|

市場調查報告書

商品編碼

1687290

數位轉型 (DX) -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Digital Transformation (DX) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

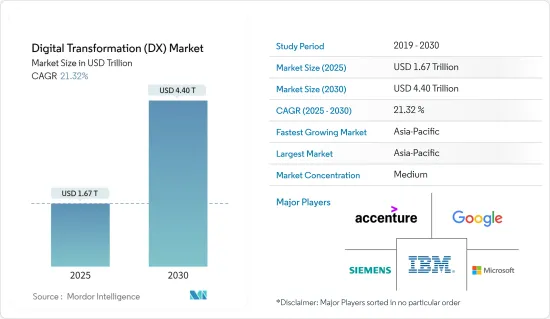

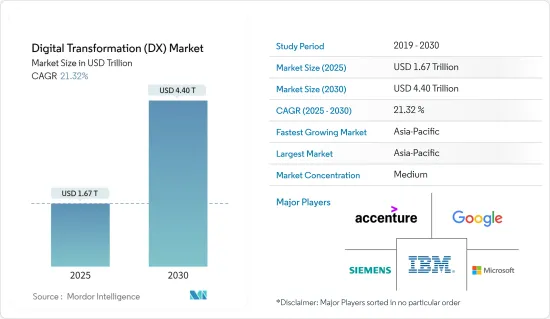

數位轉型市場規模在 2025 年估計為 1.67 兆美元,預計到 2030 年將達到 4.4 兆美元,預測期內(2025-2030 年)的複合年成長率為 21.32%。

關鍵亮點

- 隨著工業 4.0 在製造業的實施,許多工廠正在採用數位技術來改進、自動化和升級其整個流程。機器人等工業 4.0 技術已在許多公司中普及。例如,計劃辦公家具製造商 Vepa 在其倉庫中採用了機器人技術,這有助於提高銷售額。預計協作機器人在生產現場的應用將會越來越廣泛。

- 根據IFR的預測,到2025年,協作機器人產業的規模將達到123億美元。智慧機器人可以與人類一起工作,並經過訓練,可以執行並正確完成大多數生產工人最常見、最耗時的任務。

- 此外,預計企業對物聯網設備的使用增加將加速各產業的數位轉型。根據思科年度網際網路報告,到 2023 年,將有約 300 億個連網設備和服務。到2023年,物聯網設備將佔所有連網設備的50%(147億)。

- 隨著人工智慧和深度學習的應用在全球範圍內從大型科技公司擴展到中小型企業,人工智慧專家出現了短缺。如果沒有人才,人工智慧和機器學習方面增加的所有投資都可能浪費掉,導致財務損失和無法實現的機會。

- 遠端工作人員使用系統解決方案來管理各種活動。我們融合了各種先進技術,包括人工智慧 (AI)、雲端運算、產品、巨量資料工具和功能,以最大限度地提高您的業務業務。疫情過後,一些公司打算投資最新技術,以滿足日益成長的數位化需求。例如,2022 年 1 月,Alphabet LLC 的子公司谷歌與 Airtel 合作投資約 10 億美元。此次合作旨在增加雲端基礎運算的使用,同時為企業提供經濟實惠的智慧型手機存取。這項投資旨在幫助印度小型企業獲得數位技術,從而實現數位化。預計這些努力將刺激數位轉型的需求,並有助於推動新冠疫情後的市場成長。

數位轉型(DX)市場趨勢

物聯網領域預計將佔據最大市場佔有率

- 製造業、汽車業和醫療保健等終端用戶產業擴大採用物聯網技術,這積極推動了市場成長。在傳統製造業數位轉型之際,物聯網正催生新一輪智慧互聯的工業革命。這正在改變各行業處理系統和機器中日益複雜的流程的方式,以提高效率並減少停機時間。

- 工業 4.0 和物聯網是整個物流鏈開發、生產和管理的新技術方法的核心,即智慧工廠自動化。隨著工業 4.0 和物聯網的到來,製造業發生了重大轉變,要求企業採用更敏捷、更聰明、更具創新性的方式來推動生產,利用機器人和技術補充和增強人力,以減少因工藝故障造成的工業事故。

