|

市場調查報告書

商品編碼

1708245

可回收阻隔包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Recyclable Barrier Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

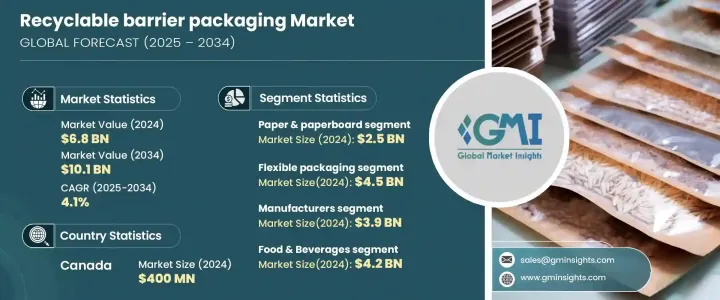

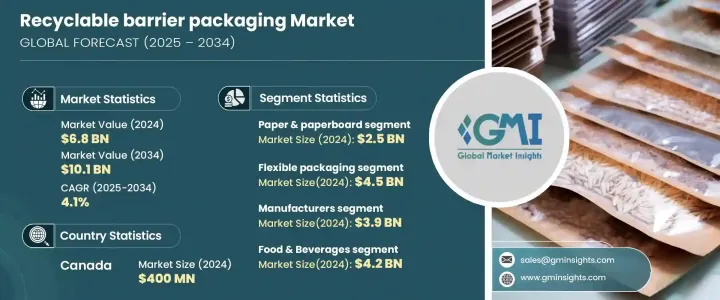

2024 年全球可回收阻隔包裝市場價值為 68 億美元,預計 2025 年至 2034 年的複合年成長率為 4.1%。對永續性的日益重視,加上政府旨在遏制塑膠垃圾的嚴格法規,正在推動可回收阻隔包裝解決方案的需求。隨著全球各地的產業轉向對環境負責的做法,企業正在積極投資創新材料,這些材料不僅符合不斷變化的法規,而且還能滿足消費者對永續包裝日益成長的偏好。公司優先考慮可回收性、功能性和耐用性,從而推動包裝技術不斷進步。市場對單一材料阻隔膜和可生物分解替代品的採用正在激增,這簡化了回收流程並提高了永續性。此外,食品飲料、製藥和個人護理行業正在向環保解決方案轉型,以保持合規性和消費者信任,從而推動對可回收阻隔包裝的巨大需求。

可回收阻隔包裝市場根據材料細分,包括塑膠、紙和紙板、金屬、玻璃和其他材料。 2024 年,紙和紙板領域的市場規模將達到 25 億美元,這得益於消費者對環保包裝選擇的需求不斷成長。隨著永續性成為焦點,企業正積極以更易於回收的紙質包裝取代傳統的塑膠包裝。對永續替代品的追求導致了研發投入的增加,從而產生了具有耐用性和阻隔保護功能的高性能紙質包裝。公司正在利用技術進步來創造滿足產業要求同時減少環境影響的紙包裝。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 68億美元 |

| 預測值 | 101億美元 |

| 複合年成長率 | 4.1% |

市場進一步按包裝類型分類,包括硬質包裝和軟質包裝。 2024 年,軟包裝領域創造了 45 億美元的收入,這主要歸功於其輕量、經濟高效和永續的特性。軟包裝越來越成為各行業的首選,因為它不僅可以減少材料消耗,還可以最大限度地減少運輸成本和碳足跡。該公司正專注於開發可回收和可生物分解的軟包裝材料,以解決日益嚴重的環境問題。軟包裝解決方案中新阻隔技術的引入和增強的可回收特性正在推動其在食品、醫療保健和個人護理領域的廣泛應用。

預計到 2034 年,中國可回收阻隔包裝市場將創造 11 億美元的產值。隨著永續性成為優先事項,中國企業正在迅速轉向可回收包裝材料,以符合不斷發展的行業標準。傳統的多層阻隔膜在回收方面存在困難,因此正被更易於加工的創新單一材料解決方案所取代。日益成長的監管壓力和消費者對永續包裝的認知正在加速這一轉變,導致可回收阻隔包裝在各種應用中的應用日益增多。市場參與者正在積極開發先進的可回收材料,以滿足中國對永續包裝解決方案日益成長的需求,鞏固中國作為全球可回收阻隔包裝市場主要貢獻者的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 消費者對永續包裝的需求不斷增加

