|

市場調查報告書

商品編碼

1464279

全球數位匯款市場:2024-2028Global Digital Money Transfer & Remittances: 2024-2028 |

||||||

| 關鍵統計 | |

|---|---|

本報告審視了全球數位匯款市場,探討了影響數位匯款採用和發展的關鍵驅動因素和挑戰,以及開放銀行、穩定幣、CBDC 和行動貨幣等各種金融技術。 、交易金額的趨勢與預測,行動、線上、國內/國際、即時支付等各類別、地區/主要國家的詳細分析、主要廠商競爭排行榜等。

市場數據與預測報告

研究套件包括對 85 個表格和 40,000 多個數據點中的一整套預測數據的存取。 此調查套件包括以下指標:

- 匯款用戶數

- 匯款交易總數

- 匯款交易總額

這些指標是為以下主要市場提供的:

- 手機國內匯款

- 網路國內匯款

- 行動國際匯款

- 線上國際匯款

- 消費者即時付款

瞻博網路研究互動式預測 (Excel) 具有以下功能:

- 統計分析:優點是可以搜尋資料期間所有地區和國家顯示的特定指標。 可以輕鬆修改圖表並將其匯出到剪貼簿。

- 國家/地區資料工具:此工具可讓您查看預測期間內的所有區域和國家指標。 您可以縮小搜尋欄中顯示的指標範圍。

- 國家比較工具:您可以選擇特定國家進行比較。 該工具包括匯出圖表的功能。

- 假設分析:透過五個互動式情境將預測指標與您自己的假設進行比較。

目錄

市場趨勢與策略

第1章要點/策略建議

- 要點

- 策略建議

第2章國際數位匯款

- 國際數位匯款

- 區塊鏈和穩定幣

- 區塊鏈

- 穩定幣

- CBDC

- 國際付款中的即時付款

- CBDC

- 數位匯款中的人工智慧

- 造成國際匯款市場混亂的因素

- 行動貨幣

- 新銀行

- 支付網關

- 小額信貸

- 時事

- 透過 P2P 平台改善數位匯款

第3章國內數位匯款與行動貨幣

- 國內數位匯款與行動貨幣

- 當前市場狀況與顯著趨勢

第4章數位匯款:主要匯款路線與區域分析

- 數位匯款:主要匯款路線和區域分析

- 數位匯款:區域分析與未來前景

- 北美

- 拉丁美洲

- 西歐

- 中歐/東歐

- 印度次大陸

- 遠東/中國

- 其他亞太地區

- 非洲/中東

- 各國數位匯款準備:熱圖分析

競賽排行榜

第1章數位匯款平台供應商:Juniper Research 競爭排行榜

第2章數位匯款平台供應商的公司簡介

- 數位匯款平台供應商供應商簡介

- Amdocs

- 康維瓦

- 華為

- Infosys EdgeVerve

- 交互

- 萬事達卡

- 尼姆

- OBO支付

- 貝寶

- RemitONE

- 波紋

- 無縫分發系統

- Telepin 軟體

- 圖恩斯

- 簽證

- 瞻博網路研究排行榜評估調查方法

第 3 章數位貨幣轉帳服務供應商:Juniper Research 競爭排行榜

- 匯款代理供應商簡介

- 貨幣直接

- 貨幣公平

- FairFX

- 因斯塔雷姆

- Moneycorp

- 速匯金

- OFX

- 雷米特利

- 瑞亞

- 斯克裡爾

- 西聯匯款

- 明智的

- 世界匯款

- Xoom

- 瞻博網路研究排行榜評估調查方法

資料和預測

第1章市場概述

- 數位匯款:簡介

- 國內數位匯款與行動貨幣

第2章假設及研究方法總結

- 研究方法與假設

- 立即付款

第 3 章數位匯款:預測概述

- 預測數位匯款的使用

- 行動和線上數位匯款活躍用戶

- 行動與線上匯款交易總數

- 手機匯款及網路匯款交易總額

第4章國內匯款:市場預測與要點

- 國內匯款預測

- 國內匯款活躍用戶

- 國內匯款交易總數

- 國內匯款交易總額

第5章國際匯款:市場預測與要點

- 預測國際匯款

- 國際匯款活躍用戶

- 國際匯款交易總數

- 國際匯款交易總額

第6章消費者即時支付:市場預測與重點

- 預測即時消費者付款

- 交易金額:國內消費者

- 交易金額:海外消費者

- 交易金額:消費者

| KEY STATISTICS | |

|---|---|

| Total transaction value in 2024: | $3.9tn |

| Total transaction value in 2028: | $6.5tn |

| 2024 to 2028 market growth: | 41% |

| Forecast period: | 2024-2028 |

Overview

Our "Digital Money Transfer & Remittances" research report provides a detailed evaluation and analysis of both the domestic and international markets, including the impact of instant payments, blockchain and CBDC and other initiatives disrupting the market such as mobile money, neobanks, mobile wallets and payment gateways. The research also considers the future challenges within digital money transfer and remittances, and emerging trends in the space.

