|

市場調查報告書

商品編碼

1273305

二聚酸市場 - COVID-19 的增長、趨勢、影響和預測 (2023-2028)Dimer Acid Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,二聚酸市場的複合年增長率預計將超過 5%。

COVID-19 大流行阻礙了市場,因為封鎖、社會疏遠和貿易制裁對全球供應鍊網絡造成了巨大破壞。 由於活動暫停,建築業出現下滑。 然而,預計 2021 年情況將有所改善,在預測期內使市場受益。

主要亮點

- 聚□胺樹脂應用的擴展以及粘合劑和燃料油添加劑應用的擴展正在推動市場增長。

- 原材料價格的波動以及油菜籽、棉籽和豆油生產的不確定性預計會阻礙市場增長。

二聚酸市場走勢

對醇酸樹脂和粘合劑的需求不斷擴大

- 二聚酸被稱為二聚脂肪酸,屬於二羧酸組。 二聚酸用於表面塗層、潤滑劑和燃料添加劑。

- 二聚酸用於生產醇酸樹脂,主要用於合成油漆和塗料,並因其特性而用於建築行業。

- 2021 年,美國生產了 1239 億磅樹脂。 高密度聚乙烯 (HDPE) 是當年產量最大的樹脂,產量為 220 億磅。 線性低密度聚乙烯 (LLDPE) 產量相似,為 217 億英鎊。

