|

市場調查報告書

商品編碼

1708147

汽車載貨地板市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Load Floor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

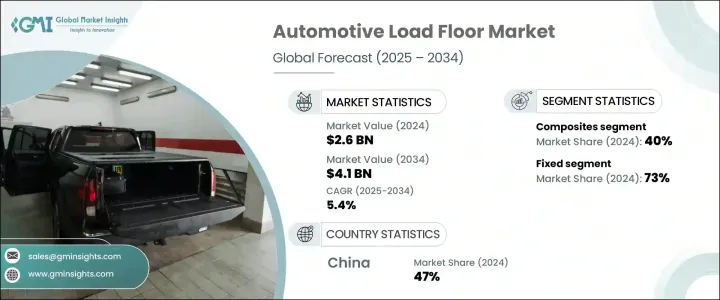

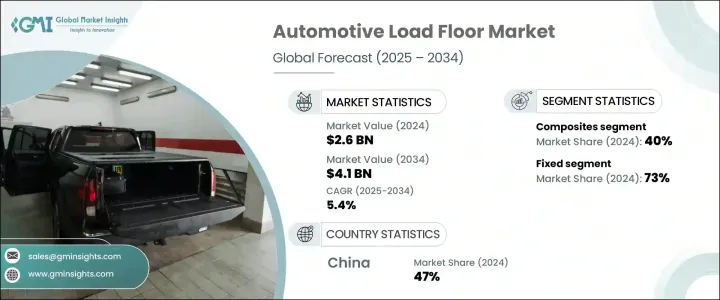

2024 年全球汽車載貨地板市場規模達 26 億美元,預計 2025-2034 年期間複合年成長率為 5.4%。這種擴張是由對電動和自動駕駛汽車(EV 和 AV)不斷成長的需求所推動的,這些汽車需要先進的設計和增強的功能。由於電動車的電池組通常位於地板下方,汽車製造商越來越關注超輕但耐用的貨物地板。因此,人們正在採用複合材料和熱塑性塑膠等先進材料來提高空間效率、最佳化貨物容量並保持結構完整性。

隨著對燃油經濟性和永續性的日益重視,製造商正在優先考慮輕質材料以減少碳足跡。將非增強聚合物複合材料、熱塑性塑膠和蜂窩結構整合到載貨地板中,在降低車輛整體重量且不犧牲耐用性方面發揮著至關重要的作用。隨著汽車製造商致力於嚴格的排放法規和提高燃油效率,這一趨勢正在增強。隨著消費者意識的增強和針對環保汽車零件的監管要求的加強,向永續解決方案的轉變進一步加速。高檔和豪華汽車產量的不斷成長也推動了對高性能材料的需求,輕質而堅固的載貨地板解決方案對於增強功能性和舒適性至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26億美元 |

| 預測值 | 41億美元 |

| 複合年成長率 | 5.4% |

市場按材料類型細分,包括硬質纖維板、蜂巢聚丙烯、波紋聚丙烯和複合材料。複合材料憑藉其輕質、高強度和防潮性能,將在 2024 年佔據 40% 的市場佔有率。碳纖維增強塑膠 (CFRP) 和玻璃纖維複合材料越來越受到人們的關注,因為它們可以提供卓越的結構支撐,同時有效減輕車輛重量。這些材料對提高燃油效率和降低碳排放做出了巨大貢獻,使其成為努力實現永續發展目標的汽車製造商的首選。

載貨地板依其操作特性分為固定式和滑動式。 2024年,固定載重地板佔據73%的市場佔有率,預計將持續保持強勁成長。固定負載地板具有出色的結構穩定性、耐用性和成本效益,是乘用車和商用車的標準選擇。這些地板可確保最佳的負載分佈和增強的安全性,因此比滑動地板更受歡迎。

2024 年,中國汽車載重地板市場規模達到 5.2 億美元,得益於中國電動車產業的快速發展,中國汽車載重地板市場將領先全球市場。政府鼓勵使用複合材料和環保材料的激勵措施進一步增強了對輕量、高性能載重地板解決方案日益成長的需求。支持政策、技術進步和國內汽車製造商的擴張相結合,鞏固了中國作為汽車載重地板行業主要參與者的地位。隨著全球市場朝著更大的永續性和創新性發展,中國預計將在塑造汽車載貨地板解決方案的未來格局方面繼續發揮關鍵作用。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件製造商

- 一級供應商

- 原始設備製造商 (OEM)

- 售後市場供應商

- 利潤率分析

- 價格趨勢

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 輕質材料需求不斷成長

- 電動車和自動駕駛汽車的擴張

- 消費者對貨物管理解決方案的需求不斷增加

- 嚴格的燃油效率和排放法規

- 製造技術的進步

- 產業陷阱與挑戰

- 汽車產量波動

- 材料成本波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 硬質纖維板

- 凹槽聚丙烯

- 蜂窩狀聚丙烯

- 複合材料

第6章:市場估計與預測:按營運,2021 - 2034 年

- 主要趨勢

- 固定的

- 滑動

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第8章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- ABC Technologies

