|

市場調查報告書

商品編碼

1708226

住宅節能窗市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Residential Energy Efficient Windows Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

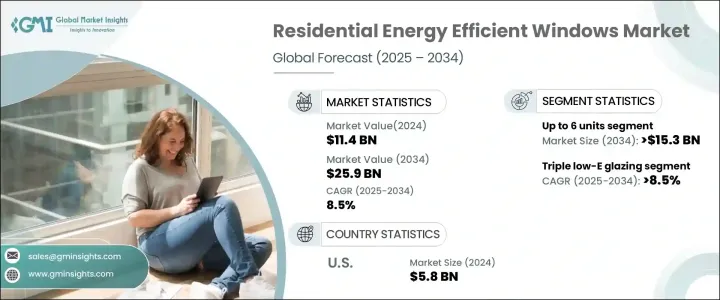

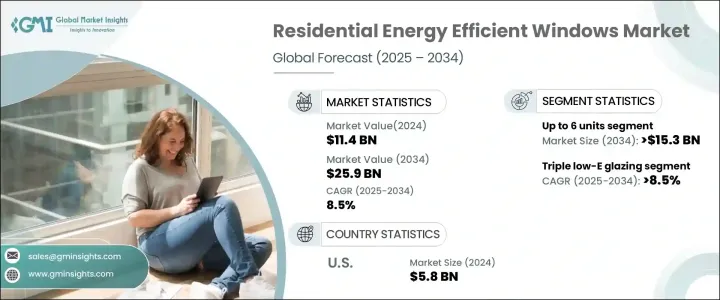

2024 年全球住宅節能窗戶市場價值為 114 億美元,預計 2025 年至 2034 年的複合年成長率為 8.5%。人們對家庭供暖和製冷效率的日益關注推動了對節能窗戶的需求,這有助於減少能源消耗並最大限度地減少碳足跡。在政府鼓勵永續投資的稅收抵免、退稅和低利率貸款等激勵措施的支持下,屋主越來越有意識地採用節能技術。綠色融資選擇也越來越受到關注,使屋主能夠提高房產價值,同時為全球環境目標做出貢獻。此外,人們對環境保護、氣候變遷和減少溫室氣體排放的意識不斷增強,促使屋主投資先進的窗戶技術,促進產業成長。

屋主們正在轉向節能產品,這些產品透過保持恆定的室內溫度、最大限度地減少通風、減少冷凝、消除窗戶附近的冷點(尤其是在極端天氣條件下)來提供更高的舒適度。這些好處不僅創造了更舒適的生活環境,而且還增加了房屋的轉售價值,使節能窗戶成為吸引潛在買家的一個特徵。隨著能源成本不斷上升,屋主優先考慮能夠實現長期節約、永續性和提高舒適度的解決方案,從而加速這些產品的採用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 114億美元 |

| 預測值 | 259億美元 |

| 複合年成長率 | 8.5% |

該行業根據安裝的窗戶數量進行分類,包括最多6扇、6扇以上至10扇、10扇以上。由於暖氣和冷氣成本上升以及環境問題日益嚴重,預計到 2034 年,最多 6 個單位的細分市場的規模將超過 153 億美元。規模較小的家庭如果安裝隔熱性能好的窗戶,溫度調節效果會更好,從而減少對暖通空調系統的依賴,並減少碳排放。隨著越來越多的屋主尋求在保持舒適的室內環境的同時減少能源消耗,預計這一趨勢將持續下去。

就玻璃類型而言,市場分為雙層玻璃和三層低輻射玻璃,其中後者由於其優異的隔熱性能,到 2034 年複合年成長率將超過 8.5%。三層低輻射玻璃有助於全年保持恆定的室內溫度,這對於經歷極端溫度變化的地區尤其有益。此外,由於城市環境中噪音污染問題日益嚴重,對隔音的需求也不斷成長,這進一步推動了三層低輻射玻璃的採用。屋主越來越尋求耐用、高性能的窗戶解決方案,這些解決方案可以提供長期成本節省,並且使用壽命可達 20 至 30 年(取決於框架材料和維護)。

2024 年,北美佔據全球市場佔有率的 63.1% 以上,預計到 2034 年這一數字將會上升。光是美國市場在 2022 年的價值就達到 49 億美元,2023 年達到 53 億美元,2024 年達到 58 億美元,凸顯了該地區對節能解決方案的日益重視。產業參與者加強對開發先進窗戶技術的投資,包括低輻射塗層和根據外部溫度調節的動態窗戶,將進一步推動市場成長。旨在提高老房子能源效率的房屋改造項目不斷增多,消費者對節能解決方案的長期利益的認知不斷提高,預計將維持該行業的積極發展軌跡。