- 二聚酸的特點包括分子量大、結晶和蒸餾困難、環狀結構高度靈活、易溶於烴類、反應活性容易控制。

- 聚□胺熱熔膠在製造過程中使用了大量的二聚酸。 由於其特性,這些熱熔膠可用於金屬、紙張、木材和許多塑料(如 PVC、表面處理的聚丙烯和聚乙烯)的出色粘合。

- 合成聚□胺因其耐用性和強度而常用於紡織品、汽車工業、地毯、廚具和運動服。 運輸製造業是主要消費者,佔聚□胺 (PA) 消費量的 35%。

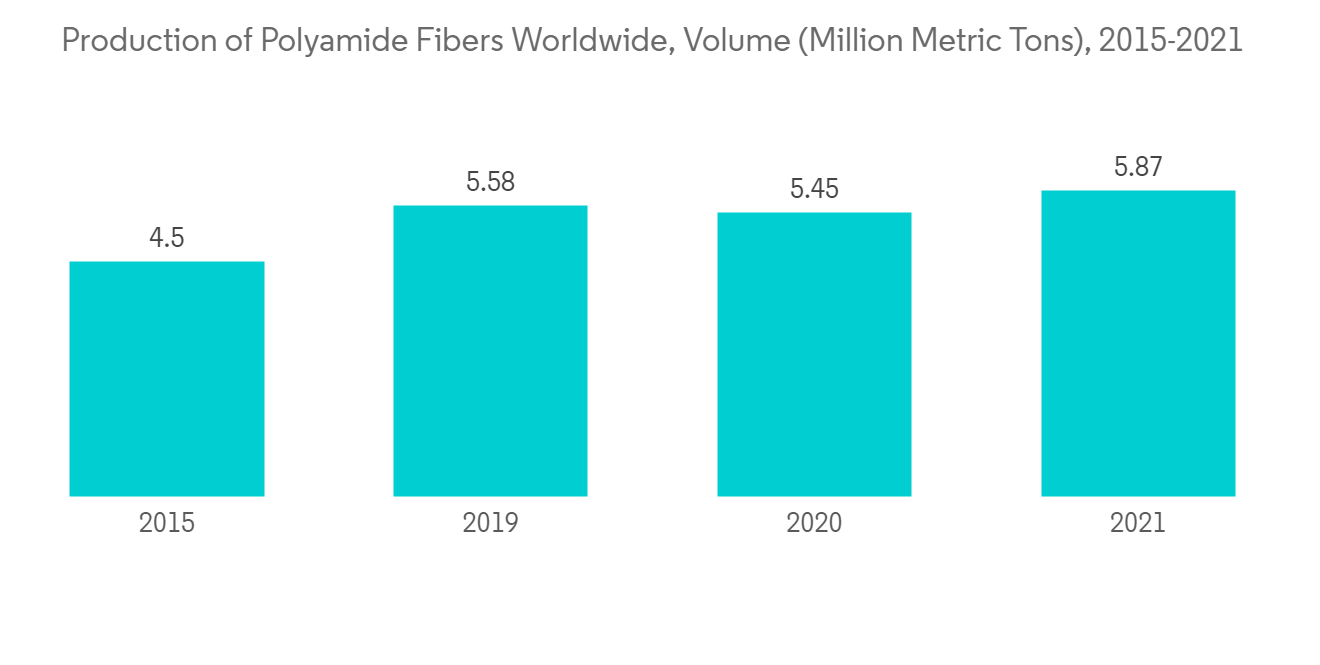

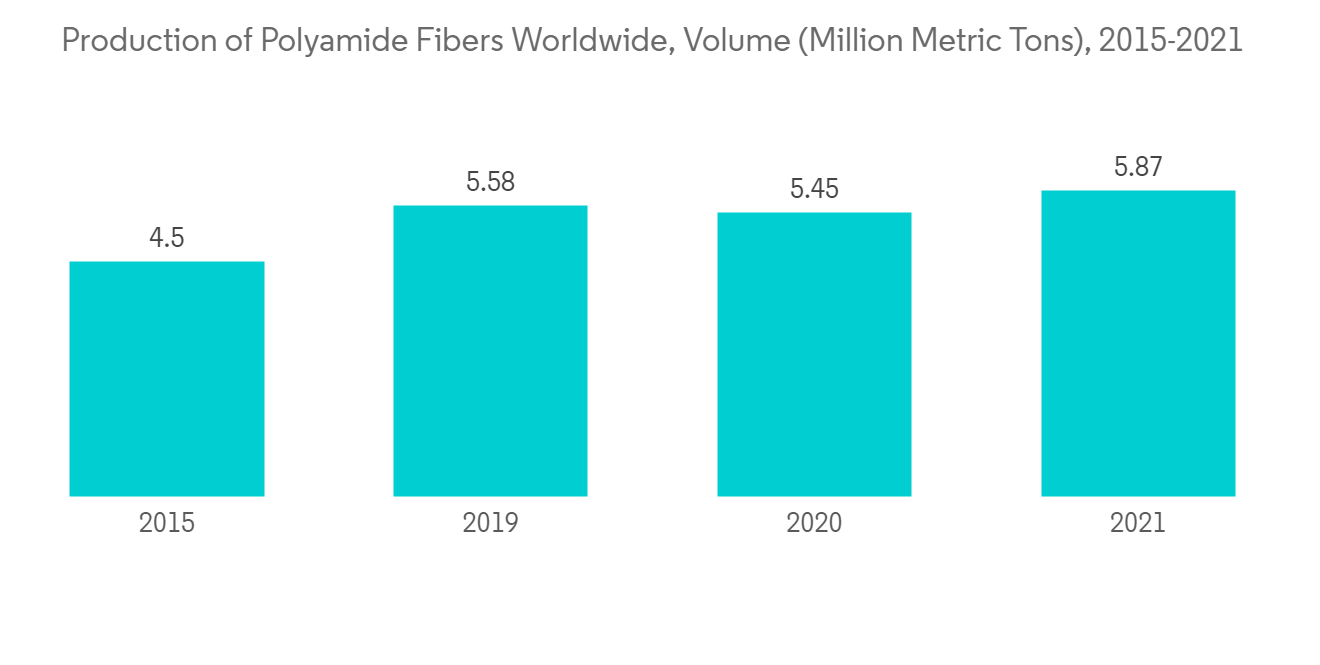

- 熱熔膠具有高熱穩定性、高熔點和對許多化合物的耐化學性。 這些特性使這些粘合劑在當前情況下比其他粘合劑要求更高。 2021年全球聚□胺產量為587萬噸。

- 根據 Statista 的數據,到 2027 年,粘合劑的市場價值預計將增長到近 650 億美元,而密封劑的市場價值預計將超過 150 億美元。

- 在食品和飲料等終端用戶行業的強勁需求推動下,包裝行業越來越多地使用粘合劑,這推動了二聚酸市場的發展。

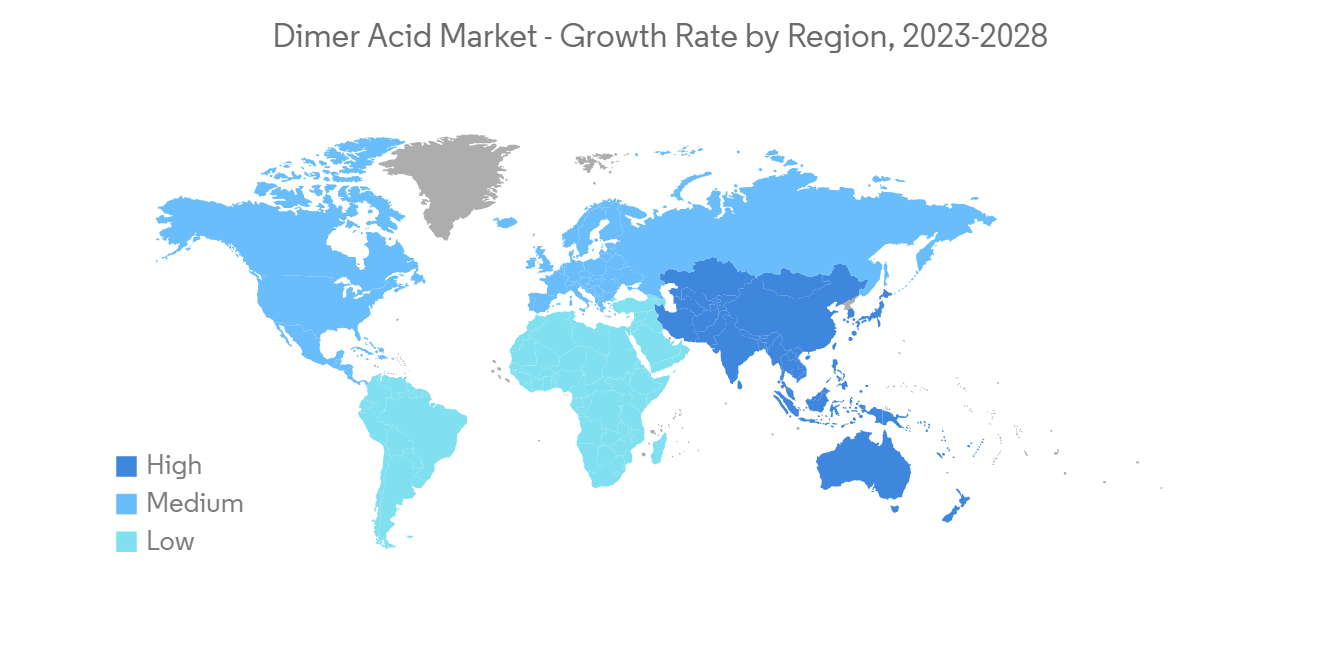

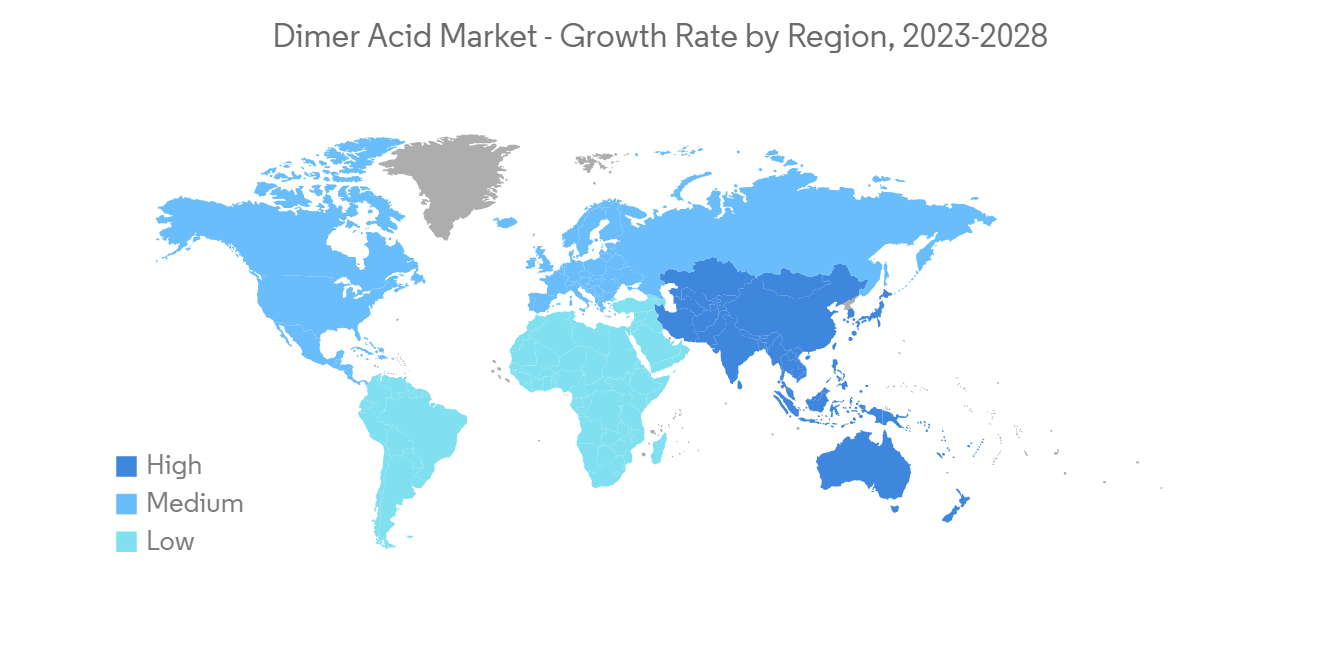

亞太地區主導市場

- 亞太地區的建築業正在逐步發展,產量也在增加。 中國、印度和東盟國家其他行業的粘合劑需求正在增加對用於塗料和熱熔膠製造的二聚酸的需求。

- 在建築行業,油漆和塗層劑等樹脂用於室內外裝飾。 在這些應用中,二聚酸因其對高溫、酸雨和雪等環境變化的抵抗力得到改善而被用於生產。

- 全球建築行業的收入預計在未來幾年穩步增長,到 2030 年將達到 4.4 萬億美元。 中國正在經歷建築業的巨大增長。 根據中國國家統計局的數據,2021 年中國建築業產值約為 4.29 萬億美元。