- 連網型設備和感測器的廣泛採用,使得 M2M通訊成為可能,推動了製造業產生的資料點數量的激增。這些資料點可能差異很大,範圍從表示材料經歷一個製程週期所需時間的簡單指標到更高級的計算(例如汽車行業的材料應力能力)。

- 現場設備、感測器和機器人技術的進步預計將進一步擴大市場範圍。物聯網技術正在克服製造業的勞動力短缺問題。對越來越多的公司來說,機器人等工業4.0技術的使用已成為日常業務的一部分。

- 預計未來幾年全球物聯網需求趨勢將從消費需求轉向工業領域,其中大量需求將由各種工業 4.0 應用推動。預計大部分需求將由製造業、能源、商業流動、醫療保健和供應鏈推動。

- 此外,預計智慧城市計畫將在未來幾年帶動物聯網的發展。物聯網設備和系統預計將日益成為交通運輸、公共工程和基礎設施的一部分。預計政府同時推出的措施和推廣活動將提高採用率。

亞太地區可望成為成長最快的市場

- 中國傳統上被認為是世界領先的製造地之一,它透過數位化和工業化做出了巨大努力,從(廉價)勞動力製造向高階工業生產轉型。根據 GSMA 預測,到 2025 年,中國將佔據全球 IIoT 市場的三分之一。

- 該地區採用智慧製造和政府舉措也可能加速該國的數位轉型。中國透過實施智慧製造第一個五年規劃,計畫在2025年建成智慧製造體系,實現重點產業轉型升級。

- 此外,國家經濟與社會發展第十四個五年規劃2035願景強調智慧城市、工業機器人技術、人工智慧和物聯網。

- 中國政府在《中國製造2025》(MIC2025)產業規劃中將機器人產業定位為具有戰略意義的產業。這種分類為外國投資者帶來了機會和劣勢。

- 此外,各國工業IoT的日益普及也大大刺激了市場的成長。例如,「中國製造2025」舉措旨在透過向創新主導、以品質為中心的生產方式轉變來擴大中國經濟。

- 此外,亞洲汽車產業的發展為全球工業機器人市場創造了巨大的潛力。例如,中國擁有世界上最大的電動車市場。根據國際能源總署統計,中國電動車保有量達340萬輛,佔全球市場佔有率的51.5%。根據中國環球電視網報道,中國也透露,到2025年,中國將成為世界機器人強國。

數位轉型(DX)市場概覽

數位轉型市場已基本固化,主要企業包括埃森哲公司、Google有限責任公司(Alphabet Inc.)、西門子股份公司、IBM 公司和微軟公司。該市場的參與企業正在採用聯盟、合併、創新和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2022 年 10 月,Google有限責任公司透過幫助更多公司遷移到運算基礎設施來擴展其雲端業務。此前,該公司加強了與印度技術諮詢公司 HCL Technologies Ltd. 的合作夥伴關係。作為擴大合作夥伴關係的一部分,HCL Tech 開發了兩項新服務,幫助客戶更快地從雲端投資中獲得更多價值。它提供專家、專有智慧財產權、遷移框架和自動化工具的組合,幫助公司更快地將關鍵工作負載遷移到 Google Cloud。此外,新成立的 HCL Tech Cloud 加速團隊結合了架構專業知識和強大的洞察力,以加快客戶在 Google Cloud 上的價值實現時間。

2022 年 9 月,埃森哲收購了 Beacon Group,這是一家成長策略顧問公司,為科技、航太、工業、醫療保健和生命科學產業的財富 500 強公司提供服務。除了傳統的成長策略諮詢業務外,Beacon 的建立市場模型業務還透過對客戶現在和未來的目標市場進行客自訂預測,為客戶提供更高的透明度。該公司的可擴展平台利用來自 400 個細分市場、16 個地區和 15 個垂直行業的資料和見解來創建客製化的自訂預測市場模型。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 產業生態系統分析(詳細介紹數位轉型產業的關鍵相關人員,包括產品/解決方案供應商、系統整合商/增值轉售商、連接提供者、監管機構、最終用戶、服務供應商等)

