|

市場調查報告書

商品編碼

1699415

法布瑞氏症治療市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Fabry Disease Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

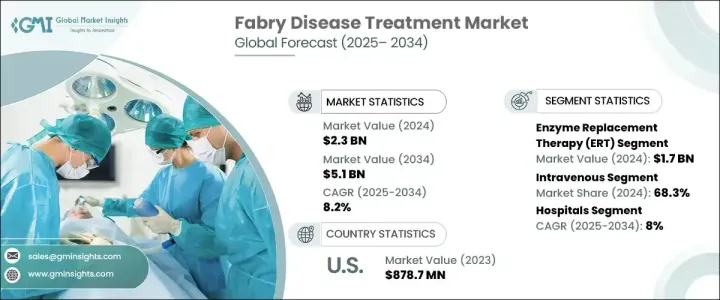

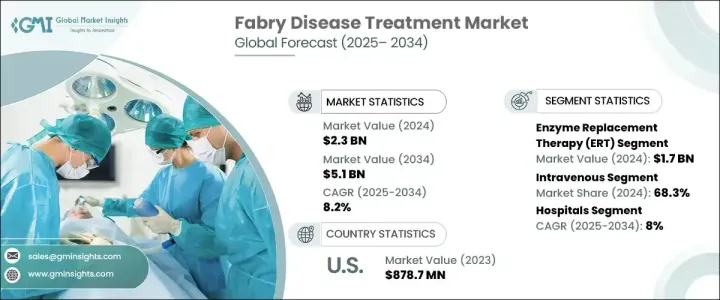

2024 年全球法布瑞氏症治療市場價值為 23 億美元,預計 2025-2034 年期間複合年成長率為 8.2%。對法布瑞氏症高效、有針對性和特異性治療的需求不斷成長,推動全球市場擴張。這種疾病是一種由 GLA 基因突變引起的罕見遺傳性疾病,會導致有害脂肪物質在各個器官中積聚,引發影響腎臟、心臟和神經系統的嚴重併發症。隨著人們對法布瑞氏症的認知不斷提高,醫療保健提供者和製藥公司正致力於開發針對症狀和根本原因的創新療法。隨著研究的不斷深入和臨床的進步,新的治療方案不斷湧現,為患者帶來了更好的治療效果和更高的生活品質。公共和私營部門的資金增加以及生物製藥公司之間的合作預計將加速該市場的創新。監管支持以及新療法的快速通道指定進一步加快了藥物核准,為行業參與者創造了有利可圖的機會。競爭格局正在發生變化,各公司大力投資研發,將更有效、更容易取得的治療方法推向市場。

市場分為幾種治療方案,其中酵素替代療法 (ERT) 處於領先地位。 ERT 在 2024 年的價值為 17 億美元,並且由於其作為法布瑞氏症標準治療的既定地位而繼續佔據主導地位。這種療法透過替代缺乏的酵素α-半乳糖苷酶A來發揮作用,該酵素是控制疾病和防止器官逐漸受損的重要組成部分。法布瑞氏症率的上升直接增加了對 ERT 的需求,隨著診斷方法的改進,更多的患者獲得了治療。次世代定序和酵素測定徹底改變了法布瑞氏症的診斷,能夠更早、更準確地檢測,進一步推動了 ERT 的採用。正在進行的具有延長半衰期和提高療效的下一代 ERT 配方研究預計將維持該領域的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 51億美元 |

| 複合年成長率 | 8.2% |

市場也根據給藥途徑區分治療方法,包括靜脈注射和口服。靜脈注射治療在 2024 年佔據 68.3% 的佔有率,預計在 2025-2034 年期間將繼續以 8.1% 的複合年成長率成長。人們對法布瑞氏症的認知不斷提高以及基因篩檢計畫的改進導致了更多的診斷,這推動了對靜脈治療的需求。臨床研究一致表明,靜脈注射 ERT 在長期穩定症狀方面更為有效,因此成為首選治療方法。然而,口服療法因其潛在的便利性和提高患者依從性而受到關注。

2024 年,北美法布瑞氏症治療市場的收入為 9.458 億美元,成為市場擴張的關鍵地區。成長的動力來自於政府的有利舉措、發病率的上升以及專門從事罕見疾病治療的領先醫療保健公司的存在。美國治療程序數量的不斷增加,加上高昂的醫療支出和強力的報銷政策,大大促進了市場的成長。該地區在法布瑞氏症治療領域的研發方面仍處於領先地位,多項臨床試驗和新藥核准塑造了競爭格局。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球法布瑞氏症病例不斷增加

