|

市場調查報告書

商品編碼

1273430

綜合驗光儀市場 - 增長、趨勢、COVID-19 的影響、預測 (2023-2028)Phoropters Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計在預測期內,所研究的綜合驗光儀市場將以近 4.1% 的複合年增長率增長。

COVID-19 大流行對市場產生了重大影響。 在大流行初期,由於建議醫院和外科醫生推遲或取消擇期手術,眼科手術被推遲。 例如,根據國家醫學圖書館發表的一項研究,2021 年 3 月,在大流行的第一個高峰期間,87.2% 的門診預約、90.9% 的眼科手術、50.2% 的眼科轉診和 50 次病房審查。 % 減少。 在 1,377 個取消的預約中,6.8% 被認為有資格進行遠程眼科治療。 2021 年 5 月發表在 BMC Ophthalmology 上的另一項研究發現,在 COVID-19 衛生緊急事件期間,視網膜門診量減少了 62%。 從登記到技術人員的平均時間減少了 79%,總訪問時間減少了 46%,在提供者階段花費的時間減少了 53%。 因此,COVID-19 大流行導致眼保健領域大幅收縮,影響了早期市場的增長率。 然而,由於全球範圍內眼科護理的恢復,市場正在穩步增長,預計未來幾年將繼續保持同樣的趨勢(根據分析結果)。

