|

市場調查報告書

商品編碼

1406080

煞車油:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Brake Fluids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

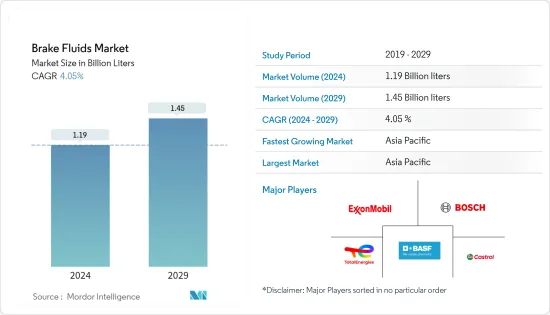

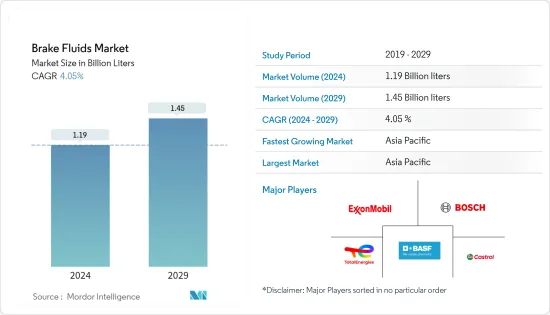

預計2024年煞車油市場規模為11.9億公升,預計2029年將達到14.5億公升,在預測期間(2024-2029年)複合年成長率為4.05%。

COVID-19 大流行對煞車油行業造成了沉重打擊。全球封鎖和政府實施的嚴格規定摧毀了大多數生產基地。儘管如此,業務自 2021 年以來已經復甦,預計未來幾年將大幅成長。

主要亮點

- 推動市場的主要因素是電動車產量的增加以及新興國家汽車產量的顯著成長。

- 另一方面,與煞車油使用相關的嚴格安全標準阻礙了市場成長。

- 汽車領域的技術開拓預計將為市場研究提供機會。

- 亞太地區是最大的市場,由於中國、印度和日本等國家的消費,預計在預測期內將成為成長最快的市場。

煞車油市場趨勢

輕型商用車需求增加

- 煞車油是一種用於所有類型車輛的液壓油,包括小客車和輕型商用車。

- 煞車油也用於電動車。近年來,電動車產量的成長受到政府多項零排放和環保汽車措施的推動,以及消費者意識的提高,推動了市場需求。

- 全球許多汽車製造商都在積極投資電動車,包括特斯拉、通用汽車、豐田、BME、日產、福特和福斯。這些投資預計將在未來五到十年內獲得回報。

- 2022年前三季全球小客車產量約5,000萬輛,較2021年同期成長近9%。然而,根據歐洲汽車工業協會(ACEA)的報告,銷量仍較2019年疫情前水準下降約500萬輛。

- 根據世界經濟論壇 (WEF) 的公告,2022 年上半年全球售出約 430 萬輛新電池驅動電動車 (BEV) 和插電式混合動力汽車(PHEV)。此外,純電動車銷量每年成長約75%,插電式混合動力車銷量成長37%。此外,2022年前8個月,全球電動車銷量突破570萬輛大關,插電式電動車市場佔有率增至近15%。