In addition, this report covers market opportunities; providing strategic insights into the development of digital money transfer capabilities in line with new technologies, such as AI and machine learning.

It highlights future opportunities and technologies that are important for vendors, merchants and financial institutions to consider when adapting money transfer and digital remittances for the future, incorporating aspects such as Open Banking, instant transfers and CBDCs.

The report also positions 29 vendors across two Juniper Research Competitor Leaderboards, for digital money transfer and digital remittance; providing an invaluable resource for stakeholders seeking to understand the competitive landscape in the market.

The research suite contains a detailed dataset; providing forecasts for 61 countries across a wide range of different metrics, including total revenue from mobile domestic money transfer and online domestic money transfer to international mobile and online money transfer and instant transfers.

Key Features

- Market Dynamics: A strategic analysis of the major drivers, challenges, and innovations shaping the adoption and development of the digital money transfer and remittances space, including:

- The importance of using digital money transfer and remittances systems in the face of growing digital solutions.

- Future strategic directions and market outlook for digital money transfer and remittances vendors.

- Key drivers and benefits of digital money transfer and remittances for vendors, including an increase in global digital acceptance, the implementation of AI and ML, the analysis of real-time data and the impact on the digital money transfer and remittance space, as well as how money transfer platforms can improve the digital money transfer space.

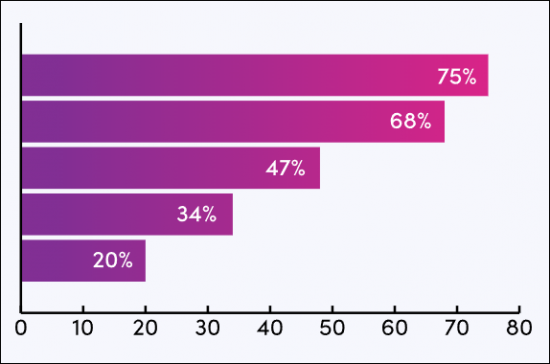

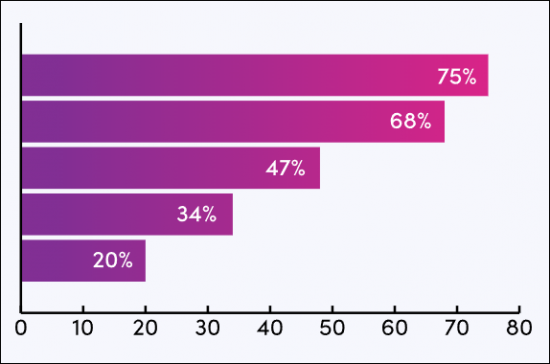

- Country Readiness Index: Comprehensive coverage featuring country-level market analysis on the future of the market in a select 61 countries split by 8 key regions; thoroughly analysing each country's potential success in the digital money transfer and remittance market, with insight into current and future trends, paired with supplementary 5-year forecast data.

