|

市場調查報告書

商品編碼

1639503

脲醛樹脂:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Urea Formaldehyde Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

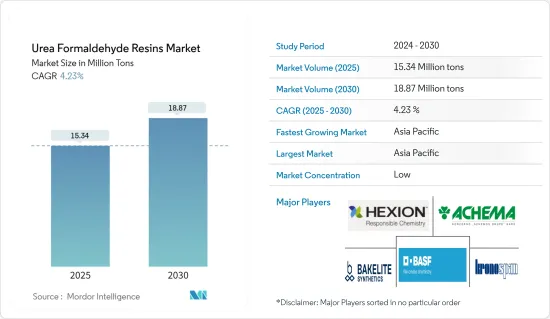

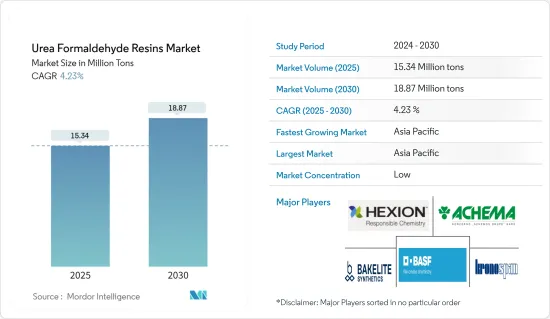

脲醛樹脂市場規模預計2025年為1,534萬噸,預計2030年將達到1,887萬噸,預測期間(2025-2030年)複合年成長率為4.23%。

COVID-19的疫情對尿素甲醛市場產生了負面影響。全球封鎖和嚴格的政府法規關閉了大多數生產基地,對它們造成了破壞。儘管如此,市場預計將在 2021 年復甦,並在未來幾年大幅成長。

主要亮點

- 短期內,家具業對塑合板的需求增加以及對中密度纖維板(MDF)的需求增加預計將推動市場成長。

- 然而,與脲醛樹脂相關的健康危害預計將阻礙市場成長。

- 汽車和電器產品對優質樹脂的需求預計將為所研究的市場創造新的機會。

- 亞太地區主導全球市場,大部分消費來自中國和印度。

脲醛樹脂市場趨勢

建築和施工領域預計將主導市場

- 建築業高度依賴塑合板、膠合板和中密度纖維板等材料,是脲醛樹脂市場成長的關鍵驅動力。

- 隨著建設活動的活性化,這些建築材料的需求和產量也將增加。脲醛在板材和膠合板中的廣泛使用凸顯了其重要性並推動了脲醛市場的整體成長。

- 牛津經濟研究院預測,全球建築產值將繼續保持強勁成長勢頭,到 2037 年從超過 4.2 兆美元增至超過 13.9 兆美元。

- 亞太地區和北美的住宅建設正在蓬勃發展。在亞太地區,印度、中國、菲律賓、越南和印尼等國家則位居前列。同時,人口成長、移民增加和核心家庭趨勢正在推動北美的住宅建設。

- 建築業是韓國主要經濟貢獻者,也是外匯和出口收益的重要來源。韓國國內建築市場的擴張主要得益於私人住宅的穩定成長。

- 政府還計劃實施大規模再開發計劃,到2025年將在首爾和其他城市提供83萬住宅。該計畫要求在首爾建造323,000套新住宅,在京畿道和仁川建造293,000套新住宅。釜山、大邱和大田等大城市也將受益於四年內建造的 22 萬棟新住宅。

- 隨著住宅市場的崛起,以中國和印度為首的亞太地區可能會引領全球住宅建設熱潮。

- 佔全球建築投資20%的中國預計到2030年將在建築上花費約13兆美元,凸顯了鈮市場的看漲前景。

- 印度政府意識到住房的重要性,正在加大力度建造住宅,旨在滿足13億人民的需求。

- 根據國家房地產開發公司(NAREDCO)的報告,2023年排名前七的城市將總合竣工435,000套公寓,預計2024年將大幅增加。為了進一步支持這一趨勢,諾伊達著名的房地產開發商 County Group 今年將宣布三個雄心勃勃的住宅計劃,超過 400 萬平方英尺。

- 美國在美國的建築業中佔據主導地位,加拿大和墨西哥也進行了大量投資。根據美國人口普查局的數據,2023年美國新建住宅數量增加4.46%,從2022年的1,390,500套達到1,452,000套。此外,2023年該國年度建築業價值達1.97兆美元,比2022年的1.84兆美元成長7%。

- 在加拿大,經濟適用住房舉措(AHI)、加拿大新建築計劃 (NBCP) 和加拿大製造等政府舉措預計將顯著加強建築業。 2022 年 8 月,加拿大政府宣布對這些舉措進行超過 20 億美元的重大投資,旨在全國開發約 17,000住宅,其中包括我開發的大量經濟適用住宅。

- 鑑於這些發展,建築業預計將在預測期內保持其市場主導地位。

亞太地區主導市場

- 以中國和印度為首的亞太地區主導全球市場。

- 中國作為世界最大的脲醛樹脂生產國發揮著至關重要的作用。隨著人口的成長,中國的農業部門正在不斷發展,以滿足日益成長的糧食需求。這種演變取決於肥料的性能和效率,從而推高了脲醛樹脂的消耗。

