|

市場調查報告書

商品編碼

1640493

電磁閥:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Solenoid Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

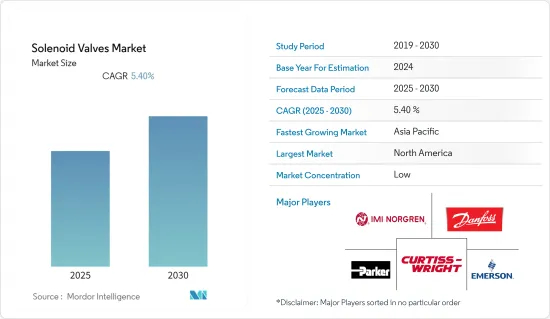

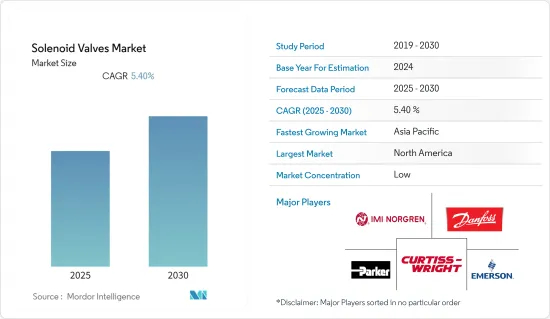

預測期內,電磁閥市場預計將以 5.4% 的複合年成長率成長。

電磁閥市場的發展主要受到製程自動化的日益普及以及電磁閥在各個製程環節的部署日益增多的推動。例如,這些閥門經常用於水處理廠。除了幫助去除污水中的有機污染物外,它還有多種用途。

關鍵亮點

- 水處理領域使用了許多電磁閥,包括塑膠、黃銅和不銹鋼。用於各種設備的進氣閥、水箱填充、軟水器的服務閥、大型氣動或水力閥門的先導閥等。

- 此外,電磁閥在食品加工產業最常使用,是食品加工的最佳選擇之一。許多電磁閥的設計可承受惡劣的室溫以及潮濕、腐蝕性的條件。電磁閥通常由不銹鋼製成,因為這種材料具有耐污染性。

- 電磁閥也可以用於水力發電(一種可再生能源),作為控制水流的系統中的組件。可再生能源計劃的增加預計將推動所研究市場的發展。例如,今年11 月,作為卡納塔克邦投資的一部分,ABC Cleantech 與卡納塔克邦政府簽署了一份合作備忘錄,將建立一個年產能為20 萬噸的綠色氫氣生產裝置和一個年產能為100 萬噸的綠色氨生產裝置噸。

- 電磁閥在醫療領域至關重要,因為它們有助於向使用醫療人工呼吸器的患者輸送正確濃度和流速的氣體。此外,電磁閥可以非常快速且精確地調節氧氣流量(增量小至每分鐘半升),確保有效的患者照護。 COVID-19 疫情增加了對關鍵醫療設備的需求,從而增加了對電磁閥的需求。

- 醫療領域也見證了幾種滿足某些關鍵應用需求的電磁閥創新。例如,今年 4 月,艾默生擴展了其 ASCO 090 系列微型電磁閥產品線,包括 090 系列,該系列為氧氣療法、壓迫療法和氣體分析設備中的氣體控制提供了輕巧、節省空間的解決方案。了三個雙向閥配置。

- 然而,阻礙市場擴大的因素之一是電磁線圈故障。如果施加了錯誤的電壓,線圈可能會發生故障,甚至燒壞。突波和尖峰也會損壞線圈。燒毀的線圈無法修復,必須更換。

電磁閥市場趨勢

食品和飲料行業預計將佔據主要市場佔有率

- 食品級電磁閥和電磁閥歧管用於許多食品處理應用,尤其是飲料分配機。特殊要求包括食品級密封和閥體材料(316 SS),以免改變飲料的味道。電磁閥的設計可承受惡劣的溫度、濕度和腐蝕性條件,使其成為食品和飲料行業的首選閥門。由於其抗污染性能,不銹鋼被用於製造這些閥門以確保其使用壽命。

