|

市場調查報告書

商品編碼

1512212

工業連接市場:2024-2028Industrial Connectivity Market Report 2024-2028 |

|||||||

全球工業連結市場規模預計將從 2023 年的 890 億美元成長到 2028 年的 1,040 億美元,未來四年的複合年增長率為 5%。

雖然工業連接硬體領域預計將繼續主導整個工業連接市場,但成長預計最慢,而軟體領域預計將成長最快。在軟體領域,工業連接協定轉換軟體市場預計將以超過10%的複合年增長率成長,而較小的訊息代理(MQTT代理)軟體市場預計將以更快的速度成長。工業數據營運市場正在迅速興起。由數據品質管理和數據建模組成的 DataOps 軟體市場預計將在未來四年內以最快的速度成長。

本報告對工業連接市場進行了全面調查,包括硬體、軟體、架構、協議、技術、市場預測和採用驅動因素,以幫助您做出明智的決策和策略,並對驅動因素進行了深入分析。

上市公司

報告中提到的一些公司

|

|

目錄

第一章簡介

第 2 章執行摘要

第 3 章主題概述

- 章節概述

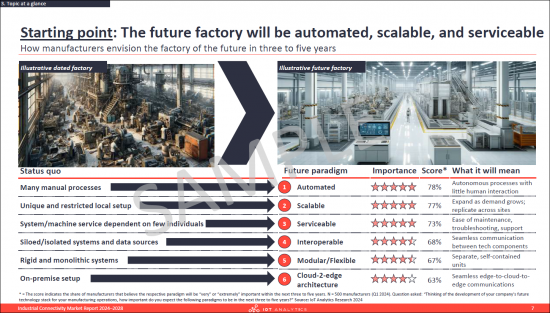

- 製造商如何展望其工廠 3 至 5 年後的未來?

- 影響工業互聯的 7 個關鍵變化

- 流行工業連接技術的當前搜尋趨勢

- 例證 - Equinor 的連接驅動的數位轉型

- 工業連結的定義 - 7 個要素和 5 個維度

第 4 章總體趨勢與問題

- 章節概述

- 一般工業連接趨勢

- 常見的工業連接課題

第五章市場規模與前景

- 章節概述

- 全球工業連結市場規模與市場驅動因素/阻礙因素

- 全球工業連接市場:依細分市場:硬體/軟體:協定轉換器、訊息代理、資料操作

- 全球工業連結市場:依行業(離散、製程、混合)

- 全球工業連結市場:依地區

第 6 章工業連接硬體

- 章節概述

- 技術概述

- 全球市場規模與驅動因素

- 技術概況:現場設備

- 依類型(市場規模/主要供應商)劃分的市場概覽:現場設備

- 趨勢-現場設備

- 技術概述:遠端 I/O

- 依類型(市場規模/主要供應商)劃分的市場概覽:遠端 I/O

- 趨勢-遠端 I/O

- 技術概述:控制器

- 依類型(市場規模/主要供應商)劃分的市場概覽:控制器

- 趨勢控制器

- 技術概述:網關

- 依類型(市場規模/主要供應商)劃分的市場概覽:網關

- 趨勢網關

第 7 章工業連接軟體:協定轉換器

- 章節概述

- OT-OT 和 OT-IT 協定轉換器的技術概述

- 全球市場規模與驅動因素

- 技術概述 OT-OT 協定轉換器

- 依 OPC/非 OPC 類型劃分的市場概覽(市場規模/主要供應商)

- OT-IT協定轉換器技術概述

- 依細分市場概述(特定於雲端/應用程式/獨立於雲端/應用程式)以及每個細分市場的 OPC/非 OPC 類型(市場規模/主要供應商)

