|

市場調查報告書

商品編碼

1699428

乙太網路網路交換器市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Ethernet Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

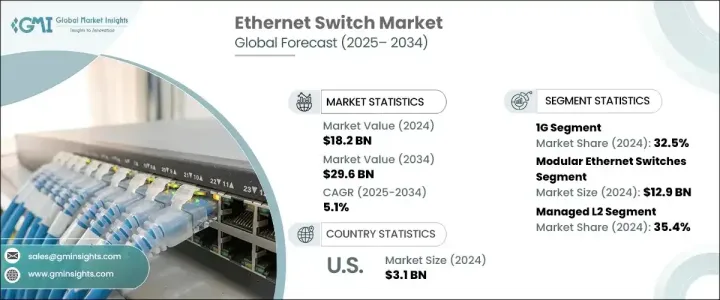

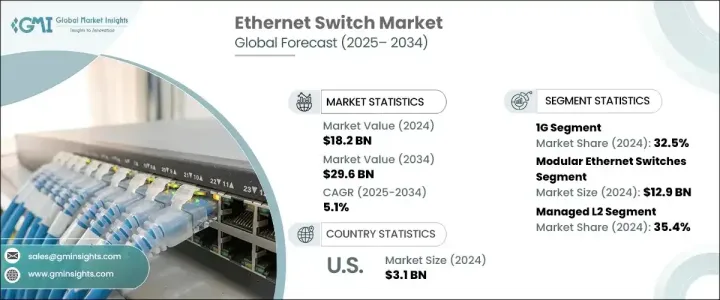

2024 年全球乙太網路交換器市場價值為 182 億美元,預計 2025 年至 2034 年期間複合年成長率為 5.1%,這得益於全球資料中心的快速擴張。隨著雲端運算、巨量資料和物聯網 (IoT) 的不斷發展,對高速、可靠的網路基礎架構的需求變得比以往任何時候都更加重要。越來越多的組織開始投資先進的乙太網路交換機,以最佳化資料流量管理、提高網路效率並支援數位轉型產生的日益成長的資料量。遠距工作、智慧製造和工業 4.0 計畫的激增進一步擴大了對強大網路解決方案的需求。企業正在對其 IT 基礎設施進行現代化改造,以適應下一代連接要求,而 5G 網路的持續部署正在加速採用乙太網路交換器將流量從基地台回傳到核心網路。此外,軟體定義網路 (SDN) 和網路虛擬化正在推動乙太網路網路交換器的創新,使企業能夠實現更高的靈活性、可擴展性和成本效益。

隨著對無縫資料傳輸的需求不斷成長,乙太網路交換器在確保資料中心、儲存網路和企業系統之間的不間斷連接方面發揮關鍵作用。企業優先考慮高速乙太網路解決方案,以促進雲端運算應用和即時資料處理,從而促進市場的持續成長。隨著網路流量的增加和人工智慧驅動應用程式的出現,網路效能和效率已成為企業的重要考慮因素。市場的主要參與者正專注於技術進步,包括人工智慧網路管理和自動化,以提高營運效率並最大限度地減少延遲問題。由於企業需要在雲端和本地環境之間進行更快的資料交換,因此向邊緣運算的轉變也增加了對乙太網路交換器的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 182億美元 |

| 預測值 | 296億美元 |

| 複合年成長率 | 5.1% |

市場按速度細分,其中 1G 細分市場在 2024 年佔 32.5% 的佔有率。十億位元乙太網路網路交換器已成為現代網路的標準,可提供更高的資料傳輸速率並降低延遲以提高生產力。這些交換器對於基於雲端的應用程式至關重要,因為可靠和高速的連接對於實現最佳效能至關重要。隨著企業越來越依賴雲端服務,對先進乙太網路網路交換器的需求持續上升,推動了 1G 領域的成長。

按類型分類,模組化交換器佔據市場主導地位,到 2024 年將達到 129 億美元。模組化乙太網路網路交換器提供無與倫比的靈活性和可擴展性,允許企業透過整合安全性增強功能和堆疊功能等附加模組來客製化其網路。它們能夠透過在不停機的情況下更換故障組件來確保網路不間斷運行,這使它們成為關鍵網路和大型資料中心的理想選擇。金融、醫療保健和電信等需要高可用性和最小中斷的行業擴大採用模組化交換機來保持無縫連接。

在物聯網、資料中心擴展和雲端運算的快速發展的推動下,美國乙太網路交換器市場規模到 2024 年將達到 31 億美元。憑藉完善的 IT 基礎設施和領先的技術公司,美國繼續在塑造全球乙太網路交換器格局方面發揮至關重要的作用。主要參與者正在投資下一代網路解決方案以支援數位轉型計劃,進一步推動整個地區的市場成長。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 物聯網 (IoT) 設備需求激增,以及資料中心快速擴張

- 5G技術的推廣日益普及

- 資料中心快速擴張

- 雲端服務採用率上升

- 軟體定義網路(SDN)的採用日益增多

- 產業陷阱與挑戰

- 與乙太網路交換器相關的技術複雜性

- 對網路安全的擔憂日益增加

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按速度,2021-2034

- 主要趨勢

- 1G

- 10G

- 25克

- 40克

- 100克

- 其他

第6章:市場估計與預測:按類型,2021-2034

- 主要趨勢

- 模組化乙太網路交換機

- 固定配置乙太網路交換機

第7章:市場估計與預測:依配置,2021-2034

- 主要趨勢

- 未託管

- 聰明的

- 託管 L2

- 託管 L3

- 分裂

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- ABB Ltd.

