|

市場調查報告書

商品編碼

1708233

馬匹影像服務市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Equine Imaging Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

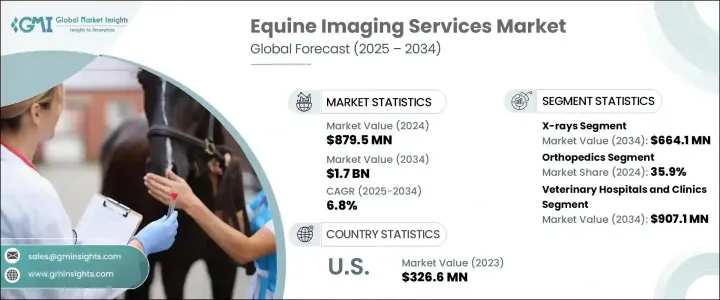

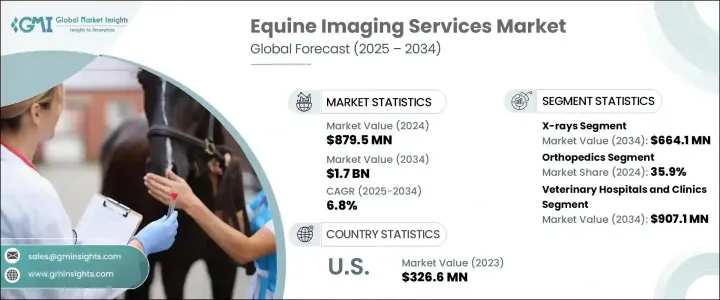

2024 年全球馬匹影像服務市場價值為 8.795 億美元,預計 2025 年至 2034 年的複合年成長率為 6.8%。這一成長是由馬匹中關節炎、韌帶損傷等肌肉骨骼疾病患病率上升所推動的。 3D 成像、數位放射成像和攜帶式機器等診斷成像技術的進步已獲得廣泛認可,促進了市場擴張。此外,馬術運動和賽馬產業的快速發展也加劇了對用於預防和治療傷害的先進影像解決方案的需求。加強獸醫研究和致力於開發創新影像技術的合作夥伴關係進一步推動了市場的發展。人工智慧診斷工具的接受度不斷提高也提高了馬匹影像的效率和準確性,使其成為獸醫實踐的寶貴補充。

馬匹影像服務涉及可視化馬匹解剖結構的診斷技術,以支持診斷和治療。這些服務利用 X 光、超音波、磁振造影 (MRI)、電腦斷層掃描 (CT) 和核子成像來檢測肌肉骨骼問題、韌帶損傷和內部異常。根據影像方式,全球市場分為 X 光、超音波、MRI、核子造影系統、CT 掃描和其他方式。 X光部門在 2024 年創造了 3.552 億美元的最高收入,預計到 2034 年將達到 6.641 億美元,複合年成長率為 6.5%。 X 光仍然是診斷骨折、關節問題和肌肉骨骼疾病最常用的影像方法。它們價格實惠、易於獲取,並且能夠快速提供診斷結果,因此成為馬獸醫的首選。攜帶式X光機允許進行現場評估,進一步簡化了診斷過程,減少了將馬匹運送到專門設施的需要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.795億美元 |

| 預測值 | 17億美元 |

| 複合年成長率 | 6.8% |

根據應用,市場分為骨科、腫瘤科、心臟科、神經病學和其他應用。 2024 年,骨科領域佔了 35.9% 的市場佔有率,這反映了運動馬、賽馬和農場馬中肌肉骨骼損傷和關節疾病的盛行率很高。 X 光和 MRI 掃描經常用於診斷馬科動物骨科中的韌帶損傷、骨折、肌腱異常和骨關節炎。隨著診斷準確性和治療計劃的不斷提高,先進成像技術的應用也將不斷擴大,預計將推動這一領域的擴張。對馬匹醫療保健和診斷的投資增加推動了對骨科影像服務的需求,鞏固了其市場地位。

根據最終用途,全球市場分為獸醫院和診所、獸醫診斷中心以及學術和研究機構。預計獸醫醫院和診所將佔據主導地位,成長率為 6.6%,到 2034 年將達到 9.071 億美元。這種主導地位歸因於這些設施中廣泛使用先進的影像技術,例如 X 光、CT 掃描、MRI 和其他模式。這些醫院和診所專門診斷和治療馬的肌肉骨骼、神經和內科疾病,是影像服務的首選。此外,馬匹醫療保健支出的增加和馬主數量的增加也刺激了這些機構提供的影像服務的需求。獸醫醫院和研究機構在先進診斷應用方面的策略合作正在進一步推動市場成長。

2024 年,美國成為北美馬匹影像服務市場的領導者,估值從 2023 年的 3.266 億美元成長至 3.465 億美元。這一領先地位歸功於該國先進的獸醫基礎設施、較高的馬匹數量以及在馬匹醫療保健方面的大量投資。配備有 MRI、CT 和數位放射成像等先進影像技術的專科診所和醫院的存在正在促進國家層面的發展。政府對獸醫研究的支持和資助,加上不斷的技術進步,進一步促進了美國市場的擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 馬病發生率上升

- 成像技術的進步

- 不斷發展的馬術運動產業

- 擴展移動影像服務

- 產業陷阱與挑戰

- 先進成像設備成本高昂

- 成長動力

- 成長潛力分析

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依影像方式,2021 - 2034 年

- 主要趨勢

- X光

- 超音波

- MRI掃描

- 核子造影系統

- CT掃描

- 其他成像方式

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 骨科

- 腫瘤學

- 心臟病學

- 神經病學

- 其他應用

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 獸醫醫院和診所

- 獸醫診斷中心

- 學術及研究機構

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Chaparral Veterinary Medical Center

- Chine House Veterinary Hospital

- Daniel Equine Services

- Hagyard Equine Medical Institute

- IDEXX Laboratories

- IMV Imaging

- Mid-Atlantic Equine Medical Center

- Moore Equine PC

- National Research Center on Equines.