- 中國是全球最大的建築市場,佔全球建築投資的20%。據預測,到2030年,中國將在建築領域投資約13兆美元,市場前景良好。住宅需求的成長將推動公共和私人住宅建設,高層建築和酒店將顯著增加。

- 為加速低成本住宅計劃,香港住宅委員會宣布了一項計劃,旨在到2030年提供301,000個公共住宅。

- 除了建築之外,脲醛樹脂在纖維板製造上也扮演著重要角色。這種纖維板用於汽車領域,形成儀表板和門殼等部件。中國工業協會(CAAM)最新公佈的資料顯示,2023年汽車產量將突破3,016萬輛,與前一年同期比較增加11.6%。 2023年國內乘用車銷量3,009萬輛,與前一年同期比較成長12%。

- 印度汽車製造商協會(SIAM)公佈的資料顯示,2023會計年度汽車產量為458萬輛,而2022會計年度產量為365萬輛。 2023會計年度汽車產量比上年度成長約25%。

- 在政府優惠措施的支持下,印度電子製造業正穩步成長。這包括 100% 外國直接投資 (FDI)、取消工業許可要求以及轉向自動化生產。 2023年8月,印度推出M-SIPS(修改激勵特別計畫)及EDF(電子發展基金),預算1.14億美元,支持國內電子製造業。

- 鑑於這些動態,預計亞太地區將在預測期內保持其市場主導地位。

脲醛樹脂產業概況

全球脲醛樹脂市場較為分散。市場上的主要企業(排名不分先後)包括 Achema、 BASF SE、Hexion、Kronoplus Limited 和 Bakelite Synthetics。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 對中密度纖維板(MDF)的需求增加

- 家具業對塑合板的需求不斷增加

- 其他司機

- 抑制因素

- 脲醛樹脂對健康的危害

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 按用途

- 塑合板

- 木膠

- 合板

- 中密度纖維板

- 其他

- 按最終用戶產業

- 車

- 電器產品

- 農業

- 建築/施工

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Achema

- ARCL Organics Ltd

- Arclin Inc.

- Ashland

- Asta Chemicals

- Bakelite Synthetics

- BASF SE

- Hexion

- Hexza Corporation Berhad

- Jiangsu Sanmu Group Co. Ltd

- Kronoplus Limited

- Melamin kemicna tovarna dd Kocevje

- Metadynea Metafrax Group

- QAFCO

- SABIC

第7章 市場機會及未來趨勢

- 汽車和家用電子電器產品對高品質樹脂的需求增加

- 其他機會

The Urea Formaldehyde Resins Market size is estimated at 15.34 million tons in 2025, and is expected to reach 18.87 million tons by 2030, at a CAGR of 4.23% during the forecast period (2025-2030).

The COVID-19 epidemic negatively impacted the urea formaldehyde market. Global lockdowns and severe government rules resulted in a catastrophic setback, as most production hubs were shut down. Nonetheless, the market recovered in 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the short term, the growing demand for particle boards from the furniture sector and the increasing demand for medium-density fiberboard (MDF) are expected to drive the market's growth.

- However, health hazards regarding urea-formaldehyde resins are expected to hinder the market's growth.

- Nevertheless, the demand for good-quality resins in automobiles and electrical appliances is expected to create new opportunities for the market studied.

- Asia-Pacific dominates the market globally, with the most consumption from China and India.

Urea Formaldehyde Resins Market Trends

Building and Construction Segment Anticipated to Dominate the Market

- The building and construction sector, heavily dependent on materials like particle boards, plywood, and medium-density fiberboard, is a crucial driver of the urea formaldehyde resin market's growth.

- As construction activities ramp up, so does the demand and production of these building materials. The extensive use of urea-formaldehyde in boards and plywood underscores its importance and propels the overall growth of the urea-formaldehyde market.

- Oxford Economics forecasts a robust growth trajectory for global construction output, projecting an increase from over USD 4.2 trillion to a staggering USD 13.9 trillion by 2037, predominantly fueled by the construction powerhouses of China, the United States, and India.

- Both Asia-Pacific and North America are experiencing a surge in residential construction. Countries like India, China, the Philippines, Vietnam, and Indonesia are at the forefront in Asia-Pacific. Meanwhile, North America's residential construction is buoyed by a growing population, rising immigration, and the trend toward nuclear families.

- South Korea's construction industry is a major economic contributor and an essential source of foreign exchange and export earnings. The size of South Korea's local construction market is expanding mainly due to solid growth in private residential construction.

- The government has also planned to execute large-scale redevelopment projects to supply 830,000 housing units in Seoul and other cities by 2025. From the planned construction, Seoul will get 323,000 new houses, and 293,000 will be built near Gyeonggi Province and Incheon. Major cities like Busan, Daegu, and Daejeon will also benefit with 220,000 new houses in 4 years.

