|

市場調查報告書

商品編碼

1407006

檢查機 -市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Inspection Machines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

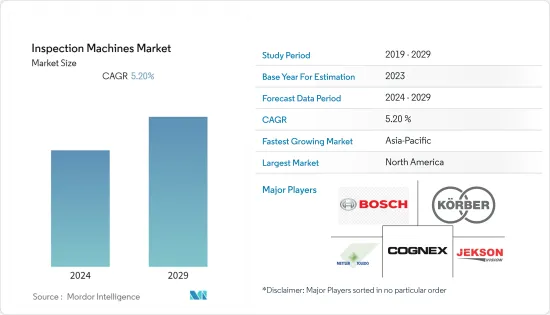

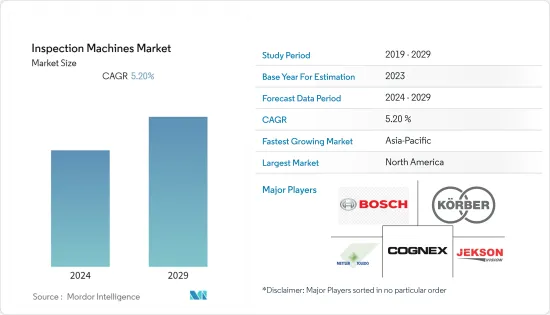

檢查機市場預計在預測期內複合年成長率為 5.2%。

COVID-19大流行對檢測設備市場的成長產生了重大影響。例如,2021年12月發表在《臨床治療學》上的一項研究指出,COVID-19大流行不僅影響了全球製藥業,也影響了監管機構的管理和營運。然而,為了遵守良好生產規範 (GMP),政府法規的增加、服務的恢復以及世界各地不斷增加的產品召回增加了對檢查機的需求。例如,2021 年 1 月,史蒂瓦那托集團與微軟義大利合作,以應對醫用玻璃產業在 COVID-19 大流行期間遇到的挑戰。該公司為國際主要抗COVID-19疫苗項目提供包裝、注射器和藥品測試設備。因此,所研究的市場預計將在預測期內成長並恢復其全部潛力。

提高對良好生產規範 (GMP) 的監管合規性和產品召回等因素正在推動市場成長。例如,2022 年 12 月,Accord Healthcare, Inc. 表示,在標有「注射用達托黴素 350 毫克/瓶」的管瓶中發現了標有「注射用達托黴素500 毫克/瓶」的小瓶.收到醫院藥局產品申訴報告後,注射用500毫克/瓶和注射用達托黴素350毫克/瓶產品。另外,外盒和內盒上印的批號和有效期限相同,對應「注射用達托黴素500毫克/瓶」。這些案例正在促進市場成長。

此外,新產品的推出預計也將在預測期內促進市場成長。例如,2022年3月,EPIC Systems推出了一款新的承包影像檢查產品,可搭配標籤偵測和蓋子封裝檢驗。此外,梅特勒-托利多於 2022 年 2 月發布了 X34C X光。此 X34C X 光檢測系統是一種快速有效的垂直 X 光檢測系統,針對製藥業規定的應用階段內的單一產品、泡殼包裝和小袋的污染物檢測進行了最佳化。

