|

市場調查報告書

商品編碼

1699433

網路遙測市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Network Telemetry Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

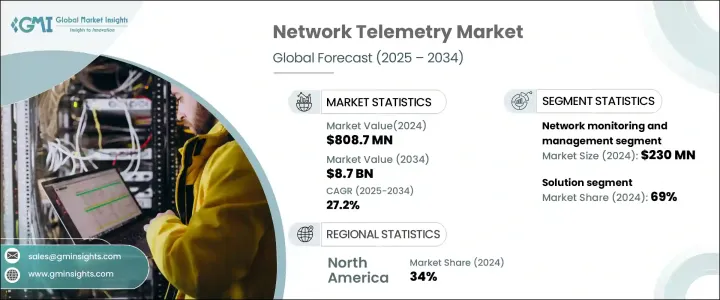

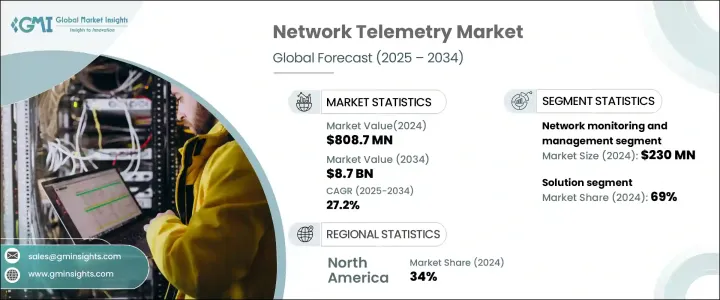

2024 年全球網路遙測市場價值為 8.087 億美元,預計 2025 年至 2034 年期間的複合年成長率為 27.2%。推動這一成長的關鍵因素是全球 5G 網路的快速擴張,增加了對先進網路監控解決方案的需求。隨著 5G 提供更低的延遲和增強的頻寬,企業正在採用即時網路遙測解決方案來最佳化效能、監控擁塞並提高訊號品質。此外,對數位化營運和基於雲端的服務的依賴日益增加,促使企業實施網路遙測,以主動檢測和緩解問題。

隨著各行各業對高速連線的需求不斷成長,網路遙測對於維護網路健康和可靠性變得至關重要。物聯網設備和雲端運算的日益普及進一步加強了對自動監控系統的需求。隨著網路複雜性的增加,公司正在從傳統的監控方法轉向遙測驅動的解決方案,以提高安全性、效率和數據驅動的決策。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.087億美元 |

| 預測值 | 87億美元 |

| 複合年成長率 | 27.2% |

在應用方面,市場包括網路監控和管理、網路安全監控、流量分析、故障排除和根本原因分析。 2024年,網路監控和管理將佔據超過29%的市場佔有率,創造約2.3億美元的收入。業務營運對網路服務的日益依賴推動了對持續效能評估、減少停機時間和確保無縫連接的需求。自動監控工具可提供網路擁塞、安全漏洞和效能波動的即時警報,使企業能夠保持營運穩定。

組件部分由解決方案和服務組成,其中解決方案在 2024 年佔據主導地位,佔據約 69% 的市場佔有率。各組織正在將人工智慧分析整合到網路管理工具中,以增強監控能力。這些解決方案有助於即時資料收集、分析和視覺化,解決現代網路挑戰。隨著雲端服務、物聯網設備和 5G 技術的日益普及,企業正在投資一體化遙測解決方案,以簡化部署並簡化網路最佳化。

根據企業規模,市場分為中小型企業 (SME) 和大型企業,大型企業在 2024 年將處於領先地位。由於業務範圍廣泛且網路基礎設施複雜,大型公司需要先進的遙測工具來管理效能、正常運作時間和安全性。這些企業產生大量資料,需要高頻寬應用程式和強大的網路監控系統來防止中斷。安全問題、合規性要求以及停機的財務影響進一步推動了遙測解決方案的大規模採用。

從部署角度來看,市場分為本地部署和雲端解決方案,其中雲端解決方案在 2024 年將佔據相當大的佔有率。雲端平台提供可擴展性,使企業能夠有效地管理不斷成長的資料流量,並將遙測解決方案與現有的雲端環境整合。基於雲端的遙測解決方案還提供經濟高效的基於訂閱的模型,減少前期投資,同時確保長期節省。雲端平台的靈活性使其成為尋求強大、即時監控功能且無需額外基礎設施負擔的企業的理想選擇。

從地區來看,北美佔據網路遙測市場的主導地位,佔超過 34% 的佔有率,其中美國在 2024 年的市場規模約為 1.426 億美元,位居第一。各行業的快速數字化轉型、雲端服務的採用率不斷提高以及對安全網路管理的推動正在加速市場成長。政府加強 5G 基礎設施和電信的措施進一步推動了對網路遙測解決方案的需求,確保了各行業的網路安全、高效能運作。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 網路遙測解決方案供應商

- 服務提供者

- 網路安全供應商

- 系統整合商

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 即時網路監控需求

- 採用雲端和虛擬化網路

- 5G部署不斷增加

- 網路最佳化和效能管理的需求

- 產業陷阱與挑戰

- 實施和維護成本高

- 與現有基礎設施整合的複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 解決方案

- 服務

- 專業服務

- 託管服務

第6章:市場估計與預測:按部署,2021 - 2034 年

- 主要趨勢

- 本地部署

- 雲

第7章:市場估計與預測:依企業規模,2021 - 2034 年

- 主要趨勢

- 大型企業

- 中小企業

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 網路監控與管理

- 網路安全監控

- 交通分析與工程

- 故障排除和根本原因分析

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Anuta Networks International

