|

市場調查報告書

商品編碼

1708167

資料中心火災偵測與滅火市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Data Center Fire Detection and Suppression Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

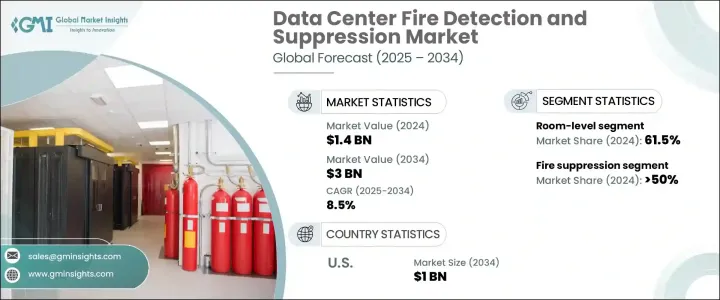

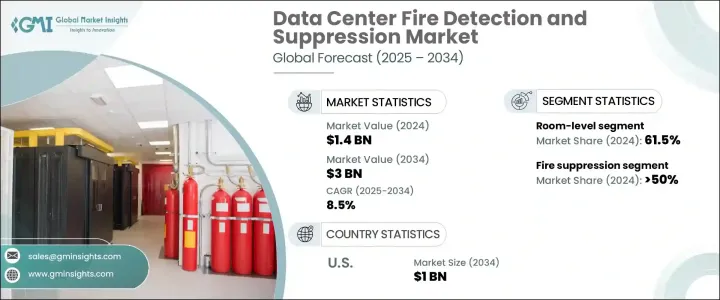

2024 年全球資料中心火災偵測抑制市場規模達到 14 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 8.5%。對先進消防安全解決方案的需求不斷成長,很大程度上受到全球資料中心數量激增的推動,而這得益於雲端運算、邊緣運算、人工智慧技術和高效能運算 (HPC) 的日益普及。隨著企業不斷擴大資料基礎設施規模,以支援大量資料流和低延遲服務,確保全面的消防安全已成為重中之重。

現代資料中心,尤其是超大規模和主機託管設施,容納了價值數百萬美元的關鍵任務 IT 資產,因此它們容易受到電氣故障、過熱或設備故障引起的火災危險。由於停機成本每分鐘高達數十萬美元,對可靠、智慧的火災偵測和滅火系統的需求從未如此強烈。此外,嚴格的消防安全法規和日益增強的敏感資料和設備保護意識正在促使營運商整合基於人工智慧和物聯網的消防解決方案,以提供即時監控和更快的回應時間。對業務連續性、營運彈性以及對日益成長的網路物理風險的防範的日益重視,進一步推動了市場向前發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 30億美元 |

| 複合年成長率 | 8.5% |

市場分為火災偵測和滅火系統,其中 2024 年,滅火系統佔據了 50% 的市場佔有率,凸顯了其在保護高價值資產免受火災損害方面的關鍵作用。火災偵測系統對於早期火災風險識別和有效的事件反應至關重要。這些系統包括人工智慧煙霧偵測器、多感測器偵測單元和吸氣式煙霧偵測 (ASD) 系統,旨在提供更快、更準確的偵測能力。 ASD+ 等尖端技術利用雙波長訊號處理,增強其區分煙霧和灰塵的能力,從而減少誤報並確保及時發出真正的威脅警報。

根據部署情況,市場分為房間級和建築級解決方案,其中房間級系統在 2024 年將佔據 61.5% 的佔有率。資料中心營運商越來越青睞房間級防火,因為它可以提供局部化和有針對性的抑制,保護單一資料大廳、伺服器機房和高密度機架空間,而不會危及整個設施。這種方法涉及使用預作用噴水滅火系統、先進的氣體抑制系統以及人工智慧整合檢測設備,旨在在密閉區域內快速響應。鑑於超大規模、主機託管和企業資料中心的快速崛起,房間級防火被視為防止火災發生時造成大面積停電和設備損失的關鍵。

預計到 2034 年,北美資料中心火災偵測和抑制市場將產生 10 億美元的產值,並在全球保持主導地位。該地區的市場實力源於複雜資料中心基礎設施的不斷擴大以及對實施最先進的消防安全技術的日益重視。在美國,雲端服務、人工智慧工作負載和資料流量的持續成長,正在加劇對具有無與倫比的可靠性並符合嚴格安全標準的下一代火災偵測和抑制系統的需求。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原物料供應商