因此,由於上述因素,所研究的市場預計在預測期內將會成長。然而,在預測期內,對再製造設備的需求不斷成長可能會阻礙檢查機市場的成長。

檢查機市場趨勢

視覺檢測系統領域預計將在預測期內佔據重要的市場佔有率

由於假藥增加、產品召回增加以及製藥業採用 GMP 實踐和新型檢測系統等因素,視覺檢測系統預計將在檢測機市場中顯著成長。

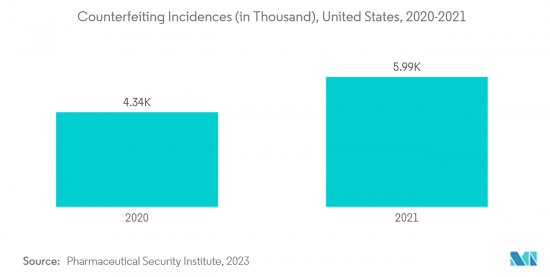

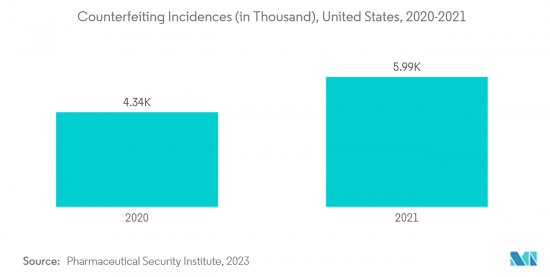

隨著假藥的增加、維持藥品安全供應的監管措施日益嚴格以及技術先進產品的推出,製藥業需要對藥品進行即時追蹤、追溯和認證,擴大採用創新檢測系統為了由於這些因素,預計該行業的成長在預測期內將會增加。例如,根據世界衛生組織的報告,2021年,不合格和仿冒品(SF)醫療物品的數量與前一年同期比較增加了52%。同樣,2021 年,世衛組織全球不合格和假冒醫療產品監測系統在印度和烏干達發現了仿冒品的 COVID-19 疫苗 Covishield。因此,此類假藥案例可能會增加對檢測設備的需求,從而支持市場成長。

此外,製藥業在製造過程中遵守多項標準,例如包裝安全、化妝品相容性以及最終用戶教育材料的內容,因此為了適應標準並提高整體質量,需要一種新穎的檢測系統。例如,根據 2022 年 6 月在國家醫學圖書館發表的一篇論文,包裝上或內部產品的存在控制和檢測是視覺檢測系統經常部署的領域之一。同一消息來源也指出,這些檢查系統可用於檢查泡殼包裝中是否有破損或缺失的錠劑,或確定特殊套件中給藥裝置的組件是否缺失。因此,製藥業擴大採用影像檢查系統,推動了該行業的成長。

此外,新推出的視覺檢測系統預計將增加市場上技術先進的機器的可用性,從而提高其在製藥行業的採用率。例如,2022年12月,FILTEC推出了遠端視覺偵測(RVI)系統,這是一個緊湊而靈活的機器視覺解決方案,用於偵測寶特瓶、玻璃瓶和鋁罐。同樣在 2021 年 2 月,星德科 (Syntegon Technology) 在自動檢查機中安裝了第一個由人工智慧 (AI) 驅動的經過充分檢驗的視覺檢查系統,用於對藥品進行視覺檢查。

因此,由於假藥增加、目視檢查系統擴大採用以及產品發布增加等因素,預計研究領域將在預測期內成長。

預計北美將在預測期內佔據主要市場佔有率

由於各行業中與檢查相關的調查和產品召回數量不斷增加,以及由於嚴格的法規而擴大採用 GMP 實踐等因素,北美檢查機市場在預測期內將出現顯著成長。預期的。例如,根據 2021 年 10 月在國家醫學圖書館發表的報導,FDA,特別是設備和放射健康中心,對醫療設備業進行集中監管。醫療設備製造商必須建立並遵守品質體系,以確保其產品持續符合相關法規和規範。這導致在產品製造和其他過程中更多地採用 GMP 政策和標準以及技術先進的檢測系統,以避免產品召回並在保持生產力的同時確保質量,從而支持市場成長。

此外,該地區不斷推出的各種測試系統也促進了市場的成長。例如,2021 年 10 月,PTI Inspection Systems 在紐約 Interphex 活動上宣布推出其全新革命性 VeriPac 465 微洩漏偵測系統。 VeriPac 465 是一款確定性微洩漏測試設備,適用於需要精確測量和檢測微洩漏的剛性容器和注射產品。因此,此類開拓預計將在預測期內推動市場成長。

因此,由於上述因素(例如增加產品推出、擴大採用 GMP 實踐以及增加產品召回),所研究的市場預計在預測期內將成長。

檢查機行業概況

這個市場部分分散,由幾個大型參與者組成。許多公司正在採取關鍵的業務策略,例如聯盟、新產品發布和其他舉措來維持其市場地位。目前主導該市場的公司包括羅伯特·博世有限公司、科柏股份公司、康耐視公司、梅特勒-托利多國際公司和 Jekson Vision。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 更好地遵守良好生產規範 (GMP) 法規

