|

市場調查報告書

商品編碼

1708149

乘用車 ADAS 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Passenger Vehicle ADAS Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

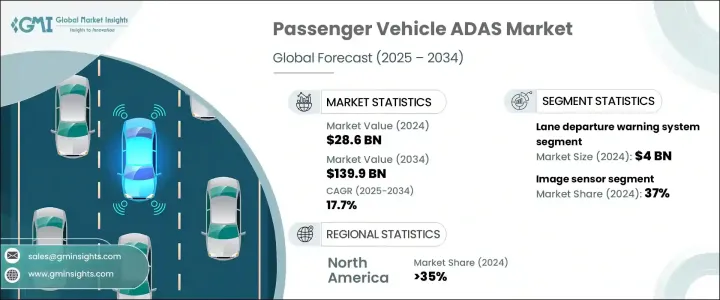

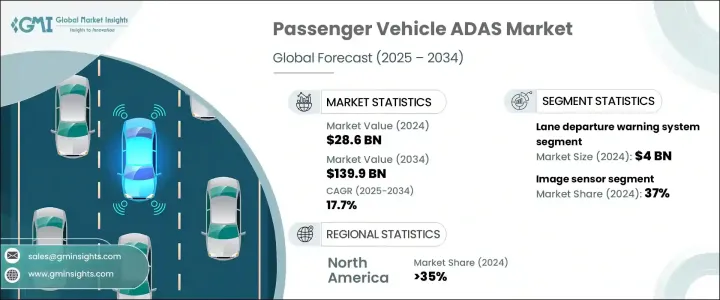

2024 年全球乘用車 ADAS 市值為 286 億美元,預計 2025 年至 2034 年期間的複合年成長率為 17.7%。消費者對車輛安全的日益重視,加上 ADAS 提供的便利性和先進功能,正在推動對這些技術的需求。汽車製造商正在積極將 ADAS 整合到他們的車型中,以滿足不斷變化的消費者偏好和全球嚴格的安全法規。各地區政府正在執行更嚴格的安全規範,迫使製造商提高汽車安全標準。隨著越來越多的消費者選擇配備駕駛輔助技術的車輛,市場正在快速擴張。此外,城市化進程的加速和交通堵塞的加劇也推動了這些系統的採用,因為它們有助於實現更安全、更有效率的駕駛。人工智慧視覺系統和即時資料處理等技術進步正在進一步革新該行業,使 ADAS 更容易應用於不同車輛領域。因此,豪華車和中檔車都出現了 ADAS 整合的激增,塑造了移動出行的未來並提高了全球範圍內的道路安全。

市場根據系統類型進行細分,其中最值得注意的是自適應巡航控制、車道偏離警告、自動緊急煞車和前方碰撞警告等。 2024年車道偏離預警系統比15%,價值40億美元。該系統透過偵測無意的車道偏離並發出即時警報或採取糾正轉向措施,在事故預防中發揮關鍵作用。由於道路安全仍然是首要任務,越來越多的消費者尋求配備車道偏離警告系統的車輛,從而推動系統的普及。汽車製造商不斷改進這些技術,使其更加準確、更能回應即時駕駛狀況。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 286億美元 |

| 預測值 | 1399億美元 |

| 複合年成長率 | 17.7% |

就感測器技術而言,市場分為雷達、LiDAR、影像感測器等。影像感測器領域在 2024 年佔據 37% 的佔有率,證明是 ADAS 功能的關鍵組成部分。這些系統中嵌入的高解析度攝影機提供必要的視覺資料,能夠精確偵測障礙物、道路標誌和行人。與雷達或超音波感測器不同,影像感測器提供卓越的視覺細節,從而提高 ADAS 功能的準確性和可靠性。它們能夠在不同的光照和天氣條件下有效運行,進一步增強了它們對道路安全的貢獻。隨著汽車製造商優先考慮駕駛輔助技術的精確度和反應能力,對影像感測器的需求將會上升。

2024 年,美國乘用車 ADAS 市場規模將達到 76 億美元,這得益於消費者對增強安全功能的需求不斷成長,以及監管機構對先進駕駛輔助系統的推動。人們對道路安全的日益擔憂以及對自動駕駛解決方案的需求促使購車者青睞配備車道維持輔助、自動緊急煞車和自適應巡航控制的車輛。美國汽車製造商的應對措施是將 ADAS 功能作為各種車型的標準或可選功能。隨著技術創新不斷完善這些系統,美國市場將繼續在全球 ADAS 領域發揮主要作用。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 零件供應商

- 技術提供者

- 製造商

- 經銷商

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 成本分析

- 衝擊力

- 成長動力

- 消費者對安全功能的需求不斷增加

- 半自動和自動駕駛汽車的開發

- 嚴格的政府法規和安全標準

- 越來越注重增強消費者體驗

- 產業陷阱與挑戰

- 對隱私和資料安全的擔憂

- ADAS技術成本高昂

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按系統,2021 - 2034 年

- 主要趨勢

- 自適應巡航控制

- 盲點偵測

- 車道偏離預警系統

- 自動緊急煞車(AEM)