- 嚴格的政府法規促進回收利用

- 材料技術的進步提高了可回收性

- 擴大採用軟包裝來提高運輸效率

- 企業對循環經濟計劃的承諾

- 產業陷阱與挑戰

- 回收基礎設施有限

- 保持阻隔性能的性能權衡

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依材料類型,2021 年至 2034 年

- 主要趨勢

- 紙和紙板

- 塑膠

- 金屬

- 玻璃

- 其他

第6章:市場估計與預測:依包裝類型,2021 年至 2034 年

- 主要趨勢

- 軟包裝

- 硬質包裝

第7章:市場估計與預測:按最終用戶,2021 年至 2034 年

- 主要趨勢

- 製造商

- 零售商與電子商務

- 食品服務提供者

第8章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 個人護理和化妝品

- 製藥

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Amcor

- Mondi

- BerryGlobal

- Tetra Pak

- Sealed Air

- Smurfit Kappa

- Sonoco

- DS Smith

- Huhtamaki

- Constantia Flexibles

- International Paer

- WestRock

- Toppan

- UFlex

- Ball Corporation

- Graphic Packaging

- Stora Enso

The Global Recyclable Barrier Packaging Market, valued at USD 6.8 billion in 2024, is projected to expand at a CAGR of 4.1% from 2025 to 2034. The increasing emphasis on sustainability, coupled with stringent government regulations aimed at curbing plastic waste, is propelling the demand for recyclable barrier packaging solutions. As industries worldwide shift towards environmentally responsible practices, businesses are actively investing in innovative materials that not only align with evolving regulations but also cater to the growing consumer preference for sustainable packaging. Companies are prioritizing recyclability, functionality, and durability, leading to continuous advancements in packaging technologies. The market is witnessing a surge in the adoption of mono-material barrier films and biodegradable alternatives, which simplify recycling processes and enhance sustainability. Additionally, the food and beverage, pharmaceuticals, and personal care industries are driving significant demand for recyclable barrier packaging as they transition toward eco-friendly solutions to maintain compliance and consumer trust.

The recyclable barrier packaging market is segmented based on materials, including plastics, paper & paperboard, metals, glass, and other materials. In 2024, the paper & paperboard segment accounted for USD 2.5 billion, driven by the growing consumer demand for eco-friendly packaging options. With sustainability taking center stage, businesses are proactively replacing conventional plastic packaging with paper-based solutions that are easier to recycle. The push for sustainable alternatives has led to increased investments in research and development, resulting in high-performance paper-based packaging that offers durability and barrier protection. Companies are leveraging technological advancements to create paper-based packaging that meets industry requirements while reducing environmental impact.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 4.1% |

The market is further categorized by packaging types, which include rigid and flexible packaging. In 2024, the flexible packaging segment generated USD 4.5 billion, largely due to its lightweight, cost-effective, and sustainable properties. Flexible packaging is increasingly becoming the preferred choice across various industries, as it not only reduces material consumption but also minimizes transportation costs and carbon footprints. Companies are focusing on the development of recyclable and biodegradable flexible packaging materials to address the escalating environmental concerns. The introduction of new barrier technologies and enhanced recyclability features in flexible packaging solutions is driving widespread adoption in food, healthcare, and personal care sectors.

The China Recyclable Barrier Packaging Market is expected to generate USD 1.1 billion by 2034. With sustainability becoming a priority, companies in China are rapidly transitioning to recyclable packaging materials to align with evolving industry standards. Traditional multilayer barrier films, which pose challenges in recycling, are being replaced by innovative mono-material solutions that facilitate easier processing. The growing regulatory pressure and consumer awareness regarding sustainable packaging are accelerating this transition, leading to increased adoption of recyclable barrier packaging across various applications. Market players are actively developing advanced recyclable materials to cater to the rising demand for sustainable packaging solutions in China, reinforcing the country's position as a key contributor to the global recyclable barrier packaging market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing consumer demand for sustainable packaging

- 3.2.1.2 Stringent government regulations promoting recycling

- 3.2.1.3 Advancements in material technology enhancing recyclability

- 3.2.1.4 Rising adoption of flexible packaging for improved transportation efficiency

- 3.2.1.5 Corporate commitments to circular economy initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited recycling infrastructure

- 3.2.2.2 Performance trade-offs in maintaining barrier properties

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 – 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Paper & Paperboard

- 5.3 Plastics

- 5.4 Metals

- 5.5 Glass

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 – 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Flexible packaging

- 6.3 Rigid Packaging

Chapter 7 Market Estimates and Forecast, By End User, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Manufacturers

- 7.3 Retailers & E-commerce

- 7.4 Food Service Providers

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Food & Beverages

- 8.3 Personal Care & Cosmetics

- 8.4 Pharmaceuticals

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amcor

- 10.2 Mondi

- 10.3 BerryGlobal

- 10.4 Tetra Pak

- 10.5 Sealed Air

- 10.6 Smurfit Kappa

- 10.7 Sonoco

- 10.8 DS Smith

- 10.9 Huhtamaki

- 10.10 Constantia Flexibles

- 10.11 International Paer

- 10.12 WestRock

- 10.13 Toppan

- 10.14 UFlex

- 10.15 Ball Corporation

- 10.16 Graphic Packaging

- 10.17 Stora Enso