|

市場調查報告書

商品編碼

1479760

VLSI 製造中的測量、檢驗和製程控制Metrology, Inspection, and Process Control in VLSI Manufacturing |

||||||

半導體計量和檢測在確保半導體裝置的品質、可靠性和性能方面發揮著至關重要的作用。 該領域的進展和投資是由多個驅動因素推動的。

總體而言,半導體產業對技術創新的不斷追求,加上對性能和品質不斷提高的期望,正在推動計量和檢測技術的不斷進步。 這些工具對於開發和生產為現代電子產品提供動力的尖端半導體裝置至關重要。

隨著半導體製造製程變得越來越複雜,對即時製程控制的需求也隨之增加。 先進的測量和檢測系統使製造商能夠密切監控流程並即時進行調整,以確保最佳的性能和產量。 這種即時回饋迴路對於維持精密製造和生產效率之間的微妙平衡至關重要。

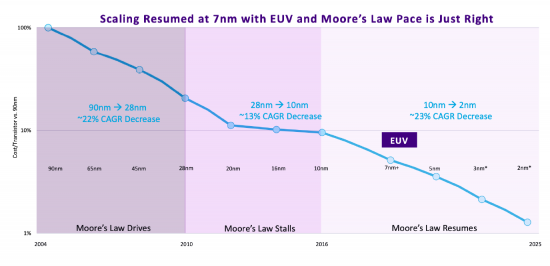

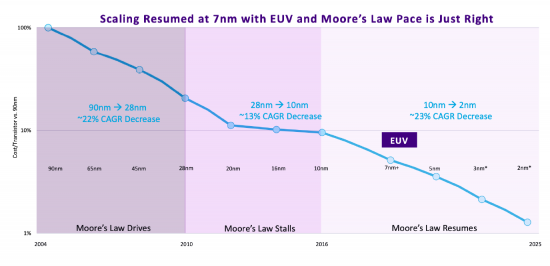

摩爾定律的追求,即微晶片上的電晶體大約每兩年增加一倍,同時成本下降,促使了半導體裝置的持續小型化。 這種小型化需要先進的測量和檢測技術來評估 1 奈米或更小的特徵。 隨著裝置變得越來越小,精確和準確的測量對於品質和良率控制至關重要,因為即使是很小的缺陷和變化□□也會對裝置性能產生重大影響。

半導體計量和檢測技術的最新創新對於應對半導體裝置尺寸越來越小和製造流程日益複雜所帶來的課題至關重要。 這些進步對於確保半導體元件(現代電子產品的支柱)的品質、性能和可靠性至關重要。

人工智慧 (AI) 和機器學習 (ML) 透過提高缺陷檢測和分類的速度、準確性和效率,正在徹底改變半導體計量和檢測。 這些技術可以分析檢查過程中產生的大量數據,識別可能表明潛在缺陷或品質問題的模式和異常情況。 人工智慧演算法可以從歷史數據中學習來預測和識別缺陷,從而減少手動檢查的時間和成本並提高產量。

本報告對半導體檢測和計量市場進行了全面、詳細的分析。 基於廣泛的研究、行業專業知識和市場洞察,我們對測試和計量行業的現狀和未來前景提供全面的瞭解。

目錄

第一章簡介

第 2 章執行摘要

第三章測量與偵測技術

- 簡介

- 影像技術

- 掃瞄探針顯微鏡

- 光學技術

- 薄膜厚度和粗糙度

第 4 章缺陷審查/晶圓檢定

- 簡介

- 缺陷審查

- 圖案化晶圓檢測

- 無圖案晶圓偵測

- 宏觀缺陷檢查

第五章薄膜測量

- 簡介

- 金屬薄膜測量

- 非金屬薄膜測量

- 基板/其他薄膜測量

第六章光刻測量

第七章市場預測

- 簡介

- 市場預測的假設

- 市場預測

- 全過程控制市場預測

- 光刻計量市場預測

- 晶圓檢測/缺陷審查市場

- 薄膜測量市場預測

- 其他製程控制系統市場預測

- 後端測量/偵測市場預測

第 8 章整合/現場測量/檢查趨勢

- 簡介

- 原位測量

- 綜合測量

第九章主要推動因素

- 3D

- 後端測量檢查

- 300mm/450mm晶圓

- 銅測量

- 低介電常數電介質

- 化學機械平化 (CMP)

- 離子注入

Driving Forces

Semiconductor metrology and inspection play crucial roles in ensuring the quality, reliability, and performance of semiconductor devices. Several driving forces propel advancements and investments in this field.