- 協定轉換器市場趨勢

第 8 章工業連接軟體:訊息代理程式

- 章節概述

- MQTT 代理的技術概述

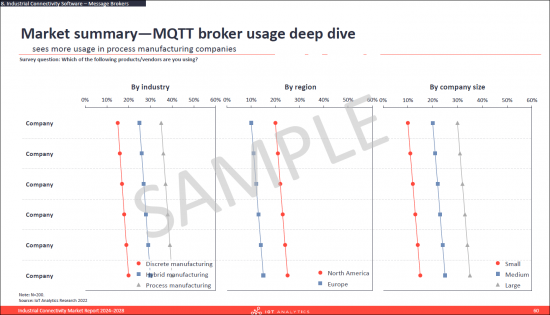

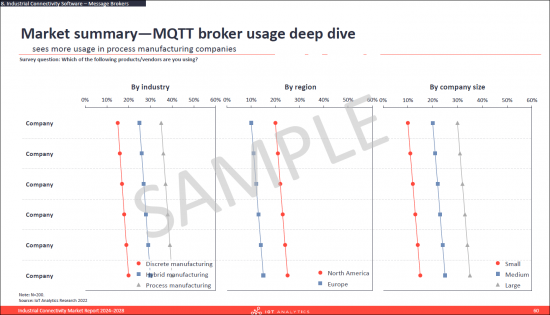

- 市場概況:MQTT 經紀商

- 訊息代理市場的趨勢

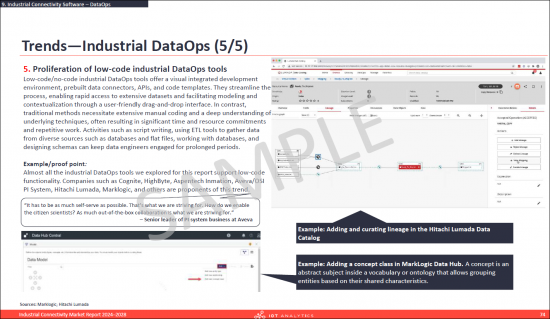

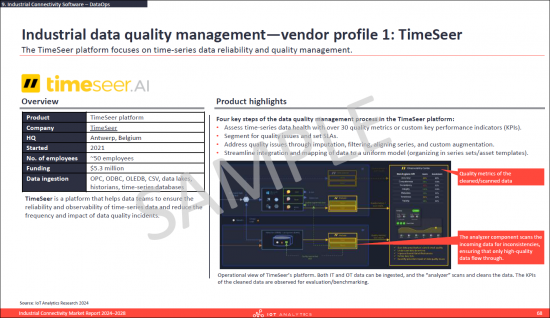

第 9 章工業連接軟體:DataOps

- 章節概述

- 定義與要素:工業資料品質控制/資料建模

- 全球市場規模與驅動因素:整體、依行業、依地區

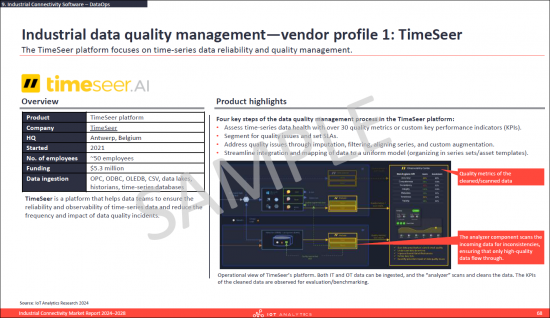

- 工業資料品質管理:定義、資料品質管理程序、市場概覽、供應商簡介

- 資料建模:定義、市場概覽、建模程序

- 資料建模概述

- 資料模型類型:資產模型/用例模型

- 標準資料模型(ISA-95設備模型、CESMII SM設定檔、PackML、PA-DIM)

- 資料建模標準(OPC-UA・Sparkplug B・AAS・DTDL・WoT)

- 資料模型的操作化

- 資料建模治理

- 資料建模供應商簡介

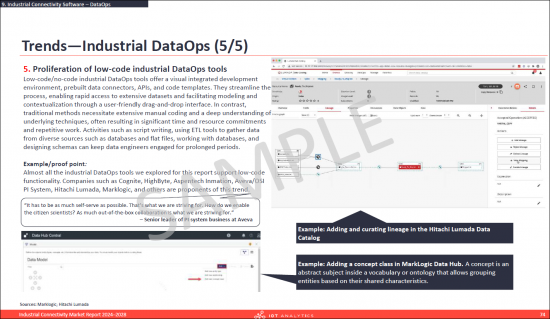

- 數據營運市場趨勢

第10章資料傳輸

- 章節概述

- 定義與元素(通訊模式與資料交換格式)

