|

市場調查報告書

商品編碼

1408329

汽車儀表板:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Automotive Fascia - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

汽車儀表板市場目前的市場規模為216.4億美元,預計將達到2,885萬美元,預測期內複合年成長率為6.65%。

主要亮點

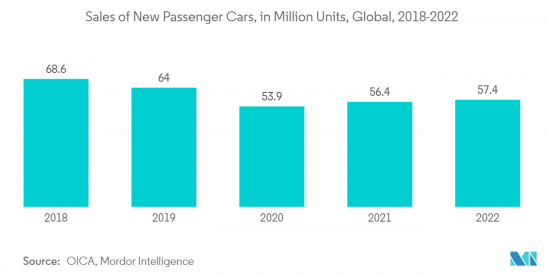

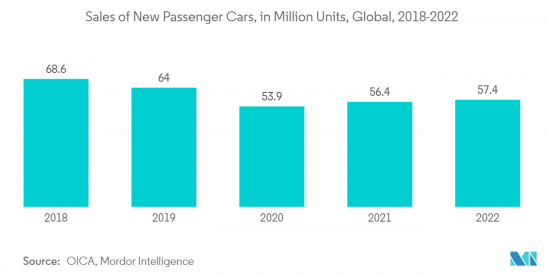

- 汽車銷售的增加、消費者對汽車先進外觀的偏好不斷增強以及對輕量化車型的需求不斷成長是決定全球整體汽車儀表板市場成長的關鍵因素。例如,2021年至2022年全球新小客車銷量成長1.9%。此外,世界各地的目標商標產品(OEM) 都在尋求開發用於設計儀表板的輕量材料,因為減輕車輛重量會直接轉化為降低油耗。

- 為了向消費者提供美觀的汽車而進行的汽車開發和改裝進一步推動了對有助於提高汽車外觀美感的汽車儀表板的需求。此外,各地區豪華車銷售的不斷成長也促進了對永續和先進汽車儀表板產品需求的增加。例如,

- 2023年上半年印度豪華車銷售年增38%。預計2023年1月至6月豪華車銷售約2萬輛,年終銷售量將突破4萬輛。

- 2023年1月,勞斯萊斯宣布2022年全球豪華車銷量為6,201輛,2021年至2022與前一年同期比較增8%。

- 除此之外,監管車輛排放氣體和安全標準的積極政府政策也對汽車儀表板市場的快速成長產生了正面影響。例如,歐盟 6 排放法規規定汽車製造商的平均二氧化碳排放低於 98 克/公里,促進了汽車中使用的創新材料的開發。此類政策還幫助汽車製造商開拓輕量化零件,有助於減輕重量並滿足政府車輛安全標準,對汽車儀表板市場產生正面影響。

- 高安裝和更換成本是市場成長的主要阻礙因素。隨著用於製造這些產品的塑膠不斷改進和發展,一旦儀表板損壞,更換儀表板的成本可能會相當高。因此,更換該零件將進一步增加車輛的營業成本並對市場成長產生負面影響。

- 對自動駕駛和電動車等新時代汽車的需求不斷增加、二手車銷量不斷成長,以及由於可支配收入增加而對豪華車的需求不斷成長,預計將推動未來幾年汽車儀表板市場的成長。

汽車儀表板市場趨勢

小客車領域佔市場主導地位

- 消費者對私人交通途徑偏好的變化正在推動全球小客車市場的成長。近年來,各國小客車銷售量均有所成長,預計未來幾年將成長更快。例如

- 2023年3月,歐洲新小客車註冊量達100萬輛,較去年同月成長28.8%。

- 在厄瓜多爾,2021年至2022年新小客車銷量較去年與前一年同期比較成長15.4%,在阿根廷,2021年至2022年新小客車銷量與前一年同期比較8.4%。

- 2021年至2022年,德國新小客車銷量較去年與前一年同期比較成長1.1%,2022年售出260萬輛小客車。

- 此外,二手車銷售量的增加也是拉動後市場汽車儀表板需求的因素。由於消費者期待升級車輛,二手車購買量的增加將導致對售後產品的需求增加。與 2023 年 5 月相比,車齡 36 個月的汽車在奧地利、德國、義大利、西班牙和英國的交易速度更快。 2021 年英國二手車銷量達 753 萬輛,而 2020 年為 675 萬輛。