Overall, the semiconductor industry's relentless pursuit of innovation, coupled with increasing performance and quality expectations, drives continuous advancements in metrology and inspection technologies. These tools are essential for enabling the development and production of cutting-edge semiconductor devices that power modern electronics.

Process Control and Throughput: As semiconductor manufacturing processes become more complex, the need for real-time process control increases. Advanced metrology and inspection systems enable manufacturers to monitor processes closely and make immediate adjustments to ensure optimal performance and throughput. This real-time feedback loop is essential for maintaining the delicate balance between precision manufacturing and production efficiency.

Technological Advancements and Miniaturization: The pursuit of Moore's Law, which predicts a doubling of transistors on a microchip approximately every two years while decreasing cost, has led to the continual miniaturization of semiconductor devices. This miniaturization necessitates advanced metrology and inspection techniques capable of characterizing features at the nanometer scale and below. As devices shrink, even the smallest defects or variations can have a significant impact on device performance, making precise and accurate measurements critical for quality control and yield management.

Complex 3D Structures and New Materials: The evolution of semiconductor devices includes not just shrinking sizes but also increasing complexity in device architecture, such as 3D NAND flash memory and FinFET transistors. These complex structures improve performance and storage capacity but introduce new challenges in measurement and inspection. Additionally, the integration of new materials with unique properties necessitates the development of novel metrology tools capable of accurately assessing material characteristics without damaging the delicate structures.

Yield Optimization: In the highly competitive semiconductor industry, optimizing yield-the percentage of devices on a wafer that function correctly-is crucial for economic viability. Metrology and inspection are integral to identifying process variations and defects early in the manufacturing process, allowing for adjustments that minimize waste and improve yield. The ability to precisely measure and control the production process leads to significant cost savings and higher profitability.

Quality and Reliability Standards: The end applications of semiconductor devices, particularly in critical areas such as automotive, medical, and aerospace industries, demand the highest levels of quality and reliability. This demand requires stringent quality control measures throughout the manufacturing process, supported by sophisticated metrology and inspection techniques. These tools ensure that devices meet the rigorous standards required for their intended applications, minimizing the risk of failures that could have severe consequences.

Innovation in Metrology and Inspection Technologies

Recent innovations in semiconductor metrology and inspection technologies have been pivotal in addressing the challenges posed by the ever-decreasing size of semiconductor devices and the complexity of their manufacturing processes. These advancements are critical for ensuring the quality, performance, and reliability of semiconductor components, which are the backbone of modern electronics. Here's an overview of some of the significant innovations in this field:

Artificial intelligence (AI) and machine learning (ML) are revolutionizing semiconductor metrology and inspection by improving the speed, accuracy, and efficiency of defect detection and classification. These technologies enable the analysis of vast amounts of data generated during the inspection process, identifying patterns and anomalies that may indicate potential failures or quality issues. AI algorithms can learn from historical data to predict and identify defects, reducing the time and cost associated with manual inspection and increasing yield rates.

High-resolution imaging techniques have seen substantial advancements, including electron microscopy (EM), atomic force microscopy (AFM), and X-ray tomography. These methods provide detailed views of semiconductor devices at the nanometer scale, allowing for precise characterization of features and defects. For instance, electron beam microscopy can now offer images at resolutions sufficient to inspect the atomic structure of materials, crucial for understanding complex 3D device architectures.

Multi-beam inspection systems use multiple electron beams simultaneously to inspect semiconductor wafers. This approach significantly increases throughput compared to traditional single-beam systems, enabling more comprehensive and faster inspections. Multibeam systems are particularly effective in identifying defects in complex patterns and multilayer structures, essential for ensuring the quality of advanced semiconductor devices.

Three-dimensional metrology technologies have become increasingly important for measuring the dimensions and profiles of complex 3D structures in semiconductor devices, such as FinFETs and 3D NAND flash memory. Techniques such as 3D X-ray microscopy (XRM) and 3D scanning electron microscopy (SEM) provide detailed volumetric measurements, offering insights into the quality and integrity of these structures.

The integration of metrology equipment directly into semiconductor fabrication tools allows for real-time process monitoring and control. This inline metrology approach enables immediate feedback and adjustments, reducing the cycle time for process optimization and significantly improving the efficiency of the manufacturing process. Integrated metrology systems utilize various measurement techniques, including optical, electrical, and material characterization methods, to ensure process stability and performance.

Advanced spectroscopic techniques, such as Raman spectroscopy and ellipsometry, have been refined for semiconductor metrology, providing non-destructive ways to analyze material properties, including composition, thickness, and refractive index. These techniques are invaluable for characterizing thin films, multi-layer stacks, and new materials being introduced in semiconductor manufacturing.

