|

市場調查報告書

商品編碼

1685706

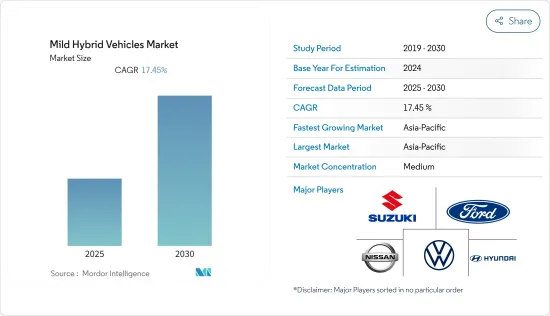

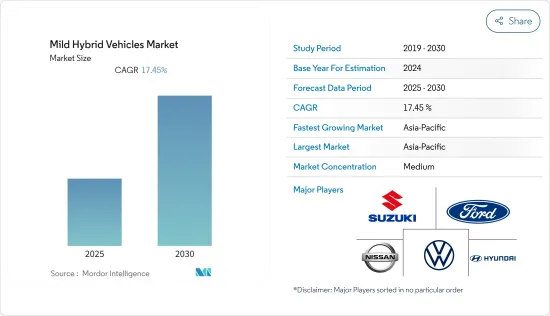

輕度混合動力車:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Mild Hybrid Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預測期內,輕度混合動力車市場預計將以 17.45% 的複合年成長率成長。

更嚴格的排放法規、燃油效率和政府激勵措施是推動汽車製造商和購買者從傳統汽車轉向混合動力汽車的主要因素。然而,電池電動車的需求正在大幅成長,這可能會阻礙輕度混合動力車市場的成長。

預計預測期內亞太地區將經歷加速成長。然而,在印度等新興經濟體,某些趨勢可能會阻礙混合動力汽車的銷售成長,例如最近取消了 FAME 計劃下對輕度混合動力車的補貼。隨著北美和歐洲專注於純電動和全混合動力汽車的發展,輕度混合動力車預計將大幅成長。

輕度混合動力車市場趨勢

輕度混合動力車( 48V 以上)繼續佔據主要市場佔有率

在過去三年中,許多汽車製造商已開始在其新車型上標配 48V輕度混合動力車。全球對 48V 以下輕度混合動力車的需求正在穩步成長。

48V+輕度混合動力車的主要優勢之一是,它們提供全混合動力汽車的許多優點,例如再生煞車和引擎啟動停止技術,但成本更低。特別是對於SUV和卡車等大型車輛來說,它是提高燃油效率和減少排放氣體的經濟有效的選擇。

包括梅賽德斯·奔馳、奧迪和寶馬在內的幾家主要汽車製造商都已投資 48V 輕度混合動力技術,現在他們的許多新車都採用了該技術。例如,2022 年梅賽德斯·奔馳 S 級轎車配備 48V 輕度混合動力系統,可增加 22 馬力和高達 184 磅-英尺的扭矩,同時將燃油經濟性提高高達 10%。

全球各地的汽車製造商都在推出配備 48V 以下輕度混合動力系統的汽車,進一步增加了 48V 以下領域的需求。

鈴木汽車公司、馬恆達和現代等主要汽車製造商過去都曾推出過 12V輕度混合動力車。由於終端用戶的需求不斷成長,製造商目前專注於開發配備 48V 輕度混合動力系統的汽車,預計這將對預測期內的市場成長構成挑戰。

亞太地區繼續佔據主要市場佔有率

亞太地區(主要是中國)的汽車銷量最多,因此佔據了最大的市場佔有率。許多汽車公司正計劃投資亞太市場,以滿足對混合動力汽車的強勁需求。

著眼於長遠發展和實現零排放,中國汽車製造商在研發強大的混合動力汽車、插電式混合動力汽車、高效引擎等先進技術的同時,正在引入48V輕度混合動力技術。例如

- 2022 年 9 月,Volvo在印度推出了最新系列汽油輕度混合動力車。 2023 年的產品陣容將包括 XC90 旗艦 SUV、XC60 中型 SUV、XC40 緊湊型 SUV 和 S90 豪華轎車的汽油輕度混合動力版本。

印度政府也採取了多項舉措,促進印度電動車的生產和普及,以根據國際條約減少排放氣體,並根據快速都市化進程促進電動交通的發展。

國家電動車使命計畫 (NEMMP) 和印度加快採用和製造混合動力和電動車 (FAME I & II) 計畫有助於激發人們對電動車的最初興趣和關注。印度加快採用和製造混合動力和電動車 (FAME) 計畫於 2015 年首次實施,並於 2019 年更新,該計畫為消費者和國內公司提供了一系列獎勵。例如,對於 FAME 的第二階段,政府已宣佈到 2022 年將投入 14 億美元。這一階段的重點是透過對 7,090 輛電動公車、50 萬輛電動三輪車、55 萬輛電動車和 100 萬輛電動二輪車提供津貼,實現公共和共用交通電氣化。

在預計預測期內,汽車製造商和政府為電動車採取的上述措施將進一步推動亞太市場輕度混合動力車的銷售。

輕度混合動力車產業概況

市場的主要企業包括日產汽車公司、大眾汽車集團、鈴木汽車公司、現代汽車公司、福特馬達公司和豐田汽車公司。各汽車製造商推出的新產品也推動了對輕度混合動力車的需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 節省燃油並減少排放氣體

- 政府法規和獎勵

- 市場限制

- 競爭性替代技術

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 容量類型

- 低於48V

- 48V 或更高

- 車輛類型

- 搭乘用車

- 商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 世界其他地區

- 巴西

- 南非

- 其他國家

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Toyota Motor Corporation

- Nissan Motor Co. Ltd

- Honda Motor Company Ltd

- Hyundai Motor Company

- Kia Motors Corporation

- Suzuki Motor Corporation

- Daimler AG

- Volvo Group

- Volkswagen Group

- BMW AG

- Ford Motor Company

- Audi AG

- Mitsubishi Motors Corporation

- BYD Co. Ltd

第7章 市場機會與未來趨勢

- 消費者對混合動力技術的認知與偏好不斷提高

- ADAS(進階駕駛輔助系統)整合

The Mild Hybrid Vehicles Market is expected to register a CAGR of 17.45% during the forecast period.