第5章 當前市場情勢與數位轉型實踐的演變

第6章 數位轉型的區域適應性分析(利用與基礎市場參數和市場前景相關的關鍵基本指標來分析當前的適應性)

第7章。 COVID-19 對數位轉型產業的影響分析(本研究涵蓋的關鍵主題包括對數位轉型實踐預算的短期和中期影響;對機器人、擴增實境、積層製造等關鍵領域的淨影響;區域影響分析。)

第8章市場區隔

- 按類型

- 人工智慧和機器學習

- 當前市場狀況和預測期市場預測

- 關鍵成長動力(促進因素、挑戰、機會)

- 按類型分類的市場區隔(需求預測 | 趨勢 | 市場展望)

- 機器學習

- 自然語言處理(NLP)

- 情境感知計算

- 電腦視覺

- 其他

- 按最終用戶分類的市場細分(製造業、石油和天然氣、公共產業、汽車和運輸業、零售業、金融和保險業、流程工業、其他)

- 按地區分類的市場(北美、歐洲、亞太地區、亞太其他地區)

- 主要市場中的成熟新興企業的分析

- 市場展望

- 工業應用的擴增實境(VR 和 AR)

- 當前市場狀況和預測期市場預測

- 關鍵成長要素(促進因素、挑戰、機會)

- 使用案例分類的市場細分(培訓與模擬、生產與組裝、3D 建模、銷售與行銷、其他)

- VR與AR相對成長預測分析

- 按地區分類的市場(北美、歐洲、亞太地區、亞太其他地區)

- 主要市場中的成熟新興企業的分析

- 市場展望

- IoT

- 當前市場狀況和預測期市場預測

- 關鍵成長要素(促進因素、挑戰、機會)

- 按類型分類的市場區隔(解決方案、平台、服務)

- 按使用案例分類的市場細分(預測性維護、業務流程最佳化、資產追蹤和供應鏈管理等)

- 按最終用戶分類的市場細分(汽車、加工工業、石油和天然氣、汽車和航太、製造業、其他)

- 按地區分類的市場

- 主要市場中的成熟新興企業的分析

- 市場展望

- 工業機器人

- 當前市場狀況和預測期市場預測

- 關鍵成長要素(促進因素、挑戰、機會)

- 市場區隔:依類型(鉸接式、線性、圓柱形、平行、SCARA、其他)

- 按最終用戶分類的市場細分(金屬/機械、電氣/電子、汽車、化學/製造、其他)

- 按地區分類的市場

- 主要市場中的成熟新興企業的分析

- 市場展望

- 區塊鏈

- 當前市場狀況和預測期市場預測

- 關鍵成長動力(促進因素、挑戰、機會)

- 依市場類型細分(物流與供應鏈、仿冒品控制、品管合規、其他)

- 按使用案例分類的市場細分(汽車、航太和國防、工業、零售、其他)

- 按地區分類的市場

- 主要市場中的成熟新興企業的分析

- 市場展望

- 數位雙胞胎

- 當前市場狀況和預測期市場預測

- 關鍵成長要素(促進因素、挑戰、機會)

- 依市場類型細分(製造業、能源與電力、航太、石油與天然氣、其他)

- 按地區分類的市場

- 市場中主要現有企業和新興企業的分析

- 市場展望

- 積層製造

- 當前市場狀況和預測期市場預測

- 關鍵成長要素(促進因素、挑戰、機會)

- 按類型分類的市場區隔(設備、材料、服務和軟體)

- 按最終用戶(汽車、製造、醫療、其他)分類的市場

- 按地區分類的市場

- 主要市場中的成熟新興企業的分析

- 市場展望

- 工業網路安全

- 當前市場狀況和預測期市場預測

- 關鍵成長要素(促進因素、挑戰、機會)

- 按類型分類的市場細分(網路、應用程式、端點、雲端、其他)

- 按最終用戶分類的市場細分(電力、公共產業、運輸、化學品、製造業)