- Applied Component Technology

- Arlington Industries

- ASG Group

- Autoneum

- CIE Automotive

- Covestro

- DS Smith

- Gemini Group

- Grudem

- Huntsman

- IDEAL Automotive

- KRAIBURG TPE

- Nagase America

- Recticel

- SA Automotive

- Sonoco Products

- Tricel Honeycomb

- UFP Technologies

- Woodbridge

The Global Automotive Load Floor Market reached USD 2.6 billion in 2024 and is projected to grow at a CAGR of 5.4% during 2025-2034. This expansion is fueled by the rising demand for electric and autonomous vehicles (EVs and AVs), which require advanced designs and enhanced functionality. Automakers are increasingly focusing on ultra-lightweight yet durable load floors, as battery packs in electric vehicles are typically positioned beneath the floor. As a result, advanced materials like composites and thermoplastics are being adopted to improve space efficiency, optimize cargo capacity, and maintain structural integrity.

With a growing emphasis on fuel economy and sustainability, manufacturers are prioritizing lightweight materials to reduce carbon footprints. The integration of non-reinforced polymer composites, thermoplastics, and honeycomb structures into load floors plays a crucial role in lowering overall vehicle weight without sacrificing durability. This trend is gaining momentum as automakers work toward stringent emissions regulations and improved fuel efficiency. The shift toward sustainable solutions is further accelerated by increasing consumer awareness and regulatory mandates focusing on eco-friendly automotive components. The demand for high-performance materials is also driven by the rising production of premium and luxury vehicles, where lightweight yet robust load floor solutions are essential for enhanced functionality and comfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 billion |

| Forecast Value | $4.1 billion |

| CAGR | 5.4% |

The market is segmented by material type, including hardboard, honeycomb polypropylene, fluted polypropylene, and composites. Composites dominated the market in 2024 with a 40% share, driven by their lightweight, high-strength, and moisture-resistant properties. Carbon fiber reinforced plastic (CFRP) and glass fiber composite materials are gaining traction as they offer superior structural support while effectively reducing vehicle weight. These materials contribute significantly to fuel efficiency and lower carbon emissions, making them a preferred choice among automakers striving to meet sustainability goals.

Load floors are classified into fixed and sliding systems based on their operational characteristics. In 2024, fixed load floors accounted for 73% of the market share and are expected to continue experiencing robust growth. Fixed-load floors provide exceptional structural stability, durability, and cost-efficiency, making them the standard choice for passenger and commercial vehicles. These floors ensure optimal load distribution and enhanced security, making them more favorable than sliding alternatives.

China Automotive Load Floor Market generated USD 520 million in 2024, leading the global market due to the country's rapidly growing electric vehicle sector. Increasing demand for lightweight, high-performance load floor solutions is further reinforced by government incentives promoting the use of composites and environmentally friendly materials. The combination of supportive policies, technological advancements, and the expansion of domestic automakers strengthens China's position as a key player in the automotive load floor industry. As the global market moves toward greater sustainability and innovation, China's role is expected to remain pivotal in shaping the future landscape of automotive load floor solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Tier 1 suppliers

- 3.2.4 Original Equipment Manufacturers (OEMs)

- 3.2.5 Aftermarket suppliers

- 3.3 Profit margin analysis

- 3.4 Price trends

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising demand for lightweight materials

- 3.9.1.2 Expansion of electric and autonomous vehicles

- 3.9.1.3 Increasing consumer demand for cargo management solutions

- 3.9.1.4 Stringent fuel efficiency and emission regulations

- 3.9.1.5 Advancements in manufacturing technologies

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Fluctuations in automotive production

- 3.9.2.2 Material cost volatility

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardboard

- 5.3 Fluted polypropylene

- 5.4 Honeycomb polypropylene

- 5.5 Composites

Chapter 6 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Fixed

- 6.3 Sliding

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicle (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ABC Technologies

- 10.2 Applied Component Technology

- 10.3 Arlington Industries

- 10.4 ASG Group

- 10.5 Autoneum

- 10.6 CIE Automotive

- 10.7 Covestro

- 10.8 DS Smith

- 10.9 Gemini Group

- 10.10 Grudem

- 10.11 Huntsman

- 10.12 IDEAL Automotive

- 10.13 KRAIBURG TPE

- 10.14 Nagase America

- 10.15 Recticel

- 10.16 SA Automotive

- 10.17 Sonoco Products

- 10.18 Tricel Honeycomb

- 10.19 UFP Technologies

- 10.20 Woodbridge