|

市場調查報告書

商品編碼

1536792

電子封裝:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Electronic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

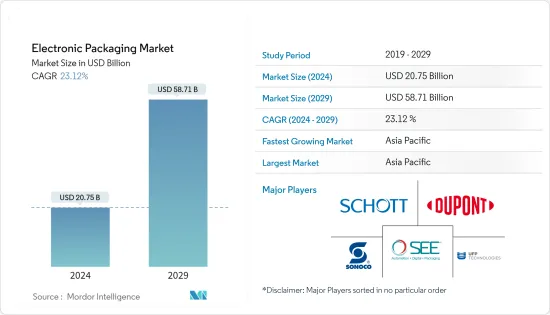

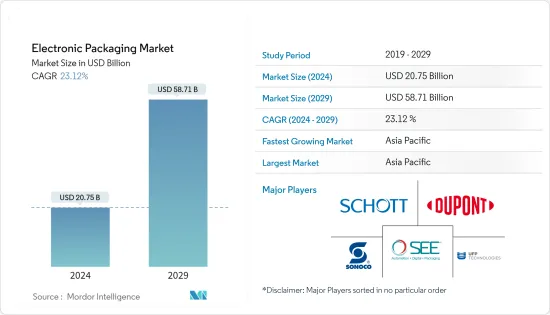

預計2024年全球電子封裝市場規模將達207.5億美元,2024-2029年預測期間複合年成長率為23.12%,2029年將達587.1億美元。

主要亮點

- 對電視、機上盒、MP3播放器、數位相機等的需求不斷成長,使得電子產品包裝適合大規模生產。物聯網、人工智慧的興起以及複雜電子產品的激增正在推動消費性電子和汽車產業的高階應用。由於這些因素,正在採用更先進的電子封裝技術來維持需求。

- 電子公司正逐漸將永續實踐納入包裝設計中。我們認知到這會對消費者的決策產生重大影響。例如,三星承諾在 2025 年之前在其產品系列中使用環境永續材料。這包括用生物分解性或回收材料替代塑膠包裝材料。此類舉措不僅迎合了具有環保意識的購買群體,而且還使該品牌在環保意識日益增強的市場中成為負責任的領導者。

- 此外,數位革命也對包裝設計產生了一些影響。消費性電子產品包裝包括2D碼、AR(擴增實境)介面、NFC(近距離場通訊)標籤等。這些技術變得越來越流行,並正在改變消費者與包裝互動的方式。

- 這些技術透過將實體包裝與數位體驗相結合來增強用戶參與度。例如,盒子上的2D碼可以引導消費者存取包含詳細產品規格、使用者評論或產品虛擬實境體驗的網站。因此,這些技術正成為消費性電子產品封裝套件中不可或缺的一部分。

- 汽車產業在受調查的市場中佔據很大一部分,這主要是由於電動車(EV)和混合動力汽車的日益普及。電動和混合動力汽車汽車使用大量儲存裝置、處理器、類比電路、分離功率元件和感測器,因此預計在預測期內需求將激增。

- 據 IBEF 稱,到 2025 年,印度電動車 (EV) 市場預計將達到 5,000 億盧比(70.9 億美元)。此外,根據 CEEW 能源金融中心的一項研究,到 2030 年,印度的電動車機會將達到 2,060 億美元。這些新興市場的開拓預計將進一步推動電子封裝市場的成長。

- 疫情嚴重影響了電子封裝解決方案和消費性電子封裝的銷售。消費性電子產品包裝的需求是由行動電話和電腦產業所推動的。即使在疫情期間,生產停頓、原料短缺和供應鏈中斷也沒有對這些產業的產出產生重大影響。

電子封裝市場趨勢

電子封裝在航太和國防領域的採用預計將增加

- 美國、法國、英國等已開發國家以及俄羅斯、印度、中國等許多開發中國家的國防預算都在定期成長。其中許多國家也有出口武器的興趣。因此,航太和國防市場的研發投資仍在繼續。

- 在當今不斷變化的地緣政治情勢下,必須重視集體自衛的重要性。從武器、導引和導航系統、對抗措施、武裝車輛及其動力來源,軍隊和國防力量對於國家安全和抵禦外部威脅至關重要。為了維持強大的軍事體系,監視和武裝部隊必須有效且有效率地運作。

- 印度國防生產部表示,該國國防產值將從2019會計年度的8,112億印度盧比(115.2億美元)增加至2023會計年度的1,086.4億印度盧比(131.6億美元)。此外,該國的國防電池需求預計將從2022年的4吉瓦時激增至2030年的10吉瓦時。該國國防生產的持續成長,加上國防電池的日益普及,預計將在預測期內推動市場成長。