- 按地區分類的市場

- 主要市場中的成熟新興企業的分析

- 市場展望

- 無線連線

- 當前市場狀況和預測期市場預測

- 關鍵成長要素(促進因素、挑戰、機會)

- 按類型分類的市場細分(Wi-Fi、NFC、ZigBee、Z-Wave、LTE Cat-M1、NB-IoT、Sigfox、其他)

- 按最終用戶分類的市場細分(汽車/運輸、工業、通訊、醫療、其他)

- 工業3D列印市場

- 當前市場狀況和預測期市場預測

- 關鍵成長要素(促進因素、挑戰、機會)

- 按機器和服務細分

- 邊緣運算

- 當前市場狀況和預測期市場預測

- 關鍵成長影響因素(促進因素、挑戰、機會)

- 按硬體、平台、軟體和服務分類的市場

- 按最終用戶分類的市場

- 智慧運輸

- 當前市場狀況和預測期市場預測

- 關鍵成長要素(促進因素、挑戰、機會)

- 按類型分類的市場(交通管理、智慧票務、移動共乘、叫車服務、移動出行即服務、智慧高速公路)

- 智慧材料

- 智慧流程自動化

- 人工智慧和機器學習

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第9章競爭格局

- 公司簡介

- Accenture PLC

- Google LLC(Alphabet Inc.)

- Siemens AG

- IBM Corporation

- Microsoft Corporation

- Cognex Corporation

- Hewlett Packard Enterprise

- SAP SE

- EMC Corporation(Dell EMC)

- Oracle Corporation

- Adobe Inc.

- Amazon Web Services Inc.(Amazon.com Inc.)

- Apple Inc.

- Salesforce.com Inc.

- Cisco Systems Inc.

第10章:關鍵變革技術

- 量子計算

- MaaS(Manufacturing-as-a-Service)

- 認知過程自動化

- 奈米科技

The Digital Transformation Market size is estimated at USD 1.67 trillion in 2025, and is expected to reach USD 4.40 trillion by 2030, at a CAGR of 21.32% during the forecast period (2025-2030).

Key Highlights

- With the introduction of Industry 4.0 in the manufacturing sector, numerous factories are embracing digital technology to improve, automate, and upgrade the whole process. Industry 4.0 technology, such as robotization, is already commonplace in many enterprises. For example, Vepa, a project and office furniture maker, employs robotization in its warehouse to help it increase its turnover. Collaborative robots are projected to see a growing application in production.

- According to IFR, the industry for collaborative robots is anticipated to reach USD 12.3 billion by 2025. Intelligent robots work alongside humans and can be trained by most production workers to execute the most common, time-consuming jobs and deliver them properly.

- Furthermore, the increasing use of IoT devices in companies is predicted to accelerate digital transformation in various industries. According to Cisco's Annual Internet Report, there will be about 30 billion network-connected gadgets and services by 2023. IoT devices will account for 50% (14.7 billion) of all networked devices by 2023.

- As AI and deep learning applications expand globally, from tech giants to small and medium-sized businesses, there has been a shortage of expert AI technicians. Without talent, these increased investments in artificial intelligence and machine learning could be wasted, leading to financial losses and unrealized opportunities.

- Remote workers used system solutions to manage various activities. It incorporates various sophisticated technologies, such as artificial intelligence (AI), cloud computing, products, big data tools, and capabilities, to maximize company operations. Following the pandemic, some firms intend to invest in modern technology to address the increasing need for digitalization. For instance, in January 2022, Google, an Alphabet LLC company, committed around USD 1 billion in collaboration with Airtel. The collaboration aimed to provide companies with cheaper smartphone access while also increasing their use of cloud-based computing. The investment aided in the digitization of India's small enterprises by allowing them to use digital technologies. Such initiatives are projected to boost the demand for digital transformation and help the market grow post-COVID-19.

