|

市場調查報告書

商品編碼

1641967

企業服務匯流排(ESB) 軟體:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Enterprise Service Bus Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

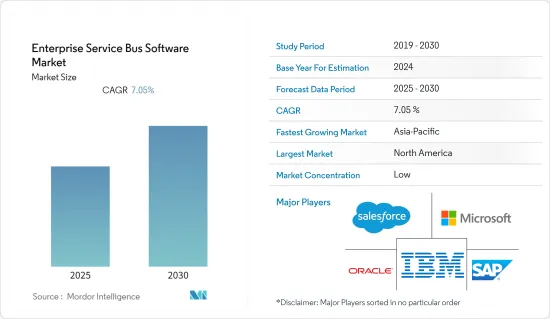

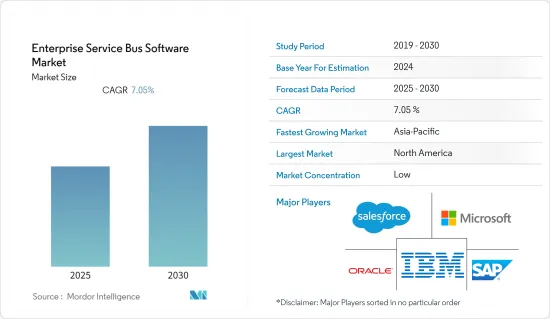

預計預測期內企業服務匯流排(ESB) 軟體市場複合年成長率為 7.05%。

主要亮點

- COVID-19 疫情表明,商業智慧、分析、雲端運算和行動運算可以幫助組織平穩運行。從那時起,公司就開始使用這些服務來改善業務架構。這標誌著企業服務匯流排(ESB)軟體在市場上的一個轉捩點。

- 透過消除重寫應用程式的需要,ESB 架構可以在整個企業內快速分發訊息並確保訊息順暢傳遞,即使某些網路或系統偶爾離線。這就是為什麼大多數公司都部署 ESB 架構作為IT基礎設施骨幹的原因。

- 此外,ESB 在 IT 和通訊業的使用正在成長,這主要得益於雲端平台的採用,雲端平台可以作為整合各種應用程式、促進新通路擴展和改善客戶資料存取的一種手段。 。

- 例如,印度國家銀行為其 23,000 個分店選擇了微軟的雲端生產力解決方案 Office 365,以改善員工之間的溝通和協作,並將職場轉變為現代化的工作場所。

- 仍以紙本方式管理資料的老企業可能會很難順利地將資料遷移到雲端,有時會影響他們的經營方式。此外,您應該分部分更改資料,而不是一次更改全部數據。對高昂實施成本的擔憂也威脅市場成長。

企業服務匯流排(ESB) 軟體市場趨勢

物聯網計劃的不斷發展將推動市場成長

預計到 2030 年,物聯網連接設備的數量將從 2019 年的 86 億增加到 294 億。連網型設備的成長受到新應用和經營模式以及設備標準化程度的提高和價格的下降所推動。

隨著物聯網連接設備數量的成長,設備和資料變得更加複雜。這些連接的設備會為整合和通訊帶來許多挑戰。因此,組織可能需要投資可以透過 ESB 解決的高效應用程式整合解決方案。

解決這個問題最簡單的方法是專注於在單一應用平台上同步各種裝置(每個裝置都有不同的通訊協定)的策略。

未來幾年,隨著商業環境的變化,對 ESB 軟體的需求可能會受到以更有效、更靈活的方式處理不同設備之間通訊的需求的推動。

預測期內亞太地區將實現顯著成長

由於中國、印度和韓國等國家對物聯網平台的關注度日益提高,亞太地區預計將見證企業服務匯流排(ESB) 軟體市場最快的成長。

隨著複雜的巨量資料和企業資源規劃 (ERP) 工作負載轉移到雲端平台,該地區對託管的雲端基礎的解決方案的需求也在增加。根據亞洲雲端運算協會(ACCA)發布的報告,新加坡憑藉其高寬頻品質、網路安全、法規和商業成熟度,被評為亞太地區雲端運算就緒性最高的國家。

隨著亞太地區大多數企業將業務轉移到雲端,阿里巴巴和騰訊等公司正在尋求透過縮短新計劃的上市時間來提高組織靈活性。

此外,透過建立和設計更靈活的應用程式,公司可以更快地響應市場變化。由於這些因素,該地區的 ESB 軟體市場也可能成長。

企業服務匯流排(ESB) 軟體產業概覽

企業服務匯流排(ESB) 軟體產業因供應商激增而變得分散。快速發展、技術創新和激烈的競爭正在推動 ESB 軟體市場的發展。主要公司包括 Oracle Corporation、Microsoft Corporation、IBM Corporation、SAP SE、MuleSoft Inc. (Salesforce)、Dell Technologies Inc. 和 TIBCO Software Inc.

2022 年 12 月,紅帽公司與通用汽車建立合作關係,幫助汽車產業參與者將尖端軟體技術融入其產品中。紅帽公司的雲端原生技術將使兩家公司能夠更快地向客戶提供增值功能。車上用軟體需要先進的網路安全保護,並且該軟體支援多種車載安全應用,包括高級駕駛輔助系統、車身控制和連接。 Linux 和雲端原生技術透過開放原始碼加速創新進程。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 擴大採用雲端基礎的解決方案

- 物聯網計劃開發增加

- 市場限制

- 高實施成本是市場成長的障礙

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按配置

- 雲

- 本地

- 按最終用戶產業

- 資訊科技/通訊

- 零售

- 衛生保健

- BFSI

- 其他最終用戶產業(政府、製造業、公共產業)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Oracle Corporation

- Microsoft Corporation

- IBM Corporation(Red Hat Inc.)