- The importance of using digital money transfer and remittances systems in the face of growing digital solutions.

- Benchmark Industry Forecasts: Includes forecasts for the total money transfer for both domestic and international money movement, as well as the total money sent through consumer instant payment. This data is split by our 8 key forecast regions and 61 countries.

- Juniper Research Competitor Leaderboards: Key player capability and capacity assessment for 29 vendors in the digital money transfer and remittance space, via two Juniper Research Competitor Leaderboards.

- Market Dynamics: A strategic analysis of the major drivers, challenges, and innovations shaping the adoption and development of the digital money transfer and remittances space, including:

- The importance of using digital money transfer and remittances systems in the face of growing digital solutions.

- Future strategic directions and market outlook for digital money transfer and remittances vendors.

- Key drivers and benefits of digital money transfer and remittances for vendors, including an increase in global digital acceptance, the implementation of AI and ML, the analysis of real-time data and the impact on the digital money transfer and remittance space, as well as how money transfer platforms can improve the digital money transfer space.

- The importance of using digital money transfer and remittances systems in the face of growing digital solutions.

- Country Readiness Index: Comprehensive coverage featuring country-level market analysis on the future of the market in a select 61 countries split by 8 key regions; thoroughly analysing each country's potential success in the digital money transfer and remittance market, with insight into current and future trends, paired with supplementary 5-year forecast data.

- Benchmark Industry Forecasts: Includes forecasts for the total money transfer for both domestic and international money movement, as well as the total money sent through consumer instant payment. This data is split by our 8 key forecast regions and 61 countries.

- Juniper Research Competitor Leaderboards: Key player capability and capacity assessment for 29 vendors in the digital money transfer and remittance space, via two Juniper Research Competitor Leaderboards.

SAMPLE VIEW

Market Data & Forecasting Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

The market-leading research suite for the "Digital Money Transfer & Remittances" market includes access to the full set of forecast data of 85 tables and over 40,000 datapoints. Metrics in the research suite include:

- Total number of Money Transfer Users

- Total Number of Money Transfer Transactions

- Total Money Transfer Transaction Value

These metrics are provided for the following key market verticals:

- Mobile Domestic Money Transfer

- Online Domestic Money Transfer

- Mobile International Money Transfer

- Online International Money Transfer

- Consumer Instant Payments

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via 5 interactive scenarios

Market Trends & Strategies Report

Juniper Research's new report examines the "Digital Money Transfer & Remittances" market landscape in detail; assessing current trends and factors shaping the market such as the growing use and anticipation surrounding different financial technologies such as Open Banking, stablecoins, CBDCs and mobile money, and the use of AI and machine learning to improve the money transfer space. The report delivers comprehensive analysis of the strategic opportunities for digital money transfer and remittance providers within various markets; addressing key verticals and developing challenges, and how stakeholders should navigate these.

Competitor Leaderboard Report

Juniper Research's Competitor Leaderboards provide detailed evaluation and market positioning for 29 leading vendors in the "Digital Money Transfer & Remittances" space. The vendors are positioned either as established leaders, leading challengers or disruptors and challengers, based on capacity and capability assessments. The vendors in the Digital Money Transfer Leaderboard include:

- Amdocs

- Comviva

- Huawei

- Infosys EdgeVerve

- Interac

- Mastercard

- Nium

- OBOPAY

- PayPal

- RemitONE

- Ripple

- Seamless Distribution Systems

- Telepin Software

- Thunes

- Visa

The vendors in the Digital Remittances Competitor Leaderboard include:

- Currencies Direct

- CurrencyFair

- FairFX

- InstaREM

- Moneycorp

- MoneyGram

- OFX

- Remitly

- Ria

- Skrill

- Western Union

- Wise

- WorldRemit

- Xoom

Backed by a robust and comprehensive scoring methodology, Juniper Research's Competitor Leaderboard allows readers to gain greater insight into leading market players; enabling them to view which companies have the highest market prospects and the strategies being implemented.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. International Digital Money Transfer & Remittances