- 電磁閥通常用於肉類和屠宰行業、水果和蔬菜罐頭廠、魚罐頭廠、醃製系統、飲料(軟飲料、葡萄酒、烈酒)和調理食品行業、乳製品行業、油脂行業、動物飼料行業。用於製造業和其他行業。根據《印度時報》報道,到2023年,47%的印度家庭將消費冷飲。

- 據經合組織稱,2016年至2022年間,全球肉類產量將從3.17億噸增加到3.45億噸以上。肉類產量的增加可能會促進所研究市場的成長。

- 此外,氣動電磁閥主要用於食品和飲料行業,因為它們比主要使用油的液壓電磁閥清潔得多。它們可以被密封以防止任何產品被困在其內部腔內。因此,產品污染的風險降低了。

- 然而,加工動物飼料、穀物和奶粉可能會產生危險且多塵的環境。當灰塵與空氣混合時,就會產生可被火花或火焰點燃的爆炸性環境。潮濕和一般使用也會導致電磁線圈故障並產生火源。因此,我們建議在所有危險環境中使用 ATEX 等級電磁閥。

亞太地區市場預計將實現高成長

- 由於人口成長、燃料和石油產品需求大幅增加以及中階可支配收入的提高,亞太地區是食品飲料、汽車、發電、石油天然氣和醫藥製藥領域電磁閥安裝量最大的地區。快的市場之一。

- 據英國石油公司(BP)稱,中國是亞太地區最大的石油消費國,去年每天消耗 1,550 萬桶石油。同年,印度成為該地區第二大石油消費國,每日消費量為 495 萬桶。此外,亞太地區石油產量2020年將達742.8萬桶/日,2021年將達到733.5萬桶/日。該地區強勁的石油和天然氣行業預計將為電磁閥市場的成長提供大量機會。

- 此外,該地區汽車產量的增加預計將推動市場發展。電子機械驅動閥也構成汽車電磁閥。這些閥門可調節流體或空氣流經汽車系統和馬達的速度。當電流流過螺線管中的導線時,就會發生磁反應,螺線管就會將電能轉換為機械能。電磁閥通常用於液壓系統和動力流體。

- 據印度汽車工業商協會(SIAM)稱,印度是世界上重要的汽車製造國之一。上一會計年度,印度汽車產量約2,290萬輛,比上年度有所成長。根據中國工業協會統計,截至今年4月,我國商用車產量為21萬輛,乘用車產量為99.6萬輛。當月汽車產量為120萬輛,季減46.2%,年減46.1%。

- 根據日本經濟產業省統計,在日本金屬製品領域,去年電磁閥的產量與前一年同期比較增加了 3,200 噸(+19.38%)。因此,日本2021年的產量達到了19,660噸。生產量如此大幅度的成長表明電磁閥的採用可能會增加。

電磁閥產業概況

電磁閥市場競爭激烈。在目前的市場情勢下,市場主要企業之間存在相當大的整合。 ABB 收購通用電氣工業系統公司、艾默生電氣公司收購安沃馳 (Aventics) 等舉措,幫助許多供應商提高了市場佔有率。

第二個是緊湊且久經考驗的 50.806 壓力調節器系列的新版本。這兩種產品都是按照 DIN EN ISO 18562(評估醫療應用中呼吸道生物相容性的標準)設計的。

2023年11月,艾默生推出全新電磁閥ASCO系列。此閥門採用直接作用、高流量設計,與同類閥門相比,具有更優異的流量功率比。為了在最小功率水平下實現高流速,327C 系列採用平衡閥瓣設計,使其適合用於煉油廠、發電廠和化學加工廠。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 電磁閥在水和飲料產業的應用日益廣泛

