|

市場調查報告書

商品編碼

1708239

1 型商用電湧保護裝置市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Type 1 Commercial Surge Protection Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

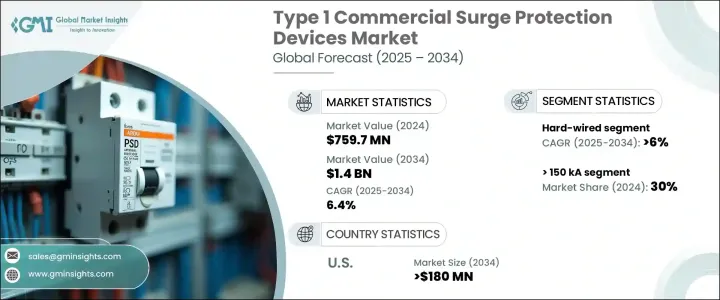

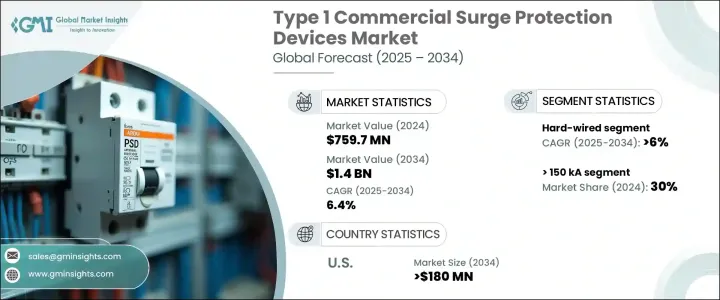

2024 年全球 1 型商用電湧保護裝置市值為 7.597 億美元,預計 2025 年至 2034 年期間將以 6.4% 的複合年成長率強勁成長。這一成長主要源自於對保護電氣系統免受電湧影響的需求日益成長,而電湧會帶來資料遺失、財務損失和設備故障等重大風險。電湧保護裝置在降低這些風險方面發揮著至關重要的作用,尤其是隨著越來越多的產業採用複雜的 IT 基礎架構、資料中心和先進的電子系統。

由於企業營運對科技的依賴性日益增強,電湧保護裝置市場變得越來越重要。隨著智慧建築技術的發展,對可靠電湧保護的需求也隨之激增。世界各國政府也大力投資電網現代化建設,進一步推動了市場的擴張。此外,人們對節能電氣系統的日益重視也推動了對這些保護裝置的進一步需求。這些解決方案對於保護設施免受因電網不穩定、雷擊和其他不可預測的電力波動而發生的瞬態電壓突波的影響至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.597億美元 |

| 預測值 | 14億美元 |

| 複合年成長率 | 6.4% |

通常安裝在服務主面板上的硬接線 1 型商用電湧保護裝置預計到 2034 年將以 6% 的複合年成長率成長。這些系統對於保護整個設施免受電湧的影響至關重要,電湧通常是由雷擊或電氣開關動作等外部事件引起的。它們在系統層級提供保護的能力對於高風險商業應用尤其有價值,可確保電源干擾不會造成大範圍的營運中斷。

額定電流 <= 50 kA 的突波保護裝置也越來越受歡迎,預計到 2034 年市場複合年成長率將達到 5.5%。推動這一成長的因素是,人們越來越意識到醫療保健、資料中心和研究設施等關鍵領域對突波保護的迫切需求。隨著雷暴和雷擊等極端天氣事件變得越來越頻繁,這些產業對強大的突波保護系統的需求持續上升。

在北美,1 型商用電湧保護裝置市場預計到 2034 年將以 6% 的複合年成長率成長。市場的成長主要歸因於電網現代化的進步,以及商業環境中伺服器、自動化系統和醫療設備等敏感電子設備的部署增加。對這些技術的日益依賴提高了對電湧保護的需求,進一步推動了該地區市場的成長。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 硬連線