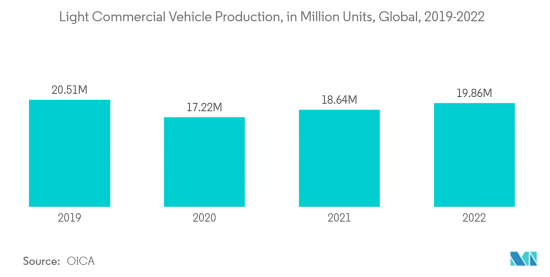

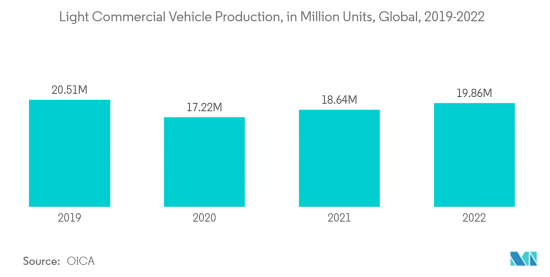

- 國際汽車組織(OICA)公佈的資料顯示,2022年全球輕型商用車(LCV)產量為19,861,126輛,較2021年成長7%。

- 因此,由於上述因素,煞車油的需求預計在預測期內將成長。

亞太地區主導市場

- 由於中國、印度、日本和韓國等主要汽車生產國的存在,預計亞太地區將佔據煞車油市場的最大佔有率。這些國家正在努力透過加強汽車製造基礎和建立高效的供應鏈來實現更高的盈利。

- 在亞太地區,各國政府正在採取有利於電動車採用和擴大電動車製造基礎設施的優惠政策。因此,亞太煞車油市場預計將在預測期內獲得顯著成長動能。

- 根據中國工業協會統計,中國是全球最大的汽車生產國,預計2022年汽車產量將達到2,700萬輛,比去年的2,600萬輛成長3.4%。

- 在印度,根據印度汽車工業協會(SIAM)的數據,該國汽車工業在2021-22年(2021年4月至2022年3月)期間將總合生產22,933,230輛汽車。此外,根據印度經濟監測中心 (CMIE) 的數據,汽車產量從 2022 年 6 月的 1,69,519 輛增加到 2022 年 7 月的 1,93,629 輛。這些因素可能會增加對煞車油的需求。

- 此外,根據OICA的數據,2022年日本和韓國的汽車總產量將分別為7,835,519輛和3,757,049輛。

- 由於上述因素,亞太地區對煞車油的需求預計將成長。

煞車油產業概況

全球煞車油市場因其性質而部分分散。主要企業(排名不分先後)包括 TotalEnergies、Robert Bosch LLC、CASTROL LIMITED、Exxon Mobil Corporation 和BASF SE。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 電動車產量增加

- 新興國家汽車產量顯著成長

- 其他司機

- 抑制因素

- 與煞車油使用相關的嚴格安全標準

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 流體類型

- 石油基

- 非石油基

- 產品類別

- DOT 3

- DOT 4

- DOT 5

- DOT 5.1

- 目的

- 輕型商用車

- 小客車

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 土耳其

- 捷克共和國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 伊朗

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率分析(%)**/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- CASTROL LIMITED

- Chevron Corporation

- China Petrochemical Corporation(SINOPEC)

- Dow

- Exxon Mobil Corporation

- FUCHS

- Hi-Tec Oils Pty Ltd.

- Morris Lubricants

- Motul

- Repsol

- Robert Bosch LLC

- TotalEnergies

- Valvoline

第7章 市場機會及未來趨勢

- 汽車領域技術發展

- 其他機會

The Brake Fluids Market size is estimated at 1.19 Billion liters in 2024, and is expected to reach 1.45 Billion liters by 2029, growing at a CAGR of 4.05% during the forecast period (2024-2029).

The COVID-19 pandemic harmed the brake fluids sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business is recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- The major factor driving the market studied is an increase in the production of electric vehicles and remarkable growth in automotive production in emerging economies.

- On the flip side, stringent safety standards associated with using brake fluids are hindering the market's growth.

- The technological development in the automobile sector is expected to act as an opportunity for the market studied.

- The Asia-Pacific region represents the largest market and is expected to be the fastest-growing market over the forecast period, owing to the consumption from countries such as China, India, and Japan.

Brake Fluids Market Trends

Increasing Demand from Light Commercial Vehicles

- Brake fluid is a type of hydraulic fluid used in all kinds of vehicles, such as passenger cars, light commercial vehicles, and others.

- Brake fluids are used in electric vehicles. The recent increase in the production of electric vehicles is driven by the initiatives taken by several governments toward zero-emission and eco-friendly vehicles, as well as growing consumer awareness is boosting the market demand.