- 前方碰撞警告

- 夜視系統

- 駕駛員監控

- 輪胎壓力監測系統

- 抬頭顯示器

- 停車輔助系統

- 其他

第6章:市場估計與預測:按感測器,2021 - 2034 年

- 主要趨勢

- 雷達

- LiDAR

- 相機

- 其他

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 轎車

- 越野車

- 掀背車

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Aisin

- Ambarella

- Aptiv

- Autoliv

- Bosch

- Clarion

- Continental

- Denso

- Ficosa

- Gentex

- Harman

- Hella Forvia

- Magna International

- Mobileye

- Renesas Electronics

- Siemens

- Spark Minda

- Texas Instruments

- Valeo

- ZF Friedrichshafen

The Global Passenger Vehicle ADAS Market was valued at USD 28.6 billion in 2024 and is projected to grow at a CAGR of 17.7% between 2025 and 2034. The increasing consumer emphasis on vehicle safety, coupled with the convenience and advanced functionalities offered by ADAS, is fueling demand for these technologies. Automakers are actively integrating ADAS into their models to cater to evolving consumer preferences and stringent safety regulations worldwide. Governments across various regions are enforcing stricter safety norms, compelling manufacturers to enhance vehicle safety standards. With a growing number of consumers opting for vehicles equipped with driver assistance technologies, the market is witnessing rapid expansion. Additionally, the rise in urbanization and increasing traffic congestion is pushing the adoption of these systems, as they contribute to safer and more efficient driving. Technological advancements, such as AI-powered vision systems and real-time data processing, are further revolutionizing the sector, making ADAS more accessible across different vehicle segments. As a result, luxury and mid-range vehicles alike are seeing a surge in ADAS integration, shaping the future of mobility and enhancing road safety on a global scale.

The market is segmented based on system types, with the most notable being adaptive cruise control, lane departure warning, automatic emergency braking, and forward collision warning, among others. In 2024, the lane departure warning system accounted for a 15% share, valued at USD 4 billion. This system plays a critical role in accident prevention by detecting unintentional lane departures and issuing immediate alerts or corrective steering actions. As road safety remains a priority, more consumers are seeking vehicles equipped with lane departure warnings, contributing to the system's increasing adoption. Automakers continue to refine these technologies, making them more accurate and responsive to real-time driving conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.6 Billion |

| Forecast Value | $139.9 Billion |

| CAGR | 17.7% |

In terms of sensor technology, the market is divided into radar, lidar, image sensors, and others. The image sensor segment held a 37% share in 2024, proving to be a key component of ADAS functionalities. High-resolution cameras embedded within these systems provide essential visual data, enabling precise detection of obstacles, road signs, and pedestrians. Unlike radar or ultrasound sensors, image sensors offer superior visual detail, improving the accuracy and reliability of ADAS features. Their ability to function effectively in diverse lighting and weather conditions further enhances their contribution to road safety. As automakers prioritize precision and responsiveness in driver-assistance technologies, the demand for image sensors is set to rise.

U.S. passenger vehicle ADAS market generated USD 7.6 billion in 2024, driven by increasing consumer demand for enhanced safety features and a growing regulatory push for advanced driver assistance systems. Rising concerns over road safety and the need for automated driving solutions are prompting car buyers to favor vehicles equipped with lane-keeping assist, automatic emergency braking, and adaptive cruise control. Automakers in the U.S. are responding by making ADAS features standard or optional across various vehicle models. As technological innovations continue to refine these systems, the U.S. market is set to remain a major player in the global ADAS landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Technology providers

- 3.2.3 Manufacturers

- 3.2.4 Distributors

- 3.2.5 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cost analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing consumer demand for safety features

- 3.9.1.2 Development of semi-autonomous and autonomous vehicles

- 3.9.1.3 Stringent government regulations & safety standards

- 3.9.1.4 Growing focus on enhanced consumer experience

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Concerns over privacy and data security

- 3.9.2.2 High cost of ADAS technologies

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Adaptive cruise control

- 5.3 Blind spot detection

- 5.4 Lane departure warning system

- 5.5 Automatic emergency braking (AEM)

- 5.6 Forward collision warning

- 5.7 Night vision system

- 5.8 Driver monitoring

- 5.9 Tire pressure monitoring system

- 5.10 Head-up display

- 5.11 Park assist system

- 5.12 Others

Chapter 6 Market Estimates & Forecast, By Sensor, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Radar

- 6.3 Lidar

- 6.4 Camera

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Sedan

- 7.3 SUV

- 7.4 Hatchback

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aisin

- 10.2 Ambarella

- 10.3 Aptiv

- 10.4 Autoliv

- 10.5 Bosch

- 10.6 Clarion

- 10.7 Continental

- 10.8 Denso

- 10.9 Ficosa

- 10.10 Gentex

- 10.11 Harman

- 10.12 Hella Forvia

- 10.13 Magna International

- 10.14 Mobileye

- 10.15 Renesas Electronics

- 10.16 Siemens

- 10.17 Spark Minda

- 10.18 Texas Instruments

- 10.19 Valeo

- 10.20 ZF Friedrichshafen