|

市場調查報告書

商品編碼

1708156

滴水盤市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Drip Trays Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

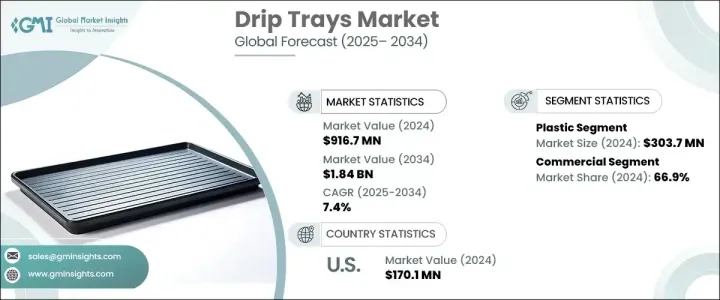

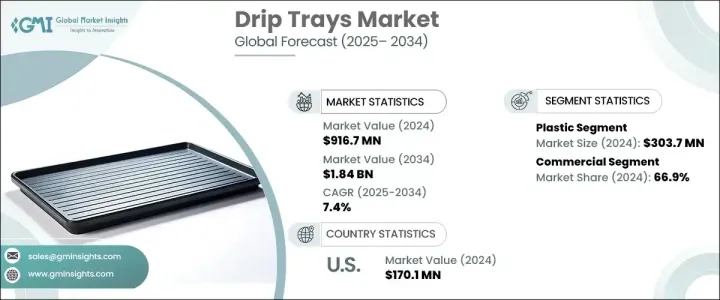

2024 年全球滴水盤市場規模達到 9.167 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.4%。這項擴張得益於材料和設計的不斷進步,使滴水盤更加耐用、高效,並適合商業和工業應用。向環保解決方案的轉變進一步推動了市場成長,製造商專注於鋁和高密度聚乙烯(HDPE)等永續和高性能材料。這些創新有助於開發輕質、耐腐蝕、耐用的滴水盤,以滿足不同的產業需求。

各行各業對工作場所安全和洩漏控制的日益重視,促使企業採用先進的滴水盤解決方案。對客製化和專業設計的需求正在增加,特別是在需要嚴格遵守法規的行業,例如汽車、食品加工和製造。公司正在尋求高效且經濟的控制解決方案,以最大限度地降低環境風險並提高營運效率。此外,技術進步在滴水盤中引入了自動洩漏檢測和防溢出功能,提高了其功能性和對最終用戶的吸引力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.167億美元 |

| 預測值 | 18.4億美元 |

| 複合年成長率 | 7.4% |

2024 年塑膠產業產值達 3.037 億美元,凸顯其在市場上的強勁地位。塑膠滴水盤因其成本效益、多功能性和重量輕的特性而受到廣泛青睞,這增強了在不同環境中的移動性和適應性。該材料固有的抗化學性和抗分解性使其成為汽車、製造和食品加工等行業的理想選擇。此外,該行業對永續性的日益關注刺激了再生塑膠和生物塑膠的創新,擴大了環保解決方案的機會。隨著監管壓力的增加和企業尋求更環保的替代品,製造商正在投資研發以創造符合永續發展目標的耐用、無毒、可重複使用的塑膠滴水盤。

2024 年,商業領域佔了 66.9% 的市場佔有率,凸顯了各行各業對遏制解決方案的需求日益成長。食品加工、汽車和製造業的企業正在採用滴水盤來提高安全性、法規遵循和營運效率。材料科學和產品設計的不斷進步使得這些解決方案更有效地防止溢出和洩漏,從而減少工作場所的危害和環境責任。由於公司優先考慮安全性和具有成本效益的洩漏管理,預計商業部門將繼續成為滴水盤市場的主導力量。

在各行業嚴格的環境法規和安全協議的支持下,美國滴水盤市場價值在 2024 年達到 1.701 億美元。由於針對特定行業需求客製化滴水盤的採用率不斷提高,市場正在穩步成長。材料技術的創新,例如耐腐蝕和輕量化選擇,正在增強產品吸引力並推動需求。該公司正在增加對高品質、耐用的滴水盤的投資,以滿足合規標準並提高營運效率,這使得美國成為全球滴水盤市場擴張的主要貢獻者。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算。

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素。

- 利潤率分析。

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 提高對工作場所安全和環境法規的認知

- 汽車和製造業等行業的需求不斷成長

- 材料創新與環保設計

- 產業陷阱與挑戰

- 市場參與者競爭激烈

- 原物料價格波動

- 成長動力

- 成長潛力分析

- 技術概述

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依材料類型,2021-2034

- 主要趨勢

- 塑膠

- 金屬

- 不銹鋼

- 鋁

- 其他

- 玻璃纖維

- 其他(橡膠、複合材料等)

第6章:市場估計與預測:依設計,2021-2034

- 主要趨勢

- 平坦的

- 磨碎的

- 可堆疊

- 其他(嵌入式等)

第7章:市場估計與預測:依規模,2021-2034

- 主要趨勢

- 標準尺寸

- 自訂尺寸

- 模組化系統

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 工業的

- 工具機

- 生產設備

- 化工廠

- 石油和天然氣

- 食品加工

- 公用事業

- 其他(電子元件等)

