|

市場調查報告書

商品編碼

1273492

硫化物市場增長,趨勢,COVID-19 影響和預測2023-2028Thiochemicals Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,硫化物市場預計將以超過 5% 的複合年增長率增長。

COVID-19 大流行對市場產生了短期和長期影響。 石油和天然氣行業的疲軟,大流行封鎖導致聚合物和化學活動暫時停止,對硫化物市場的需求產生了不利影響。 然而,大流行後對硫化物的需求急劇擴大,預計將繼續沿著同樣的道路發展。

主要亮點

- 在家禽業的關鍵營養物質甲硫氨酸的生產中使用硫化物,預計將推動市場增長。

- 但是,異丙基硫醇和四氫塞吩等易燃且對水生動物有劇毒的硫化合物可能會阻礙市場增長。

- 南非和肯尼亞等非洲經濟體的市場滲透率不斷提高,預計將為新興的硫化物市場帶來巨大機遇。

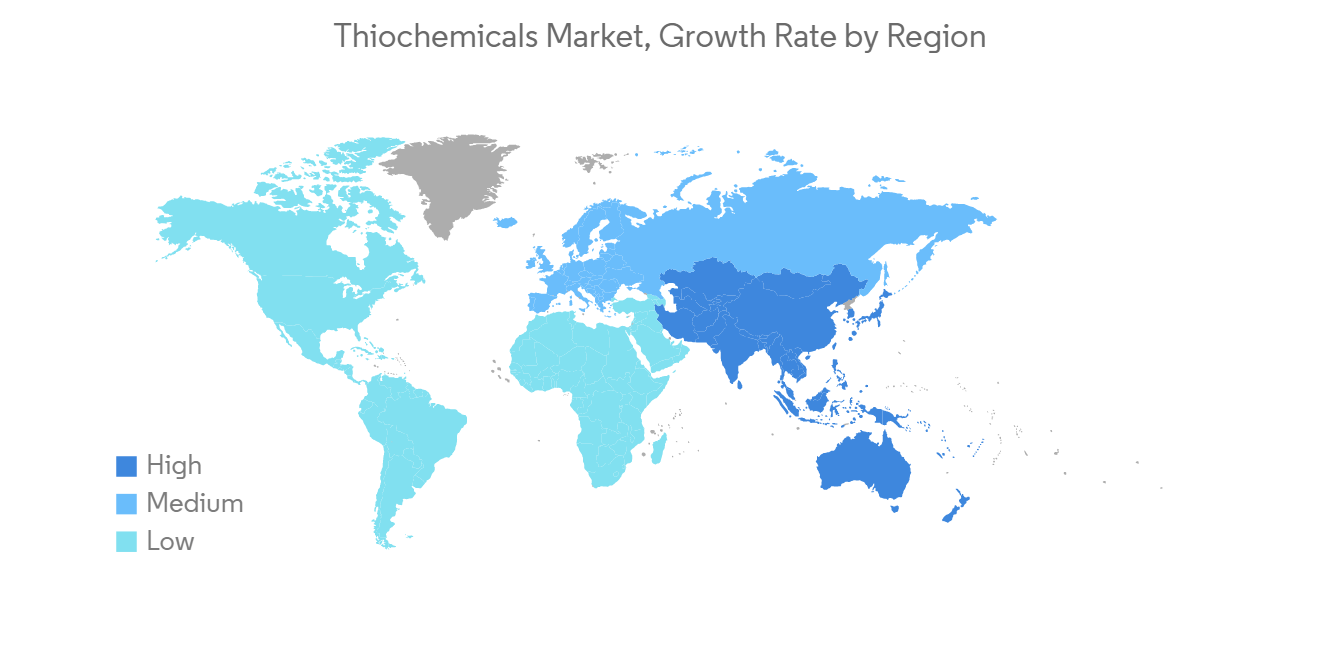

