|

市場調查報告書

商品編碼

1408396

下一代計算:市場佔有率分析、行業趨勢/統計、2024 年至 2029 年成長預測Next-generation Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

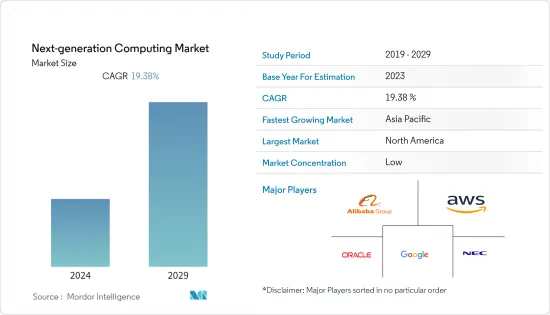

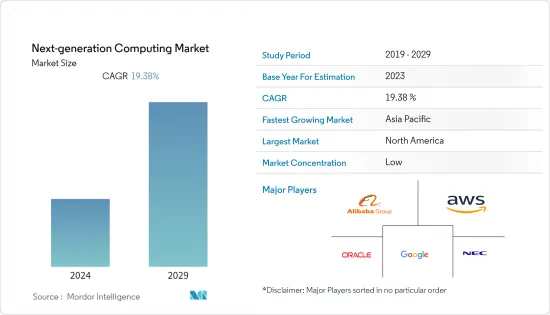

本會計年度全球下一代運算市場規模預估為1,605.1億美元,預測期內複合年成長率為19.38%,預計五年內將達到4,174億美元。

通過部署下一代計算解決方案,最終使用者將體驗到更短的產品開發交付週期、靈活性、流程效率、更高的生產力、更高的品質、更直觀的客戶體驗和更高的盈利能力,這正在推動全球市場的採用。

主要亮點

- 下一代運算市場由分散式運算、機器學習、人工智慧和雲端運算等新技術的出現推動,這些技術透過集中儲存、記憶體、處理和頻寬。各種最終用途。

- 高效能運算的需求正在不斷增加,對於組織來說變得至關重要,因為它可以快速有效地計算和分析大量資料。高效能運算應用對下一代運算解決方案的需求正在推動市場發展。

- 此外,中小型企業也透過改進供應鏈管理、提高生產力和簡化業務從數位轉型中受益。中小企業正在利用雲端運算、人工智慧和區塊鏈來實現流程自動化並降低成本,這將在預測期內推動市場發展。例如,2022年12月,數位轉型解決方案供應商UST宣布與英特爾和SAP合作,為馬來西亞北部的中小企業開啟工業4.0數位轉型之旅,工業4.0的下一代運算解決方案為市場供應商創造了機會。

- 然而,下一代解決方案和計算技術涉及共用本地設備、行動設備、雲端基礎的伺服器等之間共享的資料,這使得最終用戶在將解決方案實施到其業務流程中時很難使用資料。在預測期內,可能會出現隱私風險,並限制許多最終用戶(例如國防、BFSI 等)的市場採用。

- COVID-19 的爆發推遲了製造半導體晶片所需原料的供應鏈,從而減緩了市場成長,而半導體晶片對於下一代計算解決方案的 SOC 和其他硬體組件的開發至關重要。此外,在 COVID-19 大流行之後,對雲端運算的需求增加,透過可提高最終用戶運算能力的應用程式支援下一代運算解決方案的成長。

下一代運算市場趨勢

解決方案的雲端部署極大地促進了市場成長

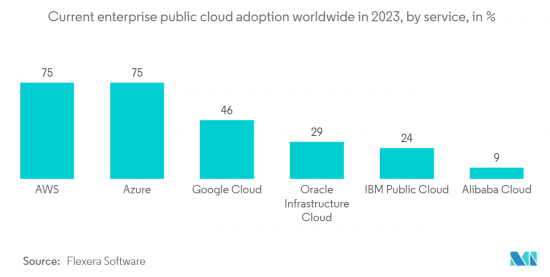

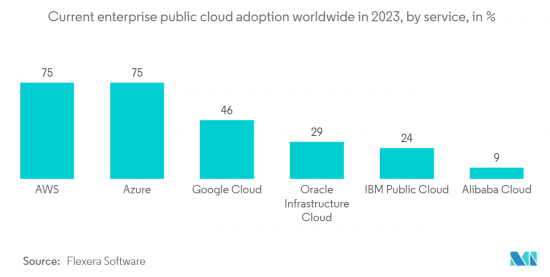

- 採用雲端基礎的運算解決方案在世界各地的大型和小型企業中越來越受歡迎,因為它具有節省成本、安全性、彈性、移動性、增強協作、輕鬆災害復原和損失預防以及自動軟體更新等優點。正在獲得包括大型企業在內的所有最終用戶的認可,並正在加速市場上採用下一代雲端基礎的運算解決方案。

