|

市場調查報告書

商品編碼

1708122

軍事人工智慧市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Artificial Intelligence in Military Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

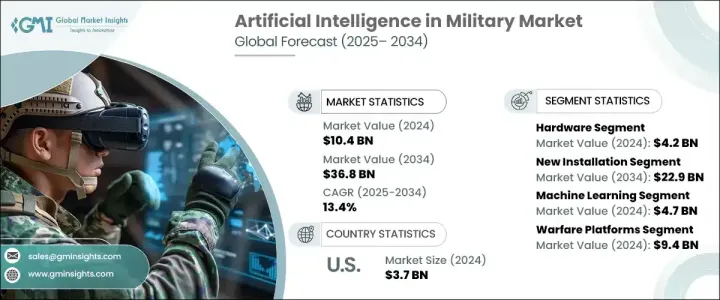

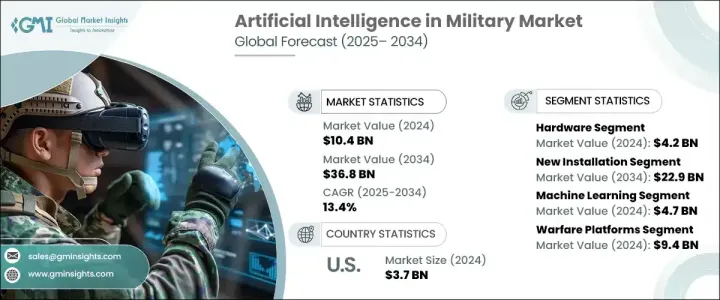

2024 年全球軍事人工智慧市場價值為 104 億美元,預計 2025 年至 2034 年期間的複合年成長率為 13.4%。這種快速成長的動力來自於軍事開支的增加以及對利用人工智慧快速分析大量資料的日益重視,使部隊能夠在行動期間做出明智的決策。世界各地的軍隊正在將人工智慧融入國防系統,以提高作戰效率、縮短反應時間並提高決策準確性。人工智慧應用涵蓋各個領域,從戰鬥和監視到物流和網路安全,即時洞察可以決定任務的成功。隨著威脅變得越來越複雜和難以預測,對自適應和智慧系統的需求正在推動對可以簡化國防行動和預測潛在威脅的人工智慧技術的投資。

隨著國防組織致力於實現指揮中心現代化、最佳化資產利用率和加強安全協議,對人工智慧解決方案的需求日益成長。人工智慧能夠自動化日常流程、偵測異常並預測戰場資料模式,使軍事人員能夠更精確、更靈活地進行行動。此外,無人機、機器人車輛和無人地面系統等自主系統的興起,正在加速採用基於人工智慧的技術,以增強監視、偵察和威脅緩解能力。這些進步減少了人為干預,降低了人員風險,同時改善了營運成果。軍事組織正在積極探索網路防禦中的人工智慧增強應用,以保護關鍵基礎設施並在漏洞升級之前檢測到潛在的漏洞。人工智慧應用的擴展正在推動全球市場向前發展,吸引了致力於加強國家安全的國防技術公司、政府和研究機構的興趣。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 104億美元 |

| 預測值 | 368億美元 |

| 複合年成長率 | 13.4% |

市場分為硬體、軟體和服務,其中硬體佔有很大佔有率。 2024 年,硬體領域的價值將達到 42 億美元,這得益於人們對自主無人機、戰鬥機器人和智慧武器等配備人工智慧的系統的日益依賴。這些技術需要先進的人工智慧演算法來完善導航系統、增強目標識別並提高即時威脅響應。隨著自主軍事平台的不斷發展,對專門的人工智慧硬體的需求也在不斷成長,這有助於實現更準確、更有效率的國防行動。

根據安裝類型,市場還分為新安裝和升級,預計到 2034 年新安裝將產生 229 億美元的市場規模。軍事組織優先部署人工智慧驅動的系統,以實現其國防基礎設施的現代化。新裝置的需求源自於需要將尖端人工智慧功能整合到現有的指揮中心和國防資產中,以增強整體性能和態勢感知能力。國防承包商正在將人工智慧功能融入各種軍事平台,包括戰鬥機和裝甲車,以滿足現代戰爭不斷變化的需求。