- 持續轉向可再生能源計劃推動需求

- 市場限制

- 需求和成本降低的動態性質

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 對電磁閥市場的影響

- 行業標準和法規

第5章 技術簡介

- 電磁閥的演變及其在汽車(電動和自動駕駛汽車)等關鍵行業中的新應用

- 關鍵設計和技術考慮因素

第6章 市場細分

- 按類型

- 直動式

- 試運行

- 雙向

- 三通

- 四方

- 尺寸

- 超緊湊

- 超小型

- 微型

- 小振膜

- 大振膜

- 按最終用戶產業

- 食品和飲料(過濾系統、進料系統、食品加工等)

- 車

- 按類型

- 氣壓懸吊

- 燃油噴射和廢氣控制

- 安全保障體系

- 傳動系統

- 其他(門系統、暖通空調等)

- 按應用

- 乘客

- 商用車

- 越野

- 化工和石化

- 儲能裝置方向控制閥

- 隔離閥

- 發電

- 蒸氣控制及供料裝置

- 升降和泵浦系統

- 洪水系統

- 石油和天然氣

- 鑽井系統

- 萃取系統

- 下游供應

- 醫療與製藥(醫療設備與空氣清淨系統)

- 其他最終用戶(例如農業、航太、紡織業)

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 亞洲

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 其他

- 墨西哥

- 巴西

- 非洲

- 其他(土耳其等)

- 北美洲

第7章 競爭格局

- 公司簡介

- IMI Precision Engineerng

- Danfoss Industries Ltd

- Curtiss Wright Corporation

- Emerson Electric Co.

- Parker Hannifin Corporation

- AirTAC International Group

- KANKEO SANGYO Co. Ltd

- Anshan Solenoid Valve Co. Ltd

- CEME SpA

- The Lee Company

- Kendrion NV

- Peter Paul Electronics Co., Inc.

第8章投資分析

第9章 市場展望

The Solenoid Valves Market is expected to register a CAGR of 5.4% during the forecast period.

The market for solenoid valves is primarily driven by the growing popularity of process automation and the increased deployment of solenoid valves in various process sectors. For instance, these valves are frequently used in water treatment facilities. They assist in removing organic pollutants from contaminated water and have several other uses.

Key Highlights

- Numerous solenoid valves, including those composed of plastic, brass, and stainless steel, are used in the water treatment sector. They can be used for various equipment intake valves, tank filling, service valves on water softeners, piloting larger actuated valves with air or water, and more.

- Further, the solenoid valve is one of the most commonly used in the food processing industry and is a great option for food processing. Many solenoid valves are designed to withstand harsh room temperatures and moist, corrosive conditions. Solenoid valves are often constructed with stainless steel because of the material's resistance to contaminants.

- A solenoid valve can also be used in hydropower, a kind of renewable energy, as a component of a system to control the flow of water. The rise in renewable energy projects is expected to drive the studied market. For instance, in November this year, as part of Invest Karnataka, ABC Cleantech and the Government of Karnataka signed an MoU for the establishment of a green hydrogen production unit with an annual capacity of 0.2 million tonnes and a green ammonia production unit with an annual capacity of 1 million tonnes, both integrated with 5 GW of renewable energy projects and costing an estimated USD 6 billion.

- The solenoid valves are of utmost importance in the medical sector as they facilitate delivering the correct concentration of gas and rate of flow to a patient on medical ventilators. In addition, solenoid valves moderate the oxygen flow rate with great speed and precision (increments as small as half a liter per minute) which provides effective patient care. The COVID-19 pandemic augmented the demand for critical medical equipment, thereby increasing the demand for solenoid valves.

- The medical sector is also witnessing several solenoid valve innovations catering to specific vital applications. For instance, in April this year, Emerson expanded its ASCO Series 090 line of miniature solenoid valves, adding a three-way Series 090 valve configuration to enable lighter, space-efficient solutions for gas control in oxygen therapy, compression therapy, and gas analyzer devices.

- However, one of the reasons that can hinder market expansion is solenoid coil failure, which has various possible causes. The coil could malfunction and perhaps burn out if the wrong voltage is applied. Electrical surges or spikes could also harm the coil. Coils that have burned out are beyond repair and must be replaced.