- 專家和醫生的意識不斷增強

- 法布瑞氏症治療療法的進展

- 健康意識不斷提高,早期診斷需求不斷增加

- 產業陷阱與挑戰

- 治療費用高

- 治療選擇有限

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 定價分析

- 產品線分析

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依治療方式,2021 年至 2034 年

- 主要趨勢

- 酵素替代療法(ERT)

- 陪伴治療

- 其他治療類型

第6章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 靜脈

- 口服

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 居家照護環境

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Amicus Therapeutics

- Avrobio

- Freeline Therapeutics

- Idorsia Pharmaceuticals

- ISU Abxis

- JCR Pharmaceuticals

- Novartis

- Pfizer

- Protalix BioTherapeutics

- Sanofi

- Takeda Pharmaceuticals

- Viatris

The Global Fabry Disease Treatment Market was valued at USD 2.3 billion in 2024 and is projected to grow at a CAGR of 8.2% during 2025-2034. The increasing demand for highly effective, targeted, and specific treatments for Fabry disease is driving market expansion worldwide. The condition, a rare genetic disorder caused by mutations in the GLA gene, leads to the buildup of harmful fatty substances in various organs, resulting in severe complications affecting the kidneys, heart, and nervous system. As awareness of Fabry disease continues to grow, healthcare providers and pharmaceutical companies are focusing on developing innovative therapies that address both the symptoms and underlying causes. With ongoing research and clinical advancements, new treatment options are emerging, giving patients improved outcomes and an enhanced quality of life. Increased funding from both public and private sectors, along with collaborations among biopharmaceutical companies, is expected to accelerate innovation in this market. Regulatory support, along with fast-track designations for novel therapies, is further expediting drug approvals, creating lucrative opportunities for industry participants. The competitive landscape is evolving, with companies investing heavily in research and development to bring more effective and accessible treatments to market.

The market is categorized into several treatment options, with enzyme replacement therapy (ERT) leading the way. ERT was valued at USD 1.7 billion in 2024 and continues to dominate due to its established role as the standard treatment for Fabry disease. This therapy works by replacing the deficient enzyme alpha-galactosidase A, an essential component in managing the disease and preventing progressive organ damage. The rising prevalence of Fabry disease has directly increased the demand for ERT, with more patients gaining access to treatment due to improved diagnostic methods. Next-generation sequencing and enzyme assays have revolutionized Fabry disease diagnosis, enabling earlier and more accurate detection, which is further fueling the adoption of ERT. Ongoing research into next-generation ERT formulations with extended half-lives and improved efficacy is expected to sustain growth in this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 8.2% |

The market also distinguishes treatments based on their route of administration, including intravenous and oral options. Intravenous treatments accounted for a 68.3% share in 2024 and are expected to continue growing at a CAGR of 8.1% during 2025-2034. The increasing awareness of Fabry disease and improvements in genetic screening programs have led to more diagnoses, which is driving demand for intravenous therapies. Clinical studies consistently show that intravenous ERT is more effective at stabilizing symptoms over the long term, making it the preferred treatment. However, oral therapies are gaining attention due to their potential convenience and improved patient adherence.

North America generated USD 945.8 million in revenue from the Fabry Disease Treatment Market in 2024, making it a key region for market expansion. Growth is driven by favorable government initiatives, rising incidence rates, and the presence of leading healthcare companies specializing in rare disease treatments. The increasing number of treatment procedures in the U.S., coupled with high healthcare expenditure and strong reimbursement policies, has significantly contributed to market growth. The region remains at the forefront of research and development in Fabry disease treatments, with multiple clinical trials and new drug approvals shaping the competitive landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising cases of fabry disease across the globe

- 3.2.1.2 Growing awareness among specialists and physicians

- 3.2.1.3 Advancements in fabry disease treatment therapies

- 3.2.1.4 Rising health awareness and demand for early-stage diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment cost

- 3.2.2.2 Limited treatment options

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Pricing analysis

- 3.6 Product pipeline analysis

- 3.7 Regulatory landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Treatment, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Enzyme replacement therapy (ERT)

- 5.3 Chaperone treatment

- 5.4 Other treatment types

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Intravenous

- 6.3 Oral

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Homecare settings

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amicus Therapeutics

- 9.2 Avrobio

- 9.3 Freeline Therapeutics

- 9.4 Idorsia Pharmaceuticals

- 9.5 ISU Abxis

- 9.6 JCR Pharmaceuticals

- 9.7 Novartis

- 9.8 Pfizer

- 9.9 Protalix BioTherapeutics

- 9.10 Sanofi

- 9.11 Takeda Pharmaceuticals

- 9.12 Viatris