- 產品召回增加

- 市場抑制因素

- 播放設備需求不斷成長

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依產品

- 影像檢查系統

- X光偵測系統

- 洩漏檢查系統

- 金屬探測器

- 其他

- 按最終用戶

- 製藥和生物技術公司

- 醫療設備製造商

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東/非洲

- GCC

- 南非

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭形勢

- 公司簡介

- ACG

- Antares Vision Group

- Brevetti CEA Spa

- Cognex Corporation

- Jekson Vision

- Korber AG

- Mettler-Toledo International Inc

- Omron Corporation

- OPTEL GROUP

- Robert Bosch GmbH

- Teledyne Technologies

- Thermo Fisher Scientific

第7章 市場機會及未來趨勢

The inspection machines market is projected to register a CAGR of 5.2% during the forecast period.

The COVID-19 pandemic had a significant impact on the growth of the inspection machines market. For instance, a research study published in Clinical Therapeutics, in December 2021, stated that the COVID-19 pandemic has affected the management and operation of regulatory agencies as well as the pharmaceutical industry around the world. However, the increased government restrictions to comply with good manufacturing (GMP) practices, resumed services and the growing product recalls across the globe have increased the demand for inspection machines. For instance, in January 2021, Stevanato Group collaborated with Microsoft Italy to meet the challenges that the pharmaceutical glass industry was experiencing during the COVID-19 pandemic. The company provides packaging and syringes for the major international anti-COVID-19 vaccine programs, as well as pharmaceutical inspection equipment. Thus, the studied market is anticipated to grow and regain its full potential over the forecast period.

Factors such as increasing regulatory compliance with good manufacturing practices (GMP) and product recalls are boosting market growth. For instance, in December 2022, Accord Healthcare, Inc. voluntarily recalled a single lot of Daptomycin for Injection 500 mg/vial, and Daptomycin for Injection 350 mg/vial product as they received a product complaint report from a hospital pharmacy that vials labeled as Daptomycin for Injection 500 mg/vial' were found in cartons labeled as 'Daptomycin for Injection 350 mg/vial'. Also, the lot and expiration date printed on the outer carton and inner vial are the same and correspond to 'Daptomycin for Injection 500 mg/vial'. Such instances are contributing to market growth.

Furthermore, new product launches are also anticipated to augment the market growth over the forecast period. For instance, in March 2022, EPIC Systems launched a new turnkey vision inspection product, matching label inspection and lid package verification that is designed to provide industry-leading vision inspection solutions for manufacturers. Also, in February 2022, Mettler Toledo introduced X34C X-ray, a fast and effective vertical X-ray inspection system optimized for contaminant detection of individual products within a defined application ste, blister packs, and sachets in the pharmaceutical industry.

Therefore, owing to the aforementioned factors, the studied market is expected to grow over the forecast period. However, the growing demand for refurbished equipment is likely to hinder the growth of the inspection machines market over the forecast period.

Inspection Machines Market Trends

Vision Inspection System Segment is Expected to Hold a Significant Market Share Over the Forecast Period

The vision inspection system is anticipated to witness significant growth in the inspection machines market owing to the factors such as the rising number of counterfeit drugs and increasing product recalls as well as the adoption of GMP practices and novel inspection systems by the pharmaceutical industry.

The increasingly stringent regulatory measures in maintaining a secure drug supply in the wake of rising counterfeit drugs, and the introduction of technological advanced products have increased the adoption of innovative inspection systems for the real-time tracking, tracing, and authentication of drugs in the pharmaceutical industry. These factors are projected to increase segment growth over the forecast period. For instance, according to the WHO report, there has been an increase in the number of cases of substandard and falsified (SF) medical items by 52% in 2021 as compared to the previous year. Similarly, in 2021, WHO's worldwide surveillance and monitoring system for substandard and counterfeit medical products discovered fraudulent versions of the COVID-19 vaccine Covishield in India and Uganda. Thus, such cases of counterfeit drugs are likely to raise the demand for inspection machines thereby supporting market growth.

