|

市場調查報告書

商品編碼

1402995

農用輪胎:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Agricultural Tires - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

目前農用輪胎市場規模為65.7億美元。

預計未來五年將達88.8億美元,預測期內複合年成長率將超過5.13%。

雖然整體市場情況樂觀,但需求高度依賴經濟中斷,這肯定會影響農民的收入和農業機械的購買。然而,由於COVID-19大流行嚴重影響了包括農用輪胎市場在內的汽車產業,2020年農業設備銷售出現下滑。

對高效、多產農業機械最終產品的需求不斷成長正在推動市場,特別是在已開發國家。德國是繼中國之後的第二大農用輪胎出口國和製造商。人口成長和農業機械技術進步對農產品的需求是推動市場成長的主要因素。

農用輪胎售後市場高度分散,為該行業的OEM帶來了很高的風險。隨著農業機械設計的變化並滲透到更新、更未知的領域,可能需要採用更新、更強橡膠化合物的輪胎。浮動輪胎、林業輪胎、拖車輪胎和鋼製軟性壁複合橡膠輪胎是農用輪胎市場的趨勢。

農用輪胎市場趨勢

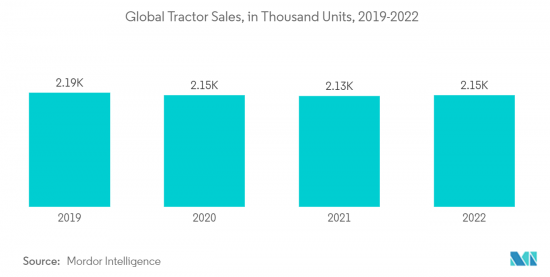

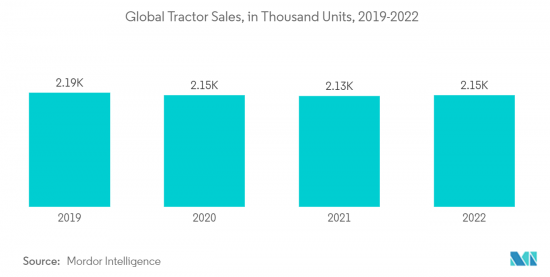

曳引機需求的增加推動了市場

大多數新興國家的農村人口向都市區遷移、人事費用上升以及技術純熟勞工短缺正在推動曳引機銷售。農業勞動力稀缺及其成本上升是農業機械化程度不斷提高的主要原因之一。

對工作效率的日益成長的需求和不斷上升的勞動力成本預計將推動對農用曳引機的需求。在預測期內,農用曳引機市場可能會受到勞動力有限的推動。

考慮到簡單的供需經濟學和勞動力從都市區的流動,農業勞動力的成本與一個國家從事農業的總人口的比例直接相關。因此,為了減少對人力的依賴,農民正在投資農業機械,以減少耕作所需的時間和精力。

各國政府推出了新的地產地銷策略,以彌合供應鏈差距並解決農業部門的勞動力短缺問題。為了支持小農,政府實施了許多全面的稅收改革。例如

- 印度政府實施了“農業宏觀管理計畫”,對35 PTO馬力以下的曳引機提供25%的補貼。同時,加拿大政府推出了《加拿大農業貸款法案》,為農民提供高達50萬美元的貸款,用於購買土地和曳引機。它也可用於建築物維修。

農民正在增加對農業設備的投資,以更少的勞動力實現最佳性能。雖然此類設備需要較高的初始投資,但有助於提高作物的整體品質和數量。許多農民現在正在縮小農場規模並出租部分農場,以抵消不斷上漲的人事費用。

隨著越來越多的農民減少對勞動力的依賴,曳引機銷售預計在未來幾年將健康成長,從而推動預測期內對曳引機輪胎的需求。

儘管農業收入下降,美國的需求仍在增加

美國經濟的整體實力,包括收入水準、購買力、基礎建設發展等因素,對農用輪胎的需求起到了推動作用。強勁的經濟支持農業部門的投資,導致對設備和輪胎的需求增加。 2001年,農業總收入為2,499億美元,大幅成長,到年終超過6,041億美元。

該國農業部門廣泛且高度發達,擁有大量農場和大規模農業經營。如此大規模的耕作需要大量的農用輪胎來支撐各種設備和機械。此外,到 2022 年,美國將有 200 萬個農場,低於 2007 年的 220 萬個。同樣,農業用地面積也將持續減少,從2002年的9.15億英畝減少到2022年的8.93億英畝。平均農地面積將從 1970 年代的 440 英畝小幅增加到 2022 年的 446 英畝。