- 製造商

- 系統整合商

- 安裝和維護提供者

- 最終用途

- 供應商格局

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 案例研究

- 監管格局

- 衝擊力

- 成長動力

- 資料中心擴張

- 消防安全法規日益嚴格

- 人工智慧和智慧檢測的普及率不斷提高

- 擴大轉向永續滅火

- 產業陷阱與挑戰

- 實施成本高

- 與現有基礎設施整合

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按系統,2021 - 2034 年

- 主要趨勢

- 火災偵測

- 抽煙

- 熱

- 火焰

- 氣體

- 滅火

- 清潔劑

- 水性

- 氣基

- 泡沫基

第6章:市場估計與預測:按部署,2021 - 2034 年

- 主要趨勢

- 房間級

- 大樓樓層

第7章:市場估計與預測:按資料中心,2021 - 2034 年

- 主要趨勢

- 超大規模

- 主機託管

- 企業

- 邊緣

- 政府和軍隊

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- 3S

- Ambetronics Engineers

- Cannon Fire Protection

- Chemours

- Control Fire Systems

- Eaton

- Fike

- FireFlex Systems

- Hiller Companies

- Honeywell

- Impact Fire Services

- Johnson Controls

- Minimax

- ORR Protection

- Robert Bosch

- SEM-SAFE

- SEVO Systems

- Siemens

- Victaulic

- WAGNER Group

The Global Data Center Fire Detection and Suppression Market reached USD 1.4 billion in 2024 and is expected to witness a robust CAGR of 8.5% from 2025 to 2034. The rising demand for advanced fire safety solutions is largely fueled by the exponential growth of data centers worldwide, driven by the increasing adoption of cloud computing, edge computing, AI-powered technologies, and high-performance computing (HPC). As companies continue to scale up their data infrastructure to support massive data flows and low-latency services, ensuring comprehensive fire safety has become a top priority.

Modern data centers, especially hyperscale and colocation facilities, house mission-critical IT assets worth millions of dollars, making them vulnerable to fire hazards caused by electrical faults, overheating, or equipment failures. With downtime costs running into hundreds of thousands of dollars per minute, the need for reliable and intelligent fire detection and suppression systems has never been greater. Additionally, stringent fire safety regulations and rising awareness about safeguarding sensitive data and equipment are pushing operators to integrate AI-based and IoT-enabled fire protection solutions, which offer real-time monitoring and faster response times. Increasing emphasis on business continuity, operational resilience, and protection against growing cyber-physical risks is further propelling the market forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3 Billion |

| CAGR | 8.5% |

The market is categorized into fire detection and fire suppression systems, where in 2024, the fire suppression segment captured a 50% market share, highlighting its critical role in safeguarding high-value assets from fire-related damages. Fire detection systems are indispensable for early-stage fire risk identification and efficient incident response. These systems comprise AI-powered smoke detectors, multi-sensor detection units, and aspirating smoke detection (ASD) systems, all designed to offer faster and more accurate detection capabilities. Cutting-edge technologies like ASD+ leverage dual-wavelength signal processing, enhancing their ability to differentiate between smoke and dust, thereby reducing false alarms and ensuring timely alerts for genuine threats.

Based on deployment, the market is split between room-level and building-level solutions, with room-level systems commanding a 61.5% share in 2024. Data center operators increasingly prefer room-level fire protection because it provides localized and targeted suppression, protecting individual data halls, server rooms, and high-density rack spaces without compromising entire facilities. This approach involves the use of pre-action sprinklers, advanced gas-based suppression systems, and AI-integrated detection devices designed to respond swiftly within confined zones. Given the rapid rise of hyperscale, colocation, and enterprise data centers, room-level fire protection is seen as essential to prevent widespread outages and equipment loss in the event of a fire.

North America Data Center Fire Detection and Suppression Market is projected to generate USD 1 billion by 2034, retaining its dominant position globally. The region's market strength stems from the expanding footprint of complex data center infrastructure and a growing emphasis on implementing state-of-the-art fire safety technologies. In the U.S., continuous growth in cloud services, AI workloads, and data traffic is escalating the demand for next-gen fire detection and suppression systems that offer unmatched reliability and compliance with stringent safety standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Manufacturers

- 3.1.3 System integrators

- 3.1.4 Installation and maintenance providers

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Case studies

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising data center expansion

- 3.9.1.2 Increasing stringency of fire safety regulations

- 3.9.1.3 Growing adoption of AI & smart detection

- 3.9.1.4 Increasing shift to sustainable fire suppression

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High implementation cost

- 3.9.2.2 Integration with existing infrastructure

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Fire detection

- 5.2.1 Smoke

- 5.2.2 Heat

- 5.2.3 Flame

- 5.2.4 Gas

- 5.3 Fire suppression

- 5.3.1 Clean agent

- 5.3.2 Water-based

- 5.3.3 Gas- based

- 5.3.4 Foam- based

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Room level

- 6.3 Building level

Chapter 7 Market Estimates & Forecast, By Data Center, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Hyperscale

- 7.3 Colocation

- 7.4 Enterprise

- 7.5 Edge

- 7.6 Government & military

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 3S

- 9.2 Ambetronics Engineers

- 9.3 Cannon Fire Protection

- 9.4 Chemours

- 9.5 Control Fire Systems

- 9.6 Eaton

- 9.7 Fike

- 9.8 FireFlex Systems

- 9.9 Hiller Companies

- 9.10 Honeywell

- 9.11 Impact Fire Services

- 9.12 Johnson Controls

- 9.13 Minimax

- 9.14 ORR Protection

- 9.15 Robert Bosch

- 9.16 SEM-SAFE

- 9.17 SEVO Systems

- 9.18 Siemens

- 9.19 Victaulic

- 9.20 WAGNER Group