The use of big data analytics in semiconductor metrology and inspection involves processing and analyzing the vast amounts of data generated during the manufacturing process. This analysis helps identify trends, predict failures, and optimize manufacturing processes. Big data tools enable the correlation of data across different stages of production, improving overall yield and device performance.

Non-contact inspection methods, such as terahertz imaging and ultrasonic scanning, are being developed to inspect semiconductor wafers and devices without risking damage. These methods are particularly useful for inspecting delicate structures and materials, offering a safer alternative to traditional contact-based inspection techniques.

Need For This Report

In today's semiconductor industry, where innovation and precision are paramount, the importance of inspection and metrology cannot be overstated. As semiconductor devices continue to evolve at a rapid pace, with shrinking feature sizes, increasing complexity, and growing demands for reliability and performance, the need for robust inspection and metrology solutions has never been greater. These technologies serve as the cornerstone of quality assurance in semiconductor manufacturing, enabling the detection of defects, measurement of critical dimensions, and characterization of materials at the nanoscale level.

As the semiconductor landscape undergoes profound transformations driven by technological advancements, shifting market dynamics, and evolving customer requirements, staying abreast of the latest trends, developments, and challenges in inspection and metrology is essential for industry stakeholders. Whether you are a semiconductor manufacturer striving to optimize production processes, a supplier seeking to develop innovative solutions, a researcher exploring cutting-edge technologies, or an investor evaluating market opportunities, a comprehensive understanding of the semiconductor inspection and metrology landscape is indispensable.

Against this backdrop, this report offers a comprehensive and in-depth analysis of the semiconductor inspection and metrology market. Drawing on extensive research, industry expertise, and market insights, this report provides a holistic view of the current state and future prospects of the inspection and metrology sector. From emerging trends and technological innovations to competitive dynamics and growth opportunities, this report covers a wide range of topics essential for industry professionals and decision-makers.

Key areas of focus include the latest advancements in inspection and metrology technologies, market trends and drivers shaping industry growth, competitive landscape and key players' strategies, regulatory and standards landscape, and future outlook and growth prospects. By leveraging actionable insights and strategic recommendations provided in this report, stakeholders can gain a competitive edge, identify growth opportunities, mitigate risks, and make informed decisions to drive success in the dynamic and fast-paced semiconductor inspection and metrology market.

In summary, this report serves as an indispensable resource for anyone looking to navigate the complexities of the semiconductor inspection and metrology landscape. Whether you are seeking to understand market dynamics, evaluate competitive positioning, identify growth opportunities, or formulate strategic plans, this report equips you with the insights and analysis needed to succeed in the ever-evolving semiconductor industry.

About This Report

This 300-page report offers a complete analysis of the Process Control market, segmented as:

- Lithography Metrology

- Overlay (standalone)

- CD Measurement

- Mask Inspection

- Mask Metrology

- Wafer Insp/Defect

- Patterned Wafer Insp

- E-beam Patterned

- Optical Patterned

- Defect Review

- SEM Defect Review

- Optical Defect Review

- Other Defect Review

- Unpatterned Wafer Insp

- Macro Defect Detection

- Patterned Wafer Insp

- Thin Film Metrology

- Non-Metal Thin Film

- Non-Metal Standalone

- Non-Metal Integrated

- Substrate Metrology

- Non-Metal Thin Film

- Other Process Systems

- Other Process

- Software

- Back End

Includes excel spreadsheet of market revenues of each competitor in 22 segments from 2012 to 2023.

Table of Contents

Chapter 1. Introduction

Chapter 2. Executive Summary

Chapter 3. Metrology/Inspection Technologies

- 3.1. Introduction

- 3.2. Imaging Techniques

- 3.2.1. Scanning Electron Microscope (SEM)

- 3.2.2. Transmission Electron Microscope (TEM)

- 3.3. Scanning Probe Microscopes

- 3.3.1. Atomic Force Microscopy (AFM)

- 3.3.2. Scanning Tunneling Microscopy (STM)

- 3.3.3. Scanning Probe Microscopy (SPM)

- 3.3.4. AFM Types

- 3.3.4.1. Contact AFM

- 3.3.4.2. Dynamic Force Mode AFM Techniques

- 3.3.5. Scanning Surface Potential Microscopy (SSPM)

- 3.4. Optical Techniques

- 3.4.1. Scatterometry

- 3.4.1.1. Ellipsometry

- 3.4.1.2. Reflectometry

- 3.4.1.3. Scatterometry Developments

- 3.4.2. Total Reflection X-Ray Fluorescence (TXRF)