Digital Transformation (DX) Market Trends

The IoT Segment is Expected to Occupy the Largest Market Share

- The growing adoption of IoT technology across end-user industries, such as manufacturing, automotive, and healthcare, is positively driving the market's growth. With the traditional manufacturing sector amid a digital transformation, IoT is fueling the next industrial revolution of intelligent connectivity. This is changing how industries approach increasingly complex processes of systems and machines to improve efficiency and reduce downtime.

- Industry 4.0 and IoT are central to new technological approaches for developing, producing, and managing the entire logistics chain, otherwise known as smart factory automation. Massive shifts in manufacturing due to Industry 4.0 and the acceptance of IoT require enterprises to adopt agile, smarter, and innovative ways to advance production with technologies that complement and augment human labor with robotics and reduce industrial accidents caused by process failure.

- With the high rate of adoption of connected devices and sensors and the enabling of M2M communication, there has been a surge in data points generated in the manufacturing industry. These data points can be of various kinds, ranging from a metric describing the time taken for the material to pass through one process cycle to a more advanced one, such as calculating the material stress capability in the automotive industry.

- The advancements in field devices, sensors, and robots are expected to expand the market scope further. IoT technologies are overcoming the labor shortage in the manufacturing sector. For more and more organizations, using Industry 4.0 technologies, like robotization, is part of day-to-day operations.

- The global IoT demand trend is expected to shift toward the industrial space from consumer demand over the coming years, with sheer volume demand driven by various Industry 4.0 applications. A significant share of the demand is expected to drive the manufacturing industries, energy, business mobility, healthcare, and supply chain.

- Moreover, smart city initiatives are expected to spearhead IoT growth over the coming years. IoT devices and systems are expected to increase as part of transportation, utilities, and infrastructure. Government initiatives and drives in line with this are expected to boost the adoption rates.

Asia-Pacific is Expected to be the Fastest Growing Market

- Traditionally regarded as the world's leading manufacturing facility, China has made significant efforts to transition from (cheap) employment manufacturing to high-end industrial production through digitization and industrialization. China is estimated to account for one-third of the worldwide IIoT market by 2025, according to the GSMA.

- The adoption of smart manufacturing and governmental efforts in the region are also likely to accelerate the country's digital transformation. China plans to develop its smart manufacturing system and accomplish major industry transformation by 2025, per the 13th Five-Year Plan of Smart Manufacturing.

- Furthermore, in the 14th Five-Year Plan for National Economic and Social Development and Vision 2035, the government emphasizes smart cities, robotic technology for the industrial industry, artificial intelligence, and the Internet of Things, among other things.

- In its Made in China 2025 (MIC 2025) industrial program, the Chinese government has identified the robotics industry as a strategically significant sector. Foreign investors have both possibilities and disadvantages as a result of this categorization.

- Additionally, the increasing prevalence of industrial IoT across countries has substantially aided market growth. For example, the "Made in China 2025" initiative aims to broaden the Chinese economy by shifting toward innovation-driven and quality-focused production.

- Furthermore, Asia's developing automobile sector is creating significant worldwide industrial robot market potential. China, for example, has the world's largest electric car market. According to the IEA, China registered 3.4 million electric vehicles, accounting for 51.5% of the worldwide market share. According to CGTN, China has also revealed its aim to become a worldwide robot powerhouse by 2025.

Digital Transformation (DX) Market Overview

The Digital Transformation Market is semi-consolidated, with major players like Accenture PLC, Google LLC (Alphabet Inc.), Siemens AG, IBM Corporation, and Microsoft Corporation. Players in the market are adopting strategies such as partnerships, mergers, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In October 2022, Google LLC expanded its cloud business by assisting more enterprises in migrating to its computing infrastructure. It did so by increasing its partnership with the Indian technology consulting firm HCL Technologies Ltd. HCLTech to develop a pair of new offerings as part of the expanded partnership to help customers get more value from their cloud investments faster. They included the recent Google Cloud Global Migration and Modernization Factory, which provides a combination of experts, unique intellectual property, migration frameworks, and automation tools to assist enterprises more quickly in migrating critical workloads to Google Cloud. Furthermore, a new HCLTech Cloud Acceleration Team was formed to increase customer time-to-value on Google Cloud through a combination of architectural expertise and powerful insights.