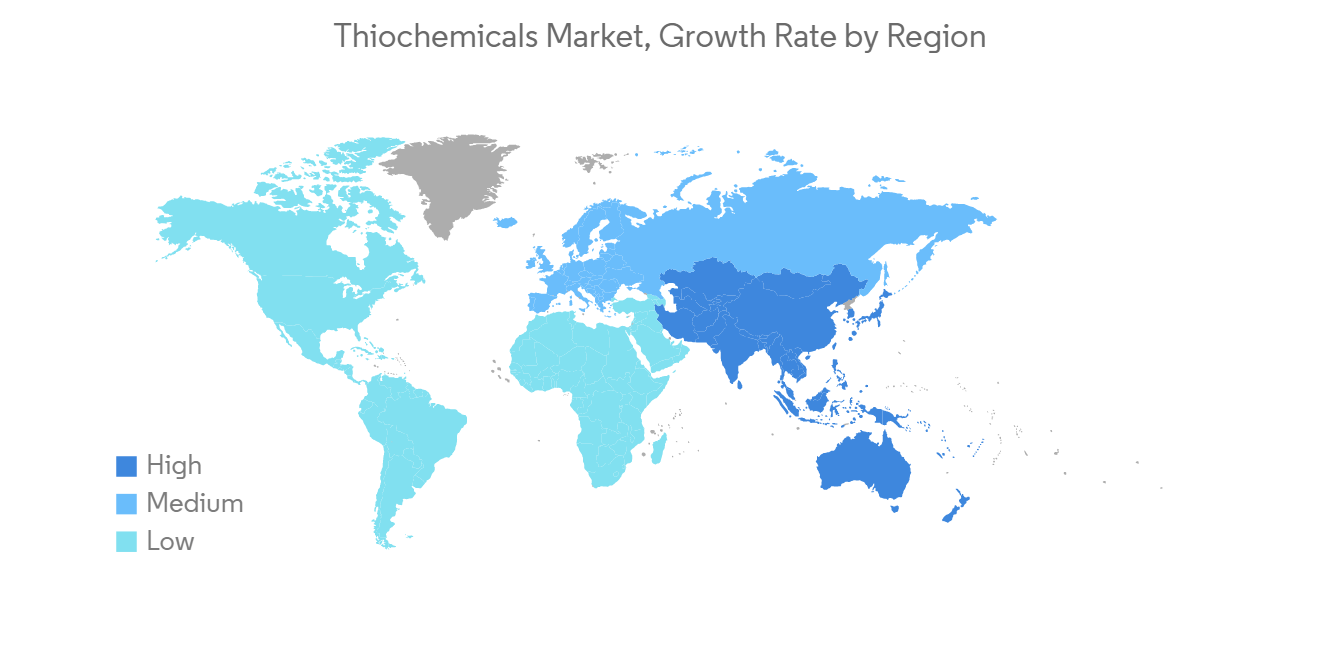

- 亞太地區在硫化物市場佔據主導地位,預計在預測期內將成為最大的硫化物市場。

硫化物市場趨勢

增加在動物營養中的使用

- 在動物營養中,硫化合物主要以甲硫醇的形式用於製造蛋氨酸。 蛋氨酸主要用作畜禽飼料中的膳食補充劑。

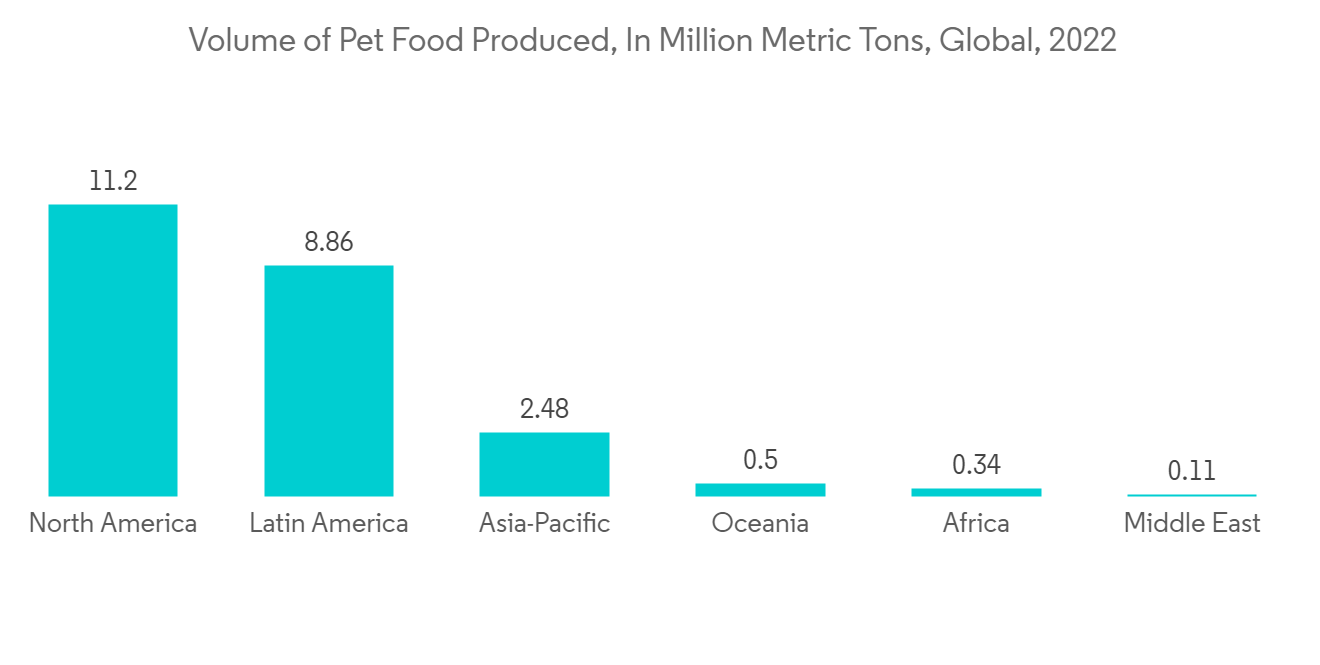

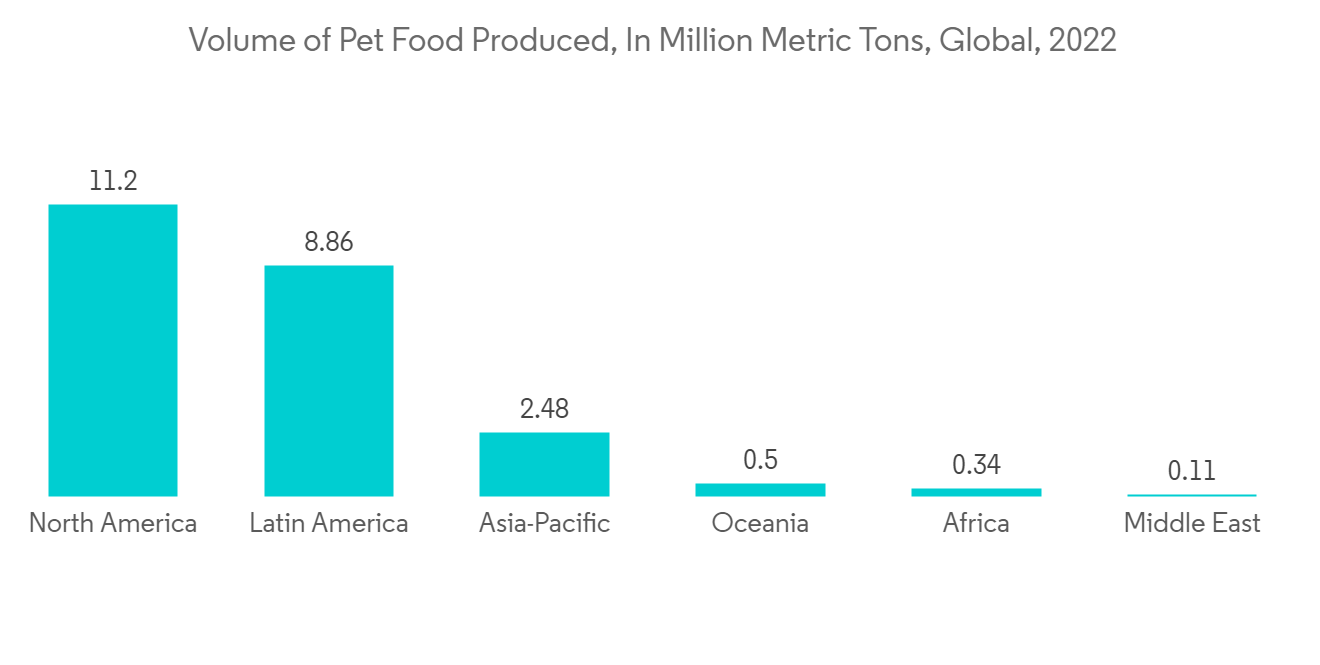

- 根據 2023 年奧特奇農業食品預測,歐洲和北美將在 2022 年生產世界上最多的寵物食品,產量為 1100 萬噸。 拉丁美洲排名第三,約為 886 萬噸。

- Alltech 還表示,美國擁有世界上最大的寵物食品市場。 到 2021 年,美國的寵物食品銷售額將達到約 440 億美元。 還注意到許多世界領先的寵物食品公司,包括 Mars Petcare,Nestle Purina Petcare 和 J.M. Smucker,都位於美國。