- 海軍軍艦、艦載衛星通訊通道、武器控制系統、海岸防衛隊等使用許多先進的電子產品,並需要電子元件採用軍用級封裝。潮濕和惡劣的環境需要高品質的產品,並鼓勵研發投資。

亞太地區市場將實現顯著成長

- 由於汽車基礎設施的成長和電動車銷量的增加,預計亞太地區在估計和預測期內將佔據最大的市場佔有率。中產階級收入的增加和大量年輕人口可能會增加對汽車產業的需求。印度汽車工業商協會(SIAM)預計,2023年乘用車總產量為454萬輛,較2022年的365萬輛大幅成長,預計將帶動未來研究市場的成長馬蘇。

- 此外,中國被認為是世界電子中心,因為它生產大量符合最高品質、性能和交付標準的電氣元件和電子產品。這為電子封裝市場帶來了巨大的成長潛力。

- 內需大幅成長、技術進步、高品質產品生產是中國工業成長的主要動力。中國如此大規模的紙和紙板生產為電子產品包裝的銷售創造了健康的環境。

- 據NIPFA(國家投資促進和便利機構)稱,印度對電子產品的需求大幅成長。在強力的政策支持、相關人員大規模投資以及電子產品需求快速成長的推動下,電子製造業預計到2025年將達到2,200億美元。

電子封裝產業概況

電子封裝市場較為分散。微系統幾乎應用於每個工業領域,其中包括消費性電子、醫療保健設備、航太和國防以及通訊等關鍵領域。主要市場參與者包括 UFP Technologies、Schott AG、Sealed Air Corporation、DuPont de Nemours, Inc. 和 Sonoco Products Company。

- 2023 年 9 月,Schott AG 推出了適用於航太業的新型微電子封裝。該封裝旨在延長航空電子設備保護的使用壽命,同時與可伐鐵鎳合金製成的傳統電子封裝相比,重量減輕高達 75%。據說該產品還可以保護敏感電子設備,例如射頻設計、直流/直流轉換器(DC/DC)、儲能設備和感測器組件。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 市場促進因素

- 加速全球電動車銷售

- 技術進步提升產品品質

- 市場限制因素

- 電子封裝高成本且缺乏熟練的專業人員是市場成長的挑戰

- 技術簡介

第5章市場區隔

- 按材質

- 塑膠

- 金屬

- 玻璃

- 按最終用戶產業

- 家電

- 航太/國防

- 車

- 衛生保健

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 中國

- 印度

- 日本

- 澳洲

- 拉丁美洲

- 巴西

- 阿根廷

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 北美洲

第6章 競爭狀況

- 公司簡介

- SCHOTT AG

- DuPont de Nemours Inc.

- Sealed Air Corporation

- GY Packaging

- UFP Technologies Inc.

- Sonoco Products Company

- Smurfit Kappa Group PLC

- Dunapack Packaging Group

- WestRock Company

- Mondi Group

- Dordan Manufacturing Company

第7章 投資分析

第8章市場的未來

The Electronic Packaging Market size is estimated at USD 20.75 billion in 2024, and is expected to reach USD 58.71 billion by 2029, growing at a CAGR of 23.12% during the forecast period (2024-2029).

Key Highlights

- Electronic packaging is more suited for mass production due to the rising demand for TVs, set-top boxes, MP3 players, and digital cameras. The rise of IoT and AI and the proliferation of complex electronics drive the high-end application segment in the consumer electronics and automotive industries. Due to these factors, more advanced electronic packaging technologies are being adopted to sustain demand.

- Electronics corporations are progressively incorporating sustainable practices into their packaging designs. They acknowledge that this can significantly influence consumer decisions. For instance, Samsung has pledged to use environmentally sustainable materials throughout its product range by 2025. This initiative includes substituting plastic packaging materials with biodegradable or recycled goods. Such endeavors not only cater to environmentally conscious buyers but also establish a brand as a responsible leader in an increasingly sensitive market to environmental concerns.

- Moreover, the digital revolution has impacted packaging design in several ways. Consumer electronics packaging includes QR codes, augmented reality (AR) interfaces, and NFC (near-field communication) tags. These technologies are becoming increasingly popular and are transforming the way consumers interact with packaging.

- These technologies enhance user engagement by merging physical packaging with digital experiences. For instance, a QR code on a box can direct consumers to a website with detailed product specifications, user reviews, or even virtual reality experiences of the product in action. As a result, these technologies are becoming an essential part of the consumer electronics packaging toolkit.

- The automotive sector accounts for a significant portion of the market studied, mainly due to its increasing adoption of electric vehicles (EVs) and hybrid vehicles. As a large number of memory devices, processors, analog circuits, discrete power devices, and sensors are used in electric and hybrid cars, demand is set to rise rapidly over the forecast period.