2024年美國軍事人工智慧市場價值為37億美元,反映了美國在國防應用人工智慧創新方面的領導地位。美國軍方仍然處於人工智慧融合的前沿,國防科技公司和人工智慧平台之間的廣泛合作推動了突破性解決方案的發展。美國軍事行動中擴大採用人工智慧,這增強了國防系統的效力,並改變了全球軍事戰略的規劃和執行方式。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 軍費開支增加

- 戰術無人機系統(UAS)的進步

- 對自主軍事系統的需求不斷成長

- 人工智慧網路安全解決方案的進步

- 人工智慧在監視和偵察領域的應用日益廣泛

- 產業陷阱與挑戰

- 人工智慧開發和實施成本高昂

- 與傳統軍事系統的整合挑戰

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按供應量,2021 - 2034 年

- 主要趨勢

- 硬體

- 軟體

- 雲

- 本地

- 服務

- 部署與整合

- 升級和維護

- 軟體支援

- 其他

第6章:市場估計與預測:按安裝類型,2021 - 2034 年

- 主要趨勢

- 新安裝

- 升級

第7章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 機器學習

- 自然語言處理

- 情境感知計算

- 電腦視覺

- 智慧虛擬代理(Iva)/虛擬代理

- 其他

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 作戰平台

- 網路安全

- 物流與運輸

- 監視和態勢感知

- 命令與控制

- 戰場醫療保健

- 模擬與訓練

- 威脅偵測

- 資訊處理

- 其他

第9章:市場估計與預測:按平台,2021 - 2034 年

- 主要趨勢

- 空降

- 戰鬥機

- 特殊任務飛機

- 直升機

- 無人機(UAV)

- 土地

- 軍用戰車(MFV)

- 無人地面車輛(UGV)

- 武器系統

- 總部和指揮中心

- 徒步士兵系統

- 海軍

- 船舶

- 潛水艇

- 無人駕駛船舶(UMV)

- 空間

- 立方體衛星

- 衛星

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- BAE Systems

- Boeing

- CACI International

- General Dynamics

- IBM

- L3Harris Technologies

- Leonardo

- Lockheed Martin

- Northrop Grumman

- Nvidia

- Palantir Technologies

- Rafael Advanced Defense Systems

- Raytheon Technologies

- Saab

- Safran

- Thales

The global artificial intelligence in military market was valued at USD 10.4 billion in 2024 and is projected to grow at a CAGR of 13.4% between 2025 and 2034. This rapid growth is fueled by increased military spending and a rising emphasis on utilizing AI to analyze vast amounts of data swiftly, enabling forces to make informed decisions during operations. Militaries worldwide are integrating AI into defense systems to enhance operational efficiency, reduce response times, and improve decision-making accuracy. AI applications span various domains, from combat and surveillance to logistics and cybersecurity, where real-time insights can determine mission success. As threats become more complex and unpredictable, the need for adaptive and intelligent systems is driving investments in AI technologies that can streamline defense operations and anticipate potential threats.

AI-powered solutions are increasingly in demand as defense organizations aim to modernize their command centers, optimize asset utilization, and strengthen security protocols. AI's ability to automate routine processes, detect anomalies, and predict patterns in battlefield data empowers military personnel to operate with greater precision and agility. Moreover, the rise of autonomous systems, including drones, robotic vehicles, and unmanned ground systems, is accelerating the adoption of AI-based technologies that enhance surveillance, reconnaissance, and threat mitigation capabilities. These advancements reduce human intervention and lower the risk to personnel while improving operational outcomes. Military organizations are actively exploring AI-enhanced applications in cyber defense to safeguard critical infrastructure and detect potential breaches before they escalate. This expansion of AI applications is propelling the global market forward, attracting interest from defense technology firms, governments, and research institutions focused on strengthening national security.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $36.8 Billion |

| CAGR | 13.4% |

The market is segmented into hardware, software, and services, with hardware accounting for a significant share. In 2024, the hardware segment was valued at USD 4.2 billion, driven by the growing reliance on AI-equipped systems such as autonomous drones, combat robots, and smart weaponry. These technologies require advanced AI algorithms to refine navigation systems, enhance target identification, and improve real-time threat response. As autonomous military platforms continue to evolve, the need for specialized AI-enabled hardware is rising, contributing to more accurate and efficient defense operations.