- 由於人口增長,世界各地的人們可能會吃更多的雞肉。 預計這將增加對家禽和雞蛋的需求,並增加該行業對硫化物的使用。

- OECD-FAO 農業預測 2022-2031 預測,2021 年全球肉類產量將增長 5%,達到 339 公噸。 這主要是由於中國豬肉產量在因非洲豬瘟 (ASF) 爆發而連續兩年大幅下降後增長了 34%。 預計 2021 年全球肉類進口量將達到 40 公噸,其中家禽進口量居首位。 增加的肉類進口需求大部分來自巴西,歐盟和美國等主要出口國。

- 此外,OECD-FAO 農業展望 2022-2031 指出,到 2031 年,雞肉,豬肉,牛肉和羊肉的蛋白質含□□量將分別增加 16%,17%,8% 和 16%。 與 2019-2022 年期間相比,預計 47% 的肉類來源蛋白質總量來自家禽,其次是豬,羊和牛。

- 此外,根據這一預測,2021 年全球將食用 133,996,620,000 噸雞肉,到 2031 年將食用 153,849,670,000 噸雞肉。 到 2031 年,家禽仍然是全球肉類產量增長 16% 的主要驅動力。

隨著歐洲,亞洲,中東和非洲,北美和拉丁美洲動物飼料生產和消費的增加,預計將出現顯著增長,預計這將增加對該行業產品的需求。

中國主導亞太市場

- 在中國富裕的中產階級對肉類產品需求增加的推動下,中國對用於生產蛋氨酸的硫化物的需求增長速度快於全球平均水平。 這種巨大的增長可以解釋為畜牧業和農業正在使用更多的動物飼料。

- 蛋氨酸製造商正在該國建立新工廠以擴大生產。 這有利於將國家飼料產業鏈向上游延伸,極大地促進了飼料加工和養殖業的發展。

- OECD-FAO 農業展望 2022-2031 在報告中預測,2021 年中國雞肉總產量為 2144.8 萬噸,2031 年將達到 2444.8 萬噸。 另一方面,2021年中國雞肉總消費量約為2231.8萬噸,由於近期轉向富含蛋白質的動物,預計也將逐漸增加。