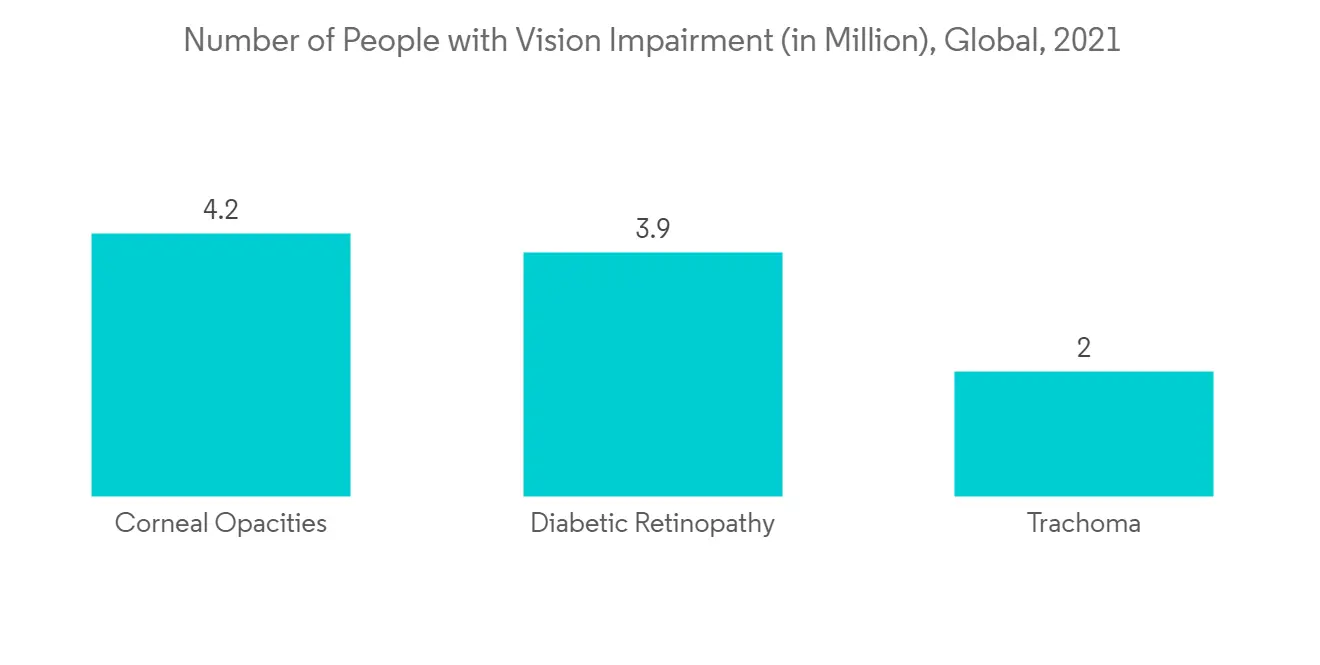

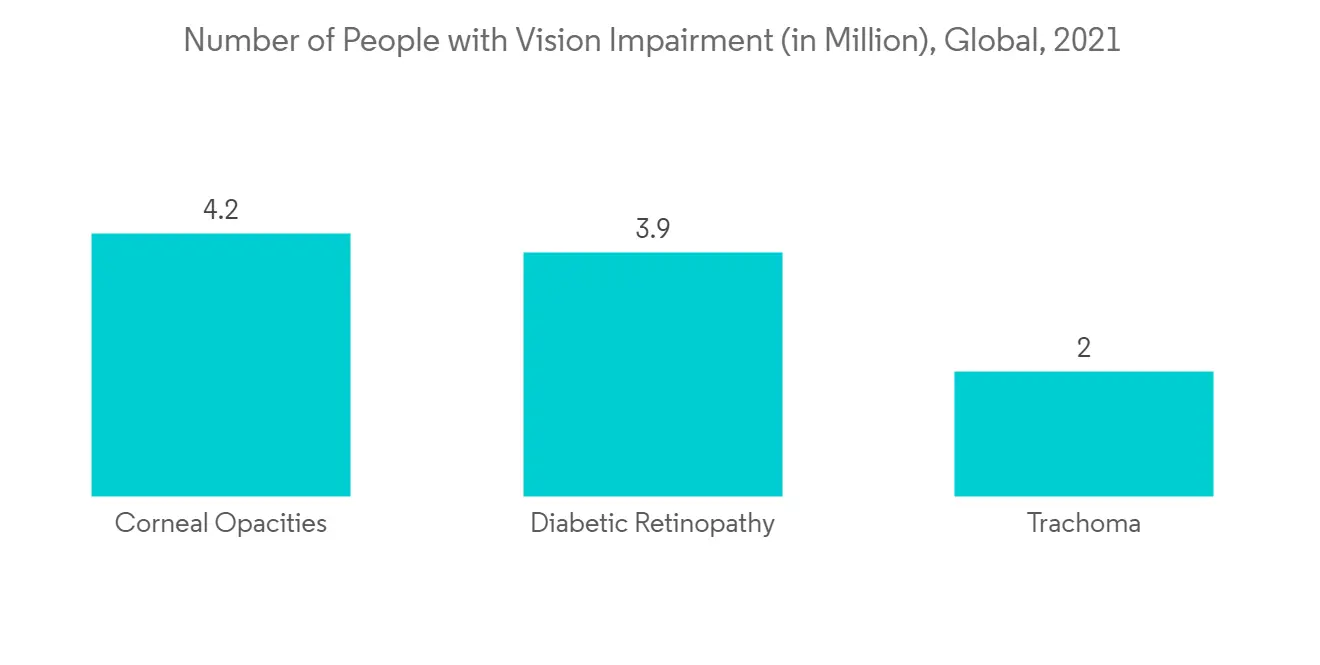

眼部疾病患病率和復發率的增加以及技術進步等因素預計將在預測期內推動市場增長。 例如,根據世界衛生組織2021年的統計,全球至少有22億人患有近視或遠視。 至少有 10 億人(其中近一半)可以避免或控制視力障礙。 大多數視力障礙或失明的人都在 50 歲以上。 因此,此類統計數據表明對視力矯正設備的需求不斷增長,因此有望推動市場增長。

此外,預計技術進步將在預測期內推動市場增長。 例如,根據 Healthtech 專區 2022 年 12 月發表的一篇文章,Advanced 綜合驗光儀是對這種傳統設備的改進。 它使用激光技術將文本投射到患者面前的屏幕上,這樣他們就可以閱讀,而無需先打印出來。 這使醫生能夠比傳統的驗光儀更快地進行調整,從而改善患者體驗並節省寶貴的整體時間。 因此,這些進步有望推動市場的增長。