Solenoid Valves Market Trends

The Food and Beverage Sector is Anticipated to Hold a Major Market Share

- Food-grade solenoid valves and solenoid valve manifolds are used for many food handling applications, especially in beverage dispensing machines. Special requirements include food-grade seals and valve body materials (316 SS) for unaltered beverage taste. The solenoid valves are designed to resist adverse temperature, humidity, and corrosive conditions, making them the most preferred valves in the food and beverage industry. Due to its contaminant resistance, stainless steel is used to construct these valves to ensure their longevity.

- Solenoid valves are commonly used in the Meat and Abattoir Industry, Fruit and Vegetable Canneries, Fish Canneries, Salting Systems, Beverage (Soft Drinks, Wines, Spirits) and Ready Meal Industry, Dairy Industry, Oils and Fats Industry, Animal Feed Production Industry, and other Industries. According to Times of India, In 2023, cold beverages had penetrated 47% of Indian households.

- According to OECD, between 2016 and 2022, the global production volume of meat increased from 317 million metric tons to over 345 million metric tons. Such an increase in meat production is likely to boost the growth of the studied market.

- Moreover, the use of pneumatic solenoid valves is predominantly witnessed in the food and beverage industry as they are much cleaner than hydraulic solenoid valves, which mainly use oil. They can be sealed to prevent any product from being trapped within its internal cavities. Thus, lessening the risk of product contamination.

- However, when processing animal fodder, cereals, and powdered milk, a dusty hazardous environment is produced. Dust, when mixed with air, can create a potentially explosive atmosphere that a spark or flame could ignite. There is always a chance that due to moisture or general usage, the solenoid coil may fail and generate an ignition source. So, for all hazardous environments, an ATEX-rated solenoid valve is advisable to be used.

The Asia Pacific Region is Expected to Witness a High Market Growth

- Asia Pacific is expected to stand as one of the fastest-growing markets for solenoid valve installations in food & beverage, automotive, power generation, oil & gas, healthcare & pharmaceutical, owing to the rising population, a significant increase in demand for fuel and petroleum products, and the increasing disposable income of the middle-class population in the region.

- According to British Petroleum (BP), China is the largest oil consumer in the Asia-Pacific region, consuming 15.5 million barrels per day last year. In the same year, India consumed over 4.95 million barrels daily, making it the second-largest oil consumer in the region. Also, the oil production in the Asia Pacific region amounted to 7,428 thousand barrels per day in 2020 and 7,335 thousand barrels per day in 2021. Such a robust oil and gas sector in the region is anticipated to offer numerous opportunities for the growth of the solenoid valve market.

- Further, the rise in the production of automotive vehicles in the region is expected to drive the market. Electromechanically operated valves also comprise automotive solenoid valves. These valves regulate the rate at which fluid or air flows through automotive systems and motors. When electric current flows through the solenoid's wire, it produces a magnetic reaction, which is how solenoids transform electrical energy into mechanical energy. Solenoid valves are often used with hydraulic systems and power fluids..

- According to the Society of Indian Automobile Manufacturers (SIAM), India was one of the significant manufacturers in terms of global automobile production. The total number of automobiles produced in India during the last fiscal year was approximately 22.9 million units, an increase over the previous year. Further, according to the China Association of Automobile Manufacturers, 210,000 commercial vehicles and 996,000 passenger automobiles were produced in China as of April this year. The industry produced a total of 1.2 million automobiles during the month, a decrease of 46.2% from the previous month and 46.1% year-over-year.

- According to METI(Japan), in Japan's fabricated metals sector, the production volume of solenoid-operated valves increased by 3.2 thousand tonnes (+19.38%) last year compared to the previous year. As a result, Japan's output volume reached 19.66 thousand tonnes in 2021. Such a huge rise in the production volume hints at the possibility of an increase in the adoption of solenoid valves.

Solenoid Valves Industry Overview

The Solenoid Valves Market is highly competitive. In the current market scenario, there is a considerable consolidation among top players in the market. Acquisitions, such as ABB of General Electric Industrial Systems and by Emerson Electric Co. of Aventics have helped a number of vendors to improve their market share as suppliers of solenoid valves and other industrial automation solutions.