- 通訊模式和通訊模式類型的描述

- 資料交換格式描述與資料交換格式類型

- 資料/事件流詳細信息

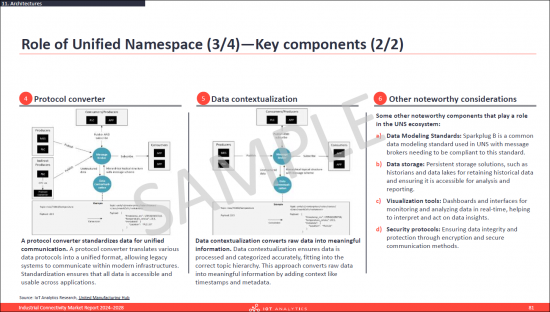

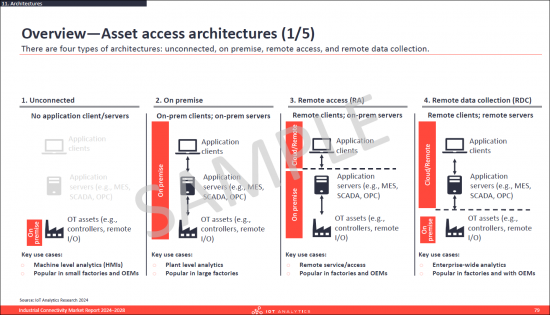

第 11 章架構

- 章節概述

- 架構概述

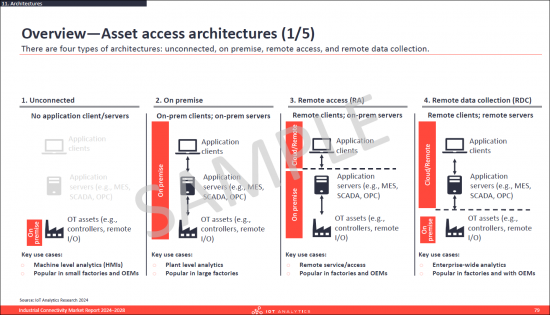

- 資產架構/選擇標準概述

- 資產架構概述/優點/缺點

- 網路拓樸概述

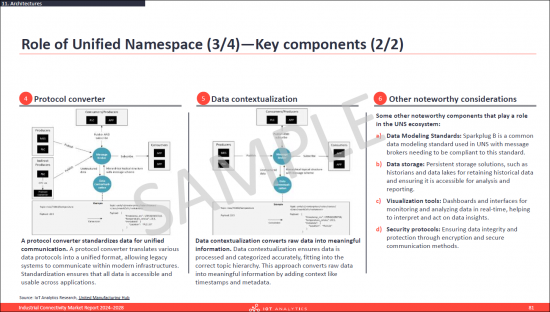

- 統一命名空間:概述、主要元件、實作範例

- 架構趨勢

第12章協定

- 章節概述

- 工業連接協定的三種主要類型

- 協定-OSI 模型

- 技術概述 - 專注於 L1 的 OT 協議

- 市場概覽 - 專注於 L1 的 OT 協議

- 主要協議詳細資訊 - 重點關注 L1 的 OT 協議

- 趨勢 - 專注於 L1 的 OT 協議

- 技術概述:常見 OT 協議

- 市場概覽:常見 OT 協議

- 主要協定詳細資訊:常見 OT 協議

- 趨勢 - 常見 OT 協議

- 技術概述 - IT 協議

- 市場概覽 - IT 協議

- 兩個主要協議的詳細資訊 - IT 協議

- 趨勢-IT 協議

- 協議調查結果

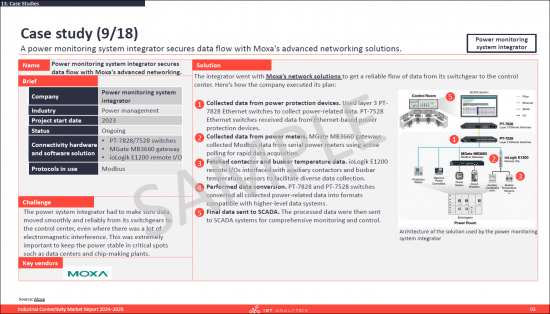

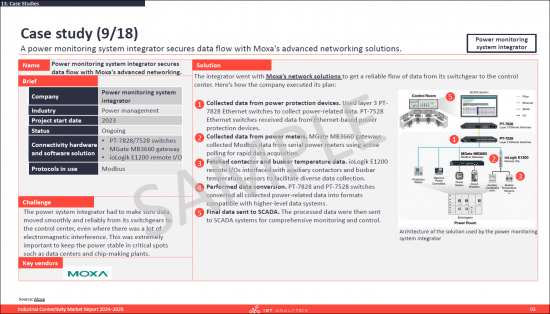

第 13 章案例研究

- 案例研究:概述

- 7個要點

- 18 個案研究

第14章定義/調查方法

第 15 章關於 IoT 分析

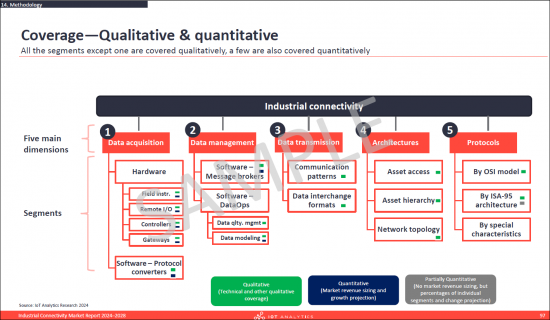

The "Industrial Connectivity Market Report 2024-2028" is part of IoT Analytics' comprehensive coverage of industrial and connectivity topics. The content presented in this report is based on a combination of primary and secondary research, including 35+ interviews with industrial connectivity vendors and system integrators conducted between June 2023 and June 2024.

