|

市場調查報告書

商品編碼

1708240

口服抗糖尿病藥物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Oral Antidiabetic Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

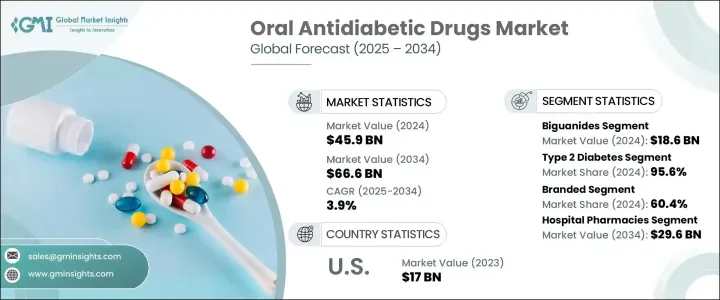

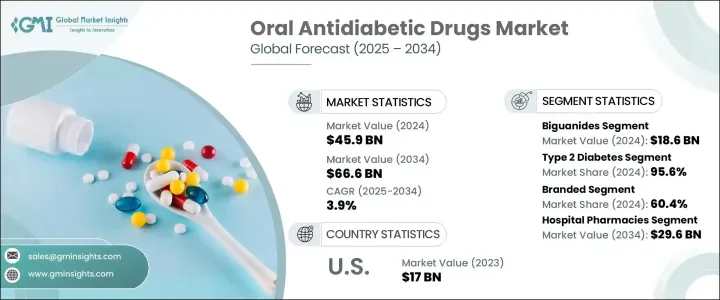

2024 年全球口服抗糖尿病藥物市場規模達 459 億美元,預計 2025 年至 2034 年期間的複合年成長率為 3.9%。該市場的成長主要得益於全球糖尿病盛行率的上升,尤其是第 2 型糖尿病 (T2DM)。被診斷出患有 2 型糖尿病的人數不斷增加,尤其是在發展中國家,這可以歸因於普遍存在的久坐生活方式和不良的飲食習慣。肥胖是導致胰島素阻抗的主要原因,進一步加劇了對調節血糖水平的口服藥物的需求。鈉葡萄糖轉運蛋白 2 (SGLT-2) 抑制劑和二肽基肽酶 4 (DPP-4) 抑制劑等藥物越來越受歡迎。這些藥物除了能有效控制血糖水平外,還能起到管理體重的額外作用,為患者的病情提供全面的解決方案。

此市場按藥物類別細分為雙胍類、SGLT-2 抑制劑、DPP-4 抑制劑、磺醯脲類、噻唑烷二酮類、格列奈類、α-葡萄糖苷酶抑制劑和其他類別。 2024 年,雙胍類藥物市場收入達 186 億美元,其中二甲雙胍作為最廣泛使用的雙胍類藥物,繼續保持其作為 2 型糖尿病一線治療藥物的主導地位。它透過降低肝臟葡萄糖生成和增加胰島素敏感性來降低血糖水平的能力鞏固了其在市場上的地位。此外,雙胍類藥物仍然是醫療保健提供者的首選,對市場穩定做出了重大貢獻。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 459億美元 |

| 預測值 | 666億美元 |

| 複合年成長率 | 3.9% |

從疾病類型來看,2024 年第 2 型糖尿病佔據了主導地位,達到 95.6%。這與全球 2 型糖尿病盛行率的上升直接相關。城市化、不健康的飲食習慣和缺乏體能活動是導致第 2 型糖尿病早期發病的關鍵因素,尤其是在人口大國。因此,對方便、長期口服治療方案的需求不斷成長,加強了口服抗糖尿病藥物在糖尿病管理中日益成長的作用。

在北美,口服抗糖尿病藥物市場在 2024 年佔有 41.1% 的佔有率。該地區糖尿病盛行率高,加上藥物配方的不斷進步和患者意識的提高,預計將繼續推動市場成長。人口老化、久坐的生活方式以及不良的飲食習慣等因素導致該地區糖尿病發病率上升。此外,遠距醫療和數位健康工具等醫療保健領域的創新使患者更容易管理自己的病情,進一步促進了口服抗糖尿病藥物的採用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 2型糖尿病盛行率上升

- 口服藥物的偏好增加

- 網路藥局和電子商務的擴張

- 聯合療法日益流行

- 產業陷阱與挑戰

- 新型藥物成本高昂

- 副作用和安全問題

- 成長動力

- 成長潛力分析

- 監管格局

- 管道分析

- 糖尿病概況

- 2024 年全球各地區糖尿病患者數

- 2024 年糖尿病患者數量最多的國家

- 2024 年全球各地區糖尿病死亡人數

- 預計 2045 年全球糖尿病患者數量最多的國家

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類別,2021 - 2034 年

- 主要趨勢

- 雙胍類

- 二肽基肽酶-4(DPP-4)抑制劑

- 西他列汀

- 利拉利汀

- 維格列汀

- 沙格列汀

- 阿格列汀

- 其他DPP-4抑制劑

- 鈉-葡萄糖轉運蛋白-2(SGLT-2)抑制劑

- 達格列淨

- 恩格列淨

- 卡格列淨

- 磺醯脲類藥物

- 格列美脲

- 格列吡嗪

- 格列苯脲

- 噻唑烷二酮類

- 格列奈類

- 瑞格列奈

- 那格列奈

- α-葡萄糖苷酶抑制劑

- 其他藥物類別

第6章:市場估計與預測:依疾病類型,2021 - 2034 年

- 主要趨勢

- 2型糖尿病

- 1型糖尿病

第7章:市場估計與預測:按藥物類型,2021 - 2034 年

- 主要趨勢

- 品牌

- 通用的

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Astellas Pharma

- AstraZeneca

- Bayer

- Boehringer Ingelheim

- Bristol Myers Squibb

- Eli Lilly and Company

- Glenmark Pharmaceuticals

- Johnson & Johnson (Janssen Pharmaceuticals)