- 發達經濟體和新興經濟體的公司正在採用基於雲的軟體,並得到各國政府對ICT基礎設施投資的支援,這支援了預測期內基於雲的下一代計算解決方案市場的增長。 例如,2022 年 11 月,亞馬遜雲科技與迪拜數位經濟商會合作,提供超大規模雲計算解決方案,包括可擴展的雲存儲、服務和計算功能。 根據一份報告,預計從 2022 年到 2030 年,它將為阿聯的中小企業和初創企業帶來價值 171 億美元的經濟效益。

- 微軟、亞馬遜、IBM 和谷歌等供應商正在大力投資量子電腦,並合作為雲端基礎的量子電腦提供 SaaS 模型。這些都是依計量收費的模式,正在推動支援雲端的下一代運算解決方案的市場。

- 例如,2023年3月,HCL Technologies與微軟量子雲端處理服務Azure Quantum合作,為使用微軟平台作為其技術堆疊的企業提供雲端基礎的量子運算服務。 HCLTech 的 Q-Labs 是 Microsoft 提供 Azure 量子積分的合作夥伴之一。

- 此外,透過與量子運算領域的其他組織合作,雲端基礎的量子運算供應商一直在建議有效利用量子運算的需求,並協助企業實施雲端基礎的服務。例如,IBM開發了IBM的Q Network。它是先進量子運算領域合作並探索其潛在應用的組織的全球合作夥伴關係,支持市場採用下一代雲端基礎的運算。

亞太地區市場成長率最高

- 亞太地區是許多採用數位化解決方案的新興經濟體的所在地,包括印度、中國、日本和韓國。由於需要基於 AI/ML 的運算來提高企業生產力,醫療保健、汽車/運輸、BFSI、IT/通訊等各種最終用戶的數位化正在推動下一代運算解決方案供應商的市場。供應商的機會。

- 例如,2023年6月,領先的企業級人工智慧(AI)軟體公司Beyond Limits宣布將打造量子電腦,以推動亞太地區量子人工智慧技術的進步,並簽署了一份合作協議。與IQM 量子電腦簽署的合作備忘錄顯示了該地區對量子運算的需求,並將在預測期內推動亞太地區的市場。

- 包括亞太地區醫院在內的小型和大型企業採用線上服務會產生大量業務資料,因此需要下一代運算解決方案,使企業能夠從這些資料中獲得業務洞察,從而滿足需求。例如,2022 年 11 月,印度馬尼帕爾醫院集團 (Manipal Hospitals Group) 與 Google Cloud 合作,改善連鎖醫院的病患照護體驗和網路效率。透過 Google Cloud 基於對話式 AI 的解決方案提供始終線上的患者照護,增強客戶互動。

- 此外,新加坡、馬來西亞和印尼正在建造許多大型資料中心,以支援亞太地區大型工業企業下一代運算的發展。

- 例如,2023年7月,擁有TikTok的Equinix、GDS、微軟、AirTrunk和位元組跳動組成的聯盟被新加坡經濟發展局和通訊媒體發展局選中,營運位於新加坡的80MW資料中心。

下一代運算產業概述

全球新一代運算市場由阿里巴巴集團控股有限公司、亞馬遜網路服務公司、Oracle公司和谷歌公司主導,高度分散,由許多全球公司(例如NEC公司)佔據整體市場佔有率。下一代運算市場的供應商將越來越注重透過產品創新、聯盟和研發投資來提供增強的解決方案,以提高他們在預測期內的市場佔有率。

2023 年 6 月,Google Llc 與 T-Mobile 合作增強 5G 和邊緣運算能力,協助企業擴大數位轉型。在此次合作之後,T-Mobile 將其公共、私有和混合5G 網路的 5G ANS 套件與 Google Distributed Cloud Edge (GDC Edge) 連接起來,使客戶能夠利用 AR/VR 體驗等下一代 5G 應用。馬蘇。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 對高效能運算的需求不斷成長