- Advantech Co., Ltd.

- ALE International

- Allied Telesis Inc

- Analog Devices

- Arista

- BECKHOFF Automation

- Belden Inc.

- Brocade Communications Systems

- Cisco Systems Inc.

- D-link Corporation

- Eaton

- H3C

- Hewlett Packard

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Microchip Technology Inc.

- Moxa Inc.

- Omron Corporation

- Robert Bosch Gmbh

- Rockwell Automation

- Schneider Electric

- Siemens AG

- Yaskawa Electric Corporation

The Global Ethernet Switch Market was valued at USD 18.2 billion in 2024 and is projected to grow at a CAGR of 5.1% from 2025 to 2034, fueled by the rapid expansion of data centers worldwide. As cloud computing, big data, and the Internet of Things (IoT) continue to evolve, the need for high-speed, reliable network infrastructure is becoming more critical than ever. Organizations are increasingly investing in advanced Ethernet switches to optimize data traffic management, enhance network efficiency, and support the growing volume of data generated by digital transformation. The proliferation of remote work, smart manufacturing, and Industry 4.0 initiatives is further amplifying the demand for robust networking solutions. Enterprises are modernizing their IT infrastructure to accommodate next-generation connectivity requirements, while the ongoing deployment of 5G networks is accelerating the adoption of Ethernet switches for backhauling traffic from base stations to core networks. Additionally, software-defined networking (SDN) and network virtualization are driving innovation in Ethernet switches, allowing businesses to achieve greater agility, scalability, and cost-efficiency.

As the demand for seamless data transmission grows, Ethernet switches play a pivotal role in ensuring uninterrupted connectivity across data centers, storage networks, and enterprise systems. Businesses are prioritizing high-speed Ethernet solutions to facilitate cloud computing applications and real-time data processing, contributing to the sustained growth of the market. With rising internet traffic and the emergence of AI-driven applications, network performance and efficiency have become essential considerations for enterprises. Key players in the market are focusing on technological advancements, including AI-powered network management and automation, to enhance operational efficiency and minimize latency issues. The shift toward edge computing is also increasing the need for Ethernet switches, as enterprises require faster data exchange between cloud and on-premises environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.2 billion |

| Forecast Value | $29.6 billion |

| CAGR | 5.1% |

The market is segmented by speed, with the 1G segment accounting for a 32.5% share in 2024. Gigabit Ethernet switches have become the standard for modern networks, offering improved data transfer rates and reduced latency to enhance productivity. These switches are critical for cloud-based applications, where reliable and high-speed connectivity is essential for optimal performance. As businesses increasingly rely on cloud services, the demand for advanced Ethernet switches continues to rise, driving the growth of the 1G segment.

By type, modular switches dominated the market, reaching USD 12.9 billion in 2024. Modular Ethernet switches offer unmatched flexibility and scalability, allowing businesses to customize their networks by integrating additional modules such as security enhancements and stacking capabilities. Their ability to ensure uninterrupted network operations by replacing faulty components without downtime makes them an ideal choice for critical networks and large-scale data centers. Industries that require high availability and minimal disruption, such as finance, healthcare, and telecom, are increasingly adopting modular switches to maintain seamless connectivity.

The U.S. Ethernet Switch Market reached USD 3.1 billion in 2024, driven by rapid advancements in IoT, data center expansion, and cloud computing. With a well-established IT infrastructure and a strong presence of leading technology companies, the U.S. continues to play a vital role in shaping the global Ethernet switch landscape. Major players are investing in next-generation network solutions to support digital transformation initiatives, further propelling market growth across the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Surge in demand for Internet of Things (IoT) devices, as well as rapid expansion of data centers

- 3.6.1.2 Increasing rollout of 5G technology

- 3.6.1.3 Rapid expansion of data centers

- 3.6.1.4 Rise in the adoption of cloud-based services

- 3.6.1.5 Growing adoption of software-defined networking (SDN)

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Technological complexity associated with ethernet switches

- 3.6.2.2 Increasing concern regarding cyber security

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Speed, 2021-2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 1G

- 5.3 10 G

- 5.4 25 G

- 5.5 40 G

- 5.6 100 G

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Modular ethernet switches

- 6.3 Fixed configuration ethernet switches

Chapter 7 Market Estimates & Forecast, By Configuration, 2021-2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Unmanaged

- 7.3 Smart

- 7.4 Managed L2

- 7.5 Managed L3

- 7.6 Divided

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABB Ltd.

- 9.2 Advantech Co., Ltd.

- 9.3 ALE International

- 9.4 Allied Telesis Inc

- 9.5 Analog Devices

- 9.6 Arista

- 9.7 BECKHOFF Automation

- 9.8 Belden Inc.

- 9.9 Brocade Communications Systems

- 9.10 Cisco Systems Inc.

- 9.11 D-link Corporation

- 9.12 Eaton

- 9.13 H3C

- 9.14 Hewlett Packard

- 9.15 Honeywell International Inc.

- 9.16 Huawei Technologies Co., Ltd.

- 9.17 Juniper Networks, Inc.

- 9.18 Microchip Technology Inc.

- 9.19 Moxa Inc.

- 9.20 Omron Corporation

- 9.21 Robert Bosch Gmbh

- 9.22 Rockwell Automation

- 9.23 Schneider Electric

- 9.24 Siemens AG

- 9.25 Yaskawa Electric Corporation