|

市場調查報告書

商品編碼

1708181

免疫毒素市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Immunotoxins Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

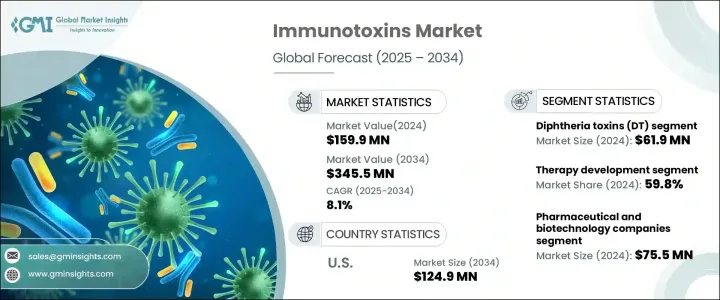

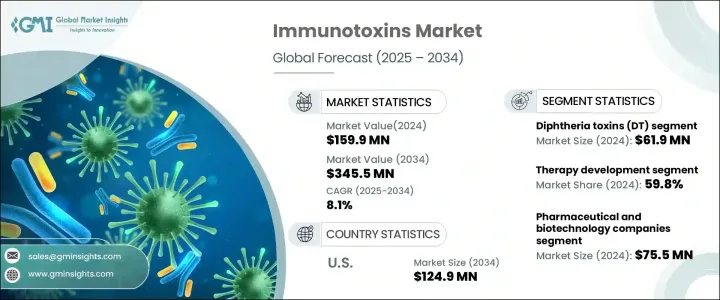

2024 年全球免疫毒素市場規模達到 1.599 億美元,預計 2025 年至 2034 年的複合年成長率為 8.1%。免疫毒素是將單株抗體或標靶分子與強效毒素結合的治療劑。它們的機制涉及將抗體與目標細胞(例如癌細胞或病變細胞)表面的抗原結合。然後毒素成分透過破壞重要的細胞過程來殺死目標細胞。針對慢性病的標靶治療的日益普及是市場成長的主要驅動力。標靶療法,包括免疫毒素,專門攻擊致病細胞,減少不良反應並改善患者的治療效果。這些益處推動了基於免疫毒素的治療在癌症和慢性病管理中的應用增加,從而促進了市場擴張。

市場根據毒素類型分為白喉毒素 (DT)、炭疽毒素、假單胞菌外毒素 (PE)、核醣體失活蛋白免疫毒素和其他免疫毒素。白喉毒素 (DT) 部分在 2024 年的價值為 6,190 萬美元,預計在預測期內的複合年成長率為 8.1%。這種成長歸因於白喉毒素強大的治療潛力,其透過抑制目標細胞中的蛋白質合成,導致細胞死亡。 Denileukin diftitox 是一種將白喉毒素與 IL-2 受體靶向片段結合在一起的融合蛋白,它體現了強化 DT 片段生長的殺細胞作用。正在進行的研究和監管部門的批准,特別是基於白喉毒素的免疫毒素的研究和監管部門的批准,進一步促進了這一領域的擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.599億美元 |

| 預測值 | 3.455億美元 |

| 複合年成長率 | 8.1% |

根據應用,市場分為生物醫學研究和治療開發。治療開發領域在 2024 年佔據 59.8% 的市場佔有率,佔據市場主導地位。其主導地位是由於癌症盛行率的上升以及臨床環境中免疫毒素的使用增加。白血病、淋巴瘤和多發性骨髓瘤等血液系統惡性腫瘤發生率的不斷上升,推動了對免疫毒素療法的需求,進一步推動了市場成長。

根據最終用途,市場分為製藥和生物技術公司、CRO 和 CMO、學術和研究機構以及其他最終用戶。 2024 年,製藥和生物技術公司以 7,550 萬美元的市場規模佔據該領域的主導地位。這些公司在研發方面投入了大量資金,以創造針對癌症和慢性疾病的先進免疫毒素療法,並專注於針對患病細胞同時保護健康細胞。他們與 CRO、CMO 和學術機構的合作加速了產品商業化和開發,為市場成長做出了重大貢獻。

預計美國免疫毒素市場將大幅成長,到 2034 年將達到 1.249 億美元。癌症盛行率的上升和死亡率的上升推動了對基於免疫毒素的標靶治療的需求,從而進一步增強了該國的市場地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 癌症和慢性病發生率上升