- 在中小型企業採用進階分析

- 市場抑制因素

- 下一代計算大規模資料儲存和處理中的資料外洩風險

- 實施解決方案面臨巨大的營運課題

第6章市場區隔

- 依成分

- 硬體

- 軟體

- 依服務

- 依計算類型

- 高效能運算

- 量子計算

- 光計算

- 邊緣運算

- 其他計算類型

- 依配置

- 雲

- 本地

- 依最終用戶

- 汽車與運輸

- 能源/公用事業

- 衛生保健

- BFSI

- 航太/國防

- 媒體與娛樂

- 資訊科技與電信

- 零售

- 製造業

- 其他最終用戶

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Alibaba Group Holding Limited

- Amazon Web Services, Inc

- Oracle Corporation

- Google LLC

- NEC Corporation

- Cisco Systems

- Intel Corporation

- IBM Corporation

- Microsoft Corporation

- NVIDIA Corp

- *List not exhaustive

第8章投資分析

第9章 市場機會及未來趨勢

Global Next-generation Computing Market is valued at USD 160.51 billion in the current year and is expected to register a CAGR of 19.38% during the forecast period, reaching USD 417.40 billion in five years. Implementing Next-generation computing solutions gives end users a shorter lead time in product development, flexibility, process efficiencies, enhanced productivity, higher quality, more intuitive customer experiences, and improved profitability, fueling market adoption worldwide.

Key Highlights

- Next-generation computing market is evolving from the emergence of new technologies such as Distributed computing, Machine learning, Artificial intelligence, and Cloud computing for efficient computing by using centralizing storage, memory, processing, and bandwidth, driving the market in various end-user applications.

- The demand for High-performance computing is increasing and becoming crucial for organizations as it enables them to compute and analyze large volumes of data quickly and efficiently, which is significantly essential in scientific research, engineering, and finance, where the ability to process large amounts of data to give insights for better operational efficiencies and customer services. The need for next-gen computing solutions for High-performance computing applications drives the market.

- Additionally, with better supply chain management, increased productivity, and streamlined operations, SMEs have benefited from digital transformation. SMEs have been automating their processes and reducing costs using cloud computing, AI, and blockchain, which would drive the market during the forecast period. For instance, in December 2022, UST, a digital transformation solutions provider, announced a collaboration with Intel and SAP to enable the Industry 4.0 digital transformation journey for small and medium-sized enterprises in northern Malaysia, creating an opportunity for the market vendors due to their next-gen computing solutions for Industry 4.0.

- However, the next-gen solutions and computing technology involve processing & data shared between local devices, mobile devices, cloud-based servers, etc., which generates a threat of data privacy risk in the end users while implementing the solutions for their business processes, which could restrict the market adoption in many end-users, such as defense, BFSIs, etc. during the forecast period.

- The COVID-19 pandemic reduced the market growth by delaying the supply chain of raw materials for the manufacturing of semiconductor chips, which are essential for developing SOCs and other hardware components of next-generation computing solutions. In addition, after the COVID-19 pandemic, as the demand for cloud computing increased, it supported the growth of Next-generation computing solutions due to its applications enabling end users to enhance their computational capabilities.

Next-generation Computing Market Trends

The Cloud Deployment of The Solutions Significantly Contributes to The Market Growth

- The adoption of cloud-based computing solutions is gaining traction in all end-users, including large and small-scale enterprises worldwide, due to its benefits such as Cost Savings, Security, Flexibility, Mobility, Increased Collaboration, Easy Disaster Recovery & Loss Prevention, Automatic Software Updates, etc., which is fueling the adoption of cloud-based next-generation computing solutions in the market.

- The enterprises in developed and developing economies, with the help of their countries' government investment in ICT infrastructure, are adopting cloud-based software, supporting the growth of the cloud-based next-generation computing solution market during the forecast period. For instance, in November 2022, Amazon Web Services, in partnership with the Dubai Chamber of Digital Economy, published a report stating that hyper-scale cloud computing solutions, which include scalable cloud storage, services, and computing capabilities, are expected to provide SMEs and startups in the UAE with USD 17.1 billion worth of economic benefits from 2022 and 2030.

- Market vendors such as Microsoft, Amazon, IBM, and Google have been investing significantly in quantum computing and partnering to offer SaaS models to their cloud-based quantum computers, enabling the technology to be accessible to mainstream enterprises, which can be shared among many companies. They can be used as a Pay-as-Use model, driving the Cloud-enabled next-generation computing solutions market.

- For instance, in March 2023, HCL Technologies partnered with Microsoft's quantum cloud computing service, Azure Quantum, to offer businesses cloud-based quantum computing services to clients using Microsoft's platform as the technology stack. The benefits would be provided through HCLTech's Q-Labs, which has already been among one of Microsoft's partners to offer Azure Quantum credits.