因此,預測期內研究的市場增長歸因於上述因素。 然而,高昂的安裝成本和缺乏熟練的驗光師預計將阻礙預測期內的市場增長。

驗光機市場趨勢

專科診所佔據了驗光機市場的很大份額

隨著眼部疾病的增加,預計專科診所的驗光機採用率將穩步增長。 例如,根據 2022 年 3 月 WHO 的更新,沙眼是 44 個國家的公共衛生問題,導致全球約 190 萬人失明或視力受損。 因此,疾病的高負擔和對手術治療的高需求正在推動市場的增長。 此外,2021 年 8 月,Valiant Clinic 將與迪拜 Moorfields 眼科醫院合作,為患者帶來 200 多年的世界級眼科卓越護理。 Moorfields Eye Hospital Dubai 提供眼科疾病的診斷和治療,以及 Valiant 診所提供的各種其他服務。 預計這些努力將在預測期內推動該部門的增長。

此外,根據2021年9月公佈的MDPI報告,意大利白內障、青光眼、黃斑病和視網膜病等眼病的患病率分別為52.6%、5.3%、5.6%和29.1%。 眼科疾病的意識有望增加專科診所的就診人數,從而推動市場增長。 例如,根據上述資料,在受影響的人中,21.8%的白內障患者、65.4%的青光眼患者和7.1%的黃斑病患者知道自己的病情。 根據MDPI報告中呈現的數據,意大利的眼病負擔逐年增加,相信這將創造更多的眼科檢查需求並推動該細分市場的增長。