- 擴大對新型免疫毒素療法的監管批准

- 越來越關注標靶治療

- 產業陷阱與挑戰

- 免疫毒素研發中與細胞毒性和製造相關的挑戰

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按毒素類型,2021 年至 2034 年

- 主要趨勢

- 白喉毒素(DT)

- 炭疽毒素

- 假單胞菌外毒素(PE)

- 核醣體去活化蛋白類免疫毒素

- 其他毒素類型

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 生物醫學研究

- 治療發展

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 製藥和生物技術公司

- CRO 和 CMO

- 學術和研究機構

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Abcam

- Bio-Techne

- Cayman Chemical

- Creative Biolabs

- Enzo Biochem

- List Biological Labs

- Merck KGaA

- Quadratech Diagnostics

- Santa Cruz Biotechnology

- The Native Antigen Company

- Thermo Fisher Scientific

The Global Immunotoxins Market reached USD 159.9 million in 2024 and is expected to grow at a CAGR of 8.1% from 2025 to 2034. Immunotoxins are therapeutic agents that combine a monoclonal antibody or a targeting molecule with a potent toxin. Their mechanism involves binding the antibody to antigens present on the surface of target cells, such as cancerous or diseased cells. The toxin component then kills the targeted cells by disrupting essential cellular processes. The increasing adoption of targeted therapies for chronic conditions is a major driver of market growth. Targeted therapies, including immunotoxins, specifically attack disease-causing cells, reducing adverse reactions and improving patient outcomes. These benefits are driving the increased use of immunotoxin-based treatments in cancer and chronic disease management, fueling market expansion.

The market is segmented by toxin type into diphtheria toxins (DT), anthrax-based toxins, pseudomonas exotoxins (PE), ribosome-inactivating protein-based immunotoxins, and other immunotoxins. The diphtheria toxins (DT) segment accounted for USD 61.9 million in 2024 and is expected to grow at a CAGR of 8.1% during the forecast period. This growth is attributed to the strong therapeutic potential of diphtheria toxins, which work by inhibiting protein synthesis in targeted cells, leading to cell death. Denileukin diftitox, a fusion protein that combines diphtheria toxin with an IL-2 receptor-targeting fragment, exemplifies the cytocidal action that reinforces the growth of the DT segment. Ongoing research and regulatory approvals, particularly for diphtheria toxin-based immunotoxins, further contribute to the expansion of this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $159.9 Million |

| Forecast Value | $345.5 Million |

| CAGR | 8.1% |

By application, the market is categorized into biomedical research and therapy development. The therapy development segment led the market with a 59.8% share in 2024. Its dominance is driven by the increasing prevalence of cancer and the rising use of immunotoxins in clinical settings. The growing incidence of hematological malignancies such as leukemia, lymphoma, and multiple myeloma is boosting the demand for immunotoxin-based therapies, further propelling market growth.

Based on end use, the market is divided into pharmaceutical and biotechnology companies, CROs and CMOs, academic and research institutes, and other end users. Pharmaceutical and biotechnology companies dominated the segment with USD 75.5 million in 2024. These companies invest extensively in research and development to create advanced immunotoxin therapies for cancer and chronic diseases, focusing on targeting diseased cells while preserving healthy ones. Their collaborations with CROs, CMOs, and academic institutions accelerate product commercialization and development, contributing significantly to market growth.

The U.S. immunotoxins market is expected to witness substantial growth, reaching USD 124.9 million by 2034. The increasing prevalence of cancer and rising mortality rates are driving demand for targeted immunotoxin-based therapies, further strengthening the country's market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cancer and chronic diseases

- 3.2.1.2 Expanding regulatory approvals for new immunotoxin therapies

- 3.2.1.3 Growing focus on targeted therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Challenges related to cytotoxicity and manufacturing in the development of immunotoxins

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Toxin Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diphtheria toxins (DT)

- 5.3 Anthrax based toxins

- 5.4 Pseudomonas exotoxins (PE)

- 5.5 Ribosomes inactivating protein based immunotoxins

- 5.6 Other toxin types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Biomedical research

- 6.3 Therapy development

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pharmaceutical and biotechnology companies

- 7.3 CROs and CMOs

- 7.4 Academic and research institutes

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abcam

- 9.2 Bio-Techne

- 9.3 Cayman Chemical

- 9.4 Creative Biolabs

- 9.5 Enzo Biochem

- 9.6 List Biological Labs

- 9.7 Merck KGaA

- 9.8 Quadratech Diagnostics

- 9.9 Santa Cruz Biotechnology

- 9.10 The Native Antigen Company

- 9.11 Thermo Fisher Scientific