|

市場調查報告書

商品編碼

1708218

自動模切機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automatic Die-Cutting Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

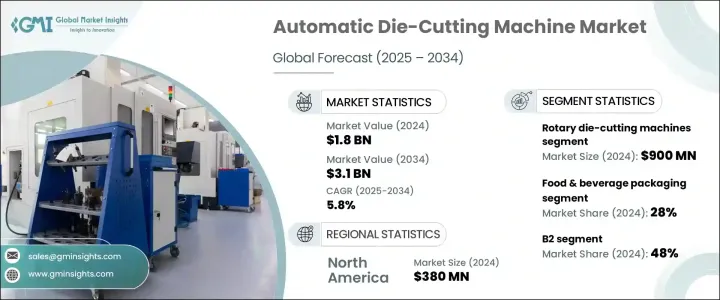

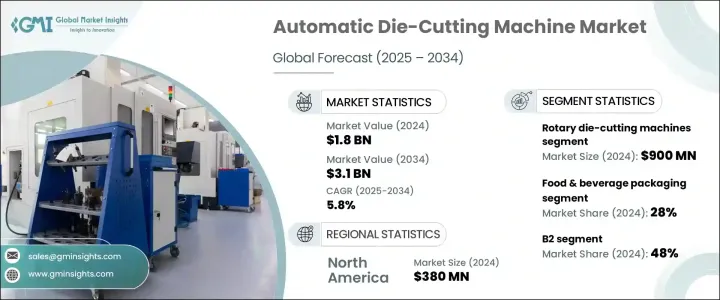

2024 年全球自動模切機市場規模達 18 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.8%。這一成長主要得益於電子商務的擴張、快速消費品 (FMCG) 需求的不斷成長以及食品和飲料行業的蓬勃發展。隨著這些行業的不斷發展,對先進、精確和高效的包裝解決方案的需求正在推動對自動模切機的需求。這些行業的公司擴大採用這些機器來提高生產力、減少錯誤並增強整體營運效率。此外,消費者對美觀和客製化設計包裝的偏好日益成長,也推動了市場上升趨勢。隨著人們對永續包裝的認知不斷提高,許多製造商正在將環保材料和技術融入他們的模切工藝中,以滿足監管標準和消費者的期望。自動化和數位技術的採用進一步改變了包裝格局,使公司能夠簡化生產流程,同時保持高品質和安全標準。這些進步使自動模切機成為現代包裝環境中不可或缺的資產。

技術創新在推動市場成長方面發揮著至關重要的作用。物聯網 (IoT)、機器人和雷射模切技術的整合提高了這些機器的速度、準確性和靈活性。支援物聯網的系統可以實現即時監控和預測性維護,最大限度地減少停機時間並確保生產流程順利進行。雷射模切技術以其精確性和多功能性而聞名,擴大被用於製作複雜的設計和客製化形狀。機器人技術進一步實現了材料處理和精加工過程的自動化,只需最少的人工干預即可實現無縫生產。這些技術進步使得自動模切機對旨在擴大經營規模和保持競爭優勢的製造商更具吸引力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 31億美元 |

| 複合年成長率 | 5.8% |

旋轉模切機市場在 2024 年創造了 9 億美元的收入,預計到 2034 年將以 6.5% 的複合年成長率成長。由於這些機器效率高,並且能夠使用圓柱形模具進行連續輸出,因此在大規模生產環境中越來越受歡迎。旋轉式模切機廣泛應用於包裝產業,擅長生產標籤、瓦楞紙箱和其他客製化設計產品等精密產品。它們能夠在高速下保持一致性和精確度,非常適合滿足大規模製造業務的需求。

從應用方面來看,自動模切機市場服務於化妝品、藥品、消費性電子產品和食品包裝等多種行業。受客製化包裝形狀和設計需求不斷成長的推動,食品和飲料行業將在 2024 年佔據 28% 的市場佔有率。自動模切機對於生產符合食品業嚴格衛生和安全標準的精密紙盒、標籤和軟包裝至關重要。這些機器專為處理食品級材料而設計,並配備食品安全油墨和塗料,確保符合行業法規。

北美自動模切機市場佔據主導地位,佔 78%,2024 年市場規模達 3.8 億美元。該地區的成長得益於持續的技術進步、對先進包裝解決方案日益成長的需求以及食品和飲料行業的不斷擴張。北美擁有眾多主要製造商和技術供應商,專注於開發尖端解決方案,包括自動化設備設定和數位模切系統。這些創新有助於該地區在全球市場上佔據領先地位,使北美成為自動模切機行業技術進步的中心。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算。

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製成品

- 經銷商

- 供應商格局

- 重要新聞和舉措

- 技術格局

- 監管格局

- 衝擊力

- 成長動力

- 包裝產業的成長

- 越來越重視永續環保的包裝材料

- 產業陷阱與挑戰

- 初期投資及維護成本高

- 熟練勞動力短缺

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依機器類型,2021-2034 年

- 主要趨勢

- 輪轉模切機

- 平板模切機

- 數位模切機

- 雷射模切機

第6章:市場估計與預測:依格式類別,2021-2034 年

- 主要趨勢

- B2

- B1

- B0

第7章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 瓦楞紙板

- 實心板(硬板)