- 在生態交通時代,世界各地的政策制定者都致力於推動私人交通解決方案,以解決交通污染和氣候變遷問題。

- 例如,2022年7月,加拿大政府實施了基於2030年排放計畫的排放策略,該國的排放目標是到2030年比2005年減排40%,到2050年實現淨零排放。

- 2021年7月,歐盟委員會宣布了2030年溫室氣體排放淨減少至少55%的臨時目標。此外,歐盟委員會也就到 2050 年實現氣候中和的藍圖提案了各種立法提案。

- 這些政府舉措,加上消費者對環境問題日益關注,各國對電動車的需求不斷增加。此外,隨著我們看到二手電動車市場在未來幾年快速成長,需要用於開拓汽車零件(例如汽車儀表板)的低碳排放材料,預計將對未來幾年汽車儀表板市場的成長。

- 近年來,電動車的需求快速成長,2021年至2022年中國新增電動車銷量較去年同期成長33.3%,美國同期年增60%。為汽車儀表板市場的發展做出積極貢獻。

亞太地區將錄得強勁成長

- 都市化的提高和消費者可支配收入的增加促進了亞太地區汽車銷售的成長,從而推動了汽車儀表板市場的快速成長。隨著消費者遷移到都市區尋找更好的就業機會和經濟前景,對私人交通途徑的需求龐大。隨著越來越多的消費者湧入都市區,未來幾年對汽車儀表板產品的需求可能會顯著成長。

- 2022年,印度城市人口將達到總人口的36%,較2021年增加,當時城市人口占總人口的比例為35%。

- 同時,2022年中國城鎮人口占總人口的比例將達64%,比2021年城鎮人口占總人口的63%小幅增加1個百分點。

- 都市化的加速和可支配收入的增加正在推動亞太小客車市場的發展。 2023年7月小客車銷量較去年同期成長3.1%。此外,這些全部區域電動車銷售的不斷成長推動了對先進汽車儀表板產品的大量需求,這些產品透過更好的外觀和材料的使用顯著減輕了車輛的重量,從而促進了需求。

- 2018 會計年度至 23 會計年度,印度四輪電動車銷量的複合年成長率為 84.6%。 22 會計年度至 23 會計年度印度電動四輪車銷量與前一年同期比較飆升 143%。 4月中國新能源車(包括純電動電動車和插電式混合動力汽車)銷量較上月成長3.6%,佔2023年5月汽車總銷量的32%。

- 由於消費者對車輛升級和維護的偏好,亞太地區公路式車輛和二手車的成長預計將對售後汽車儀表板市場需求產生積極影響。 2022年8月,道路和公路部宣布,印度道路上的車輛總數已達7,000萬輛。同時,到 2022 年,韓國的汽車註冊總數預計將達到 2,550 萬輛。

- 未來幾年,隨著政府加大投資加強大眾交通工具基礎設施,為消費者帶來更多便利,汽車儀表板市場預計將快速成長。亞太地區各國政府正積極增加對大眾交通工具基礎設施的投資。例如,2023年7月,印度政府宣布計劃在全國範圍內建設多個Ecofield高速公路計劃,總合1萬公里,耗資4.5億盧比。 2023年5月,韓國和沙烏地阿拉伯宣布簽署了兩份移動和道路領域的合作備忘錄,以擴大運輸和物流領域的商機。

汽車支撐件產業概況

汽車儀表板市場競爭激烈且分散,許多國際參與企業在世界各地開展業務。汽車支撐市場的主要企業包括 Magna International、Flex-N-Gate Corporation、Eakas Corporation、MRC Manufacturing、Gestamp Automocion、Plastic Omnium、Inhance Technologies、Samvardhana Motherson 和 Aisin Corporation。這些參與企業在產品品質、價格、使用材料、創新設計和產品重量方面競爭。