Additionally, the pharmaceutical sector adheres to several standards in their manufacturing such as packaging safety, cosmetic compatibility, and the content of educational materials for the end-user, which calls for a novel inspection system to adapt to standards and improve overall quality. For instance, as per an article published in the National Library of Medicine, in June 2022, controls for presence and absence, and the detection of products on or inside a package frequently is one of the areas where the vision inspection system is being implemented. In addition, as per the same source, these inspection systems are used to check for damaged or missing tablets in blister packaging and to determine whether any components of the medication mechanisms administered with a special kit are missing. This increases the adoption of vision inspection systems by the pharmaceutical industry, hence propelling the segment's growth.

Furthermore, the new launches of vision inspection systems increase the availability of technologically advanced machines in the market, which in turn is anticipated to increase its adoption across the pharmaceutical sector. For instance, in December 2022, FILTEC launched Remote Vision Inspection (RVI) systems, a compact and flexible machine vision solution that inspects PET bottles, glass bottles, and aluminum cans for several applications. Also, in February 2021, Syntegon Technology installed the first fully validated visual inspection system utilizing Artificial Intelligence (AI) in an automated inspection machine for pharmaceutical visual inspection.

Therefore, owing to the factors, such as the rising number of falsified drugs, growing adoption of vision inspection systems, and increasing product launches, the studied segment is expected to grow over the forecast period.

North America is Expected to Have the Significant Market Share Over the Forecast Period

North America is expected to witness significant growth in the inspection machines market over the forecast period owing to the factors such as the growing adoption of GMP practices by the players due to the stringent regulations coupled with research studies related to inspections in various industries as well as growing product recalls in the region. For instance, as per an article published in the National Library of Medicine, in October 2021, the FDA, more especially the Center for Devices and Radiological Health, intensively regulates the medical device industry. Device manufacturers are expected to set up and adhere to quality systems that guarantee their products continuously meet relevant regulations and specifications. This increases the adoption of GMP policies, and standards, along with the technologically advanced inspection systems during the manufacturing and other processes of the products to avoid such product recalls as well as to withstand the quality while maintaining productivity, hence bolstering the market growth.

Furthermore, the increasing launches of various inspection systems in the region are also contributing to the market growth. For instance, in October 2021, PTI Inspection Systems launched a new revolutionary VeriPac 465 Micro Leak Detection System at the Interphex event in New York. The VeriPac 465 is a deterministic microleak test device for rigid containers and parenteral products that require accurate measurement and leak detection of the smallest leaks. Thus, such development is anticipated to fuel the market growth over the forecast period.

Therefore, due to the aforementioned factors, such as increasing product launches, growing adoption of GMP practices and rising product recalls, the studied market is anticipated to grow over the forecast period.

Inspection Machines Industry Overview

The market is partially fragmented and consists of several major players. Various companies are adopting key business strategies such as collaboration, new product launches, and other initiatives to withhold their market position. In addition, the emerging technologically advanced inspection system and software are creating several opportunities for the market playersSome of the companies which are currently dominating the market are Robert Bosch GmbH, Korber AG, Cognex Corporation, Mettler-Toledo International Inc, and Jekson Vision among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Regulatory Compliance With Good Manufacturing Practices

- 4.2.2 Growing Product Recalls

- 4.3 Market Restraints

- 4.3.1 Growing Demand for Refurbished Equipment

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Vision Inspection System

- 5.1.2 X-ray Inspection System

- 5.1.3 Leak Detection System

- 5.1.4 Metal Detectors

- 5.1.5 Others

- 5.2 By End User

- 5.2.1 Pharmaceutical and Biotech Companies

- 5.2.2 Medical Device Companies

- 5.2.3 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ACG

- 6.1.2 Antares Vision Group

- 6.1.3 Brevetti CEA Spa

- 6.1.4 Cognex Corporation

- 6.1.5 Jekson Vision

- 6.1.6 Korber AG

- 6.1.7 Mettler-Toledo International Inc

- 6.1.8 Omron Corporation

- 6.1.9 OPTEL GROUP

- 6.1.10 Robert Bosch GmbH

- 6.1.11 Teledyne Technologies

- 6.1.12 Thermo Fisher Scientific