因此,上述因素預計將推動市場的細分增長。

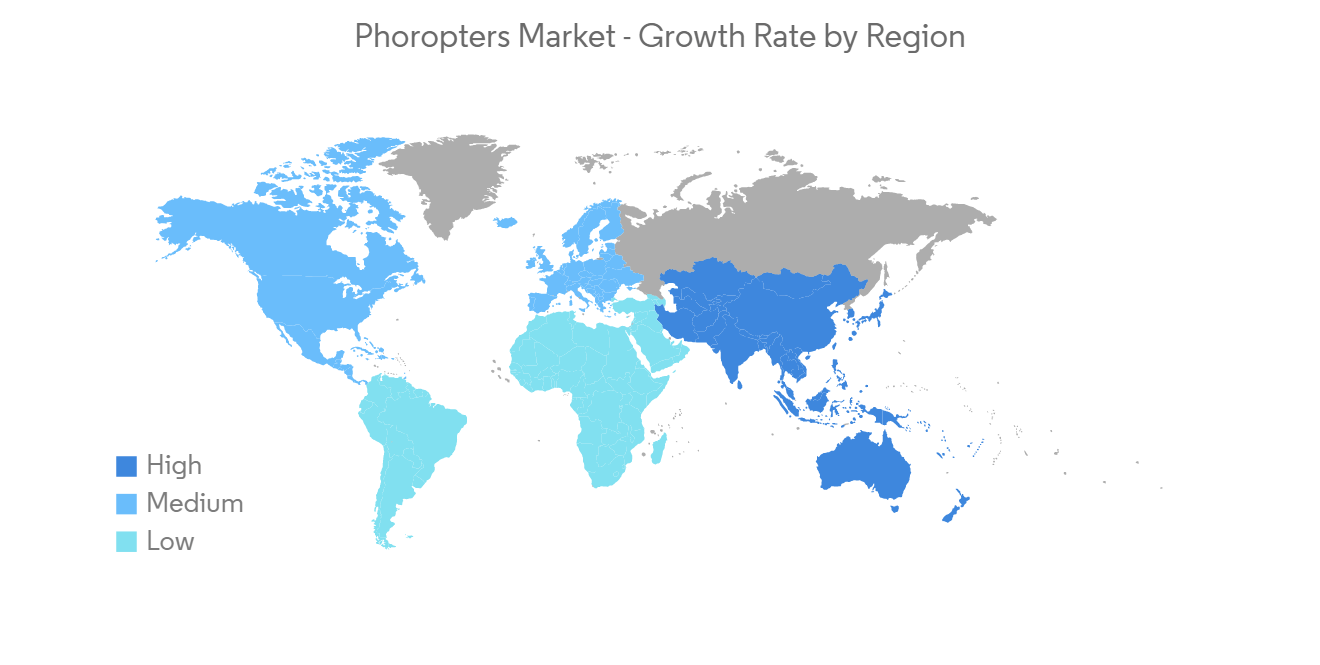

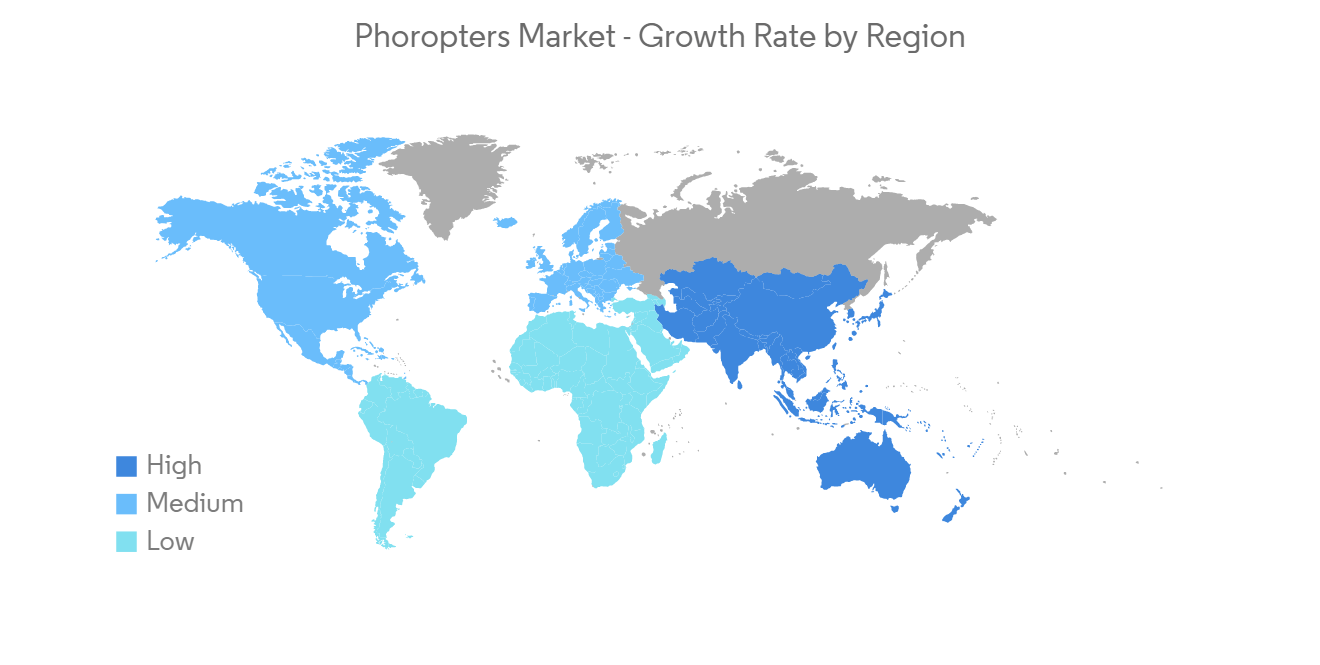

預計北美將佔據很大的市場份額,預計在預測期內也會如此

由於可支配收入高、意識提高、老年人口增加以及眼病患病率增加等因素,預計北美將佔據很大的市場份額。 例如,根據加拿大統計局 2021 年人口普查,65 歲及以上人口約為 7,021,430 人,其中男性 3,224,680 人,女性 3,796,750 人。 老年人經常患有某種類型的眼科疾病,老年人的沉重負擔有望推動市場增長。