- 2.1. International Digital Money Transfer & Remittances

- 2.1.1. Definition and Scope

- 2.2. Blockchain and Stablecoins

- 2.2.1. Blockchain

- i. Examples of Blockchain Use in International Digital Money Transfer

- ii. Advantages of Blockchain in International Digital Money Transfer

- Figure 2.1: Advantages of Blockchain in Digital Money Transfer

- 2.2.2. Stablecoins

- i. Benefits of Stablecoins in Cross-border Digital Money Transfer

- ii. Perceived Risks of Stablecoins in Cross-border Digital Money Transfer

- 2.2.3. CBDCs

- 2.2.1. Blockchain

- 2.3. Instant Payments within Cross-border Payments

- 2.4. CBDCs

- 2.4.1. Project mBridge

- 2.5. Artificial Intelligence in Digital Money Transfer

- 2.6. Players Disrupting the International Remittance Market

- 2.6.1. Mobile Money

- 2.6.2. Neobanks

- 2.6.3. Payment Gateways

- 2.6.4. Microfinance

- 2.6.5. Current Events

- 2.6.6. Improving Digital Money Transfer through P2P Platforms

- i. Additional Services

- ii. Partnerships and Open APIs

3. Domestic Digital Money Transfer & Mobile Money

- 3.1. Domestic Digital Money Transfer and Mobile Money

- 3.1.1. Definitions and Scope

- 3.2. Current Market Status and Trends to Watch

4. Digital Money Transfer: Key Remittance Corridors & Regional Analysis

- 4.1. Digital Money Transfer: Key Remittance Corridors & Regional Analysis

- Figure 4.1: Juniper Research's 8 Key Regions Definition

- Table 4.2: Juniper Research Digital Money Transfer Country Readiness Index: Scoring Criteria

- Figure 4.3: Juniper Research Country Readiness Index - Digital Money Transfer Remittances

- Figure 4.4: Juniper Research's Competitive Web: Digital Money Transfer Regional Opportunities

- 4.2. Digital Money Transfer: Regional Analysis & Future Outlook

- 4.2.1. North America

- i. US

- ii. Canada

- 4.2.2. Latin America

- i. Argentina

- ii. Brazil

- iii. Colombia

- iv. Mexico

- 4.2.3. West Europe

- i. Denmark

- ii. France

- iii. Germany

- iv. Italy

- v.Netherlands

- vi. Norway

- vii. Portugal

- viii. Spain

- ix. Sweden

- x. UK

- 4.2.4. Central & East Europe

- i. Poland

- ii. Russia

- iii. Turkey

- 4.2.5. Indian Subcontinent

- i. India

- 4.2.6. Far East & China

- i. China

- ii. Japan

- iii. South Korea

- 4.2.7. Rest of Asia Pacific

- i. Australia

- ii. Singapore

- 4.2.8. Africa & Middle East

- i. Saudi Arabia

- ii. South Africa

- 4.2.9. Digital Money Transfer & Remittances Country Readiness: Heatmap Analysis

- Table 4.5: Juniper Research's Country Readiness Index: North America

- Table 4.6: Juniper Research's Country Readiness Index: Latin America

- Table 4.7: Juniper Research's Country Readiness Index: West Europe

- Table 4.8: Juniper Research's Country Readiness Index: Far East & China

- Table 4.9: Juniper Research's Country Readiness Index: Indian Subcontinent

- Table 4.10: Juniper Research's Country Readiness Index: Rest of Asia Pacific

- Table 4.11: Juniper Research's Country Readiness Index: Africa & Middle East

- 4.2.1. North America

Competitor Leaderboard

1. Juniper Research Digital Money Transfer Platform Providers Competitor Leaderboard

- 1.1. Why Read This Report?