Stringent emission standards, fuel efficiency, and government incentives are the major factors driving automakers and buyers to shift toward hybrid vehicles from conventional vehicles. However, demand for battery-electric vehicles is growing significantly, which might hinder the growth of the mild hybrid vehicle market.

Asia-Pacific is expected to grow faster during the forecast period. However, certain trends in emerging countries, like India, may hinder the sales growth of hybrid vehicle types as the country recently removed the subsidy for mild hybrid vehicles under the FAME scheme. North America and Europe are expected to witness considerable growth for mild hybrid vehicles as these regions are focusing more on the growth of pure electric or full hybrid vehicles.

Mild Hybrid Vehicles Market Trends

48V and Above Mild Hybrid Vehicles Continue to Capture the Major Market Share

Over the past three years, many automakers started launching a 48V mild hybrid as a standard feature in their new vehicle models. The demand for mild hybrid vehicles equipped with less than 48V capacity steadily grew in various countries across the globe.

One of the key advantages of 48V and above mild hybrid vehicles is that they can offer many of the benefits of full hybrid vehicles, such as regenerative braking and engine start-stop technology, at a lower cost. It makes them a more cost-effective option for improving fuel efficiency and reducing emissions, especially for larger vehicles such as SUVs and trucks.

Several major automakers, such as Mercedes-Benz, Audi, and BMW, are investing in 48 V mild hybrid technology, and many of their new models now feature this technology. For example, the 2022 Mercedes-Benz S-Class offers a 48 V mild hybrid system that provides an additional 22 horsepower and up to 184 lb-ft of torque while also improving fuel efficiency by up to 10%.

Automobile manufacturers in various countries globally are launching vehicles with a mild hybrid system with less than 48 V capacity, which is further increasing demand for the less than 48 V capacity segment.

Leading vehicle manufacturers such as Suzuki Corporation, Mahindra, Hyundai, etc., launched vehicles with a 12 V mild hybrid in the past. With increasing demand from end users, manufacturers are now focusing on developing vehicles with a 48 V mild hybrid system, which is expected to challenge the growth of the market over the forecast period.

Asia-Pacific Continues to Capture the Major Market Share

Asia-Pacific is capturing the largest share of the market owing to the highest vehicle sales, majorly in China. Many automotive companies planned to invest in the Asia-Pacific market to cater to the strong demand for hybrid vehicles.

With an aim for long-term development and to realize the zero-emission goal, Chinese automakers are working on strong HEV, PHEV, high-efficiency engines, and other advanced technologies while introducing 48V mild hybrid technology. For instance,

- In September 2022, Volvo launched its latest range of petrol mild-hybrid cars in India. The company's 2023 line-up includes the petrol mild-hybrid version of its flagship SUV XC90, mid-size SUV XC60, compact SUV XC40, and its luxury sedan S90.

The Indian government also undertook multiple initiatives to promote the manufacturing and adoption of electric vehicles in India to reduce emissions as per international conventions and develop e-mobility in the wake of rapid urbanization.

The National Electric Mobility Mission Plan (NEMMP) and Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India (FAME I and II) schemes helped create the initial interest and exposure to electric mobility. The Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India (FAME) program, first implemented in 2015 and updated in 2019, provides consumers and domestic companies with various incentives. For instance, in phase II of FAME, the government announced an outlay of USD 1.4 billion through 2022. This phase focused on the electrification of public and shared transportation through subsidizing 7090 e-buses, 500,000 electric three-wheelers, 550,000 electric passenger vehicles, and 1,000,000 electric two-wheelers.

The above plans by automakers and governments for electric mobility are anticipated to further boost mild hybrid vehicle sales in the Asia-Pacific market during the forecast period.

Mild Hybrid Vehicles Industry Overview

Some of the major players in the market include Nissan Motor Co. Ltd, Volkswagen Group, Suzuki Motor Corporation, Hyundai Motor Company, Ford Motor Company, and Toyota Motor Corporation, among others. New product launches by various automobile manufacturers are also boosting the demand for mild hybrid cars.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Fuel Efficiency and Emissions Reduction

- 4.1.2 Government Regulations and Incentives

- 4.2 Market Restraints

- 4.2.1 Competing Alternative Technologies

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Capacity Type

- 5.1.1 Less than 48V

- 5.1.2 48V and Above

- 5.2 Vehicle Type

- 5.2.1 Passenger Car

- 5.2.2 Commercial Vehicle

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Toyota Motor Corporation

- 6.2.2 Nissan Motor Co. Ltd

- 6.2.3 Honda Motor Company Ltd

- 6.2.4 Hyundai Motor Company

- 6.2.5 Kia Motors Corporation

- 6.2.6 Suzuki Motor Corporation

- 6.2.7 Daimler AG

- 6.2.8 Volvo Group

- 6.2.9 Volkswagen Group

- 6.2.10 BMW AG

- 6.2.11 Ford Motor Company

- 6.2.12 Audi AG

- 6.2.13 Mitsubishi Motors Corporation

- 6.2.14 BYD Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Consumer Awareness and Preference for Hybrid Technology

- 7.2 Integration of Advanced Driver Assistance Systems (ADAS)