儘管農民數量有所下降,但由於美國仍然位居榜首。大型且技術先進的農場受益於規模經濟和專業化,使它們能夠提高生產力和效率。再加上農業實踐、設備和基礎設施的進步,幫助美國維持了主要農業生產國的地位。

此外,美國是重要的農產品出口國,向國內和國際市場供應食品和家庭用品。這種出口導向農業依賴高效的耕作方法和農業機械,進一步推動了對農用輪胎的需求。

過去25年,美國農產品出口穩定成長,從1997年的628億美元成長到2022年的1,960億美元。由於全球人口成長、收入增加和飲食多樣化,包括乳製品、肉類、水果和蔬菜等高價值產品在內的消費品出口大幅增加。

這些因素將在未來幾年繼續推動美國農用輪胎的需求。

農用輪胎行業概況

農用輪胎市場集中度中等。農用輪胎市場的主要企業包括普利司通公司(凡士通)、泰坦國際公司(固特異輪胎)、BKT、Continental Reifen Deutschland GmbH、米其林等。

其他產業公司包括 Carlisle Companies Incorp.、Trelleborg Wheel Systems 和 McCreary Tire &Rubber Co.。為了保持市場主導地位,主要企業正在專注於產品升級和客製化,擴大整體產品線,並在農用輪胎市場提供強大的產品。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 世界人口成長

- 其他

- 市場抑制因素

- 產品價格波動

- 其他

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 銷售管道類型

- OEM

- 更換/售後

- 應用程式類型

- 聯結機

- 聯合收割機

- 散佈

- 預告片

- 裝載機

- 其他

- 輪胎類型

- 斜交輪胎

- 子午線輪胎

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章競爭形勢

- 供應商市場佔有率

- 公司簡介

- Bridgestone Corp.

- Continental AG

- Balakrishna Industries Limited

- Titan International Inc.

- Trelleborg AB

- Michelin

- Nokian Tyres PLC

- Pirelli & C SpA(Prometeon Tyre Group)

- Alliance Tire Group

- Apollo Tyres

- Magna Tyres

第7章 市場機會及未來趨勢

- 胎壓監測系統整合

- 向環保、節能農用輪胎的動態轉變

The agricultural tires market is valued at USD 6.57 billion in the current year. It is expected to reach a value of USD 8.88 billion over the next five years, registering a CAGR above 5.13% during the forecast period.

While the overall scenario of the market is positive, the demand is hugely dependent on the economic turmoil that invariably affects the farmers' income and purchase of farm machinery. However, a downturn in farming equipment sales was witnessed in 2020, as the COVID-19 pandemic severely impacted the automotive industries, including the agriculture tires market.

The rise in demand for efficient and productive agricultural machinery end-products, especially among developed nations, drives the agriculture tires market. After China, Germany is the second-largest exporter and manufacturer of agricultural tires. The demand for farm products from expanding populations and technological advancements in agricultural equipment are the primary factors propelling the market growth.

The agriculture tires aftermarket is highly fragmented and poses a high risk to OEMs in this field. Changing agriculture machinery design and increasing penetration into newer unknown terrain may require tires with newer and stronger rubber compounds. Floatation tires, forestry tires, trailer tires, and compound rubber tires with steel flex walls are the trending tires in the agricultural tires market.

Agricultural Tires Market Trends

The Increasing Demand for Tractors is Driving the Market

The migration of people from rural to urban regions, rising labor costs, and skilled labor lack in most developing countries are fueling tractor sales. Shortage of farm labor and its rising cost are among the main reasons for the increasing mechanization of the farming industry.

The increasing need for operational efficiency and the rise in labor costs are expected to boost the demand for agricultural tractors. Over the forecast period, the market for agricultural tractors will be driven by limited labor availability.

Considering simple demand-supply economics and the transfer of labor from urban to rural areas, the cost of farm labor includes a direct link to the percentage of a country's entire population employed in agriculture. Hence, to reduce dependency on human labor, farm owners are investing in farm equipment, thereby reducing the time and effort taken for farming.