- Table 1.1: Juniper Research Competitor Leaderboard Vendors: Digital Money Transfer Platform Providers

- Figure 1.2: Juniper Research Competitor Leaderboard: Digital Money Transfer Platform Providers

- Table 1.3: Juniper Research Competitor Leaderboard: Digital Money Transfer Platform Providers

- Table 1.4: Juniper Research Competitor Leaderboard Digital Money Transfer Platform Providers - Heatmap

2. Digital Money Transfer Platform Providers Company Profiles

- 2.1. Digital Money Transfer Platform Providers Vendor Profiles

- 2.1.1. Amdocs

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.2. Comviva

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level Views of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.3. Huawei

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.4. Infosys EdgeVerve

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.5. Interac

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.6. Mastercard

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.1: Mastercard Send Platform

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.7. Nium

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.8. OBOPAY

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.9. PayPal

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Strategic Opportunities

- 2.1.10. RemitONE

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.11. Ripple

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Deevelopment Opportunities

- 2.1.12. Seamless Distributions Systems

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.13. Telepin Software

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.14. Thunes

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.15. Visa

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- Table 2.2: Juniper Research Digital Money Transfer Leaderboard Assessment Criteria

- 2.1.1. Amdocs

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.2.1. Limitations & Interpretations

3. Juniper Research Competitor Leaderboard for Digital Money Transfer Remittance Providers

- Table 3.1: Juniper Research Competitor Leaderboard: Digital Remittance Providers

- Figure 3.2: Juniper Research Competitor Leaderboard - Digital Remittance Vendors

- Table 3.3: Juniper Research Competitor Leaderboard: Digital Remittance Vendor Ranking

- Table 3.4: Juniper Research Competitor Leaderboard: Digital Remittance Vendors - Heatmap

- 3.1. Money Transfer Remittance Providers Vendor Profiles

- 3.1.1. Currencies Direct

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.2. CurrencyFair

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.3. FairFX

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.4. Instarem

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.5. Moneycorp

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.6. MoneyGram

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.7. OFX

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research View: Strategic Recommendations & Key Development Opportunities

- 3.1.8. Remitly

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.9. Ria

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.10. Skrill

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.11. Western Union

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.12. Wise

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.13. WorldRemit

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.14. Xoom

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- Table 3.5: Juniper Research Digital Remittance Assessment Criteria