- Many global automotive manufacturers, including Tesla, General Motors, Toyota, BME, Nissan, Ford, and Volkswagen, are significantly investing in electric cars. These investments are expected to show results in the next 5-10 years.

- In the first three quarters of 2022, around 50 million passenger cars were manufactured worldwide, which increased by nearly 9% compared to the same quarter in 2021. However, this was still less by around 5 million units from pre-pandemic levels in 2019, according to the European Automobile Manufacturers' Association (ACEA) report.

- As per the World Economic Forum (WEF), nearly 4.3 million new battery-powered EVs (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold globally in the first half of 2022. Additionally, BEV sales grew by around 75% yearly and PHEVs by 37%. Moreover, global electric car sales crossed the 5.7 million units mark in the first eight months of 2022, and the market share of plug-in electric cars increased to nearly 15%.

- As per data published by the International Organization of Motor Vehicles (OICA), the world production of light commercial vehicles (LCV) in 2022 accounted for 19,860,126 units, which increased by 7% compared to 2021.

- Thus, due to the factors above, the demand for brake fluids is expected to grow during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to account for the largest brake fluid market due to the presence of leading automobile producers such as China, India, Japan, and South Korea. These countries are working hard to strengthen the manufacturing base for vehicles and develop efficient supply chains for greater profitability.

- In the Asia-Pacific region, the governments adopted favorable policies toward adopting electric vehicles and expanding the manufacturing infrastructure of electric vehicles. It, in turn, is anticipated to provide a huge impetus to the brake fluids market in the Asia-Pacific region during the forecast period.

- According to the China Association of Automobile Manufacturers (CAAM), China includes the largest automotive producer in the world, with a total vehicle production of 27 million units in 2022, registering an increase of 3.4% compared to 26 million units produced last year.

- Moreover, in India, during FY 2021-22 (April 2021 to March 2022), according to the Society of Indian Automobile Manufacturers (SIAM), the country's automotive industry produced a total of 22,933,230 units of vehicles in 2022. Further, according to the Centre for Monitoring Indian Economy (CMIE), car production increased to 1,93,629 units in July 2022 from 1,69,519 units in June 2022. Such factors are likely to increase the demand for brake fluids.

- Further, according to OICA, in 2022, the total production of motor vehicles in Japan and South Korea accounted for 7,835,519 units and 3,757,049 units, respectively.

- The demand for brake fluids in Asia Pacific is expected to grow owing to the factors above.

Brake Fluids Industry Overview

The global brake fluids market is partially fragmented in nature. The major players (not in any particular order) include TotalEnergies, Robert Bosch LLC, CASTROL LIMITED, Exxon Mobil Corporation, and BASF SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in the Production of Electric Vehicles

- 4.1.2 Remarkable Growth in Automotive Production in Emerging Economies

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Safety Standard Associated With the Use of Braking Fluids

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Fluid Type

- 5.1.1 Petroleum

- 5.1.2 Non-petroleum

- 5.2 Product Type

- 5.2.1 DOT 3

- 5.2.2 DOT 4

- 5.2.3 DOT 5

- 5.2.4 DOT 5.1

- 5.3 Application

- 5.3.1 Light Commercial Vehicles

- 5.3.2 Passenger Cars

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Turkey

- 5.4.3.7 Czech Republic

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Iran

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 CASTROL LIMITED

- 6.4.3 Chevron Corporation

- 6.4.4 China Petrochemical Corporation (SINOPEC)

- 6.4.5 Dow

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 FUCHS

- 6.4.8 Hi-Tec Oils Pty Ltd.

- 6.4.9 Morris Lubricants

- 6.4.10 Motul

- 6.4.11 Repsol

- 6.4.12 Robert Bosch LLC

- 6.4.13 TotalEnergies

- 6.4.14 Valvoline

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Development in Automobile Sector

- 7.2 Other Opportunities