- With housing markets rising, the Asia-Pacific region, spearheaded by China and India, is set to lead the global surge in housing construction.

- China, commanding 20% of the world's construction investments, is projected to channel nearly USD 13 trillion into buildings by 2030, underscoring a bullish outlook for the niobium market.

- Recognizing its significance, the Indian government is ramping up housing construction efforts, aiming to cater to the needs of its 1.3 billion citizens.

- Highlighting India's momentum, the National Real Estate Development Corporation (NAREDCO) reports that the top 7 cities collectively completed 4.35 lakh units in 2023, with 2024 poised for a substantial uptick. Further underscoring this trend, County Group, a prominent Noida-based real estate developer, is set to unveil over 4 million sq. ft across three ambitious housing projects this year.

- The United States dominates the construction industry in North America, with Canada and Mexico also making substantial investments. According to the US Census Bureau, the United States saw a 4.46% increase in new housing units in 2023, reaching 1,452 thousand units, up from 1,390.5 thousand in 2022. Additionally, the annual construction value in the country hit USD 1.97 trillion in 2023, marking a 7% rise from USD 1.84 trillion in 2022.

- In Canada, government initiatives like the Affordable Housing Initiative (AHI), New Building Canada Plan (NBCP), and Made in Canada are poised to bolster the construction sector significantly. In August 2022, the Canadian government unveiled a major investment exceeding USD 2 billion for these initiatives, aiming to develop around 17,000 homes nationwide, including a substantial number of affordable units.

- Given these dynamics, the building and construction segment is poised to retain its leading position in the market during the forecast period.

Asia-Pacific to Dominate the Market

- With China and India at the forefront, the Asia-Pacific region dominates the global market.

- China plays a pivotal role as the world's top producer of urea formaldehyde resins. With its growing population, China's agricultural sector is evolving to meet rising food demands. This evolution hinges on fertilizer performance and efficiency, boosting the consumption of urea formaldehyde resins.

- Boasting the world's largest construction market, China accounts for 20% of global construction investments. Projections indicate that by 2030, China is expected to invest nearly USD 13 trillion in buildings, signaling a robust market outlook. The nation's escalating housing demand is set to bolster public and private residential construction, with a notable uptick in tall buildings and hotels.

- To accelerate low-cost housing projects, Hong Kong's housing authorities have unveiled initiatives targeting the delivery of 301,000 public housing units by 2030.

- Beyond construction, urea formaldehyde resin plays a pivotal role in fiberboard production. This fiberboard finds its application in the automotive sector, shaping components like dashboards and door shells. According to the latest data released by the China Association of Automobile Manufacturers (CAAM), car production in the country it exceeded 30.16 million units in the year 2023, registering an 11.6% increase compared to the previous year. A total of 30.09 million units of passenger cars were sold in the country in 2023, registering a 12% increase compared to last year.

- According to the data released by the Society of India Automotive Manufacturing (SIAM), 4.58 million automotive vehicles were manufactured in the FY2023, compared to 3.65 million vehicles produced in 2022. The country saw a rise of around 25% in automotive production in 2023 compared to the previous year.

- India's electronics manufacturing sector is growing steadily and is driven by favorable government policies. These include 100% Foreign Direct Investment (FDI), no industrial license requirements, and a shift to automated production. In August 2023, India launched the Modified Incentive Special Package Scheme (M-SIPS) and the Electronics Development Fund (EDF), with a budget of USD 114 million to support domestic electronics manufacturing.

- Given these dynamics, the Asia-Pacific region is set to uphold its market dominance throughout the forecast period.

Urea Formaldehyde Resins Industry Overview

The global urea formaldehyde resins market is fragmented in nature. The major players in the market (not in a particular order) include Achema, BASF SE, Hexion, Kronoplus Limited, and Bakelite Synthetics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Medium Density Fiberboard (MDF)

- 4.1.2 Rising Demand for Particle Board in the Furniture Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Health Hazards Regarding Urea Formaldehyde Resins

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Application

- 5.1.1 Particle Board

- 5.1.2 Wood Adhesives

- 5.1.3 Plywood

- 5.1.4 Medium Density Fiberboard

- 5.1.5 Other Applications

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.2 Electrical Appliances

- 5.2.3 Agriculture

- 5.2.4 Building and Construction

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Achema

- 6.4.2 ARCL Organics Ltd

- 6.4.3 Arclin Inc.

- 6.4.4 Ashland

- 6.4.5 Asta Chemicals

- 6.4.6 Bakelite Synthetics

- 6.4.7 BASF SE

- 6.4.8 Hexion

- 6.4.9 Hexza Corporation Berhad

- 6.4.10 Jiangsu Sanmu Group Co. Ltd

- 6.4.11 Kronoplus Limited

- 6.4.12 Melamin kemicna tovarna d.d. Kocevje

- 6.4.13 Metadynea Metafrax Group

- 6.4.14 QAFCO

- 6.4.15 SABIC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rise in Demand for Good Quality Resins in Automobile and Electrical Appliances

- 7.2 Other Opportunities