各種參與企業正在積極加強投資活動,以開發使用永續材料的產品,並建立多種合作夥伴關係、併購、收購和聯盟,以擴大其業務範圍。

2023年2月,馬魯蒂鈴木宣布推出基於拉皮Dzire的新款轎車Tour S。新車型的前飾板與LED尾燈一起進行了修改。

2021 年 12 月,TotalEnergies 與 Plastic Omnium 建立策略合作夥伴關係,為汽車產業設計和開發由再生聚丙烯製成的新型塑膠材料。這些材料可用於製造面板,其二氧化碳排放量比其他材料低 6 倍。

2021年7月,汽車儀表板製造商Revere Plastic Systems宣布收購美國塑膠製造公司Ferguson Production Inc。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 汽車銷量增加

- 其他

- 市場抑制因素

- 維護和更換成本高

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模-美元)

- 按職位類型

- 前飾板

- 後飾板

- 按材質

- 塑膠蓋發泡聚苯乙烯

- 塑膠塗層鋁

- 其他材質(鋼、橡膠等)

- 按車型

- 小客車

- 商用車

- 按銷售管道

- 目的地設備製造商(OEM)

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 其他

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Magna International

- Inhance Technologies

- Flex-N-Gate Corporation

- Dongfeng Electronic Technology Co. Ltd.

- Eakas Corporation

- MRC Manufacturing

- Chiyoda Manufacturing

- Sanko GOSEI

- Gestamp Automocion

- Plastic Omnium

- Aisin Corporation

- Dakkota Integrated System LLC

- Revere Plastics System

- Guardian Industries

- Samvardhana Motherson

- Toyoda Gosei

第7章 市場機會及未來趨勢

- 電動車和自動駕駛汽車的普及

The automotive fascia market is valued at USD 21.64 billion in the current period and is expected to reach USD 28.85 million, registering a CAGR of 6.65% during the forecast period.

Key Highlights

- Increasing vehicle sales, consumers' growing preference for the advanced look of vehicles, and rising demand for lightweight vehicle models serve as major determinants for the growth of the automotive fascia market across the globe. For instance, sales of new passenger cars recorded a growth of 1.9% between 2021 and 2022 across the world. Further, original equipment manufacturers (OEMs) across the world are eyeing to develop lightweight materials for designing fascia since the reduction in vehicle weight directly corresponds to a reduction in fuel consumption.

- The development and modification of vehicles to offer consumers attractive-looking cars is further boosting the demand for automotive fascia, which helps in enhancing the aesthetics of a vehicle. Coupled with that, increasing luxury vehicle sales across various regions act as a catalyst for the rising demand for sustainable and advanced automotive fascia products. For instance,

- Luxury vehicle sales in India witnessed a surge of 38% in the first six months of 2023 compared to the same period in the previous year. Approximately 20,000 luxury vehicles were sold between January and June 2023, which is estimated to cross the 40,000 mark by the end of the year.

- In January 2023, Rolls Royce reported sales of 6,201 units of its luxury models across the world in 2022, showcasing an 8% growth Y-o-Y between 2021 and 2022, with the Middle East being its strongest market.

- Coupled with that, aggressive government policy to regulate vehicle emissions and safety standards is positively impacting the surging growth of the automotive fascia market. For instance, The Euro 6 emission standard sets a legal requirement for a car manufacturer to average CO2 emissions below 98g/km, which is leading to the development of innovative materials utilized in a vehicle. Policies such as this also contribute to the development of lightweight parts by automotive manufacturers, which in turn assists in weight reduction and complying with the government's safety standards of vehicles, thereby positively impacting the automotive fascia market.

