|

市場調查報告書

商品編碼

1639391

對苯二甲酸 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Terephthalic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

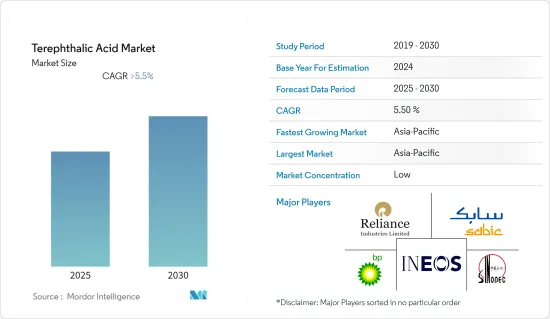

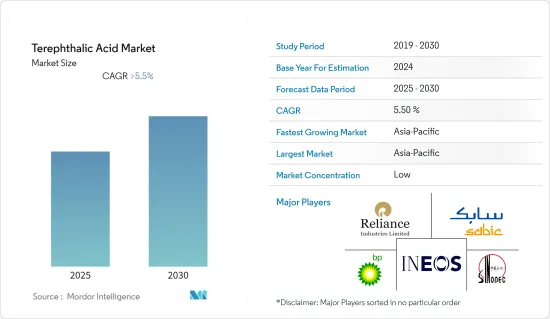

預計對苯二甲酸市場在預測期內的複合年成長率將超過5.5%。

由於2020年和2021年初Covid-19大流行的零星爆發,包裝、紡織品、油漆和塗料等關鍵應用領域對對苯二甲酸的需求因政府禁令和限制以及市場成長有限而受到顯著抑制。在下游包裝行業,由於商業設施關閉和遊客流動,銷售低迷。電商食品和零售服務在停工期間有所成長,但無法抵消大型食品和飲料領域銷售額的下降。此外,由於人們被限制在家裡,對紡織品的需求大幅下降。同時,由於原料供不應求、工作時間和條件限制以及資金緊張,對苯二甲酸的生產和銷售陷入癱瘓。然而,自2021年中疫情消退以來,該產業一直呈現復甦趨勢。 2022年,下游需求復甦,對苯二甲酸合約恢復,市場成長動力增強。

主要亮點

- 從中期來看,包裝領域下游產品聚對苯二甲酸乙二醇酯(PET)消費量的增加以及亞太紡織業對聚酯纖維的高需求是推動該市場成長的關鍵驅動力。

- 另一方面,對苯二甲酸的健康和環境毒性預計將在預測期內限制目標產業的成長。

- 對苯二甲酸生產中採用的生產技術的進一步進步可能為全球市場創造利潤豐厚的成長機會。

- 亞太地區已成為最大的紡織化學品市場,預計在預測期內仍將維持最高複合年成長率。亞太地區的這一優勢歸因於中國和印度等不斷發展的經濟體對包裝、紡織品和塗料應用的強勁需求。

對苯二甲酸市場趨勢

聚酯纖維需求增加

- 全球生產的對苯二甲酸大部分用於生產聚酯纖維。

- 聚酯纖維具有高強度、彈性和耐久性等特性。聚酯纖維快乾、耐洗、抗收縮、抗張伸、耐磨和耐各種化學物質。聚酯纖維被認為是耐用的合成纖維,用於服裝、家居用品(地板材料、窗簾等)、室內裝飾、汽車紡織品和工業應用(頁岩氣裂解、地工織物、過濾、屋頂膜)。的。

- 聚酯纖維防潮、防污,使其成為戶外服裝、特殊服裝和防護服裝的首選布料。聚酯纖維因其重量輕且易於染色而廣泛用於家居家具和室內裝飾織物。

- 服飾是一些國家的重要出口商品。美國擁有蓬勃發展的時尚和服飾。該國多年來一直在加強服飾貿易,2021年出口額達850.7億美元(根據美國商務部和OTEXA公佈),比2020年服裝出口成長21.07%。

- 此外,根據國際勞工組織(ILO)的數據,全球服飾出口的60%以上是在新興國家生產的,其中亞太地區佔32%。中國海關總署公佈的數據顯示,2022年1月至7月,中國作為亞太地區最大的服飾市場,服飾出口額成長17.35%,達到1,893.5億美元。

- 聚酯纖維因其高強度和模量、優異的形狀保持性以及強大的抗紫外線、耐熱和耐磨性能而成為汽車座椅套設計的廣泛首選材料。除了座椅套之外,聚酯纖維還用於安全氣囊、安全帶、側板、車頂內襯等。根據OICA統計,2021年汽車產量達8,014萬輛,較2020年同期成長3%。預計這將增加所研究市場的需求。

- 紡織品、汽車生產和其他應用領域不斷擴大的市場趨勢預計將大幅增加聚酯纖維的消費量,從而增加預測期內對苯二甲酸的需求。

亞太地區主導市場

- 由於中國和印度等國家擁有成熟的下游包裝、紡織製造以及食品和飲料產業,亞太地區在全球對苯二甲酸市場佔據主導地位。廉價的勞動力和低廉的生產成本支撐了這些國家下游產業的成長。