Various governments introduced new strategies to produce and consume locally to bridge the supply chain gaps and address the labor shortage in the agriculture sector. To assist smaller players, the governments implemented a few comprehensive tax reforms. For example:

- The Indian government implemented the 'Macro-Management Scheme of Agriculture,' which provides a 25% subsidy on tractors up to 35 PTO HP. At the same time, the Canadian government introduced the 'Canadian Agricultural Loans Act,' which offers farmers a loan of up to USD 500,000 when purchasing land or a tractor. It may also be used to repair buildings.

Farmers are increasingly investing in farm equipment to work at optimum capacity with a smaller workforce. Although these equipment types come with a high initial investment, they help improve overall crop quality and quantity. Many farmers are now scaling down their agricultural operations and leasing out a portion of their farms to offset rising labor costs.

As more farmers are reducing their dependency on labor, it is expected that tractor sales will witness healthy growth in the coming years, thereby driving the demand for tractor tires over the forecast period.

Increasing Demand in the United States Despite Falling Farm Income

The overall strength of the US economy, including factors such as income levels, purchasing power, and infrastructure development, plays a role in driving demand for agricultural tires. A robust economy supports investments in the agricultural sector, leading to increased demand for equipment and tires. In 2001, the gross farm income totaled USD 249.9 billion, which increased significantly by the end of 2022 to over USD 604.1 billion.

The country holds a vast and highly developed agricultural sector, with a significant number of farms and extensive agricultural operations. This large-scale farming requires a substantial number of agricultural tires to support various equipment and machinery. Moreover, in 2022, 2 million farms were in the United States, down from 2.20 million in 2007. In a similar vein, farmland acres continue to decline, falling from 915 million acres in 2002 to 893 million acres in 2022. The average farm size increased a bit from 440 acres in the 1970s to 446 acres in 2022.

Despite the decrease in the number of farms, the United States remains at the top due to the consolidation and modernization of the agricultural sector. Larger, more technologically advanced farms benefit from economies of scale and specialization, allowing for increased productivity and efficiency. It, combined with advancements in agricultural practices, equipment, and infrastructure, helps the United States maintain its position as a leading agricultural producer.

Additionally, the United States is a significant exporter of agricultural products, supplying food and commodities to both domestic and international markets. This export-oriented agriculture relies on efficient farming practices and equipment, further driving the demand for agricultural tires.

US agricultural exports grew steadily in the past 25 years, from USD 62.8 billion in 1997 to USD 196 billion in 2022. Consumer-oriented products, including high-value items like dairy, meats, fruits, and vegetables, experienced significant export growth due to global population growth, rising incomes, and dietary diversification.

Such factors are likely to drive the demand for agriculture tires in the United States over the coming years.

Agricultural Tires Industry Overview

The agricultural tire market is moderately concentrated. The major players in the agricultural tires market are Bridgestone Corporation (Firestone), Titan International Inc. (Goodyear Tires), BKT, Continental Reifen Deutschland GmbH, and Michelin, among others.

Other companies in the industry include Carlisle Companies Incorp., Trelleborg Wheel Systems, and McCreary Tire & Rubber Co. In order to maintain market dominance, the major companies are focusing on product up-gradation and customization to expand the overall product line, with robust offerings in the agricultural tires market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Global Population

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 Fluctuating Commodity Prices

- 4.2.2 Others

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sales Channel Type

- 5.1.1 OEM

- 5.1.2 Replacement/Aftermarket

- 5.2 Application Type

- 5.2.1 Tractors

- 5.2.2 Combine Harvesters

- 5.2.3 Sprayers

- 5.2.4 Trailers

- 5.2.5 Loaders

- 5.2.6 Other Application Types

- 5.3 Tire Type

- 5.3.1 Bias Tires

- 5.3.2 Radial Tires

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Italy

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Bridgestone Corp.

- 6.2.2 Continental AG

- 6.2.3 Balakrishna Industries Limited

- 6.2.4 Titan International Inc.

- 6.2.5 Trelleborg AB

- 6.2.6 Michelin

- 6.2.7 Nokian Tyres PLC

- 6.2.8 Pirelli & C SpA (Prometeon Tyre Group)

- 6.2.9 Alliance Tire Group

- 6.2.10 Apollo Tyres

- 6.2.11 Magna Tyres

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Intergration of Tire Pressure Monitoring System

- 7.2 A Dynamic Shift Towards Eco-Friendly and Energy-Efficient Agriculture Tires