6 Hanwha Advanced Materials

- 9.7 Hitachi Chemical Co., Ltd.

- 9.8 Isola Group

- 9.9 ITEQ Corporation

- 9.10 Kingboard Laminates Holdings Ltd.

- 9.11 Mitsubishi Gas Chemical Company, Inc.

- 9.12 Nan Ya Plastics Corporation

- 9.13 Nelco Products (Park Electrochemical Corp.)

- 9.14 Nippon Mektron, Ltd.

- 9.15 Panasonic Corporation

- 9.16 Rogers Corporation

- 9.17 Shengyi Technology Co., Ltd.

- 9.18 Shinko Electric Industries Co., Ltd.

- 9.19 Sumitomo Bakelite Co., Ltd.

- 9.20 SYTECH

- 9.21 Taiwan Union Technology Corporation (TUC)

- 9.22 TUC (Taiwan Union Technology Corporation)

- 9.23 Ventec International Group

- 9.24 Wazam New Materials

- 9.25 Zhongying Science & Technology