- 此外,根據中國飼料工業協會的數據,2022 年上半年中國工業飼料總產量估計約為 1.36 億噸。

- 此外,該國煉油業務的擴張和天然氣需求的增加預計將對市場增長做出重大貢獻。

- 根據 BP 世界能源統計評論 2022,中國將在 2021 年成為亞太地區石油產量最高的國家。 生產石油近2億噸,比上年增長2.5%。

- 中國占 2021 年天然氣市場的三分之一,也是該地區最大的天然氣生產國。 在此期間,中國整體生產天然氣約2100億立方米。

由於該國發生的所有好事,預計硫化物市場在預測期內將會增長。

硫化工業概況

硫化物市場本質上是高度整合的。 市場上的主要參與者包括(排名不分先後)阿科瑪,Daicel Corporation,Chevron Phillips Chemical Company LLC,Hebei Yanuo Bioscience 和 Toray Fine Chemicals。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 在甲硫氨酸生產中使用硫化合物

- 其他司機

- 約束因素

- 硫化合物的高毒性

- 其他限制

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(市場規模:基於數量)

- 類型

- 硫醇

- 二甲基二硫化物 (DMDS)

- 二甲基亞□ (DMSO)

- 巰基乙酸和酯

- 其他類型

- 硫醇

- 最終用戶行業

- 動物營養

- 石油和天然氣行業

- 聚合物/化學品

- 其他最終用戶行業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 西班牙

- 其他歐洲

- 世界其他地方

- 亞太地區

第六章競爭格局

- 併購,合資,合作,合同等。

- 市場份額 (%)/排名分析

- 主要公司採用的策略

- 公司簡介

- Arkema

- Bruno Bock

- Chevron Phillips Chemical Company LLC

- Daicel Corporation

- Dr. Spiess Chemische Fabrik GmbH

- Hebei Yanuo Bioscience Co. Ltd.

- Merck KGaA

- Taizhou Sunny Chemical Co. Ltd.

- TCI Chemicals

- Toray Fine Chemicals Co. Ltd.

- Zhongke Fine Chemical Co. Ltd.

第七章市場機會與未來趨勢

- 在南非和肯亞等非洲經濟區的擴散

During the time frame of the forecast, the thiochemicals market is expected to register a CAGR of over 5%.

The COVID-19 pandemic had both short- and long-term effects on the market. The weakening oil and gas industry, as well as a brief halt in polymer and chemical activity owing to the pandemic lockdown, had a detrimental impact on thiochemicals market demand. However, demand for thiochemicals has expanded dramatically during the post-pandemic era and is expected to continue on the same path.

Key Highlights

- The rising use of thiochemicals in methionine production, which serves as a major nutrient for the poultry industry, is expected to drive market growth.

- However, the high toxicity of thiochemicals, such as isopropyl mercaptan and tetrahydrothiophene, which are flammable and extremely toxic to aquatic fauna, is likely to hinder the growth of the market.

- The increasing market penetration in African economies, like South Africa and Kenya, is expected to provide a substantial opportunity for the thiochemicals market in emerging economies.

- The Asia-Pacific region dominated the market for thiochemicals and is forecast to be the largest market for thiochemicals during the forecast period as well.

Thiochemicals Market Trends

Growing Usage in Animal Nutrition

- In animal nutrition, thiochemicals are mostly used in the form of methyl mercaptan, which is used to make methionine. Methionine is primarily utilized in livestock and poultry feed as a dietary supplement.

- According to the Alltech Agri-Food Forecast for 2023, Europe and North America made the most pet food in the world in 2022. Together, they made more than 11 million metric tons.With a production volume of roughly 8.86 million metric tons, Latin America came in third.

- Alltech also says that the United States has the largest pet food market in the world. In 2021, pet food sales in the United States will bring in nearly USD 44 billion.It was also noteworthy that most of the leading pet food companies around the globe are based in the United States, like Mars Petcare Inc., Nestle Purina PetCare, and J.M. Smucker.

- Due to a growing population, people all over the world are likely to eat more chicken. This is expected to increase the demand for chicken meat and eggs and increase the use of thiochemicals in the industry.