- 3.4.3. Energy Dispersive X-Ray Analysis (EDX)

- 3.4.4. Secondary Ion Mass Spectrometry (SIMS)

- 3.4.4.1. Surface Imaging Using SIMS

- 3.4.4.2. SIMS Depth Profiling

- 3.4.5. Auger Electron Spectroscopy

- 3.4.6. Focused Ion Beam (FIB)

- 3.4.7. X-Ray Reflectometry (XRR)

- 3.4.8. X-Ray Photoelectron Spectroscopy (XPS)

- 3.4.9. Rutherford Backscattering (RBS)

- 3.4.10. Optical Acoustics Metrology

- 3.4.11. Fourier Transform Infrared Spectroscopy (FTIR)

- 3.4.12. Thermally-Induced Voltage Alteration (TIVA)

- 3.4.1. Scatterometry

- 3.5. Film Thickness And Roughness

- 3.5.1. Surface Inspection Technology

- 3.5.2. Dimensional Technology

- 3.5.3. Stylus Profilometer

Chapter 4. Defect Review/Wafer Inspection

- 4.1. Introduction

- 4.2. Defect Review

- 4.2.1. SEM Defect Review

- 4.2.2. Optical Defect Review

- 4.2.3. Other Defect Review

- 4.3. Patterned Wafer Inspection

- 4.3.1. E-Beam Patterned Wafer Inspection

- 4.3.2. Optical Patterned Wafer Inspection

- 4.4. Unpatterned Wafer Inspection

- 4.5. Macro-Defect Inspection

Chapter 5. Thin Film Metrology

- 5.1. Introduction

- 5.1.1. Front End Applications

- 5.1.2. Back End Applications

- 5.2. Metal Thin-Film Metrology

- 5.3. Non-Metal Thin-Film Metrology

- 5.4. Substrate/Other Thin Film Metrology

Chapter 6. Lithography Metrology

- 6.1. Overlay

- 6.2. CD

- 6.3. Mask (Reticle) Metrology/Inspection

Chapter 7. Market Forecast

- 7.1. Introduction

- 7.2. Market Forecast Assumptions

- 7.3. Market Forecast

- 7.3.1. Total Process Control Market Forecast

- 7.3.2. Lithography Metrology Market Forecast

- 7.3.2.1. Overlay Market Forecast

- 7.3.2.2. CD Measurement Market Forecast

- 7.3.2.3. Mask Inspection Market Forecast

- 7.3.2.4. Mask Metrology Market Forecast

- 7.3.3. Wafer Inspection / Defect Review Market

- 7.3.3.1. Patterned Wafer Inspection Market Forecast

- E-Beam Patterned Wafer Inspection Market Forecast

- Optical Patterned Wafer Inspection Market Forecast

- 7.3.3.2. Defect Review Market Forecast

- SEM Defect Review Market Forecast

- Optical Defect Review Market Forecast

- Other Defect Review Market Forecast

- 7.3.3.3. Unpatterned Wafer Inspection Market Forecast

- 7.3.3.4. Macro Defect Detection Market Forecast

- 7.3.3.1. Patterned Wafer Inspection Market Forecast

- 7.3.4. Thin Film Metrology Market Forecast

- 7.3.4.1. Non-Metal Thin Film Metrology Market Forecast

- Non-Metal Standalone Thin Film Metrology Market Forecast

- Non-Metal Integrated Thin Film Metrology Market Forecast

- 7.3.4.2. Substrate / Other Thin Film Metrology Market Forecast

- 7.3.4.1. Non-Metal Thin Film Metrology Market Forecast

- 7.3.5. Other Process Control Systems Market Forecast

- 7.3.6. Back-End Metrology/Inspection Market Forecast

Chapter 8. Integrated/In-Situ Metrology/Inspection Trends

- 8.1. Introduction

- 8.2. In-Situ Metrology

- 8.3. Integrated Metrology

- 8.3.1. Benefits

- 8.3.2. Limitations

Chapter 9. Key Drivers

- 9.1. 3D

- 9.2. Back End Metrology Inspection

- 9.3. 300mm/450mm Wafers

- 9.4. Copper Metrology

- 9.5. Low-K Dielectrics

- 9.6. Chemical Mechanical Planarization (CMP)