In September 2022, Accenture acquired the Beacon Group, a growth strategy consulting firm that serves Fortune 500 companies in the technology, aerospace, industrial, healthcare, and life sciences industries. In addition to its traditional growth strategy advisory work, Beacon's market modeling practice provides clients with greater transparency as they work through custom-made forecasting of current and potential markets served. The company's scalable platform leveraged data and insights from 400 market segments, 16 geographies, and 15 vertical markets and created interactive custom forecast market models.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 INDUSTRY ECOSYSTEM ANALYSIS (Detailed Coverage of Key Stakeholders in Digital Transformation Industry Product/Solution Providers, System Integrators/VARs, Connectivity Providers, Regulatory Bodies, End-users, Service Providers, etc.)

5 CURRENT MARKET SCENARIO AND EVOLUTION OF DIGITAL TRANSFORMATION PRACTICES

6 ANALYSIS OF REGIONAL READINESS DIGITAL TRANSFORMATION ADOPTION (Analysis of the current readiness based on key base indicators related to underlying market parameters and Market Outlook)

7 IMPACT OF COVID-19 ON THE DIGITAL TRANSFORMATION INDUSTRY (Key themes addressed in the study will include short & medium-term impact on budgets for Digital Transformation practices| Net effect on key segments such as robotics, Extended reality, additive manufacturing, etc.| Regional impact analysis)

8 MARKET SEGMENTATION

- 8.1 By Type

- 8.1.1 Artificial Intelligence and Machine Learning

- 8.1.1.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.1.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.1.3 Market Breakdown by Type (Demand Forecasts | Trends | Market Outlook)

- 8.1.1.3.1 Machine Learning

- 8.1.1.3.2 Natural Language Processing (NLP)

- 8.1.1.3.3 Context-aware Computing

- 8.1.1.3.4 Computer Vision

- 8.1.1.3.5 Other Types

- 8.1.1.4 Market Breakdown by End-user (Manufacturing, Oil and Gas, Utilities, Automotive and Transportation, Retail, BFSI, Process Industries, and Others)

- 8.1.1.5 Market Breakdown by Region (North America, Europe, Asia-Pacific, and Rest of the World)

- 8.1.1.6 Analysis of the Key Market Incumbents and Emerging Players

- 8.1.1.7 Market Outlook

- 8.1.2 Extended Reality (VR & AR) for Industrial Applications

- 8.1.2.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.2.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.2.3 Market Breakdown by Use-cases (Training & Simulation, Production & Assembly, 3D Modeling, Sales & Marketing, and Others)

- 8.1.2.4 Relative Growth Forecast Analysis for VR & AR

- 8.1.2.5 Market Breakdown by Region (North America, Europe, Asia-Pacific, and Rest of the World)

- 8.1.2.6 Analysis of the Key Market Incumbents and Emerging Players

- 8.1.2.7 Market Outlook

- 8.1.3 IoT

- 8.1.3.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.3.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.3.3 Market Breakdown by Type (Solutions, Platforms & Services)

- 8.1.3.4 Market Breakdown by Use-case (Predictive Maintenance, Business Process Optimization, Asset Tracking & Supply Chain Management, and Others)

- 8.1.3.5 Market Breakdown by End User (Automotive, Process Industries, Oil & Gas, Automotive & Aerospace, Manufacturing, and Others)

- 8.1.3.6 Market Breakdown by Region

- 8.1.3.7 Analysis of the Key Market Incumbents and Emerging Players

- 8.1.3.8 Market Outlook

- 8.1.4 Industrial Robotics

- 8.1.4.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.4.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.4.3 Market Breakdown by Type (Articulated, Linear, Cylindrical, Parallel, SCARA, and Others)

- 8.1.4.4 Market Breakdown by End User (Metal & Machinery, Electrical & Electronics, Automotive, Chemical and Manufacturing, and Others)

- 8.1.4.5 Market Breakdown by Region

- 8.1.4.6 Analysis of the Key Market Incumbents and Emerging Players

- 8.1.4.7 Market Outlook

- 8.1.5 Blockchain

- 8.1.5.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.5.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.5.3 Market Breakdown by Type (Logistics & Supply Chain, Counterfeit Management, Quality Control & Compliance, and Others)