此外,CDC 2022 年 2 月的新聞稿提供了最常見眼病和眼病的患病率估計值。 美國約有 1200 萬 40 歲以上的成年人有視力障礙,其中約有 100 萬是盲人。 三分之一的美國人有散光,大約三分之一的人有散光。 在 40 歲以上,8.4% 的人口患有遠視(超過 1420 萬人)。 此外,超過 23.9% 的 40 歲以上的人患有近視(約 3400 萬人)。 眼科疾病的這種增加預計會增加對用於測試眼科疾病的驗光儀的需求。

因此,由於上述因素,預計北美地區的市場在預測期內將會增長。

驗光儀行業概覽

綜合驗光儀市場競爭適中,由幾家主要參與者組成。 全球市場有本地和國際公司。 主要參與者包括 Briot USA Inc.、Huvitz、Marco、Nidek、Reichert Inc.、Rexxam 和 Carl Zeiss AG。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 眼病的患病率和復發率增加

- 技術進步

- 市場製約因素

- 高昂的引進成本和熟練的驗光師短缺

- 波特五力

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分

- 按類型

- 手冊

- 數字

- 最終用戶

- 醫院

- 專科門診

- 其他最終用戶

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- Briot USA Inc.

- Huvitz Co. Ltd

- Marco

- NIDEK CO. LTD

- Reichert Inc.

- Rexxam Co. Ltd

- Righton Limited

- Topcon Corporation

- Carl Zeiss AG

第7章 市場機會未來動向

The phoropters market studied is anticipated to witness a CAGR of nearly 4.1% during the forecast period.

The COVID-19 pandemic had a significant impact on the market. Ophthalmic procedures were postponed at the beginning of the pandemic as the hospitals and surgeons were advised to postpone or cancel elective procedures. For instance, according to a study published by the National Library of Medicine, in March 2021, outpatient clinic appointments were reduced by 87.2%, ophthalmic surgery by 90.9%, outpatient referrals to ophthalmology by 50.2%, and ward reviews by 50% during the first peak of the pandemic. There were 1,377 canceled appointments, with 6.8% of them deemed appropriate for teleophthalmology. Another study published by BMC Ophthalmology in May 2021 found that during the COVID-19 health emergency, retina clinic volume fell by 62%. The average time from check-in to technician has decreased by 79%, total visit length has decreased by 46%, and time spent in the provider phase of care has decreased by 53%. Thus, the COVID-19 pandemic severely curtailed ophthalmology services, thereby impacting the market growth rate in its initial phase. However, the market is witnessing stabilized growth currently owing to the resumption of ophthalmology procedures worldwide and is expected to project a similar trend over the coming years, as per the analysis.

Factors such as the growing prevalence and recurrence of eye disorders and technological advancements are expected to drive the growth of the market over the forecast period. For instance, according to WHO statistics from 2021, at least 2.2 billion individuals worldwide have near or farsighted vision impairment. Vision impairment may have been avoided or managed in at least 1 billion, or nearly half of these cases. The majority of those who have vision impairment or blindness are over 50 years old. Thus, such statistics suggest the increasing need for vision correction devices and thus are expected to drive the growth of the market.

Furthermore, technological advancement is expected to drive the growth of the market over the forecast period. For instance, according to an article published by Healthtech zone in December 2022, the Advanced Phoropter is an improvement on this traditional device. It uses laser technology to project text onto a screen in front of the patient's face, allowing him or her to read it without having it printed on paper beforehand. This allows the doctor to make adjustments more quickly than with traditional phoropters, improving patient experience and saving valuable time overall. Thus, such advancement is expected to drive the growth of the market.