SAMPLE VIEW

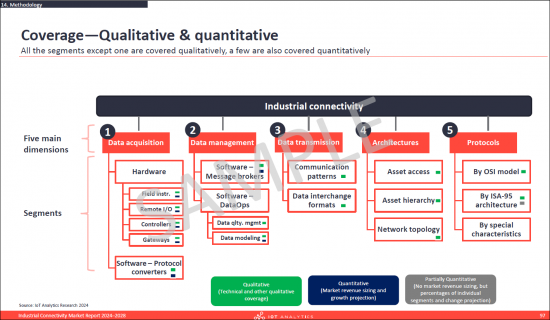

The primary objective of this document is to provide our readers with a comprehensive understanding of the current industrial connectivity market landscape. It offers in-depth analysis of industrial connectivity hardware, software, architectures, protocols, technologies, market projections, factors driving adoption, notable trends, and insightful case studies to facilitate informed decision-making and strategic planning.

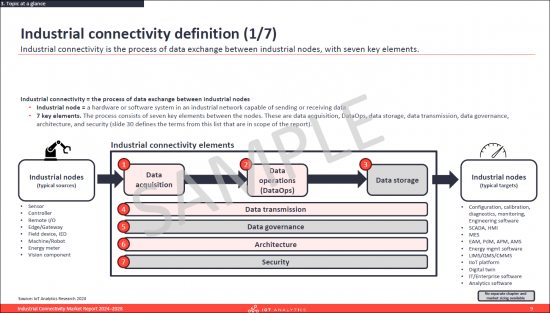

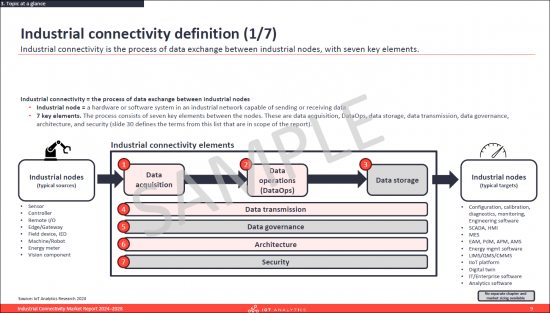

Industrial connectivity definition

Industrial connectivity is the process of data exchange between industrial nodes, with seven key elements. These are data acquisition, DataOps, data storage, data transmission, data governance, architecture, and security.

Overview of the industrial connectivity market

According to the "Industrial Connectivity Market Report 2024-2028" by IoT Analytics, the global industrial connectivity market is projected to grow from $89 billion in 2023 to $104 billion by 2028 at a CAGR of 5% over the next 4 years.

