|

市場調查報告書

商品編碼

1332508

家用殺蟲劑的市場規模和份額分析——增長趨勢和預測(2023-2028)Household Insecticides Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

家用農藥市場規模預計到 2023 年為 172.4 億美元,預計到 2028 年將達到 233.4 億美元,在預測期內(2023-2028 年)複合年增長率為 6.25,預計將增長 %。

主要亮點

- 瘧疾等傳染病造成的威脅日益增加,以及地方政府和國家機構對病媒控制的日益重視,預計將在預測期內推動市場發展。

- 為了滿足家庭消費者的需求,市場參與者越來越多地通過易於使用、無麻煩的產品來提供便利。 更安全、更環保的家用農藥的發展趨勢也在不斷增長。 因此,被認為比傳統殺蟲劑更安全的合成擬除蟲菊酯的使用正在增加。

- 市場面臨的主要挑戰之一是抗性昆蟲的出現。 因此,人們正在開發更有效且保質期更長的新型殺蟲劑。 另一個問題是農藥對環境和人體的負面影響。 這增加了對更可持續、更環保的解決方案的需求。 因此,越來越多地關注更安全、更可持續的產品,再加上旨在提高病媒控制效率和有效性的新創新和解決方案的增加,預計將在預測期內推動行業增長。我是。