- 9.7. Ion Implant

List of Tables

- 3.1. Comparison Of Derivative AFM Techniques

- 5.1. Comparison Of White-Light With Multiple-Angle Laser Ellipsometry

- 7.1. Total Process Control Market Forecast

- 7.2. Lithography Metrology Market Forecast

- 7.3. Overlay Market Forecast

- 7.4. CD Measurement Market Forecast

- 7.5. Mask Inspection Market Forecast

- 7.6. Mask Metrology Market Forecast

- 7.7. Wafer Inspection / Defect Review Market Forecast

- 7.8. Patterned Wafer Inspection Market Forecast

- 7.9. E-Beam Patterned Wafer Inspection Market Forecast

- 7.10. Optical Patterned Wafer Inspection Market Forecast

- 7.11. Defect Review Market Forecast

- 7.12. SEM Defect Review Market Forecast

- 7.13. Optical Defect Review Market Forecast

- 7.14. Other Defect Review Market Forecast

- 7.15. Unpatterned Wafer Inspection Market Forecast

- 7.16. Macro Defect Detection Market Forecast

- 7.17. Thin Film Metrology Market Forecast

- 7.18. Non-Metal Thin Film Metrology Market Forecast

- 7.19. Non-Metal Standalone Thin Film Metrology Market Forecast

- 7.20. Non-Metal Integrated Thin Film Metrology Market Forecast

- 7.21. Substrate / Other Thin Film Metrology Market Forecast

- 7.22. Other Process Control Systems Market Forecast

- 9.1. Dielectric Film Challenges

List of Figures

- 3.1. Schematic Of Scanning Electron Microscope

- 3.2. Schematic Of Transmission Electron Microscope

- 3.3. Schematic Of Atomic Force Microscopy

- 3.4. Schematic Of Scanning Tunneling Microscopy

- 3.5. Interaction Between Two Atoms In AFM

- 3.6. Schematic Of Lateral Force Microscopy

- 3.7. Schematic Of Dynamic Force Mode AFM

- 3.8. Schematic Of Scanning Surface Potential Microscopy

- 3.9. Principle Of Scatterometry

- 3.10. Schematic Of Ellipsometer

- 3.11. Principles Of CD Scatterometry

- 3.12. Conventional TXRF Analysis Geometry

- 3.13. Schematic Of Secondary Ion Mass Spectrometry

- 3.14. Principle Of Auger Electron Emission

- 3.15. Schematic Of Auger Electron Spectroscopy

- 3.16. Schematic Of Focused Ion Beam Technology

- 3.17. Schematic Of X-Ray Reflectometry

- 3.18. Schematic Of X-Ray Photoelectron Spectroscopy

- 3.19. Schematic Of Rutherford Backscattering

- 3.20. Schematic Of Optical Acoustics Metrology

- 3.21. Spatial Wavelength Of Nanotopography

- 3.22. Schematic Of Non-Contact Capacitive Gauging

- 3.23. Schematic Of Stylus Profilometer

- 5.1. Spectroscopic Ellipsometry Diagram

- 6.1. ITRS Overlay Technology Roadmap

- 6.2. Illustration Of 3D Structure

- 6.3. ITRS Metrology Roadmap

- 6.4. Schematic Of OCD Optics

- 7.1. Total Process Control Market Forecast

- 7.2. Total Process Control Market By Geographic Region

- 7.3. Total Process Control Market Vs. Overall Equipment Market

- 7.4. Lithography Metrology Market Shares

- 7.5. Overlay Market Shares

- 7.6. CD Measurement Market Shares

- 7.7. Mask Inspection Market Shares

- 7.8. Mask Metrology Market Shares

- 7.9. Wafer Inspection / Defect Review Market Shares

- 7.10. Patterned Wafer Inspection Market Shares

- 7.11. E-Beam Patterned Wafer Inspection Market Shares

- 7.12. Optical Patterned Wafer Inspection Market Shares

- 7.13. Defect Review Market Shares

- 7.14. SEM Defect Review Market Shares

- 7.15. Optical Defect Review Market Shares

- 7.16. Other Defect Review Market Shares

- 7.17. Unpatterned Wafer Inspection Market Shares

- 7.18. Macro Defect Detection Market Shares

- 7.19. Thin Film Metrology Market Shares

- 7.20. Non-Metal Thin Film Metrology Market Shares

- 7.21. Non-Metal Standalone Thin Film Metrology Market Shares

- 7.22. Non-Metal Integrated Thin Film Metrology Market Shares

- 7.23. Substrate / Other Thin Film Metrology Market Shares

- 7.24. Other Process Control Systems Market Shares

- 7.25. Other Process Software Market Shares

- 8.1. Integrated Control In A Fab

- 9.1. Polish Endpoint Control