- 8.1.5.4 Market Breakdown by Use-case (Automotive, Aerospace & Defense, Industrial, Retail and Others)

- 8.1.5.5 Market Breakdown by Region

- 8.1.5.6 Analysis of the Key Market Incumbents and Emerging Players

- 8.1.5.7 Market Outlook

- 8.1.6 Digital Twin

- 8.1.6.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.6.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.6.3 Market Breakdown by Type (Manufacturing. Energy & Power, Aerospace, Oil & Gas, Others)

- 8.1.6.4 Market Breakdown by Region

- 8.1.6.5 Analysis of the Key Market Incumbents and Emerging Players

- 8.1.6.6 Market Outlook

- 8.1.7 Additive Manufacturing

- 8.1.7.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.7.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.7.3 Market Breakdown by Type (Equipment, Materials, Services & Software)

- 8.1.7.4 Market Breakdown by End User (Automotive, Manufacturing, Healthcare, Others)

- 8.1.7.5 Market Breakdown by Region

- 8.1.7.6 Analysis of the Key Market Incumbents and Emerging Players

- 8.1.7.7 Market Outlook

- 8.1.8 Industrial Cyber security

- 8.1.8.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.8.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.8.3 Market Breakdown by Type (Network, Application, Endpoint, Cloud, Others)

- 8.1.8.4 Market Breakdown by End User (Power, Utilities, Transportation, Chemicals & Manufacturing)

- 8.1.8.5 Market Breakdown by Region

- 8.1.8.6 Analysis of the Key Market Incumbents and Emerging Players

- 8.1.8.7 Market Outlook

- 8.1.9 Wireless Connectivity

- 8.1.9.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.9.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.9.3 Market Breakdown by Type (Wi-Fi, NFC, ZigBee, Z-Wave, LTE Cat-M1, NB-IoT, Sigfox, Others)

- 8.1.9.4 Market Breakdown by End User (Automotive & Transportation, Industrial, Telecommunication, Healthcare, Others)

- 8.1.10 Industrial 3D Printing Market

- 8.1.10.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.10.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.10.3 Breakdown by Machine & Services

- 8.1.11 Edge Computing

- 8.1.11.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.11.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.11.3 Market Breakdown by Hardware, Platforms, Software & Services

- 8.1.11.4 Market Breakdown by End User

- 8.1.12 Smart Mobility

- 8.1.12.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.12.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.12.3 Market Breakdown by Type (Traffic Management, Smart Ticketing, Mobility Ridesharing, Ride Hailing, Mobility-as-a-Service, and Smart Highway)

- 8.1.12.4 Smart Materials

- 8.1.12.5 Intelligent Process Automation

- 8.1.1 Artificial Intelligence and Machine Learning

- 8.2 By Geography

- 8.2.1 North America

- 8.2.2 Europe

- 8.2.3 Asia-Pacific

- 8.2.4 Latin America

- 8.2.5 Middle East and Africa

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Accenture PLC

- 9.1.2 Google LLC (Alphabet Inc.)

- 9.1.3 Siemens AG

- 9.1.4 IBM Corporation

- 9.1.5 Microsoft Corporation

- 9.1.6 Cognex Corporation

- 9.1.7 Hewlett Packard Enterprise

- 9.1.8 SAP SE

- 9.1.9 EMC Corporation (Dell EMC)

- 9.1.10 Oracle Corporation

- 9.1.11 Adobe Inc.

- 9.1.12 Amazon Web Services Inc. (Amazon.com Inc.)

- 9.1.13 Apple Inc.

- 9.1.14 Salesforce.com Inc.

- 9.1.15 Cisco Systems Inc.

10 KEY TRANSFORMATIVE TECHNOLOGIES

- 10.1 Quantum Computing

- 10.2 Manufacturing as a Service (MaaS)

- 10.3 Cognitive Process Automation

- 10.4 Nanotechnology