- 中國對苯二甲酸的產量和需求均領先全球。此外,為了鞏固其在下游市場的地位,中國正在對苯二甲酸進行大規模產能擴張。例如,2021年,逸盛石化新建的兩條高純度對苯二甲酸(PTA)生產線開始運作。江蘇嘉通能源南通市也計劃擴建其PTA生產線,年產能為250萬噸。

- 另一方面,中國擁有全球最大的紡織業,對PTA衍生聚酯纖維的需求量大。中國工業和資訊化部資料顯示,2022年1-9月中國紡織業持續平穩擴張。中國主要紡織企業營業收入達3.86兆元(5,700億美元),較去年同期成長3.1%。

- 根據IBEF估計,到2025-2026年,印度紡織服裝業預計將達到1,900億美元。印度在全球紡織品和服裝貿易中的佔有率為4%。 2022年,印度紡織品服飾出口額達444億美元,與前一年同期比較大幅成長41%。

- 聚對苯二甲酸乙二醇酯 (PET) 源自對苯二甲酸,是包裝應用中使用的重要塑膠材料。據印度包裝工業協會 (PIAI) 稱,過去五年該行業的複合年成長率超過 20%。印度包裝產業在進出口方面擁有良好的記錄,促進了該國技術和創新的成長,並為各個製造業增加了價值。

- 因此,PTA 生產投資的增加以及各最終用戶產業對 PTA 需求的增加預計將推動亞太地區受訪市場的成長。

對苯二甲酸產業概況

對苯二甲酸市場是部分分割的。主要參與企業(排名不分先後)包括 SABIC、中國石化、阿科瑪、INEOS 和 BP plc。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 包裝領域聚對苯二甲酸乙二酯消費性擴大

- 亞太地區紡織業對聚酯纖維的龐大需求

- 抑制因素

- 對苯二甲酸毒性

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 衍生性商品

- 聚對苯二甲酸乙二酯 (PET)

- 聚丁烯對苯二甲酸酯(PBT)

- 聚對苯二甲酸丙二醇酯 (PTT)

- 對苯二甲酸二甲酯

- 目的

- 包裝

- 纖維

- 畫

- 膠水

- 其他用途(醫藥、化學中間體)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Arkema

- BP plc

- INEOS

- China Petroleum & Chemical Corporation

- Eastman Chemical Company

- Formosa Petrochemical Co.

- Indian Oil Corporation Ltd

- Indorama Ventures Public Company Limited

- Lotte Chemical Corporation

- Mitsubishi Chemical Corporation

- PetroChina Company Limited

- Reliance Industries Limited

- SABIC

- Samyang Holdings Corporation

第7章 市場機會及未來趨勢

- 生產技術的進步

The Terephthalic Acid Market is expected to register a CAGR of greater than 5.5% during the forecast period.

The sporadic outbreak of the COVID-19 pandemic in 2020 and the first half of 2021 drastically curtailed the demand for terephthalic acid in its major application sectors, i.e., packaging, fibers for textile, and paint and coatings, due to imposed government bans and restrictions, thereby limiting the growth of the market. The downstream packaging industry exhibited lackluster sales due to closed commercial places and tourist movements. The increased e-commerce food and retail service during lockdowns could not compensate for the declining sales in large-scale food and beverage sectors. Furthermore, the demand for textiles dropped drastically as people were confined to staying in their houses. Meanwhile, terephthalic acid production and distribution activities were paralyzed owing to scarce raw material supply, limited working hours/labor strength, and constrained financials. However, the industries have been on track for recovery since the pandemic's retraction in mid-2021. The demand from downstream sectors rebounded in 2022, reinstating terephthalic acid contracts, which kick-started the market growth.

Key Highlights

- Over the medium term, the rising consumption of the downstream product polyethylene terephthalate (PET) from the packaging sector and the high demand for polyester fibers in the textile industries of Asia Pacific are the major driving factors augmenting the growth of the market studied.

- On the flip side, the toxic effects of terephthalic acid on health and the environment are anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the growing advancement in production techniques employed in manufacturing terephthalic acid will likely create lucrative growth opportunities for the global market.

- Asia-Pacific emerged as the largest market for textile chemicals and is expected to witness the highest CAGR during the forecast period. This dominance of Asia-Pacific is attributed to the bullish demand for packaging, fibers, and coating applications in growing economies like China and India.

Terephthalic Acid Market Trends

Increasing Demand from Polyester Fibers

- A significant share of the total globally produced terephthalic acid is used for manufacturing polyester fiber, a long-chain polymer with the ester functional group in each repeating unit.

- Polyester fibers carry attributes such as high strength, resilience, and durability. They exhibit quick drying ability, washability, and resistance to shrinkage, stretching, abrasion, and various chemicals. Polyester fibers are recognized as durable synthetic fabric/textiles that find application in apparel, home furnishing (floor coverings, curtains, etc.), upholstery, automotive textiles, and industrial (shale gas cracking, geotextiles, filtration, membranes for roofing) applications.