家用殺蟲劑市場趨勢

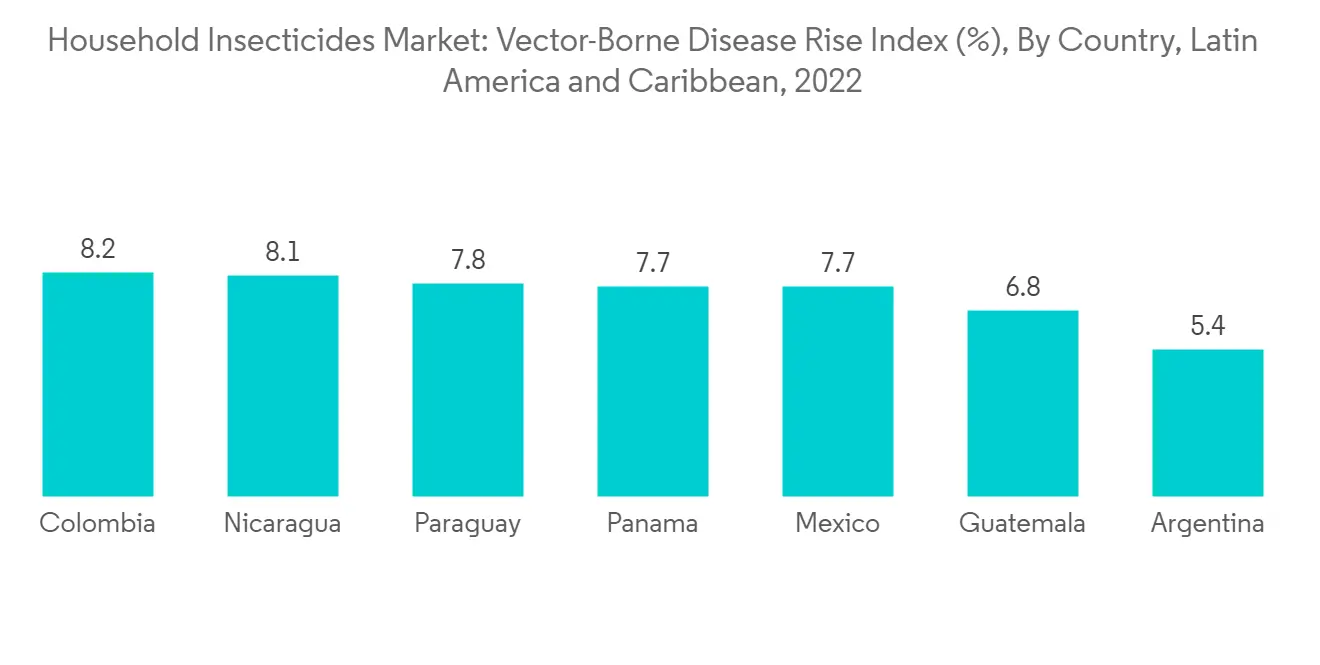

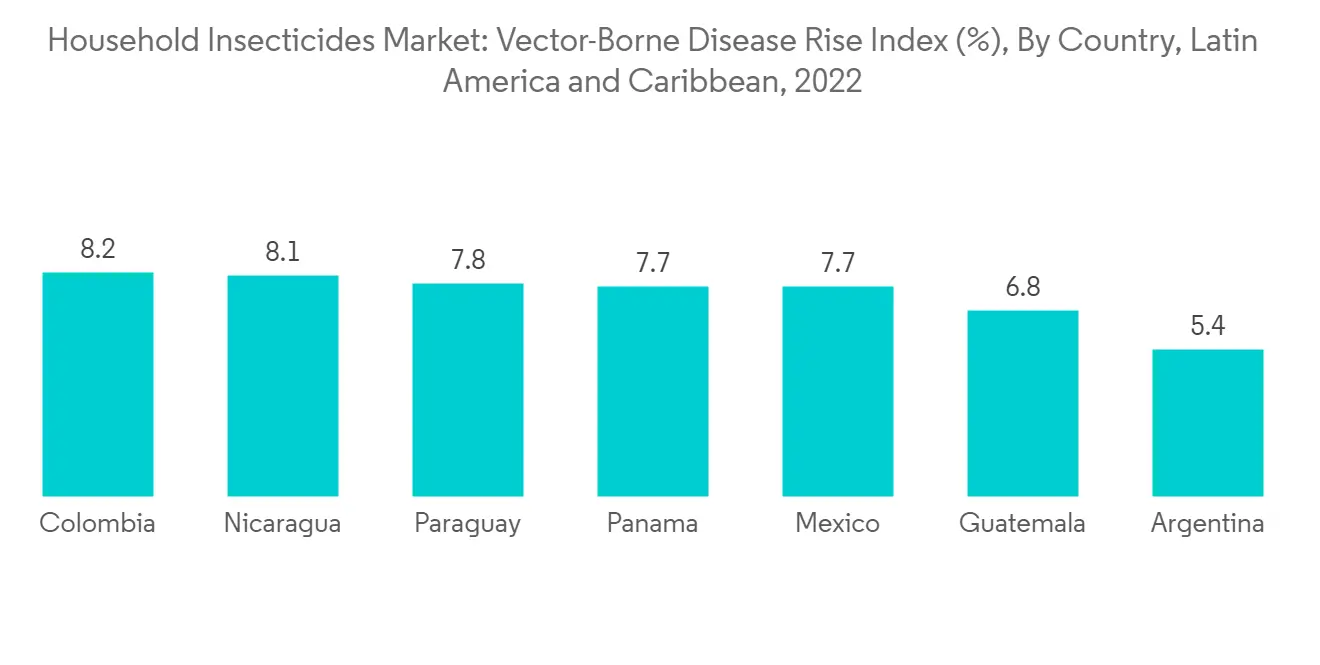

蟲媒疾病的患病率不斷上升

- 昆蟲,尤其是蚊子和蜱蟲,是許多疾病傳播的原因,包括瘧疾、登革熱、寨卡病毒、萊姆病和西尼羅河病毒。 蟲媒疾病爆發增加的原因有多種,包括氣候變化、城市化和全球旅行增加。

- 隨著世界城市人口的健康意識日益增強,人們也越來越意識到蚊蟲叮咬的危險。 此外,隨著發展中國家蚊媒疾病的增加,農村地區的人們越來越關注健康和衛生。

- 根據世界衛生組織 (WHO) 2020 年 3 月發布的報告,蟲媒傳播疾病佔所有傳染病的 17% 以上。 每年有超過 70 萬人死於這些疾病。 此外,空調和其他集水設備的激增也可能為蚊子提供滋生地。

- 氣候變化是蟲媒疾病傳播的主要原因之一。 隨著全球氣溫上升,許多昆蟲媒介的地理範圍將會擴大。 例如,由於氣溫上升,亞洲虎蛾(登革熱和寨卡病毒的蚊子載體)正在向歐洲和美洲的新地區傳播。 因此,蟲媒疾病日益流行是一個由多種因素造成的複雜問題。