In November 2023, Kendrion presents new pressure regulators and new pinch valve at COMPAMED 2023,both high-flow pressure regulator, which is designed for particularly high flow rates with low pressure losses, and the other is a new version of the compact and proven 50.806 pressure regulator family. Both products are designed in accordance to DIN EN ISO 18562, the standard for assessing the biocompatibility of the respiratory tract in medical applications.

In November 2023, Emerson has introduced the new ASCO Series solenoid valve. The valve features a directacting, high flow design that provides an advantage over similar valves in terms of the ratio of flowing volts to power. In order to allow high flows at minimum power levels, the Series 327C design features a balanced poppet structure, making it suitable for use in refineries, power plants and chemical processing plants.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption for solenoid valves in the water treatment and beverage industries

- 4.2.2 Ongoing shift to renewable energy-based projects to drive demand

- 4.3 Market Restraints

- 4.3.1 Dynamic nature of demand and cost reduction

- 4.4 Industry Stakeholder Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Solenoid Valves Market

- 4.7 Industry Standards & Regulations

5 TECHNOLOGY SNAPSHOT

- 5.1 Evolution of Solenoid valves and emerging applications in key verticals such as Automotive (Electric vehicles & Autonomous vehicles)

- 5.2 Major design and technical considerations

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Direct Acting

- 6.1.2 Pilot Operated

- 6.1.3 Two Way

- 6.1.4 Three Way

- 6.1.5 Four Way

- 6.2 By Size

- 6.2.1 Micro-miniature

- 6.2.2 Sub-miniature

- 6.2.3 Miniature

- 6.2.4 Small Diaphragm

- 6.2.5 Large Diaphragm

- 6.3 By End-user Industry

- 6.3.1 Food and Beverage (Filtration Systems, Feeder systems, Food Processing, etc.)

- 6.3.2 Automotive

- 6.3.2.1 By Type

- 6.3.2.1.1 Air Suspension

- 6.3.2.1.2 Fuel Injection & Emission Control

- 6.3.2.1.3 Safety & Security Systems

- 6.3.2.1.4 Transmission Systems

- 6.3.2.1.5 Others (Door Systems, HVAC, etc.)

- 6.3.2.2 By Application

- 6.3.2.2.1 Passenger

- 6.3.2.2.2 Commercial

- 6.3.2.2.3 Off-road

- 6.3.3 Chemical & Petrochemical

- 6.3.3.1 Direction-based control valves for storage units

- 6.3.3.2 Isolation-based valves

- 6.3.4 Power Generation

- 6.3.4.1 Steam control & Feeder units

- 6.3.4.2 Lifts & Pumping Systems

- 6.3.4.3 Deluge Systems

- 6.3.5 Oil and Gas

- 6.3.5.1 Drilling Systems

- 6.3.5.2 Extraction Systems

- 6.3.5.3 Downstream supply

- 6.3.6 Healthcare & Pharmaceutical (Medical Devices & Air Purification Systems)

- 6.3.7 Other end-user verticals (Agriculture, Aerospace, Textile, etc.)

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 Italy

- 6.4.2.4 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Rest of the World

- 6.4.5.1 Mexico

- 6.4.5.2 Brazil

- 6.4.5.3 Africa

- 6.4.5.4 Others (Turkey, etc.)

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IMI Precision Engineerng

- 7.1.2 Danfoss Industries Ltd

- 7.1.3 Curtiss Wright Corporation

- 7.1.4 Emerson Electric Co.

- 7.1.5 Parker Hannifin Corporation

- 7.1.6 AirTAC International Group

- 7.1.7 KANKEO SANGYO Co. Ltd

- 7.1.8 Anshan Solenoid Valve Co. Ltd

- 7.1.9 CEME SpA

- 7.1.10 The Lee Company

- 7.1.11 Kendrion NV

- 7.1.12 Peter Paul Electronics Co., Inc.