- Polyester fibers have become a fabric of choice for outdoor, specialty, and protective clothing because they can resist moisture and remain stain resistant. Polyester fabrics are widely used in home furnishing and upholstery fabrics due to being lightweight and presenting the ease of dyeing to form an array of colors and patterns.

- Clothing is a crucial export commodity in several countries. The United States boasts a thriving fashion and clothing industry. The country has strengthened its clothing trade over the years, closing the year 2021 with USD 85,007 million export value (revealed by the US Department of Commerce and OTEXA), up by 21.07% from the apparel export value obtained in 2020.

- Furthermore, as per the International Labour Organization, more than 60% of the world's clothing exports are manufactured in developing countries, with Asia-Pacific accounting for 32% of the share. China, the biggest apparel market in the Asia-Pacific region, registered a 17.35% hike in garment export shipments valued at USD 189.35 billion in the first seven months of 2022, as per the General Administration of Customs China.

- Polyester fibers are widely preferred material for designing automobile seat covers because of their high strength and modulus, good shape retention, and firm performance against UV radiation, heat, and abrasion. Apart from seat covers, polyester fibers are used in airbags, seat belts, side panels, headliners, etc. According to the OICA, in 2021, automobile production reached 80.14 million units, increasing by 3% from the same period in 2020. This is expected to augment the demand for the market studied.

- The growing market trends in the textile, automobile production, and other application sectors are expected to surge the consumption of polyester fibers, thereby increasing the demand for terephthalic acid in the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominates the global terephthalic acid market owing to the presence of matured downstream packaging, textile manufacturing, and food and beverage industries in countries like China and India. The availability of cheap labor and low production cost back the growth of the downstream industries in these countries.

- China leads the world in terms of both production and demand for terephthalic acid. Moreover, to bolster its position in the downstream markets China is undergoing a massive capacity expansion of terephthalic acid. For instance, in 2021, the country witnessed the commissioning of Yisheng Petrochemical's two new purified terephthalic acid (PTA) production lines, each having a capacity of 3.3 million tons per year. Jiangsu Jiatong Energy Nantong City is also planning to expand its PTA line with the addition of 2.5 million tons per annum capacity.

- On the other hand, China owns the world's largest textile industry where PTA-derived polyester fibers are in high demand. China's textile industry continued steady expansion in the first nine months of 2022, according to data from the country's Ministry of Industry and Information Technology. The combined operating revenue of major textile enterprises in China rose by 3.1% y-o-y reaching CNY 3.86 trillion (USD 570 billion) in that period.

- According to IBEF, the Indian textile and apparel industry is estimated to reach USD 190 billion by 2025-2026. India has a 4% share of the global trade in textiles and apparel. In FY 2022, India's textile and apparel exports amounted to USD 44.4 billion, registering a whopping 41% y-o-y increase.

- Polyethylene terephthalate (PET) derived from terephthalic acid is a crucial plastic material used for packaging applications. According to the Packaging Industry Association of India (PIAI), the sector has grown at a CAGR of over 20% in the past five years. The Indian packaging industry has made a mark with its exports and imports, thus driving technology and innovation growth in the country and adding value to the various manufacturing sectors.

- Thus, the rising investments in PTA production and growing demand for PTA in various end-user industries are projected to propel the growth of the market studied in the Asia-Pacific region.

Terephthalic Acid Industry Overview

The terephthalic acid market is partly fragmented in nature. Some of these major players (not in any particular order) include SABIC, Sinopec Corp., Arkema, INEOS, and BP p.l.c. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Consumption for Polyethylene Terephthalate in the Packaging Sector

- 4.1.2 Significant Demand of Polyester Fibers from the Textile Sector in Asia Pacific

- 4.2 Restraints

- 4.2.1 Toxic Effects of Terephthalic Acid

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Derivative

- 5.1.1 Polyethylene Terephthalate (PET)

- 5.1.2 Polybutylene Terephthalate (PBT)

- 5.1.3 Polytrimethylene Terephthalate (PTT)

- 5.1.4 Dimethyl Terephthalate

- 5.2 Application

- 5.2.1 Packaging

- 5.2.2 Fibers

- 5.2.3 Paints and Coatings

- 5.2.4 Adhesives

- 5.2.5 Other Applications (Pharmaceuticals, Chemical Intermediates)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 BP p.l.c.

- 6.4.3 INEOS

- 6.4.4 China Petroleum & Chemical Corporation

- 6.4.5 Eastman Chemical Company

- 6.4.6 Formosa Petrochemical Co.

- 6.4.7 Indian Oil Corporation Ltd

- 6.4.8 Indorama Ventures Public Company Limited

- 6.4.9 Lotte Chemical Corporation

- 6.4.10 Mitsubishi Chemical Corporation

- 6.4.11 PetroChina Company Limited

- 6.4.12 Reliance Industries Limited

- 6.4.13 SABIC

- 6.4.14 Samyang Holdings Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancement in Production Technology