- Apcela

- Arista

- Broadcom

- Check Point Software

- Cisco

- ExtraHop Networks

- F5 Networks

- Fortinet

- Gigamon

- Juniper

- Kentik

- Keysight Technologies

- Marvell Technology Group

- Mellanox Technologies

- NetAcquire

- Riverbed Technology

- VOLANSYS Technologies

- Waystream

The Global Network Telemetry Market was valued at USD 808.7 million in 2024 and is projected to expand at a CAGR of 27.2% from 2025 to 2034. A key factor driving this growth is the rapid expansion of 5G networks worldwide, increasing the need for advanced network monitoring solutions. With 5G offering reduced latency and enhanced bandwidth, businesses are adopting real-time network telemetry solutions to optimize performance, monitor congestion, and improve signal quality. Additionally, rising dependence on digital operations and cloud-based services is pushing enterprises to implement network telemetry for proactive issue detection and mitigation.

As demand for high-speed connectivity grows across industries, network telemetry is becoming essential for maintaining network health and reliability. The rising adoption of IoT devices and cloud computing is further strengthening the need for automated monitoring systems. With network complexities increasing, companies are shifting from traditional monitoring methods to telemetry-driven solutions for improved security, efficiency, and data-driven decision-making.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $808.7 Million |

| Forecast Value | $8.7 Billion |

| CAGR | 27.2% |

In terms of application, the market includes network monitoring & management, network security monitoring, traffic analysis, troubleshooting, and root cause analysis. In 2024, network monitoring and management accounted for over 29% of the market, generating approximately USD 230 million. Growing reliance on network services for business operations is fueling demand for continuous performance assessment, reducing downtime, and ensuring seamless connectivity. Automated monitoring tools provide real-time alerts on network congestion, security breaches, and performance fluctuations, allowing businesses to maintain operational stability.

The component segment consists of solutions and services, with solutions dominating in 2024, holding around 69% of the market. Organizations are integrating AI-powered analytics into network management tools to enhance monitoring capabilities. These solutions facilitate real-time data collection, analysis, and visualization, addressing modern networking challenges. With the increasing adoption of cloud services, IoT devices, and 5G technology, enterprises are investing in all-in-one telemetry solutions that simplify deployment and streamline network optimization.

By enterprise size, the market is categorized into small and medium enterprises (SMEs) and large enterprises, with large enterprises leading in 2024. Due to their expansive operations and complex network infrastructures, large companies require advanced telemetry tools to manage performance, uptime, and security. These enterprises generate vast amounts of data, necessitating high-bandwidth applications and robust network monitoring systems to prevent disruptions. Security concerns, compliance requirements, and financial implications of downtime further drive large-scale adoption of telemetry solutions.

Deployment-wise, the market is divided into on-premise and cloud solutions, with the cloud segment holding a significant share in 2024. Cloud platforms offer scalability, allowing businesses to efficiently manage growing data traffic and integrate telemetry solutions with existing cloud environments. Cloud-based telemetry solutions also offer cost-effective, subscription-based models, reducing upfront investment while ensuring long-term savings. The flexibility of cloud platforms makes them ideal for enterprises seeking robust, real-time monitoring capabilities without additional infrastructure burdens.

Regionally, North America dominated the network telemetry market, capturing over 34% of the share, with the US leading at approximately USD 142.6 million in 2024. Rapid digital transformation across sectors, increased adoption of cloud services, and the push for secure network management are accelerating market growth. Government initiatives to enhance 5G infrastructure and strengthen telecommunications are further fueling demand for network telemetry solutions, ensuring secure and high-performance network operations across industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Network telemetry solution providers

- 3.2.2 Service providers

- 3.2.3 Network security providers

- 3.2.4 System integrators

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Demand for real-time network monitoring

- 3.8.1.2 Adoption of cloud and virtualized networks

- 3.8.1.3 Rising 5G rollout

- 3.8.1.4 Need for network optimization and performance management

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High implementation and maintenance costs

- 3.8.2.2 Complexity of integration with existing infrastructure

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.3 Service

- 5.3.1 Professional services

- 5.3.2 Managed services

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premise

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Large enterprises

- 7.3 SME

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Network monitoring & management

- 8.3 Network security monitoring

- 8.4 Traffic analysis and engineering

- 8.5 Troubleshooting and root cause analysis

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Anuta Networks International

- 10.2 Apcela

- 10.3 Arista

- 10.4 Broadcom

- 10.5 Check Point Software

- 10.6 Cisco

- 10.7 ExtraHop Networks

- 10.8 F5 Networks

- 10.9 Fortinet

- 10.10 Gigamon

- 10.11 Juniper

- 10.12 Kentik

- 10.13 Keysight Technologies

- 10.14 Marvell Technology Group

- 10.15 Mellanox Technologies

- 10.16 NetAcquire

- 10.17 Riverbed Technology

- 10.18 VOLANSYS Technologies

- 10.19 Waystream