- 外掛

- 電源線

- 電力控制裝置

第6章:市場規模及預測:依功率等級,2021 - 2034 年

- 主要趨勢

- ≤50千安

- > 50 kA 至 100 kA

- > 100 kA 至 150 kA

- > 150 千安

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 西班牙

- 荷蘭

- 奧地利

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 馬來西亞

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 奈及利亞

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ABB

- Belkin

- Eaton

- Emerson Electric

- Hubbell

- Intermatic

- Legrand

- Leviton Manufacturing

- Littelfuse

- LS Electric

- Mersen

- Raycap

- Phoenix Contact

- Schneider Electric

- Siemens

- Socomec

The Global Type 1 Commercial Surge Protection Devices Market was valued at USD 759.7 million in 2024 and is anticipated to experience robust growth at a CAGR of 6.4% from 2025 to 2034. This growth is primarily driven by the increasing need for safeguarding electrical systems from power surges, which pose significant risks such as data loss, financial damages, and equipment malfunctions. Surge protection devices play a vital role in mitigating these risks, particularly as more industries adopt complex IT infrastructures, data centers, and advanced electronic systems.

The surge protection device market is becoming increasingly essential due to the growing dependence on technology in business operations. As smart building technologies gain traction, the demand for reliable surge protection has surged in parallel. Governments worldwide are also investing heavily in grid modernization efforts, which are further propelling the market's expansion. Additionally, the increased emphasis on energy-efficient electrical systems is driving further demand for these protective devices. These solutions are indispensable in safeguarding facilities from transient voltage surges, which can occur due to grid instability, lightning strikes, and other unpredictable power fluctuations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $759.7 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 6.4% |

The hard-wired Type 1 commercial surge protection devices, typically installed at service main panels, are expected to grow at a CAGR of 6% through 2034. These systems are crucial in protecting entire facilities from power surges, often resulting from external events like lightning strikes or electrical switching actions. Their ability to provide protection at the system level is particularly valuable for high-risk commercial applications, ensuring that power disturbances do not cause widespread operational disruptions.

Surge protection devices rated <= 50 kA are also gaining traction, with the market projected to grow at a CAGR of 5.5% through 2034. This growth is driven by heightened awareness about the critical need for surge protection in key sectors such as healthcare, data centers, and research facilities. As extreme weather events like thunderstorms and lightning strikes become more frequent, the demand for robust surge protection systems continues to rise across these industries.

In North America, the Type 1 Commercial Surge Protection Devices Market is poised to grow at a CAGR of 6% through 2034. The market's growth is largely attributed to advances in grid modernization, alongside the increased deployment of sensitive electronic equipment such as servers, automated systems, and medical devices within commercial settings. The increasing reliance on these technologies has heightened the need for surge protection, further fueling the region's market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 ('000 Units & USD Million)

- 5.1 Key trends

- 5.2 Hard-wired

- 5.3 Plug-in

- 5.4 Line cord

- 5.5 Power control devices

Chapter 6 Market Size and Forecast, By Power Rating, 2021 - 2034 ('000 Units & USD Million)

- 6.1 Key trends

- 6.2 ≤ 50 kA

- 6.3 > 50 kA to 100 kA

- 6.4 > 100 kA to 150 kA

- 6.5 > 150 kA

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 ('000 Units & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Russia

- 7.3.4 UK

- 7.3.5 Italy

- 7.3.6 Spain

- 7.3.7 Netherlands

- 7.3.8 Austria

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 India

- 7.4.5 Australia

- 7.4.6 New Zealand

- 7.4.7 Malaysia

- 7.4.8 Indonesia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Egypt

- 7.5.5 South Africa

- 7.5.6 Nigeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Belkin

- 8.3 Eaton

- 8.4 Emerson Electric

- 8.5 Hubbell

- 8.6 Intermatic

- 8.7 Legrand

- 8.8 Leviton Manufacturing

- 8.9 Littelfuse

- 8.10 LS Electric

- 8.11 Mersen

- 8.12 Raycap

- 8.13 Phoenix Contact

- 8.14 Schneider Electric

- 8.15 Siemens

- 8.16 Socomec