- 商業的

- 餐廳和咖啡館

- 飯店及餐飲業

- 零售店

- 辦公大樓

- 機構

- 醫院

- 其他(政府設施等)

- 住宅

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Brewfitt

- DENIOS

- Drrader Manufacturing

- Eagle Manufacturing

- Haws

- Justrite

- MFG Tray

- Micro Matic

- New Pig

- Raffeiner GmbH

- Riverside Sheet Metal & Fabrications

- Short Run Pro

- SP Bel-Art

- Weber

- WirthCo Engineering

The Global Drip Trays Market reached USD 916.7 million in 2024 and is projected to grow at a CAGR of 7.4% between 2025 and 2034. This expansion is driven by continuous advancements in material and design, making drip trays more durable, efficient, and suited for commercial and industrial applications. The shift toward eco-friendly solutions is further fueling market growth, with manufacturers focusing on sustainable and high-performance materials such as aluminum and High-Density Polyethylene (HDPE). These innovations contribute to the development of lightweight, corrosion-resistant, and long-lasting drip trays that cater to diverse industry needs.

A rising emphasis on workplace safety and spill containment across multiple industries is pushing businesses to adopt advanced drip tray solutions. The demand for customized and specialized designs is increasing, particularly in industries that require stringent regulatory compliance, such as automotive, food processing, and manufacturing. Companies are seeking efficient and cost-effective containment solutions to minimize environmental risks and enhance operational efficiency. Furthermore, technological advancements have introduced automated leak detection and spill prevention features in drip trays, improving their functionality and appeal to end users.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $916.7 million |

| Forecast Value | $1.84 billion |

| CAGR | 7.4% |

The plastic segment generated USD 303.7 million in 2024, highlighting its strong presence in the market. Plastic drip trays are widely preferred due to their cost-effectiveness, versatility, and lightweight nature, which enhances mobility and adaptability in different settings. The material's inherent resistance to chemicals and degradation makes it an ideal choice for sectors such as automotive, manufacturing, and food processing. Additionally, the industry's growing focus on sustainability has spurred innovations in recycled plastics and bioplastics, expanding opportunities for environmentally conscious solutions. As regulatory pressures mount and businesses seek greener alternatives, manufacturers are investing in research and development to create durable, non-toxic, and reusable plastic drip trays that align with sustainability goals.

The commercial sector held a commanding 66.9% market share in 2024, emphasizing the increasing need for containment solutions across various industries. Businesses in the food processing, automotive, and manufacturing sectors are adopting drip trays to enhance safety, regulatory compliance, and operational efficiency. The ongoing advancements in material science and product design are making these solutions more effective in preventing spills and leaks, thus reducing workplace hazards and environmental liabilities. As companies prioritize safety and cost-effective spill management, the commercial sector is expected to remain a dominant force in the drip trays market.

The U.S. drip trays market was valued at USD 170.1 million in 2024, supported by stringent environmental regulations and safety protocols across industries. The market is experiencing steady growth due to the rising adoption of customized drip trays tailored to specific industry requirements. Innovations in material technology, such as corrosion-resistant and lightweight options, are enhancing product appeal and driving demand. Companies are increasingly investing in high-quality, durable drip trays to meet compliance standards and improve operational efficiencies, making the U.S. a key contributor to the global drip trays market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing awareness of workplace safety and environmental regulations

- 3.6.1.2 Rising demand from industries such as automotive and manufacturing

- 3.6.1.3 Innovation in materials and eco-friendly designs

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High competition among market players

- 3.6.2.2 Fluctuating raw material prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Technology overview

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Metal

- 5.3.1 Stainless steel

- 5.3.2 Aluminum

- 5.3.3 Others

- 5.4 Fiberglass

- 5.5 Others (Rubber, Composite, etc.)

Chapter 6 Market Estimates & Forecast, By Design, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Flat

- 6.3 Grated

- 6.4 Stackable

- 6.5 Others (Recessed, etc.)

Chapter 7 Market Estimates & Forecast, By Size, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Standard sizes

- 7.3 Custom sizes

- 7.4 Modular systems

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Industrial

- 8.2.1 Machine tools

- 8.2.2 Production equipment

- 8.2.3 Chemical plants

- 8.2.4 Oil & gas

- 8.2.5 Food processing

- 8.2.6 Utilities

- 8.2.7 Others (Electronic component, etc.)

- 8.3 Commercial

- 8.3.1 Restaurants & cafes

- 8.3.2 Hotels & hospitality

- 8.3.3 Retail stores

- 8.3.4 Office buildings

- 8.3.5 Institutional

- 8.3.6 Hospitals

- 8.3.7 Others (Government facilities, etc.)

- 8.4 Residential

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Brewfitt

- 11.2 DENIOS

- 11.3 Drrader Manufacturing

- 11.4 Eagle Manufacturing

- 11.5 Haws

- 11.6 Justrite

- 11.7 MFG Tray

- 11.8 Micro Matic

- 11.9 New Pig

- 11.10 Raffeiner GmbH

- 11.11 Riverside Sheet Metal & Fabrications

- 11.12 Short Run Pro

- 11.13 SP Bel-Art

- 11.14 Weber

- 11.15 WirthCo Engineering