- The OECD-FAO Agricultural Forecast 2022-2031 predicts that the world's meat production will rise by 5% to 339 MT in 2021. This is mostly due to a 34% rise in China's pig meat production, which follows two years of sharp drops caused by an outbreak of African Swine Fever (ASF).Global meat imports were estimated to reach 40 MT in 2021, with imports of chicken taking the lead. Most of this increased demand for meat imports came from the top exporters, such as Brazil, the European Union, and the United States.

- The OECD-FAO Agricultural Outlook 2022-2031 also said that by 2031, the amount of protein in chicken, pig, cow, and sheep meat would rise by 16%, 17%, 8%, and 16%, respectively.Compared to the period between 2019 and 2022, it is expected that 47% of all meat-based protein will come from chicken, followed by pig, sheep, and bovine.

- The projection also said that the world would eat 133,996.62 million tons of poultry meat in 2021 and 153,849.67 million tons of poultry meat in 2031.By 2031, poultry meat will still be the main reason why global meat production will have grown by 16%.

Increasing production and consumption of animal feed across Europe, Asia, the Middle East, Africa, North America, and Latin America is predicted to witness significant growth, which, in turn, is expected to augment product demand in the sector.

China to Dominate the Asia-Pacific Regional Market

- China's thiochemicals demand for methionine production is rising faster than the global average, due to the rising demand for meat products from China's wealthy middle class. The huge growth can be explained by the fact that the livestock and farming industries are using more and more animal feed.

- Methionine manufacturers are expanding production in the country by setting up new plants. This helps the country's animal feed industrial chain extend upstream and greatly boosts the development of the animal feed processing and breeding industries.

- The OECD-FAO Agricultural Outlook 2022-2031 stated in its report that the total production of poultry meat in China in the year 2021 was 21,448 thousand tons, which is expected to reach 24,448 thousand tons in 2031. On the other side, the total consumption of poultry meat in China in 2021 was about 22,318 thousand tons, which is also expected to increase at a gradual rate due to the shift towards more protein-rich animals in recent years.

- Moreover, according to the China Feed Industry Association, the total industrial feed output in China during the first half of 2022 is estimated to be around 136 million tons.

- Also, growing refining operations in the country and higher demand for natural gas are expected to help market growth a lot.

- According to the BP Statistical Review of World Energy 2022, China produced the most oil in the Asia-Pacific region in 2021. It produced close to 200 million tons of oil, which is 2.5% more than it did the year before.

- Accounting for one-third of the natural gas market in 2021, China was also the region's largest natural gas producer. Around 210 billion cubic meters of natural gas were produced in China overall in that period.

The market for thiochemicals is expected to grow during the forecast period because of all the good things that are happening in the country.

Thiochemicals Industry Overview

The theochemicals market is highly consolidated in nature. The major players in the market include (in no particular order) Arkema, Daicel Corporation, Chevron Phillips Chemical Company LLC, Hebei Yanuo Bioscience Co., Ltd., and Toray Fine Chemicals Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Use of Thiochemicals in Methionine Production

- 4.1.2 Other Drivers

- 4.2 Restraint

- 4.2.1 High Toxicity of Thiochemicals

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Mercaptan

- 5.1.1.1 Dimethyl Disulfide (DMDS)

- 5.1.2 Dimethyl Sulfoxide (DMSO)

- 5.1.3 Thioglycolic Acid and Ester

- 5.1.4 Other Types

- 5.1.1 Mercaptan

- 5.2 End-user Industry

- 5.2.1 Animal Nutrition

- 5.2.2 Oil and Gas

- 5.2.3 Polymers and Chemicals

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Bruno Bock

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 Daicel Corporation

- 6.4.5 Dr. Spiess Chemische Fabrik GmbH

- 6.4.6 Hebei Yanuo Bioscience Co. Ltd.

- 6.4.7 Merck KGaA

- 6.4.8 Taizhou Sunny Chemical Co. Ltd.

- 6.4.9 TCI Chemicals

- 6.4.10 Toray Fine Chemicals Co. Ltd.

- 6.4.11 Zhongke Fine Chemical Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Penetration in African Economies, like South Africa and Kenya