- The high cost of installation and replacement is a major deterrent to the growth of the market. There exists a substantial cost requirement for replacing the fascia once damaged owing to the improved and advanced plastic used for the manufacturing of these products. Therefore, replacing this component of the vehicle further increases the vehicle's operating cost, which negatively impacts the growth of the market.

- Rising demand for new-age vehicles such as autonomous vehicles and electric vehicles, increasing sales of used cars, and the growing demand for high-end cars attributed to the growth in disposable income are expected to fuel the growth of the automotive fascia market in the coming years.

Automotive Fascia Market Trends

Passenger Cars Segment to Dominate the Market

- Consumers' shifting preference towards availing private medium of transportation is aiding the growth of the passenger car market all over the world. Various countries have recorded increasing sales of passenger cars in recent years, which is anticipated to further surge in the coming years. For instance,

- New passenger car registrations in Europe touched 1.0 million units in March 2023, an increase of 28.8% from the same month in 2022.

- Ecuador witnessed a Y-o-Y growth of 15.4% in new passenger car sales between 2021 and 2022, while Argentina witnessed a Y-o-Y growth of 8.4% in new passenger car sales between 2021 and 2022.

- Germany recorded a Y-o-Y growth of 1.1% in new passenger car sales between 2021 and 2022, selling 2.6 million units of passenger cars in 2022.

- Coupled with that, increasing used car sales will also contribute to boosting the demand for automotive fascia in the aftermarket. Greater purchase of used cars leads to higher demand for aftermarket products as consumers look forward to upgrading their vehicles. Compared with May 2023, Austria, Germany, Italy, Spain, and the United Kingdom witnessed speedier transactions take place for 36-month-old vehicles. Sales of used cars in the United Kingdom touched 7.53 million units in 2021 compared to 6.75 million units in 2020.

- In the era of green mobility, to address environmental pollution from transportation and climate change issues, policymakers across the world are focused on advancement in private transportation solutions.

- For instance, in July 2022, the government of Canada implemented an emission reduction strategy under "The 2030 Emission Reduction Plan", which outlines the country's emissions reduction target of 40 percent below 2005 levels by 2030 and net-zero emissions by 2050.

- In July 2021, the European Commission announced its intermediate target of at least a 55% net reduction in greenhouse gas emissions by 2030. Further, the commission also proposed various legislative proposals on the roadmap to achieve climate neutrality by 2050.

- Such initiatives by the government, coupled with the consumers growing concerns for environmental hazards, are contributing to the growing demand for electric vehicles across nations. Further, as the market for used EVs witnesses surging growth in the coming years, there will exist a need for advanced automotive parts & components used in vehicles, such as low carbon emission material used in the development of automotive fascia, which is expected to positively impact the growth of the automotive fascia market in the coming years.

- Demand for EVs has surged exponentially in recent years, with China recording a 33.3% increase in new electric vehicle sales between 2021 and 2022, while the United States recorded a 60% Y-o-Y during the same period, which is expected to positively contribute to the growth of automotive fascia market in the coming years.

Asia Pacific to Record Substantial Growth

- The rising urbanization rate, coupled with the growing disposable income of consumers, is contributing to the increased sales of vehicles across the Asia Pacific Region, which is fuelling the surging growth of the automotive fascia market. With consumers migrating to the urban areas for better employment opportunities and financial prospects, there exists a massive demand for availing of the private medium of transportation. As more and more consumers flock to urban areas, the demand for automotive fascia products will witness substantial growth in the coming years.

- The urban population in India stood at 36% of the overall population in 2022, an increase from 2021, wherein the urban population stood at 35% as a percentage of the overall population.

- On the other hand, the urban population in China stood at 64% of the overall population in 2022, a marginal growth of 1% from 2021, wherein the urban population stood at 63% as a percentage of the overall population.

- The increasing urbanization and disposable income fuel the market of passenger vehicles in the Asia-Pacific region. Overall passenger vehicle sales expanded 3.1% in July 2023 compared to the same period in the previous year. Coupled with that, increasing electric vehicle sales across these regions is contributing to the massive demand for advanced automotive fascia products with better looks and usage of materials, which substantially reduces the weight of vehicles.