- Rainbow Equine Hospital

- Royal Veterinary College's Equine Referral Hospital

- Tennessee Equine Hospital

- VET.CT

- Vets Pets

- Virginia Equine Imaging

The Global Equine Imaging Services Market was valued at USD 879.5 million in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2034. This growth is driven by the rising prevalence of musculoskeletal disorders such as arthritis, ligament injuries, and other conditions in horses. Advances in diagnostic imaging technologies, including 3D imaging, digital radiography, and portable machines, have gained widespread acceptance, contributing to market expansion. Moreover, the rapid growth of the equine sports and racing sectors has intensified the need for advanced imaging solutions for injury prevention and treatment. Increased veterinary research and partnerships focused on developing innovative imaging technologies are further driving the market. Higher acceptance of AI-powered diagnostic tools is also enhancing the efficiency and accuracy of equine imaging, making it a valuable addition to veterinary practices.

Equine imaging services involve diagnostic techniques that visualize a horse's anatomy to support diagnosis and treatment. These services utilize X-rays, ultrasound, magnetic resonance imaging (MRI), computed tomography (CT), and nuclear imaging to detect musculoskeletal issues, ligament injuries, and internal abnormalities. By imaging modality, the global market is segmented into X-rays, ultrasound, MRI, nuclear imaging systems, CT scans, and other modalities. The X-rays segment generated the highest revenue of USD 355.2 million in 2024 and is expected to reach USD 664.1 million by 2034, growing at a CAGR of 6.5%. X-rays remain the most commonly used imaging method for diagnosing fractures, joint problems, and musculoskeletal disorders. Their affordability, availability, and ability to deliver rapid diagnostic results make them a preferred choice for equine veterinarians. Portable X-ray machines have further simplified the diagnostic process by allowing on-site evaluations, reducing the need to transport horses to specialized facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $879.5 Million |

| Forecast Value | $1.7 Billion |

| CAGR | 6.8% |

Based on application, the market is categorized into orthopedics, oncology, cardiology, neurology, and other applications. The orthopedics segment accounted for 35.9% of the market share in 2024, reflecting the high prevalence of musculoskeletal injuries and joint disorders in sport, racing, and farm horses. X-rays and MRI scans are frequently used for diagnosing ligament injuries, fractures, tendon abnormalities, and osteoarthritis in equine orthopedics. The growing adoption of advanced imaging technologies for diagnostic accuracy and treatment planning is expected to fuel the expansion of this segment. Increased investments in equine healthcare and diagnostics are driving the demand for orthopedic imaging services, reinforcing their market position.

By end use, the global market is segmented into veterinary hospitals and clinics, veterinary diagnostic centers, and academic and research institutes. Veterinary hospitals and clinics are expected to hold a dominant position with a growth rate of 6.6%, reaching USD 907.1 million by 2034. This dominance is attributed to the extensive availability of advanced imaging technologies such as X-rays, CT scans, MRI, and other modalities in these facilities. These hospitals and clinics specialize in diagnosing and treating equine musculoskeletal, neurological, and internal disorders, making them the preferred choice for imaging services. Additionally, increasing expenditure on equine healthcare and the rising population of horse owners have fueled the demand for imaging services offered by these facilities. Strategic collaborations between veterinary hospitals and research organizations for advanced diagnostic applications are further driving market growth.

In 2024, the US emerged as a leader in the North American equine imaging services market, with a valuation of USD 346.5 million, up from USD 326.6 million in 2023. This leadership is attributed to the country's advanced veterinary infrastructure, high equine population, and significant investments in equine healthcare. The presence of specialized clinics and hospitals equipped with advanced imaging technologies such as MRI, CT, and digital radiography is fostering growth at the country level. Government support and funding for veterinary research, combined with continuous technological enhancements, are further contributing to market expansion in the US.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of equine diseases

- 3.2.1.2 Advancements in imaging technologies

- 3.2.1.3 Growing equine sports industry

- 3.2.1.4 Expansion of mobile imaging services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced imaging equipment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Imaging Modality, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 X-rays

- 5.3 Ultrasound

- 5.4 MRI scans

- 5.5 Nuclear imaging systems

- 5.6 CT scans

- 5.7 Other imaging modalities

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Orthopedics

- 6.3 Oncology

- 6.4 Cardiology

- 6.5 Neurology

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Veterinary hospitals & clinics

- 7.3 Veterinary diagnostic centers

- 7.4 Academic & research institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Chaparral Veterinary Medical Center

- 9.2 Chine House Veterinary Hospital

- 9.3 Daniel Equine Services

- 9.4 Hagyard Equine Medical Institute

- 9.5 IDEXX Laboratories

- 9.6 IMV Imaging

- 9.7 Mid-Atlantic Equine Medical Center

- 9.8 Moore Equine P.C

- 9.9 National Research Center on Equines.

- 9.10 Rainbow Equine Hospital

- 9.11 Royal Veterinary College's Equine Referral Hospital

- 9.12 Tennessee Equine Hospital

- 9.13 VET.CT

- 9.14 Vets Pets

- 9.15 Virginia Equine Imaging