目錄

第1章:方法論與範圍

- 研究設計

- 基礎估算與計算

- 預測計算

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

第5章:市場規模及預測:依玻璃類型,2021 年至 2034 年

- 主要趨勢

- 雙層玻璃

- 三層低輻射玻璃

第6章:市場規模及預測:依採用情況,2021 年至 2034 年

- 主要趨勢

- 替代品

- 絕緣

第7章:市場規模及預測:依窗戶數量,2021 年至 2034 年

- 主要趨勢

- 最多 6 個單位

- >6至10個單位

- >10個單位

第8章:市場規模及預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 亞太地區

- 中國

- 日本

- 澳洲

- 世界其他地區

第9章:公司簡介

- AeroShield

- Atrium Corporation

- Andersen Corporation

- Builders First Choice

- Champion Window

- Fenesta

- French Steel Company

- Jeld-Wen

- Milgard Manufacturing

- Marvin Windows & Doors

- Nordik Windows

- Pella Corporation

- Soft-Lite Windows

- YKK AP

The Global Residential Energy Efficient Windows Market was valued at USD 11.4 billion in 2024 and is expected to grow at a CAGR of 8.5% from 2025 to 2034. Increasing concerns about heating and cooling efficiency in homes are driving demand for energy-efficient windows, which help reduce energy consumption and minimize carbon footprints. Homeowners are becoming more conscious of adopting energy-efficient technologies, supported by government incentives such as tax credits, rebates, and low-interest loans that encourage sustainable investments. Green financing options are also gaining traction, enabling homeowners to enhance property value while contributing to global environmental goals. Moreover, growing awareness about environmental protection, climate change, and the reduction of greenhouse gas emissions is prompting homeowners to invest in advanced window technologies, fostering industry growth.

Homeowners are shifting towards energy-efficient products that offer enhanced comfort by maintaining consistent indoor temperatures, minimizing drafts, reducing condensation, and eliminating cold spots near windows, particularly during extreme weather conditions. These benefits not only create a more comfortable living environment but also increase the home's resale value, making energy-efficient windows an attractive feature for potential buyers. As energy costs continue to rise, homeowners are prioritizing solutions that promise long-term savings, sustainability, and improved comfort, thereby accelerating the adoption of these products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.4 Billion |

| Forecast Value | $25.9 Billion |

| CAGR | 8.5% |

The industry is categorized based on the number of windows installed, including up to 6 units, more than 6 to 10 units, and above 10 units. The up to 6 units segment is projected to surpass USD 15.3 billion by 2034, driven by rising heating and cooling costs and growing environmental concerns. Smaller households that invest in well-insulated windows experience improved temperature regulation, reducing the dependence on HVAC systems and cutting down carbon emissions. This trend is expected to continue as more homeowners seek to reduce their energy consumption while maintaining a comfortable indoor environment.

In terms of glazing types, the market is segmented into double glazing and triple low-E glazing, with the latter poised to grow at a CAGR of over 8.5% by 2034 due to its superior thermal insulation properties. Triple low-E glazing helps maintain consistent indoor temperatures year-round, making it particularly beneficial for regions experiencing extreme temperature variations. Additionally, the rising demand for sound insulation in urban environments, where noise pollution is a concern, is further driving the adoption of triple low-E glazing. Homeowners are increasingly looking for durable, high-performance window solutions that provide long-term cost savings and offer lifespans of 20 to 30 years, depending on the frame material and maintenance.

North America accounted for over 63.1% of the global market share in 2024, a figure that is expected to rise by 2034. The U.S. market alone was valued at USD 4.9 billion in 2022, USD 5.3 billion in 2023, and USD 5.8 billion in 2024, highlighting the region's growing commitment to energy-efficient solutions. Increasing investment by industry players in developing advanced window technologies, including low-E coatings and dynamic windows that adjust based on external temperatures, will further fuel market growth. Rising home renovation projects aimed at improving energy efficiency in older homes and growing consumer awareness of the long-term benefits of energy-efficient solutions are expected to sustain the industry's positive trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research Design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Glazing Type, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Double glazing

- 5.3 Triple low-E glazing

Chapter 6 Market Size and Forecast, By Adoption, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Replacement

- 6.3 Insulation

Chapter 7 Market Size and Forecast, By Number of Windows, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Up to 6 units

- 7.3 >6 to 10 units

- 7.4 >10 units

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 Australia

- 8.5 Rest of World

Chapter 9 Company Profiles

- 9.1 AeroShield

- 9.2 Atrium Corporation

- 9.3 Andersen Corporation

- 9.4 Builders First Choice

- 9.5 Champion Window

- 9.6 Fenesta

- 9.7 French Steel Company

- 9.8 Jeld-Wen

- 9.9 Milgard Manufacturing

- 9.10 Marvin Windows & Doors

- 9.11 Nordik Windows

- 9.12 Pella Corporation

- 9.13 Soft-Lite Windows

- 9.14 YKK AP