Therefore, the factors mentioned above are attributed collectively to the studied market growth over the forecast period. However, high installation costs and a lack of skilled optometrists are expected to hinder market growth over the forecast period.

Phoropters Market Trends

Specialty Clinics Segment Hold Significant Share in the Phoropters Market

Specialty clinics are expected to observe steady growth in the adoption rate of phoropters, owing to the increasing number of eye disorders. For instance, according to the WHO update in March 2022, trachoma is a public health problem in 44 countries and is responsible for the blindness or visual impairment of about 1.9 million people globally. Such a high burden of disease and the need for surgical treatment is thus driving the growth of the market. Furthermore, in August 2021, Valiant Clinic collaborated with Moorfields Eye Hospital Dubai to bring over 200 years of world-class eye care excellence to its patients. Moorfields Eye Hospital Dubai delivers diagnosis and treatment of eye diseases, with a broad range of other services that are available at Valiant Clinic. Such an initiative is expected to drive segmental growth over the forecast period.

Additionally, as per the MDPI report published in September 2021, the prevalence of ophthalmic diseases such as cataracts, glaucoma, maculopathy, and retinopathy was 52.6%, 5.3%, 5.6%, and 29.1%, respectively, in Italy. Awareness about ophthalmic conditions is expected to increase visits to specialty clinics, thereby driving the market growth. For instance, according to the above source, among the affected people, those aware of their condition were 21.8% for cataracts, 65.4% for glaucoma, and 7.1% for maculopathy. The data mentioned in the MDPI report suggest that the burden of eye diseases is increasing in Italy every year, which is believed to create more demand for ophthalmic tests, thereby driving the growth of the segment.

Therefore the above-mentioned factors are expected to drive segmental growth in the market.

North America is Expected to Hold a Significant Share in the Market and Expected to do Same Over the Forecast Period

North America is expected to hold a significant share of the market owing to factors such as high disposable income, growing awareness, a rising geriatric population, and the increasing prevalence of eye diseases. For instance, as per the Statistics Canada 2021 census, there were around 7,021,430 people aged 65 years or above, out of which 3,224,680 were males, and 3,796,750 were females. The geriatric population is commonly affected by some kind of ophthalmic condition, and the high burden of the geriatric population is also expected to boost the growth of the market.

Furthermore, a press release published in February 2022 by the CDC offered prevalence estimates for the most common eye disorders and eye diseases. Nearly 12 million adults in the United States who are 40 years and above of age have vision impairment, and about a million of them are blind. Every third American has astigmatism, which affects around 1 in 3 people. Over the age of 40, 8.4% of the population suffers from farsightedness (over 14.2 million people). A little over 23.9% of those over 40 have nearsightedness (about 34 million people). Thus, such an increasing prevalence of eye diseases is expected to increase the demand for phoropters for the testing of such diseases.

Thus, owing to the abovementioned factors, the market in the North American region is expected to project growth over the forecast period.

Phoropters Industry Overview

The phoropters market is moderately competitive and consists of a few major players. There is a presence of local and international companies in the global market. Some of the key players include Briot USA Inc., Huvitz Co. LTD, Marco, Nidek, Reichert Inc., Rexxam Co. LTD, and Carl Zeiss AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence and Recurrence of Eye Disorders

- 4.2.2 Technological Advancements

- 4.3 Market Restraints

- 4.3.1 High Installation Cost and Lack of Skilled Optometrists

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value in USD million)

- 5.1 By Type

- 5.1.1 Manual

- 5.1.2 Digital

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Specialty Clinics

- 5.2.3 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Briot USA Inc.

- 6.1.2 Huvitz Co. Ltd

- 6.1.3 Marco

- 6.1.4 NIDEK CO. LTD

- 6.1.5 Reichert Inc.

- 6.1.6 Rexxam Co. Ltd

- 6.1.7 Righton Limited

- 6.1.8 Topcon Corporation

- 6.1.9 Carl Zeiss AG