- 在到 2025 年的未來五年內,中國將在重大建設項目上投資 1.43 萬億美元。 到 2022 年,印度將通過政府在基礎設施和經濟適用房方面的舉措為建築業貢獻約 6400 億美元。

- 製備聚酯的原料包括所有植物油、脂肪酸及其衍生物。 據美國農業部統計,2021年日本的植物油消費量約為7.5萬噸。

- 到 2022 年,歐盟 27 國將成為葵花籽油消費量最大的國家,其次是中國和印度。 根據美國農業部的數據,2021 年中國人口消費了約 260 萬噸葵花籽油。

- 各個行業塗料應用的增加以及各種應用對聚□胺樹脂的需求不斷增加,預計將在未來幾年推動二聚酸市場。

二聚酸行業概況

二聚酸市場部分整合,少數大公司控制著很大一部分。 主要公司包括 BASF、Croda International、Oleon NV、Harima Chemicals 和 Emery Oleochemicals。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 擴大聚□胺樹脂的應用

- 粘合劑和燃料添加劑應用的擴展

- 約束因素

- 原材料價格波動

- 其他限制

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分

- 用法

- 醇酸樹脂

- 粘合劑/彈性體

- 潤滑劑

- 聚□胺樹脂

- 燃油添加劑

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)/排名分析

- 主要公司採用的策略

- 公司簡介

- BASF

- Arizona Chemical

- Aturex Group

- Croda International

- Emery Oleochemicals

- Florachem Corp.

- Harima Chemicals

- Jinan Tongfa Resin Co. Ltd

- Nissan Chemical America Corp.

- Oleon NV

第7章 市場機會與未來動向

The market for dimer acid is expected to register a CAGR of more than 5% during the forecast period.

The market was hampered by the COVID-19 pandemic, as lockdowns, social distances, and trade sanctions triggered massive disruptions to global supply chain networks. The construction industry witnessed a decline due to the halt in activities. However, the condition recovered in 2021 is expected to benefit the market during the forecast period.

Key Highlights

- Increasing applications for polyamide resins and growing usage of adhesives and fuel oil additives are driving market growth.

- Fluctuating raw material prices and uncertainty in the production of rapeseed oil, cottonseed oil, and soybean oil are expected to hinder market growth.