- Merck

- Novartis

- Novo Nordisk

- Pfizer

- Sanofi

- Takeda Pharmaceuticals

The Global Oral Antidiabetic Drugs Market generated USD 45.9 billion in 2024 and is projected to expand at a CAGR of 3.9% from 2025 to 2034. The growth of this market is largely driven by the rising global prevalence of diabetes, particularly Type 2 diabetes (T2DM). The increasing number of people diagnosed with T2DM, especially in developing nations, can be traced back to the widespread adoption of sedentary lifestyles and poor dietary habits. Obesity, a major contributor to insulin resistance, has further intensified the demand for oral medications designed to regulate blood sugar levels. Medications such as sodium-glucose transport protein-2 (SGLT-2) inhibitors and dipeptidyl peptidase-4 (DPP-4) inhibitors are becoming more popular. These drugs offer the added benefit of weight management in addition to effectively controlling blood glucose levels, giving patients a comprehensive solution to their condition.

This market is segmented by drug class into biguanides, SGLT-2 inhibitors, DPP-4 inhibitors, sulfonylureas, thiazolidinediones, meglitinides, alpha-glucosidase inhibitors, and other categories. In 2024, the biguanides segment generated USD 18.6 billion, with Metformin, the most widely prescribed biguanide, maintaining its dominance as the first-line treatment for T2DM. Its ability to reduce blood glucose levels by lowering hepatic glucose production and increasing insulin sensitivity has solidified its position in the market. Furthermore, biguanides continue to be a primary choice for healthcare providers, contributing significantly to market stability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $45.9 Billion |

| Forecast Value | $66.6 Billion |

| CAGR | 3.9% |

When considering disease type, the Type 2 diabetes segment accounted for a dominant 95.6% share in 2024. This is directly linked to the increasing prevalence of T2DM worldwide. Urbanization, unhealthy eating habits, and a lack of physical activity are key contributors to the early onset of T2DM, particularly in large-population countries. Consequently, there is a rising demand for convenient, long-term oral treatment options, reinforcing the growing role of oral antidiabetic drugs in managing diabetes.

In North America, the oral antidiabetic drugs market held a 41.1% share in 2024. The region's high prevalence of diabetes, combined with ongoing advancements in drug formulations and increased patient awareness, is expected to continue driving market growth. Factors such as aging populations, sedentary lifestyles, and poor dietary habits are contributing to the rising incidence of diabetes in the region. Additionally, innovations in healthcare, such as telemedicine and digital health tools, have made it easier for patients to manage their condition, further boosting the adoption of oral antidiabetic drugs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of type 2 diabetes

- 3.2.1.2 Increased preference for oral medications

- 3.2.1.3 Expansion of online pharmacies and e-commerce

- 3.2.1.4 Growing trend for combination therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of newer drug classes

- 3.2.2.2 Side effects and safety concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Diabetes landscape

- 3.6.1 Number of diabetics worldwide, by region, 2024

- 3.6.2 Countries with the highest number of diabetics, 2024

- 3.6.3 Number of diabetes deaths worldwide, by region, 2024

- 3.6.4 Countries with the highest projected number of diabetics worldwide in 2045

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Biguanides

- 5.3 Dipeptidyl peptidase - 4 (DPP-4) inhibitors

- 5.3.1 Sitagliptin

- 5.3.2 Linagliptin

- 5.3.3 Vildagliptin

- 5.3.4 Saxagliptin

- 5.3.5 Alogliptin

- 5.3.6 Other DPP-4 inhibitors

- 5.4 Sodium-glucose transport protein-2 (SGLT-2) inhibitors

- 5.4.1 Dapagliflozin

- 5.4.2 Empagliflozin

- 5.4.3 Canagliflozin

- 5.5 Sulfonylureas

- 5.5.1 Glimepiride

- 5.5.2 Glipizide

- 5.5.3 Glyburide

- 5.6 Thiazolidinediones

- 5.7 Meglitinides

- 5.7.1 Repaglinide

- 5.7.2 Nateglinide

- 5.8 Alpha-glucosidase inhibitors

- 5.9 Other drug classes

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 2 diabetes

- 6.3 Type 1 diabetes

Chapter 7 Market Estimates and Forecast, By Medication Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generic

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Astellas Pharma

- 10.2 AstraZeneca

- 10.3 Bayer

- 10.4 Boehringer Ingelheim

- 10.5 Bristol Myers Squibb

- 10.6 Eli Lilly and Company

- 10.7 Glenmark Pharmaceuticals

- 10.8 Johnson & Johnson (Janssen Pharmaceuticals)

- 10.9 Merck

- 10.10 Novartis

- 10.11 Novo Nordisk

- 10.12 Pfizer

- 10.13 Sanofi

- 10.14 Takeda Pharmaceuticals