The market is also categorized by installation type into new installations and upgrades, with new installations expected to generate USD 22.9 billion by 2034. Military organizations are prioritizing the deployment of AI-driven systems to modernize their defense infrastructure. The demand for new installations stems from the need to integrate cutting-edge AI capabilities into existing command centers and defense assets, enhancing overall performance and situational awareness. Defense contractors are responding by incorporating AI features into various military platforms, including fighter jets and armored vehicles, to meet the evolving needs of modern warfare.

The U.S. artificial intelligence in military market was valued at USD 3.7 billion in 2024, reflecting the country's leadership in AI innovation for defense applications. The U.S. military remains at the forefront of AI integration, with extensive collaboration between defense technology firms and AI platforms driving the development of groundbreaking solutions. The increasing adoption of AI across U.S. military operations is enhancing the effectiveness of defense systems and transforming the way military strategies are planned and executed globally.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising military spending

- 3.2.1.2 Advancement in tactical unmanned aircraft systems (UAS)

- 3.2.1.3 Growing demand for autonomous military systems

- 3.2.1.4 Advancements in AI-powered cybersecurity solutions

- 3.2.1.5 Increasing deployment of AI in surveillance and reconnaissance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of ai development and implementation

- 3.2.2.2 Integration challenges with legacy military systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Offering, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.3.1 Cloud

- 5.3.2 On-premises

- 5.4 Services

- 5.4.1 Deployment & integration

- 5.4.2 Upgrades & maintenance

- 5.4.3 Software support

- 5.4.4 Others

Chapter 6 Market Estimates and Forecast, By Installation Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 New installation

- 6.3 Upgradation

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Machine learning

- 7.3 Natural language processing

- 7.4 Context-aware computing

- 7.5 Computer vision

- 7.6 Intelligent virtual agent (Iva) /virtual agents

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Warfare platforms

- 8.3 Cybersecurity

- 8.4 Logistics & transportation

- 8.5 Surveillance & situational awareness

- 8.6 Command & control

- 8.7 Battlefield healthcare

- 8.8 Simulation & training

- 8.9 Threat detection

- 8.10 Information processing

- 8.11 Others

Chapter 9 Market Estimates and Forecast, By Platform, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Airborne

- 9.2.1 Fighter aircraft

- 9.2.2 Special mission aircraft

- 9.2.3 Helicopters

- 9.2.4 Unmanned aerial vehicles (UAV)

- 9.3 Land

- 9.3.1 Military fighting vehicles (MFV)

- 9.3.2 Unmanned ground vehicles (UGV)

- 9.3.3 Weapons systems

- 9.3.4 Headquarter & command centers

- 9.3.5 Dismounted soldier systems

- 9.4 Naval

- 9.4.1 Ships

- 9.4.2 Submarines

- 9.4.3 Unmanned marine vehicles (UMVs)

- 9.5 Space

- 9.5.1 CubeSats

- 9.5.2 Satellites

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 BAE Systems

- 11.2 Boeing

- 11.3 CACI International

- 11.4 General Dynamics

- 11.5 IBM

- 11.6 L3Harris Technologies

- 11.7 Leonardo

- 11.8 Lockheed Martin

- 11.9 Northrop Grumman

- 11.10 Nvidia

- 11.11 Palantir Technologies

- 11.12 Rafael Advanced Defense Systems

- 11.13 Raytheon Technologies

- 11.14 Saab

- 11.15 Safran

- 11.16 Thales