- 3.1.1. Currencies Direct

- 3.2. Juniper Research Leaderboard Assessment Methodology

- 3.2.1. Limitations & Interpretations

Data & Forecasting

1. Market Overview

- 1.1. Digital Money Transfer Introduction

- 1.1.1. Definition and Scope

- 1.2. Domestic Digital Money Transfer and Mobile Money

- 1.2.1. Definitions and Scope

2. Methodology Assumptions and Summary

- 2.1. Introduction

- 2.2. Methodology & Assumptions

- 2.2.1. Market Sizing: Introduction

- 2.2.2. Methodology

- 2.2.3. Indicators

- 2.3. Instant Payments

- 2.3.1. Introduction

- Figure 2.1: Digital Money Transfer & Remittances Market Forecast Methodology

- Figure 2.2: Consumer Instant Payments Methodology

- 2.3.1. Introduction

3. Digital Money Transfer & Remittances: Forecast Summary

- 3.1. Digital Money Transfer & Remittances Usage Forecasts

- 3.1.1. Mobile & Online Digital Money Transfer Active Users

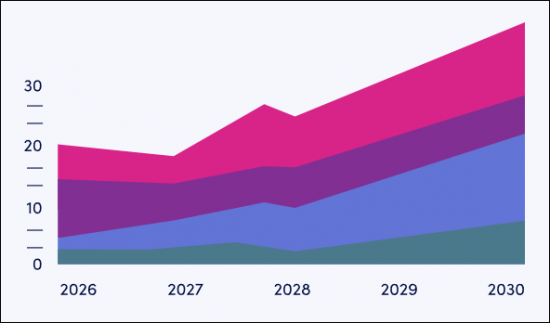

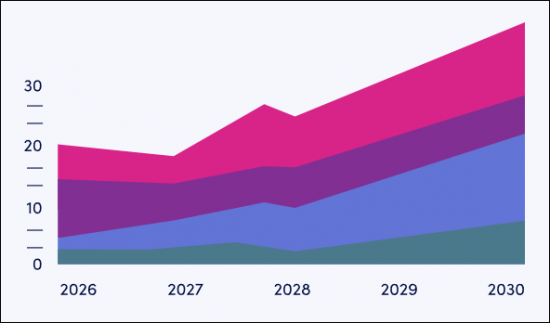

- Figure & Table 3.1: Total Number of Active Digital Money Transfer Users (m), Split by 8 Key Regions, 2023-2028

- 3.1.2. Mobile & Online Money Transfer & Remittances Total Transaction Volume

- Figure & Table 3.2: Total Digital Money Transfer & Remittance Transactions per annum (m), Split by 8 Regions, 2023-2028

- 3.1.3. Mobile & Online Money Transfer & Remittances Total Transaction Value

- Figure & Table 3.3: Total Value of Mobile & Online Money Transfer per annum ($m), Split by 8 Key Regions, 2023-2028

- 3.1.1. Mobile & Online Digital Money Transfer Active Users

4. Domestic Money Transfer: Market Forecasts & Key Takeaways

- 4.1. Domestic Money Transfer Forecasts

- 4.1.1. Domestic Money Transfer Active Users

- Figure & Table 4.1: Mobile & Online Domestic Money Transfer, Active Users (m), Split by 8 Key Regions, 2023-2028

- 4.1.2. Domestic Money Transfer Total Transactions Volumes

- Figure & Table 4.2: Total Number of Mobile & Online Domestic Money Transfer Transactions per annum (m), Split by 8 Key Regions, 2023-2028

- 4.1.3. Domestic Money Transfer Total Transaction Values

- Figure & Table 4.3: Total Value of Mobile & Online Domestic Transaction per annum ($m), Split by 8 Key Regions, 2023-2028

- 4.1.1. Domestic Money Transfer Active Users

5. International Money Transfer & Remittances: Market Forecasts & Key Takeaways

- 5.1. International Money Transfer & Remittances Forecasts

- 5.1.1. International Money Transfer Active Users

- Figure & Table 5.1: Mobile & Online International Money Transfer, Active Users (m), Split by 8 Key Regions, 2023-2028

- 5.1.2. International Money Transfer Total Transaction Volume

- Figure & Table 5.2: Total Number of Mobile & Online International Money Transfer Transactions per annum (m), Split by 8 Key Regions, 2023-2028

- 5.1.3. International Money Transfer Total Transaction Value

- Figure & Table 5.3: Total Value of Mobile & Online International Transactions per annum ($m), Split by 8 Key Regions, 2023-2028

- 5.1.1. International Money Transfer Active Users

6. Consumer Instant Payments: Market Forecasts & Key Takeaways

- 6.1. Consumer Instant Payments Forecast

- 6.1.1. Value of Domestic Consumer Instant Payments

- Figure & Table 6.1: Total Value of Instant Payments Domestic Consumer Transactions ($m), Split by 8 Key Regions, 2023-2028

- 6.1.2. Value of Cross-border Consumer Instant Payments

- Figure & Table 6.2: Total Value of Instant Payments Cross-border Consumer Transactions ($m), Split by 8 Key Regions, 2023-2028

- 6.1.3. Value of Consumer Instant Payments

- Figure & Table 6.3: Total Value of Instant Payments Consumer Transactions ($m), Split by 8 Key Regions, 2023-2028

- 6.1.1. Value of Domestic Consumer Instant Payments