SAMPLE VIEW

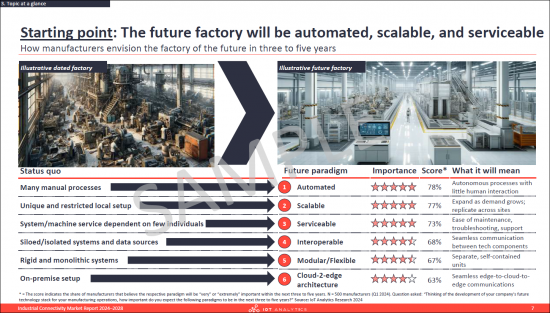

As manufacturers get ready for the factory of the future, industrial connectivity is changing. Emerging shifts include widespread data availability enabled by smart nodes, streamlined data management through DataOps, and flexible architectures facilitated by edge and cloud advancements.

SAMPLE VIEW

Industrial connectivity hardware will continue to have the dominant share of the overall industrial connectivity market but is expected to grow the slowest, with the software segments growing the fastest. Within the software segments. the industrial connectivity protocol converter software market is projected to grow at above 10% CAGR, while the smaller segment of message brokers (MQTT brokers) software is expected to grow at much faster pace. The industrial DataOps market is emerging rapidly. The DataOps software market, which consists of data quality management and data modeling, is expected to grow at the fastest pace in the next four years.

Seven key shifts are emerging with an impact on industrial connectivity:

| In the past | In the future |

| Limited data availability | Widespread data availability-enabled by smart nodes, protocols, converters |

| Rigid, siloed architectures | Flexible, scalable architectures-enabled by edge and cloud advancements |

| Poor data management | Streamlined data management-enabled by industrial DataOps practices |

| Slow and fragmented connectivity | Fast connectivity-enabled by interoperable Ethernet-based networks |

| Restrictive wired connections | Flexible wireless networks-enabled by wireless mediums and protocols |

| Basic hardware capabilities | Advanced hardware-enabled by integration of powerful CPUs/GPUs |

| Hardware dependent computing | Distributed computing-enabled by edge and software-defined hardware |

Questions answered:

- What is industrial connectivity (i.e., an industrial connectivity definition)?

- What is the size of the overall industrial connectivity market by component, region, and industry?

- What are some key trends and challenges in the industrial connectivity space?

- What types of hardware are used for data acquisition, who are the leading suppliers, and how might the landscape change in the future?

- What types of protocol converters software are used for data acquisition, who are the leading suppliers, and how will the landscape change in the future?

- What is the role of message broker software in industrial connectivity, who are the leading vendors, and how will the market change in the future?

- What are the elements of the quickly evolving space of industrial data operations (DataOps) software, who are the leading suppliers, and what changes are anticipated in the future?

- What technologies are involved in transmitting the data from source to destination?

- What are the most common architectures for achieving industrial connectivity, and how might this change in the future?

- What are the most common protocols used between each layer of the connectivity stack, and how could this change in the future?

- What are some examples of factories and original equipment manufacturers (OEMs) using industrial connectivity to create value (i.e., industrial connectivity case studies)?

SAMPLE VIEW

Companies mentioned:

A selection of companies mentioned in the report.

|

|

Table of Contents

1. Introduction

2. Executive Summary

3. Topic at a glance

- 3.1. Chapter overview

- 3.2. How manufacturers envision the factory of the future in three to five years

- 3.3. Seven key shifts are emerging that are impacting industrial connectivity

- 3.4. Current search trends for trending industrial connectivity technologies

- 3.5. Case in point - Equinor's connectivity-driven digital transformation

- 3.6. Industrial connectivity definition - 7 elements (4 covered in this report) and 5 dimensions

4. Overarching Trends and Challenges

- 4.1. Chapter summary

- 4.2. General industrial connectivity trends

- 4.3. General industrial connectivity challenges

5. Market Size & Outlook

- 5.1. Chapter overview

- 5.2. Global overall industrial connectivity market size and market drivers/inhibitors

- 5.3. Global industrial connectivity market - overall by segments: Hardware, Software - protocol converter, message broker, dataops