- According to IBEF, India's electric vehicle (EV) market is expected to reach INR 50,000 crores (USD 7.09 billion) by 2025. Furthermore, a CEEW Centre for Energy Finance study shows that India will have USD 206 billion in opportunities for electric vehicles by 2030. Such developments will further drive the market growth for electronic packaging.

- The pandemic severely affected the sales of electronic packaging solutions and consumer electronics packaging. The demand for consumer electronics packaging is driven by the mobile phone and computer industries. Even during the pandemic, the halt in production, scarcity of raw materials, and supply chain disruptions did not significantly impact the outputs of these industries.

Electronic Packaging Market Trends

The Aerospace and Defense Segment is Expected to Increasingly Adopt Electronic Packaging

- The defense budgets of developed nations, such as the United States, France, and the United Kingdom, and many developing nations, such as Russia, India, and China, have been increasing regularly. Many of these nations are also interested in the export of weapons. This has resulted in continued investment in R&D in the aerospace and defense market.

- The importance of collective defense must be addressed in today's ever-changing geopolitical landscape. From weapons, guidance, navigation systems, countermeasures, and armed vehicles and their power sources, military and defense forces are essential for a nation's security and defense against external threats. Surveillance and armed forces must operate effectively and efficiently to maintain a strong military system.

- According to the Department of Defence Production (India), the value of the country's defense production increased from INR 811.20 billion (USD 11.52 billion) in FY 2019 to INR 1086.84 billion (USD 13.16 billion) in FY 2023. Furthermore, the country's demand for defense batteries was expected to surge from 4 gigawatt hours in 2022 to 10 gigawatt hours in 2030. Such a constant rise in defense production in the country, coupled with the rise in the adoption of defense batteries, is expected to bolster the market growth during the forecast period.

- Naval warships, satellite communication channels on board, weapon control systems, coastguards, etc., use many sophisticated electronic products and require military-grade packaging of the electronic components. Humidity and harsh environments require high-quality products and facilitate investment in R&D.

Asia-Pacific to Experience Significant Market Growth

- Asia-Pacific is estimated to hold the largest market share during the forecast period owing to growing automotive infrastructure and increased sales of electric vehicles. Rising middle-class income and a large youth population may drive up demand in the automotive industry. According to the Society of Indian Automobile Manufacturers (SIAM), in 2023, the total production of passenger vehicles was 4.54 million units, significantly up from 3.65 million units in 2022, which would drive the growth of the market studied in the future.

- Furthermore, China is considered the electronic hub worldwide because it mass-manufactures and produces electrical components and electronic products that meet the highest quality, performance, and delivery standards. This gives significant growth potential to the electronic packaging market.

- Massive increases in domestic demand, technological advancements, and the production of high-quality products have been China's primary drivers of industry growth. Such large-scale production of paper and paperboard in China is creating a healthy environment for the sales of electronic packaging.

- According to the National Investment Promotion & Facilitation Agency (NIPFA), India has seen a significant increase in demand for electronic products. The electronic manufacturing sector is anticipated to reach USD 220 billion by 2025 due to strong policy support, massive investments by multiple stakeholders, and a surge in demand for electronic products.

Electronic Packaging Industry Overview

The electronic packaging market is fragmented. Microsystems are used in almost every industry vertical, with some significant sections being consumer electronics, healthcare equipment, aerospace and defense, communications, etc. The major market players include UFP Technologies, Schott AG, Sealed Air Corporation, DuPont de Nemours, Inc., and Sonoco Products Company.

- In September 2023, Schott AG unveiled new microelectronic packages for the aerospace industry. The packages aim to extend the life of avionics protection while reducing the weight by up to 75% compared to conventional electronic packaging made from Kovar iron-nickel alloy. The products are also said to protect sensitive electronics, such as radio frequency designs, direct current/direct current converters (DC/DC), electrical storage devices, and sensor components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Accelerated Sales of Electrical Automotives Across the Globe

- 4.4.2 Technological Advancements Drive the Product Quality

- 4.5 Market Restraints

- 4.5.1 High Costs for Electronic Packaging and Lack of Skilled Professionals to Challenge the Market Growth

- 4.6 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Metal

- 5.1.3 Glass

- 5.2 By End User Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Aerospace and Defense

- 5.2.3 Automotive

- 5.2.4 Healthcare

- 5.3 By Geography***

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.3 Asia

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.5 Middle East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 SCHOTT AG

- 6.1.2 DuPont de Nemours Inc.

- 6.1.3 Sealed Air Corporation

- 6.1.4 GY Packaging

- 6.1.5 UFP Technologies Inc.

- 6.1.6 Sonoco Products Company

- 6.1.7 Smurfit Kappa Group PLC

- 6.1.8 Dunapack Packaging Group

- 6.1.9 WestRock Company

- 6.1.10 Mondi Group

- 6.1.11 Dordan Manufacturing Company