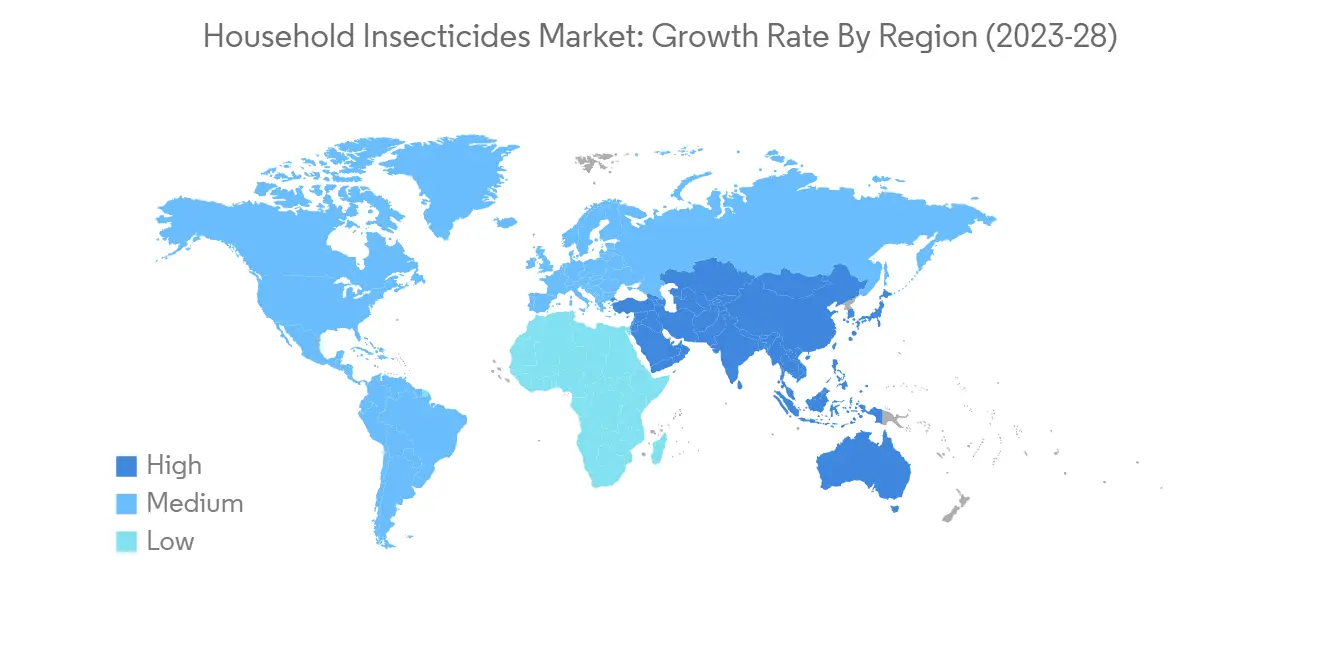

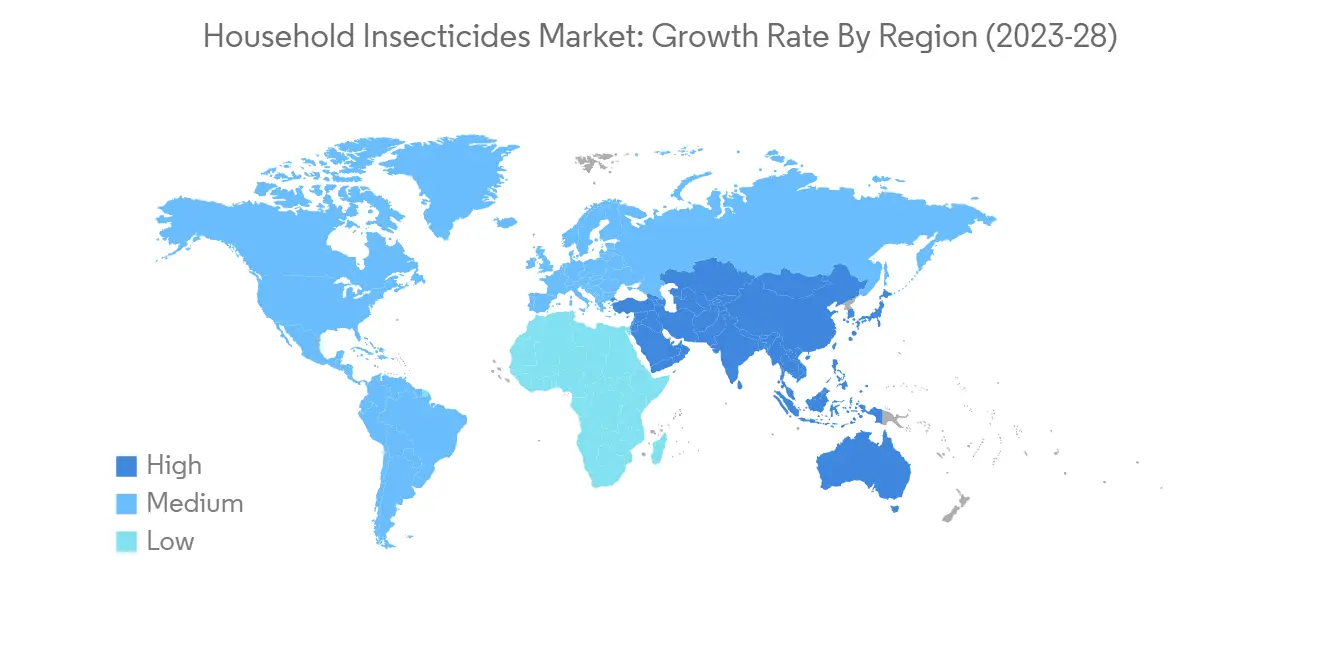

亞太地區主導市場

- 亞太地區正在經歷快速的城市化和人口增長,增加了對家用農藥的需求。 隨著越來越多的人居住在一起,昆蟲侵擾和疾病傳播的可能性增加。 此外,該地區人們的可支配收入不斷增加,導致農藥等家用產品的支出增加。

- 登革熱等渦傳疾病也是亞太地區的一個主要問題。 登革熱是一種蚊媒病毒性疾病,是該地區許多國家的主要公共衛生問題。 登革熱和其他媒介傳播疾病發病率的上升提高了人們對保持家庭無昆蟲重要性的認識。 這推動了該地區對家用農藥的需求。

- 亞太地區各國政府也在採取措施解決病媒傳播疾病問題。 我們開展宣傳活動,教育人們保持家中無蟲害的重要性,並製定法規以確保安全有效地使用殺蟲劑。 總體而言,亞太地區家用農藥市場的增長是由人口增長、城市化、可支配收入增加以及對媒介傳播疾病的擔憂等綜合因素推動的。 預計市場在預測期內將繼續增長。

家用農藥行業概況

家用殺蟲劑市場得到整合,大公司控制了大部分市場份額。 FMC Global Specialty Solutions、Godrej Consumer Products Limited、S.C Johnson & Son、Johnson and Johnson、Spectrum Brands、Natural INSECTO Products Inc. 是該行業的一些主要參與者。 產品創新是企業提高農村市場滲透率、增加城市消費的市場開發策略。 參與者還專注於發展電視、報紙、互聯網和廣播廣告等整合營銷傳播,以增加銷售額。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 研究假設和市場定義

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場動態

- 市場概覽

- 市場驅動因素

- 市場製約因素

- 行業吸引力 - 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第五章市場細分

- 昆蟲的種類

- 蚊子/蒼蠅

- 水稻和其他囓齒動物

- 白蟻

- 臭蟲/甲蟲

- 其他昆蟲類型

- 藥物類型

- 合成

- N,N-二乙基間甲苯□胺

- 羥乙基異丁基□啶羧酸鹽

- 其他化學品類型

- 自然

- 香茅油

- 香葉醇油

- 其他天然油

- 合成

- 形態學

- 灰塵/顆粒

- 液體

- 氣霧噴霧

- 其他形式

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 西班牙

- 英國

- 法國

- 意大利

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 新加坡

- 日本

- 澳大利亞

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 南非其他地區

- 北美

第6章競爭態勢

- 最常採用的策略

- 市場份額分析

- 公司簡介

- Amplecta AB

- FMC Global Specialty Solutions

- Godrej Consumer Products Ltd

- Natural INSECTO Products, Inc.

- Nicols International Sa.

- S.C. Johnson & Son

- Shogun Organics

- Spectrum Brands Holding

第7章 市場機會今後動向

The Household Insecticides Market size is estimated at USD 17.24 billion in 2023, and is expected to reach USD 23.34 billion by 2028, growing at a CAGR of 6.25% during the forecast period (2023-2028).

Key Highlights

- Increased threats due to communicable diseases such as malaria and an increased emphasis on the control of insect vectors by local and national government bodies are expected to drive the market in the forecast period.

- To cater to the needs of household consumers, companies in the market are increasingly providing convenience through products that are easy to use and require minimal effort. In addition, there is a growing trend towards safer and more environment-friendly household insecticides. This has led to an increase in the usage of synthetic pyrethroids, which are considered to be safer than traditional insecticides.

- One of the major challenges facing the market is the emergence of insect resistance among insects. This has led to the development of new and innovative insecticides that are more effective and have a longer residual effect. Another challenge is the negative impact of insecticides on the environment and human health. This has led to increasing demand for more sustainable and eco-friendly solutions. Therefore, with an increasing focus on safer and more sustainable products, the industry is expected to grow during the forecast period, coupled with increasing new innovations and solutions aimed at improving efficiency and effectiveness in controlling insect vectors.