- 其他(塑合板、蜂巢板、層墊等)

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 化妝品和個人護理

- 食品和飲料包裝

- 製藥

- 消費性電子產品及耐久財

- 印刷和出版

- 其他

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Asahi Machinery

- Berhalter

- Biermann

- Bobst

- Duplo

- Heidelberger Druckmaschinen

- Kama

- Koenig & Bauer

- Komori

- Masterwork (MK) Machinery

- MPS Systems

- Sanwa

- ThermoFlexX (Xeikon)

- Winkler+Dunnebier

- Yutian DGM Machinery

The Global Automatic Die-Cutting Machine Market generated USD 1.8 billion in 2024 and is projected to grow at a CAGR of 5.8% between 2025 and 2034. This growth is driven by the expansion of e-commerce, increasing demand for fast-moving consumer goods (FMCG), and a surge in the food and beverage industry. As these industries continue to evolve, the need for advanced, precise, and efficient packaging solutions is fueling the demand for automatic die-cutting machines. Companies across these sectors are increasingly adopting these machines to improve productivity, reduce errors, and enhance overall operational efficiency. Additionally, rising consumer preferences for aesthetically appealing and custom-designed packaging are contributing to the market's upward trajectory. With growing awareness about sustainable packaging, many manufacturers are integrating eco-friendly materials and technologies into their die-cutting processes to meet regulatory standards and consumer expectations. The adoption of automation and digital technologies is further transforming the packaging landscape, allowing companies to streamline production processes while maintaining high quality and safety standards. These advancements position automatic die-cutting machines as indispensable assets in modern packaging environments.

Technological innovations are playing a crucial role in boosting market growth. The integration of the Internet of Things (IoT), robotics, and laser die-cutting technology has enhanced the speed, accuracy, and flexibility of these machines. IoT-enabled systems allow real-time monitoring and predictive maintenance, minimizing downtime and ensuring smooth production processes. Laser die-cutting technology, known for its precision and versatility, is increasingly being adopted to produce intricate designs and custom shapes. Robotics has further automated the material handling and finishing processes, allowing for seamless production with minimal human intervention. These technological advancements make automatic die-cutting machines more appealing to manufacturers aiming to scale their operations and maintain a competitive edge.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 5.8% |

The rotary die-cutting machines segment generated USD 900 million in 2024 and is expected to grow at a CAGR of 6.5% through 2034. These machines are increasingly preferred in mass-production settings due to their high efficiency and ability to produce continuous output using cylindrical dies. Widely used in the packaging industry, rotary die-cutting machines excel in producing precision items such as labels, corrugated boxes, and other custom-designed products. Their ability to maintain consistency and precision at high speeds makes them ideal for meeting the demands of large-scale manufacturing operations.

In terms of application, the automatic die-cutting machine market serves a diverse range of industries, including cosmetics, pharmaceuticals, consumer electronics, and food packaging. The food and beverage sector accounted for a 28% market share in 2024, driven by the growing demand for custom packaging shapes and designs. Automatic die-cutting machines are essential in producing precise cartons, labels, and flexible packaging that meet the stringent hygiene and safety standards of the food industry. These machines are designed to handle food-grade materials and are equipped with food-safe inks and coatings, ensuring compliance with industry regulations.

North America automatic die-cutting machine market held a dominant 78% share and generated USD 380 million in 2024. The region's growth is fueled by continuous technological advancements, increasing demand for advanced packaging solutions, and the expanding food and beverage sector. North America is home to numerous major manufacturers and technology providers focused on developing cutting-edge solutions, including automated equipment setup and digital die-cutting systems. These innovations contribute to the region's leadership in the global market, positioning North America as a hub for technological progress in the automatic die-cutting machine industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Key news & initiatives

- 3.4 Technological landscape

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growth of packaging industry

- 3.6.1.2 Increasing focus on sustainable and eco-friendly packaging materials

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment and maintenance costs

- 3.6.2.2 Skilled labor shortage

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Rotary die-cutting machines

- 5.3 Flatbed die-cutting machines

- 5.4 Digital die-cutting machines

- 5.5 Laser die-cutting machines

Chapter 6 Market Estimates & Forecast, By Format Classes, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 B2

- 6.3 B1

- 6.4 B0

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Corrugated board

- 7.3 Solid board (rigid board)

- 7.4 Others (chipboard, honeycomb board, layer pads, etc.)

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Cosmetics and personal care

- 8.3 Food & beverage packaging

- 8.4 Pharmaceuticals

- 8.5 Consumer electronics and durable goods

- 8.6 Printing and publishing

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Asahi Machinery

- 11.2 Berhalter

- 11.3 Biermann

- 11.4 Bobst

- 11.5 Duplo

- 11.6 Heidelberger Druckmaschinen

- 11.7 Kama

- 11.8 Koenig & Bauer

- 11.9 Komori

- 11.10 Masterwork (MK) Machinery

- 11.11 MPS Systems

- 11.12 Sanwa

- 11.13 ThermoFlexX (Xeikon)

- 11.14 Winkler+Dunnebier

- 11.15 Yutian DGM Machinery