Dimer Acid Market Trends

Growing Demand for Alkyd Resins and Adhesives

- Dimer Acid is known as dimerized fatty acids and belongs to the dicarboxylic acid group. Dimer acid finds its application in surface coatings, lubricants, and fuel additives.

- Dimer acid is used to manufacture alkyd resins, mainly used for synthetic paintings and coatings and employed in the construction industry due to their properties.

- In 2021, the United States produced 123.9 billion pounds of resins. High-density polyethylene (HDPE) was the most produced resin that year, with an output of 22 billion pounds. Linear low-density polyethylene (LLDPE) accounted for a similar production volume, at 21.7 billion pounds.

- The properties of dimer acid include high molecular weight, difficulty in crystallization and distillation, highly flexible cyclic structure, soluble in hydrocarbons, and easily controlled reactivity.

- Polyamide hot-melt adhesives largely use dimer acid in the manufacturing process. These hot-melt adhesives are used on metal, paper, wood, and many plastics, like PVC, surface-treated polypropylene, and polyethylene, for excellent adhesion purposes, due to their characteristics.

- Synthetic polyamides are commonly used in textiles, the automotive industry, carpets, kitchen utensils, and sportswear due to their high durability and strength. The transportation manufacturing industry is the major consumer, accounting for 35% of polyamide (PA) consumption.

- Hot-melt adhesives have high thermal stability, melting points, and chemical resistance to many compounds. These properties are increasing the demand for these adhesives over other adhesives in the current scenario. In 2021, global polyamide production stood at 5.87 million metric tons.

- According to Statista, by 2027, the market value of adhesives is expected to increase to nearly USD 65 billion, and sealants will amount to just over USD 15 billion.

- Due to the strong demand from end-user industries such as food and beverages, increasing applications for adhesives in the packaging industry are driving the market for dimer acid.

Asia-Pacific to Dominate the Market

- There have been gradual developments in the Asian-Pacific construction sector and the growing production. The demand for adhesives in China, India, and the ASEAN countries from other sectors is increasing the demand for dimer acid used in coatings and hot-melt adhesive production.

- The construction industry uses paints, coatings, and other resins for interior and exterior applications. These applications use dimer acid in production as it provides better durability against environmental changes, such as high temperatures, acid rain, and snow.

- The revenue of the global construction industry is expected to grow steadily over the next few years and reach USD 4.4 trillion by 2030. China is experiencing massive growth in its construction sector. According to the National Bureau of Statistics of China, in 2021, the construction output in China was valued at approximately USD 4.29 trillion.

- China is investing USD 1.43 trillion in major construction projects in the next five years till 2025. In 2022, India contributed about USD 640 billion to the construction industry due to government initiatives in infrastructure development and affordable housing.

- The raw materials used to prepare polyesters include all vegetable oils, fatty acids, and their derivatives. According to the US Department of Agriculture 2021, the consumption volume of vegetable oil in Japan amounted to around 75 thousand metric tons in 2021.

- In 2022, the leading country of sunflowerseed oil consumption was the EU-27, followed by China and India. According to the US Department of Agriculture, in 2021, China's population consumed around 2.6 million metric tons of sunflower seed oil.

- Increasing applications for coatings from various industries and growing demand for polyamide resins for different applications are expected to drive the market for dimer acid through the years to come.

Dimer Acid Industry Overview

The dimer acid market is partially consolidated, with a few major players dominating a significant portion. Some major companies are BASF, Croda International, Oleon NV, Harima Chemicals, and Emery Oleochemicals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications for Polyamide Resins

- 4.1.2 Growing Usage of Adhesives and Fuel Additives

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Alkyd Resins

- 5.1.2 Adhesives and Elastomers

- 5.1.3 Lubricants

- 5.1.4 Polyamide Resin

- 5.1.5 Fuel Oil Additives

- 5.1.6 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF

- 6.4.2 Arizona Chemical

- 6.4.3 Aturex Group

- 6.4.4 Croda International

- 6.4.5 Emery Oleochemicals

- 6.4.6 Florachem Corp.

- 6.4.7 Harima Chemicals

- 6.4.8 Jinan Tongfa Resin Co. Ltd

- 6.4.9 Nissan Chemical America Corp.

- 6.4.10 Oleon NV