Household Insecticides Market Trends

Rising Prevalence of Insect-borne Diseases

- Insects, particularly mosquitoes and ticks, are responsible for the transmission of many diseases, such as malaria, dengue fever, Zika virus, Lyme disease, and West Nile virus, among others. There are several reasons for the rising prevalence of insect-borne diseases, including climate change, urbanization, and increased global travel.

- The global urban population is becoming more health-conscious, and people are becoming more aware of the risks of mosquito bites. Furthermore, as the number of diseases caused by mosquitoes increases in developing countries, the rural population is becoming increasingly concerned about health and hygiene.

- According to World Health Organization (WHO) report released in March 2020, vector-borne diseases accounted for more than 17% of all infectious diseases. Each year, these diseases cause more than 700,000 deaths. Additionally, the increase in air conditioning units and other appliances that hold water can provide breeding sites for mosquitoes.

- Climate change is one of the primary reasons for the increased prevalence of insect-borne diseases. As global temperatures rise, the geographic range of many insect vectors expands. For instance, the Asian tiger mosquito, a vector for dengue and Zika viruses, has spread to new parts of Europe and the Americas due to warming temperatures. Therefore, the rising prevalence of insect-borne diseases is a complex issue caused by a combination of factors.

Asia Pacific Dominates the Market

- The Asia-Pacific region is experiencing rapid urbanization and an increasing population, which has resulted in a rise in demand for household insecticides. With more people living in close proximity to each other, the chances of insect infestations and the spread of diseases increase. Additionally, the rising disposable incomes of people in this region have led to increased spending on household products, including insecticides.

- Vector-borne diseases like dengue fever are also a major concern in the Asia-Pacific region. Dengue fever is a mosquito-borne viral disease that has become a significant public health concern in many countries in this region. The rising incidence of dengue fever and other vector-borne diseases has led to increased awareness about the importance of keeping households insect-free. This has driven the demand for household insecticides in the region.

- Governments in the Asia-Pacific region have also taken steps to address the problem of vector-borne diseases. They have implemented awareness campaigns to educate people about the importance of keeping their homes insect-free and have also introduced regulations to ensure insecticides are used safely and effectively. Overall, the growth of the household insecticides market in the Asia-Pacific region is driven by a combination of factors, including population growth, urbanization, rising disposable incomes, and concerns over vector-borne diseases. The market is expected to continue to grow in the forecast period.

Household Insecticides Industry Overview

The household insecticides market is consolidated, with major players accounting for the majority of the share of the market. FMC Global Specialty Solutions, Godrej Consumer Products Limited, S.C Johnson & Son, Johnson and Johnson, Spectrum Brands, Natural INSECTO Products Inc., and others are some of the major players in the industry. Product innovation is a go-to-market strategy adopted by firms to increase market penetration in rural areas and consumption growth in urban areas. The players are also heavily focusing on developing integrated marketing communications like television, newspapers, Internet, and radio advertisements to increase sales.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Insect Type

- 5.1.1 Mosquitoes & Flies

- 5.1.2 Rats & other Rodents

- 5.1.3 Termites

- 5.1.4 Bedbugs & Beetles

- 5.1.5 Other Insect Types

- 5.2 Chemical Type

- 5.2.1 Synthetic

- 5.2.1.1 N, N-Diethyl-Meta-Toluamide

- 5.2.1.2 Hydroxyethyl Isobutyl Pieridine Carboxylate

- 5.2.1.3 Other Chemical Types

- 5.2.2 Natural

- 5.2.2.1 Citronella Oil

- 5.2.2.2 Geraniol Oil

- 5.2.2.3 Other Natural Oils

- 5.2.1 Synthetic

- 5.3 Form

- 5.3.1 Dust and Granules

- 5.3.2 Liquids

- 5.3.3 Aerosol Sprays

- 5.3.4 Other Forms

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 Spain

- 5.4.2.3 United Kingdom

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Singapore

- 5.4.3.4 Japan

- 5.4.3.5 Australia

- 5.4.3.6 Rest of the Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Souh Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Amplecta AB

- 6.3.2 FMC Global Specialty Solutions

- 6.3.3 Godrej Consumer Products Ltd

- 6.3.4 Natural INSECTO Products, Inc.

- 6.3.5 Nicols International Sa.

- 6.3.6 S.C. Johnson & Son

- 6.3.7 Shogun Organics

- 6.3.8 Spectrum Brands Holding