- Four-wheeler electric vehicle sales in India expanded with a CAGR of 84.6% between FY18 and FY23. The Y-o-Y growth of electric four-wheeler sales in India witnessed a 143% surge between FY22 and FY23. Sales of new energy vehicles (NEVs) in China, which include pure battery electric cars and plug-in hybrids, skid 3.6% every month in April and accounted for 32% of total car sales in May 2023.

- Rising vehicle-on-road and used cars in the Asia Pacific region are expected to positively impact the demand for the aftermarket car fascia market due to consumers' preference for the upgradation of their vehicles and servicing purposes. In August 2022, the Ministry of Road and Highways of India announced that the total number of cars plying on Indian roads touched 7 crore, while in South Korea, the total number of vehicles registered is estimated to stand at 25.5 million units as of 2022.

- With the increasing government's investment in enhancing public transportation infrastructure in the coming years, the automobile fascia market is expected to witness surging growth owing to the enhancement of consumer convenience. Various government across the Asia-Pacific region has been actively boosting their investment to develop public transportation infrastructure. For instance, in July 2023, the Indian government announced its plan to construct several greenfield expressway projects totaling 10,000 km across the country for Rs 4.5 lakh crore. In May 2023, South Korea and Saudi Arabia announced the signing of two memorandums of understanding in the fields of mobility and roads to elevate business opportunities in the transport and logistics sector.

Automotive Fascia Industry Overview

The automotive fascia market is highly competitive and fragmented, with various international players operating across the globe. Some of the major players in the automotive fascia market include Magna International, Flex-N-Gate Corporation, Eakas Corporation, MRC Manufacturing, Gestamp Automocion, Plastic Omnium, Inhance Technologies, Samvardhana Motherson, and Aisin Corporation, among others. These players compete based on product quality, pricing, materials used, innovative design, and weightage of the product, among others.

Various players are actively ramping up their investing activities to develop products with sustainable materials and engage in multiple partnerships, mergers, acquisitions, and collaborations to expand their business reach.

In February 2023, Maruti Suzuki announced the launch of a new sedan model, Tour S, which is based on a facelifted Dzire. The new model witnessed a revised front fascia along with LED tail lamps.

In December 2021, TotalEnergies and Plastic Omnium signed a strategic partnership to design and develop new plastic materials made from recycled polypropylene for the automotive industry. These materials can be used for producing fascia, which will witness six times lower CO2 emission compared to other materials.

In July 2021, Revere Plastic Systems, an automotive fascia manufacturer, announced the acquisition of a United States-based plastic manufacturing company, Ferguson Production Inc., to expand its business reach across nine different locations in the United States.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Vehicle Sales

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 High Maintenance and Replacement Cost

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Position Type

- 5.1.1 Front Fascia

- 5.1.2 Rear Fascia

- 5.2 By Material

- 5.2.1 Plastic Covered Styrofoam

- 5.2.2 Plastic Covered Aluminum

- 5.2.3 Other Materials (Steel, Rubber etc.)

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commerical Vehicles

- 5.4 By Sales Channel

- 5.4.1 Original Equipment Manufacturer (OEM)

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Magna International

- 6.2.2 Inhance Technologies

- 6.2.3 Flex-N-Gate Corporation

- 6.2.4 Dongfeng Electronic Technology Co. Ltd.

- 6.2.5 Eakas Corporation

- 6.2.6 MRC Manufacturing

- 6.2.7 Chiyoda Manufacturing

- 6.2.8 Sanko GOSEI

- 6.2.9 Gestamp Automocion

- 6.2.10 Plastic Omnium

- 6.2.11 Aisin Corporation

- 6.2.12 Dakkota Integrated System LLC

- 6.2.13 Revere Plastics System

- 6.2.14 Guardian Industries

- 6.2.15 Samvardhana Motherson

- 6.2.16 Toyoda Gosei

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Electric and Autonomous Vehicles