- TIBCO Software Inc.

- SAP SE

- Salesforce.com Inc.(MuleSoft Inc.)

- Dell Technologies Inc.

第7章投資分析

第8章 市場機會與未來趨勢

The Enterprise Service Bus Software Market is expected to register a CAGR of 7.05% during the forecast period.

Key Highlights

- The COVID-19 outbreak demonstrated the value of business intelligence, analytics, cloud computing, and mobile computing for ensuring that organizations run smoothly. After this, companies started using these services to improve their work architecture. This was the turning point for enterprise service bus software in the market.

- ESB architecture distributes information across enterprises quickly and ensures the smooth delivery of information, even when some networks or systems are offline occasionally, by eliminating the need to rewrite the application. Thus, most companies implement the ESB architecture as the backbone of their IT infrastructure.

- Furthermore, majorly driven by the adoption of cloud platforms that serve as a way to integrate various applications and can facilitate new and expanded channels as well as improve access to client data, allowing for better-tailored products and services, the IT and telecom industries are expected to mark a significant rise in the use of ESBs.

- Banks are also moving more of their data, processes, and infrastructure to the cloud to take advantage of cloud implementation, which makes it easier for enterprise applications to work together.For instance, the State Bank of India, for its 23,000 branches, chose Office 365, a cloud-powered productivity solution from Microsoft, to improve communication and collaboration among its workforce and transform it into a modern workplace.

- Older businesses that keep their data on paper will take some time to move to the cloud, which could sometimes affect how the business works. They will also have to change parts of the data at a time instead of all of it at once. Concerns about the high cost of installation are also a threat to the growth of the market.

Enterprise Service Bus Software Market Trends

Rising Development of IoT Projects Boosting the Market Growth

The number of IoT-connected devices is expected to increase from 8.6 billion in 2019 to 29.4 billion in 2030. The growth of connected devices is driven by new applications and business models, and it is helped by the fact that devices are becoming more standard and their prices are going down.

As the number of IoT-connected devices increases, the integration of devices and data becomes more complex. These connected devices may present numerous integration and messaging challenges. Organizations, thus, may have to invest in efficient application integration solutions that can be tackled with ESBs.

Also, as there are more and more devices that connect to each other, it is becoming more and more important to manage multiple networks and systems at the same time.The easiest way to deal with this problem is to concentrate on a strategy that involves synchronizing various devices (each with a distinct protocol) on a single application platform.

Over the next few years, demand for ESB software is likely to be driven by the need to handle communication between different devices in a more effective and flexible way as business environments change.

Asia-Pacific to Register a Significant Growth Over the Forecast Period

Asia-Pacific is predicted to have the quickest growth rate for the Enterprise Service Bus Software Market due to the region's expanding emphasis on the IoT platform in nations like China, India, and South Korea.

The rising demand for managed cloud-based solutions has also increased in this region due to complex big data and workloads, such as enterprise resource planning (ERP), being increasingly migrated to cloud platforms. According to a report published by the Asia Cloud Computing Association (ACCA), Singapore is the number one cloud-ready Asia-Pacific country, owing to better broadband quality, cybersecurity, regulation, and business sophistication.

As most businesses in Asia-Pacific move their operations to the cloud, companies like Alibaba and Tencent are likely to use ESBs to make their organizations more flexible by reducing the time it takes for new projects to reach the market.

It also builds and designs applications that are more flexible, which lets companies respond quickly to changes in the market. The ESB software market in the region is also likely to grow because of these factors.

Enterprise Service Bus Software Industry Overview

Due to the proliferation of vendors, the enterprise service bus software industry is fragmented. Rapid development, innovation, and intense player competition are what are driving the ESB software market. In addition to others, some of the major companies are Oracle Corporation, Microsoft Corporation, IBM Corporation, SAP SE, MuleSoft Inc. (Salesforce), Dell Technologies Inc., and TIBCO Software Inc.

In December 2022, Red Hat and General Motors joined to assist the car industry player in integrating cutting-edge software technology into its offerings. Both businesses can quickly provide clients with additional valuable features because of Red Hat's cloud-native technology. This software will support several in-vehicle safety applications, like sophisticated driver assistance systems, body control, and connection, since high levels of cybersecurity protection are necessary for in-vehicle software. Linux and cloud-native technology will speed up innovation processes through open source.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Adoption of Cloud-based Solutions

- 4.2.2 Rising Development of IoT Projects

- 4.3 Market Restraints

- 4.3.1 High Installation Cost to Challenge the Market Growth

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 On Cloud

- 5.1.2 On-premise

- 5.2 End-user Industry

- 5.2.1 IT and Telecom

- 5.2.2 Retail

- 5.2.3 Healthcare

- 5.2.4 BFSI

- 5.2.5 Other End-user Industries (Government, Manufacturing, and Utilities)

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Oracle Corporation

- 6.1.2 Microsoft Corporation

- 6.1.3 IBM Corporation (Red Hat Inc.)

- 6.1.4 TIBCO Software Inc.

- 6.1.5 SAP SE

- 6.1.6 Salesforce.com Inc. (MuleSoft Inc.)

- 6.1.7 Dell Technologies Inc.