- 5.4. Global industrial connectivity market - by industry (discrete, process, hybrid)

- 5.5. Global industrial connectivity market - by region

6. Industrial Connectivity Hardware

- 6.1. Chapter overview

- 6.2. Technical overview

- 6.3. Global market size and drivers

- 6.4. Technical summary - Field Instruments

- 6.5. Market summary by type (market size, leading vendors) - Field Instruments

- 6.6. Trends - Field Instruments

- 6.7. Technical summary - Remote I/O

- 6.8. Market summary by type (market size, leading vendors) - Remote I/O

- 6.9. Trends - Remote I/O

- 6.10. Technical summary - Controllers

- 6.11. Market summary by type (market size, leading vendors) -Controllers

- 6.12. Trends - Controllers

- 6.13. Technical summary - Gateways

- 6.14. Market summary by type (market size, leading vendors) - Gateways

- 6.15. Trends - Gateways

7. Industrial Connectivity Software - Protocol Converters

- 7.1. Chapter overview

- 7.2. Technical overview of OT-OT and OT-IT protocol converters

- 7.3. Global market size and drivers

- 7.4. Technical summary OT-OT protocol converter

- 7.5. Market summary by type OPC/Non-OPC (market size, leading vendors)

- 7.6. Technical summary OT-IT protocol converter

- 7.7. Market summary by segment (cloud/app specific, cloud/app agnostic) and by type OPC/Non-OPC for each segment (market size, leading vendors)

- 7.8. Trends in protocol converter market

8. Industrial Connectivity Software - Message Brokers

- 8.1. Chapter overview

- 8.2. Technical overview MQTT brokers

- 8.3. Market summary MQTT brokers

- 8.4. Trends in message broker market

9. Industrial Connectivity Software - DataOps

- 9.1. Chapter overview

- 9.2. Definition and elements (industrial data quality management and data modeling)

- 9.3. Global market size and drivers (overall, by industry, by region)

- 9.4. Industrial data quality management: definition, data quality management steps, market summary, vendor profiles

- 9.5. Data modeling: definition, market summary, modeling steps

- 9.6. Data modeling overview

- 9.7. Data model types: asset model, use-case model

- 9.8. Standard data models (ISA-95 equipment model, CESMII SM profile, PackML, PA-DIM)

- 9.9. Data modeling standards (OPC-UA, Sparkplug B, AAS, DTDL, WoT)

- 9.10. Operationalizing data models

- 9.11. Data modeling governance

- 9.12. Data modeling vendor profiles

- 9.13. Trends in the DataOps market

10. Data Transmission

- 10.1. Chapter overview

- 10.2. Definition and elements (Communication Pattern and Data Interchange Format)

- 10.3. Communication pattern description and types of communication patterns

- 10.4. Data interchange format description and types of data interchange formats

- 10.5. Data/Event streaming deep-dive

11. Architectures

- 11.1. Chapter overview

- 11.2. Architectures overview

- 11.3. Asset architectures overview, selection criteria

- 11.4. Asset hierarchies overview, advantages/disadvantages

- 11.5. Network topologies overview

- 11.6. Unified Namespace - overview, key components, implementation examples

- 11.7. Trends in architectures

12. Protocols

- 12.1. Chapter overview

- 12.2. 3 main types of industrial connectivity protocols

- 12.3. Protocols - OSI model

- 12.4. Technical summary - L1-focused OT protocols

- 12.5. Market summary - L1-focused OT protocols

- 12.6. Deep dive of selected protocols - L1-focused OT protocols

- 12.7. Trends - L1-focused OT protocols

- 12.8. Technical summary - General OT protocols

- 12.9. Market summary - General OT protocols

- 12.10. Deep dive of selected protocols - General OT protocols

- 12.11. Trends - General OT protocols

- 12.12. Technical summary - IT protocols

- 12.13. Market summary - IT protocols

- 12.14. Deep dive of two selected protocols - IT protocols

- 12.15. Trends - IT protocols

- 12.16. Protocol survey results

13. Case Studies

- 13.1. Case studies summary

- 13.2. Seven key takeaways

- 13.3. 18 individual industrial connectivity case studies