- Additionally, cloud-based quantum computing providers have been helping in advising the need to use quantum computing effectively and supporting the enterprise's adoption of cloud-based services through collaboration with other organizations in the field of quantum computing. For instance, IBM has developed IBM's Q Network, a global partnership of organizations working together in advanced quantum computing and exploring its potential applications, supporting the adoption of cloud-based next-generation computing in the market.

The Asia-pacific Region is Registering The Highest Market Growth

- The Asia-Pacific region has many emerging economies, including India, China, Japan, South Korea, etc., adopting digitalization solutions in their countries. The digitalization in various end users, such as Healthcare, Automotive & Transportation, BFSIs, IT & Telecom, etc., in the countries are creating an opportunity for the market vendors of next-generation computing solution providers due to the need for AI & ML based Computing in increasing the productivity of the enterprises.

- For instance, in June 2023, Beyond Limits, a leading enterprise-grade artificial intelligence (AI) software company, signed a Memorandum of Understanding with IQM Quantum Computers, a company in building quantum computers, to drive the advancement of quantum AI technology in the Asia-pacific region, which shows the demand for quantum Computing in the area, fueling the market in APAC region during the forecast period.

- The adoption of online services in small and large-scale enterprises, including the hospitals in the APAC region, generates a significant amount of business data, which drives the requirement for Next-generation computing solutions to enable the enterprises to have business insights from those data. For instance, in November 2022, Manipal Hospitals Group of India partnered with Google Cloud to improve patient care experiences and the hospital chain's network efficiency. It would use Google Cloud's conversational AI-based solution to enhance customer interactions by offering all-time patient care.

- In addition, Singapore, Malaysia, and Indonesia have constructed many large data centers, which would support the growth of Next-generation computing in large-scale industrial enterprises within the APAC region because adopting these solutions, majorly the cloud-based next-generation computing solutions, would require Data centers to store the enterprise data for Computing.

- For instance, in July 2023, Equinix, GDS, Microsoft, and a consortium of AirTrunk and TikTok-owner ByteDance were selected to operate the Singapore-based 80 MW data center by the Singapore Economic Development Board and the Infocomm Media Development Authority, which would support the adoption of next-generation computing solutions in the APAC region.

Next-generation Computing Industry Overview

The Global Next-generation Computing Market is highly fragmented due to many global companies, such as Alibaba Group Holding Limited, Amazon Web Services Inc, Oracle Corporation, Google LLC, and NEC Corporation, contributing to the overall market share. Next-generation Computing Market vendors increasingly focus on delivering enhanced solutions through product innovations, collaborations, and investment in R&D to increase their market presence during the forecast period.

In June 2023, Google Llc partnered with T-Mobile to empower 5G and edge computing capabilities, enabling enterprises to increase their digital transformation. After this partnership, T-Mobile would connect the 5G ANS suite of public, private, and hybrid 5G networks with Google Distributed Cloud Edge (GDC Edge) to help customers have next-generation 5G applications such as AR/VR experiences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in demand for high performance computing

- 5.1.2 Adoption of Advanced Analytics in SMEs

- 5.2 Market Restraints

- 5.2.1 Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing

- 5.2.2 High operational challenges in Implementing the Solution

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Computing Type

- 6.2.1 High-Performance Computing

- 6.2.2 Quantum Computing

- 6.2.3 Optical Computing

- 6.2.4 Edge Computing

- 6.2.5 Other Computing Types

- 6.3 By Deployement

- 6.3.1 Cloud

- 6.3.2 On-Premise

- 6.4 By End-user

- 6.4.1 Automotive & Transportation

- 6.4.2 Energy & Utilities

- 6.4.3 Healthcare

- 6.4.4 BFSI

- 6.4.5 Aerospace & Defense

- 6.4.6 Media & Entertainment

- 6.4.7 IT & Telecom

- 6.4.8 Retail

- 6.4.9 Manufacturing

- 6.4.10 Other End Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alibaba Group Holding Limited

- 7.1.2 Amazon Web Services, Inc

- 7.1.3 Oracle Corporation

- 7.1.4 Google LLC

- 7.1.5 NEC Corporation

- 7.1.6 Cisco Systems

- 7.1.7 Intel Corporation

- 7.1.8 IBM Corporation

- 7.1.9 Microsoft Corporation

- 7.1.10 NVIDIA Corp

- 7.2 * List not exhaustive